Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The market value of a portfolio is $500,000. Of this amount $100,000 is invested in a risk-free government bond. The remaining $400,000 is invested

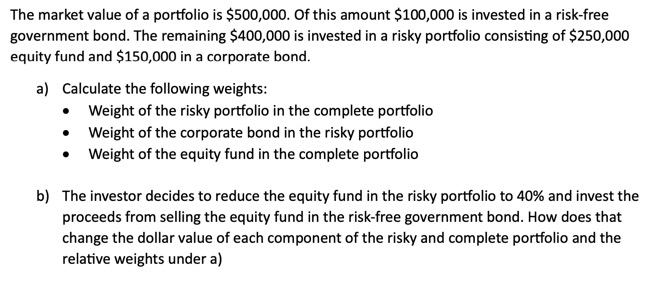

The market value of a portfolio is $500,000. Of this amount $100,000 is invested in a risk-free government bond. The remaining $400,000 is invested in a risky portfolio consisting of $250,000 equity fund and $150,000 in a corporate bond. a) Calculate the following weights: Weight of the risky portfolio in the complete portfolio Weight of the corporate bond in the risky portfolio Weight of the equity fund in the complete portfolio b) The investor decides to reduce the equity fund in the risky portfolio to 40% and invest the proceeds from selling the equity fund in the risk-free government bond. How does that change the dollar value of each component of the risky and complete portfolio and the relative weights under a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the weights we divide the dollar value of each component by the total market value of the portfolio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started