Answered step by step

Verified Expert Solution

Question

1 Approved Answer

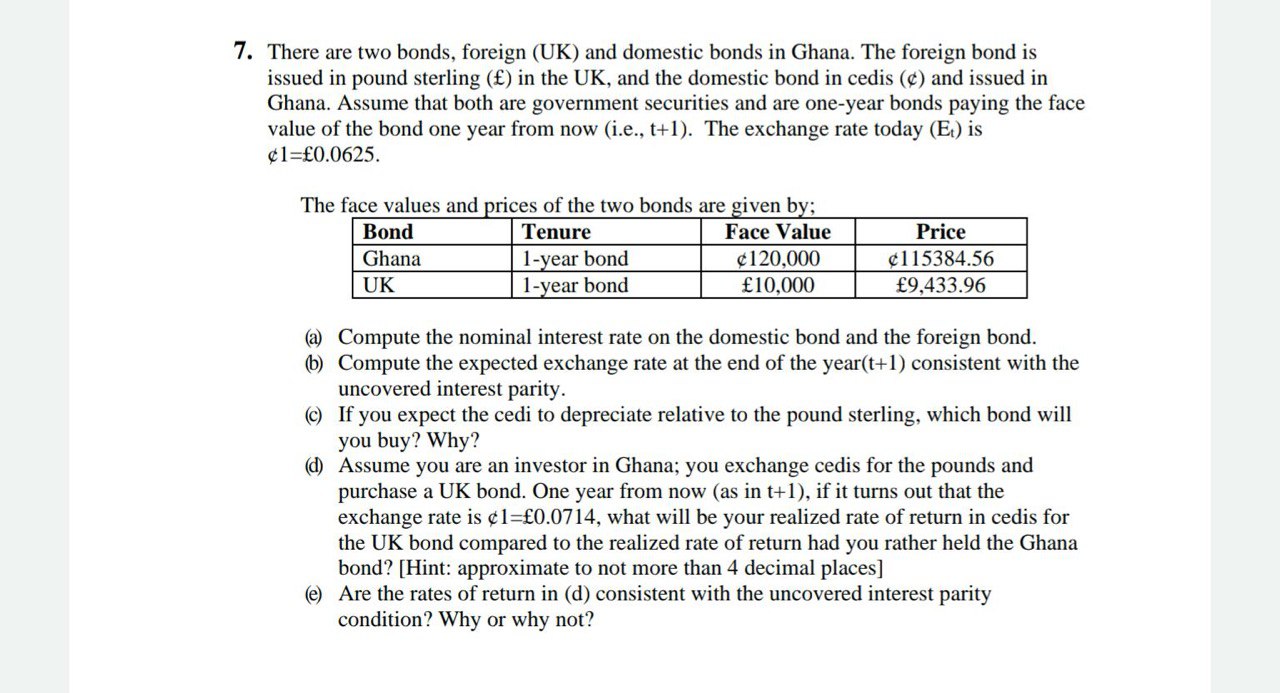

There are two bonds, foreign ( UK ) and domestic bonds in Ghana. The foreign bond is issued in pound sterling ( ) in the

There are two bonds, foreign UK and domestic bonds in Ghana. The foreign bond is

issued in pound sterling in the UK and the domestic bond in cedis and issued in

Ghana. Assume that both are government securities and are oneyear bonds paying the face

value of the bond one year from now ie The exchange rate today is

The face values and prices of the two bonds are given by;

a Compute the nominal interest rate on the domestic bond and the foreign bond.

b Compute the expected exchange rate at the end of the year consistent with the

uncovered interest parity.

c If you expect the cedi to depreciate relative to the pound sterling, which bond will

you buy? Why?

d Assume you are an investor in Ghana; you exchange cedis for the pounds and

purchase a UK bond. One year from now as in if it turns out that the

exchange rate is what will be your realized rate of return in cedis for

the UK bond compared to the realized rate of return had you rather held the Ghana

bond? Hint: approximate to not more than decimal places

e Are the rates of return in d consistent with the uncovered interest parity

condition? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started