Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are three states of nature, each of which occurs with probability 1=31,2=31, and 3=31. There is a risk-free asset with a certain rate of

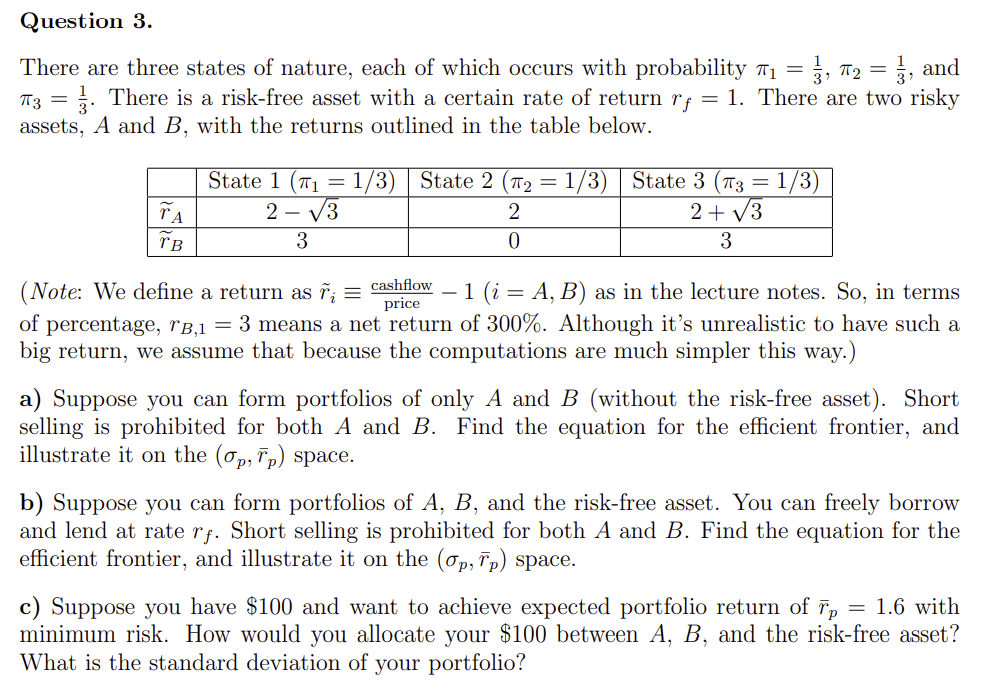

There are three states of nature, each of which occurs with probability 1=31,2=31, and 3=31. There is a risk-free asset with a certain rate of return rf=1. There are two risky assets, A and B, with the returns outlined in the table below. ( Note: We define a return as r~ipricecashflow1(i=A,B) as in the lecture notes. So, in terms of percentage, rB,1=3 means a net return of 300%. Although it's unrealistic to have such a big return, we assume that because the computations are much simpler this way.) a) Suppose you can form portfolios of only A and B (without the risk-free asset). Short selling is prohibited for both A and B. Find the equation for the efficient frontier, and illustrate it on the (p,rp) space. b) Suppose you can form portfolios of A,B, and the risk-free asset. You can freely borrow and lend at rate rf. Short selling is prohibited for both A and B. Find the equation for the efficient frontier, and illustrate it on the (p,rp) space. c) Suppose you have $100 and want to achieve expected portfolio return of rp=1.6 with minimum risk. How would you allocate your $100 between A,B, and the risk-free asset? What is the standard deviation of your portfolio

There are three states of nature, each of which occurs with probability 1=31,2=31, and 3=31. There is a risk-free asset with a certain rate of return rf=1. There are two risky assets, A and B, with the returns outlined in the table below. ( Note: We define a return as r~ipricecashflow1(i=A,B) as in the lecture notes. So, in terms of percentage, rB,1=3 means a net return of 300%. Although it's unrealistic to have such a big return, we assume that because the computations are much simpler this way.) a) Suppose you can form portfolios of only A and B (without the risk-free asset). Short selling is prohibited for both A and B. Find the equation for the efficient frontier, and illustrate it on the (p,rp) space. b) Suppose you can form portfolios of A,B, and the risk-free asset. You can freely borrow and lend at rate rf. Short selling is prohibited for both A and B. Find the equation for the efficient frontier, and illustrate it on the (p,rp) space. c) Suppose you have $100 and want to achieve expected portfolio return of rp=1.6 with minimum risk. How would you allocate your $100 between A,B, and the risk-free asset? What is the standard deviation of your portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started