Answered step by step

Verified Expert Solution

Question

1 Approved Answer

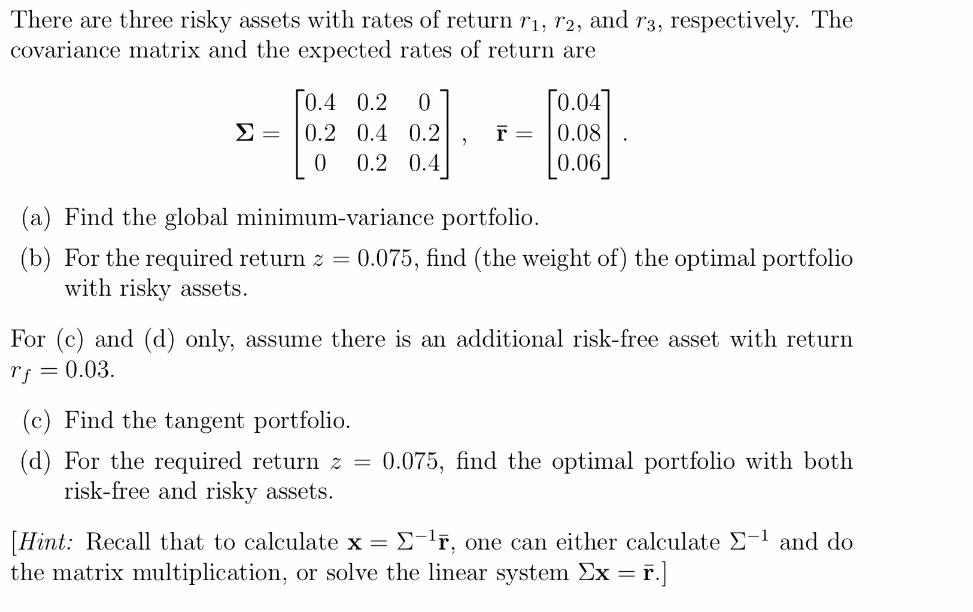

There are three risky assets with rates of return r, 72, and r3, respectively. The covariance matrix and the expected rates of return are

There are three risky assets with rates of return r, 72, and r3, respectively. The covariance matrix and the expected rates of return are = 0.4 0.2 0 0.2 0.4 0.2 0 0.2 0.4 2 r = [0.04] 0.08 0.06 (a) Find the global minimum-variance portfolio. (b) For the required return z = 0.075, find (the weight of) the optimal portfolio with risky assets. For (c) and (d) only, assume there is an additional risk-free asset with return rf = 0.03. (c) Find the tangent portfolio. (d) For the required returi z = 0.075, find the optimal rtfolio with both risk-free and risky assets. [Hint: Recall that to calculate x = -r, one can either calculate - and do the matrix multiplication, or solve the linear system Ex = = r.]

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To solve the given portfolio optimization problem we can follow these steps Step 1 Calculate the global minimumvariance portfolio Step 2 Calculate the tangent portfolio Step 3 Calculate the optimal po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started