Answered step by step

Verified Expert Solution

Question

1 Approved Answer

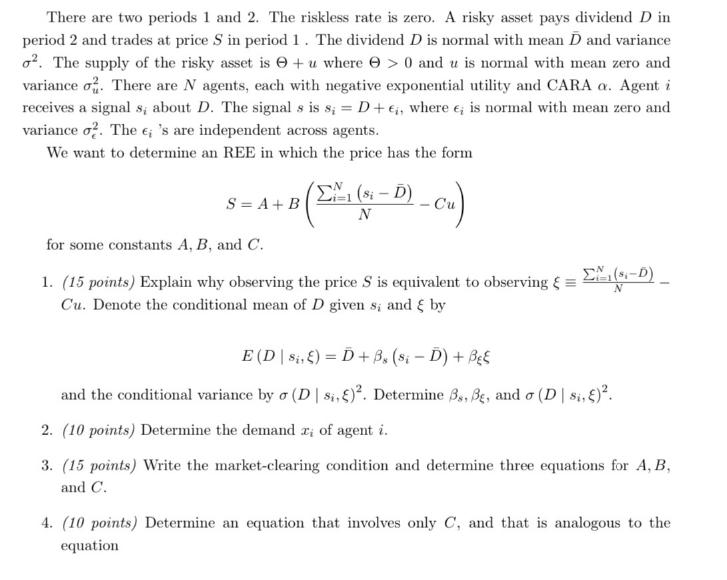

There are two periods 1 and 2. The riskless rate is zero. A risky asset pays dividend D in period 2 and trades at

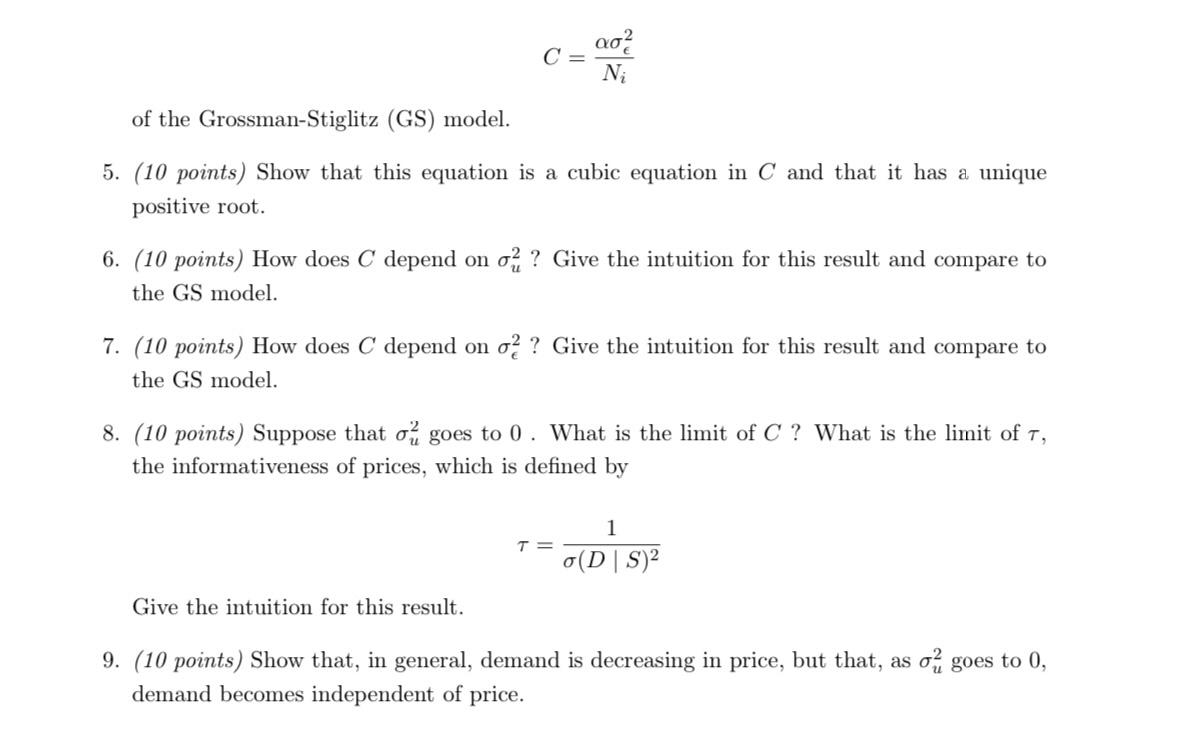

There are two periods 1 and 2. The riskless rate is zero. A risky asset pays dividend D in period 2 and trades at price S in period 1. The dividend D is normal with mean D and variance . The supply of the risky asset is + u where > 0 and u is normal with mean zero and variance. There are N agents, each with negative exponential utility and CARA a. Agent i receives a signal s; about D. The signal s is s = D +6, where e, is normal with mean zero and variance o2. The e; 's are independent across agents. We want to determine an REE in which the price has the form S = A +B N i=1 1-ca) (si - D) N for some constants A, B, and C. 1. (15 points) Explain why observing the price S is equivalent to observing (1-D) Cu. Denote the conditional mean of D given s, and by E (DS,E) = D + B. (si - D) + BeE and the conditional variance by (D | si, E). Determine 3s, Be, and o (D| si, c). 2. (10 points) Determine the demand zi of agent i. 3. (15 points) Write the market-clearing condition and determine three equations for A, B, and C. 4. (10 points) Determine an equation that involves only C, and that is analogous to the equation C = of the Grossman-Stiglitz (GS) model. 5. (10 points) Show that this equation is a cubic equation in C and that it has a unique positive root. 902 Ni 6. (10 points) How does C depend on o2? Give the intuition for this result and compare to the GS model. 7. (10 points) How does C depend on o2? Give the intuition for this result and compare to the GS model. Give the intuition for this result. 8. (10 points) Suppose that o goes to 0. What is the limit of C? What is the limit of T, the informativeness of prices, which is defined by T = 1 o(DS) 9. (10 points) Show that, in general, demand is decreasing in price, but that, as o goes to 0, demand becomes independent of price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Question 1 Observing the price S is equivalent to observing xiequivfracsumi1NsioverlineDNCu because the price S is a function of the signals sigmai and the noise u Specifically the price S is g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started