there are two images attached, i hope this is more clear.

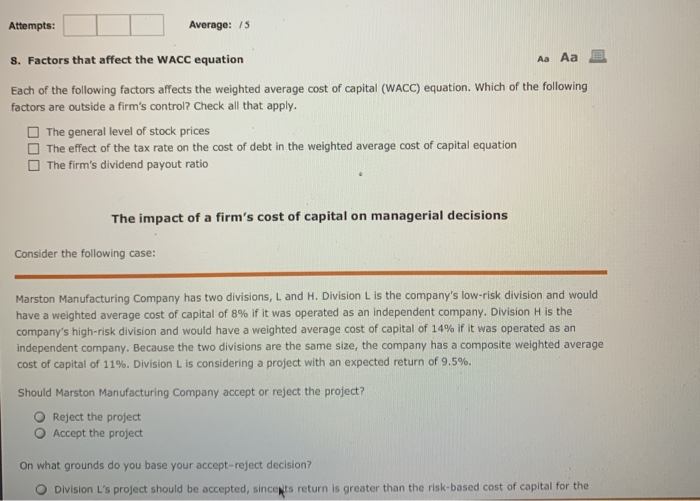

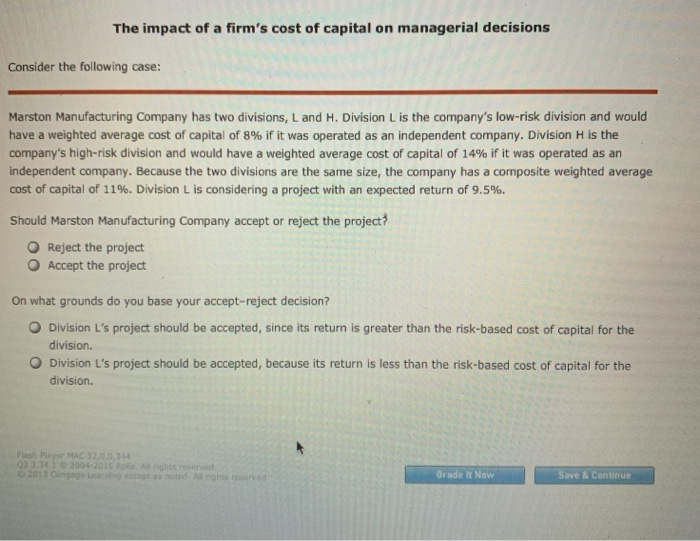

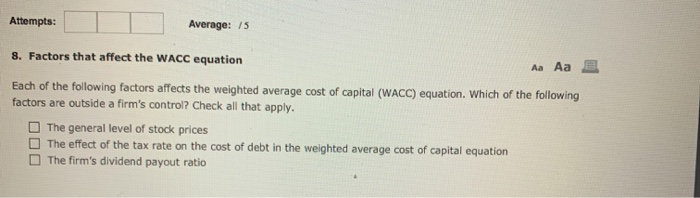

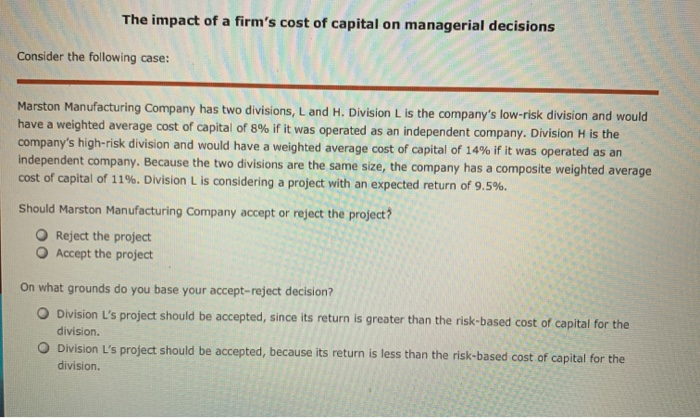

Attempts: Average: 15 8. Factors that affect the WACC equation Aa Aa E Each of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm's control? Check all that apply. The general level of stock prices The effect of the tax rate on the cost of debt in the weighted average cost of capital equation The firm's dividend payout ratio The impact of a firm's cost of capital on managerial decisions Consider the following case: Marston Manufacturing Company has two divisions, L and H. Division L is the company's low-risk division and would have a weighted average cost of capital of 8% if it was operated as an independent company. Division H is the company's high-risk division and would have a weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same size, the company has a composite weighted average cost of capital of 11%. Division L is considering a project with an expected return of 9.5%. Should Marston Manufacturing Company accept or reject the project? Reject the project O Accept the project On what grounds do you base your accept-reject decision? O Division L's project should be accepted, sincets return is greater than the risk-based cost of capital for the The impact of a firm's cost of capital on managerial decisions Consider the following case: Marston Manufacturing Company has two divisions, L and H. Division L is the company's low-risk division and would have a weighted average cost of capital of 8% if it was operated as an independent company. Division H is the company's high-risk division and would have a weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same size, the company has a composite weighted average cost of capital of 11%. Division L is considering a project with an expected return of 9.5%. Should Marston Manufacturing Company accept or reject the project? Reject the project Accept the project On what grounds do you base your accept-reject decision? Division L's project should be accepted, since its return is greater than the risk-based cost of capital for the division. Division L's project should be accepted, because its return is less than the risk-based cost of capital for the division O Orade It Now Save & Continue Attempts: Average: 15 8. Factors that affect the WACC equation Aa Aa E Each of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm's control? Check all that apply. The general level of stock prices The effect of the tax rate on the cost of debt in the weighted average cost of capital equation The firm's dividend payout ratio The impact of a firm's cost of capital on managerial decisions Consider the following case: Marston Manufacturing Company has two divisions, L and H. Division L is the company's low-risk division and would have a weighted average cost of capital of 8% if it was operated as an independent company. Division H is the company's high-risk division and would have a weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same size, the company has a composite weighted average cost of capital of 11%. Division L is considering a project with an expected return of 9.5%. Should Marston Manufacturing Company accept or reject the project? Reject the project O Accept the project On what grounds do you base your accept-reject decision? O Division L's project should be accepted, since its return is greater than the risk-based cost of capital for the division Division L's project should be accepted, because its return is less than the risk-based cost of capital for the division