There are two questions but they are related to each other, so essentially it is one question with a part b.)

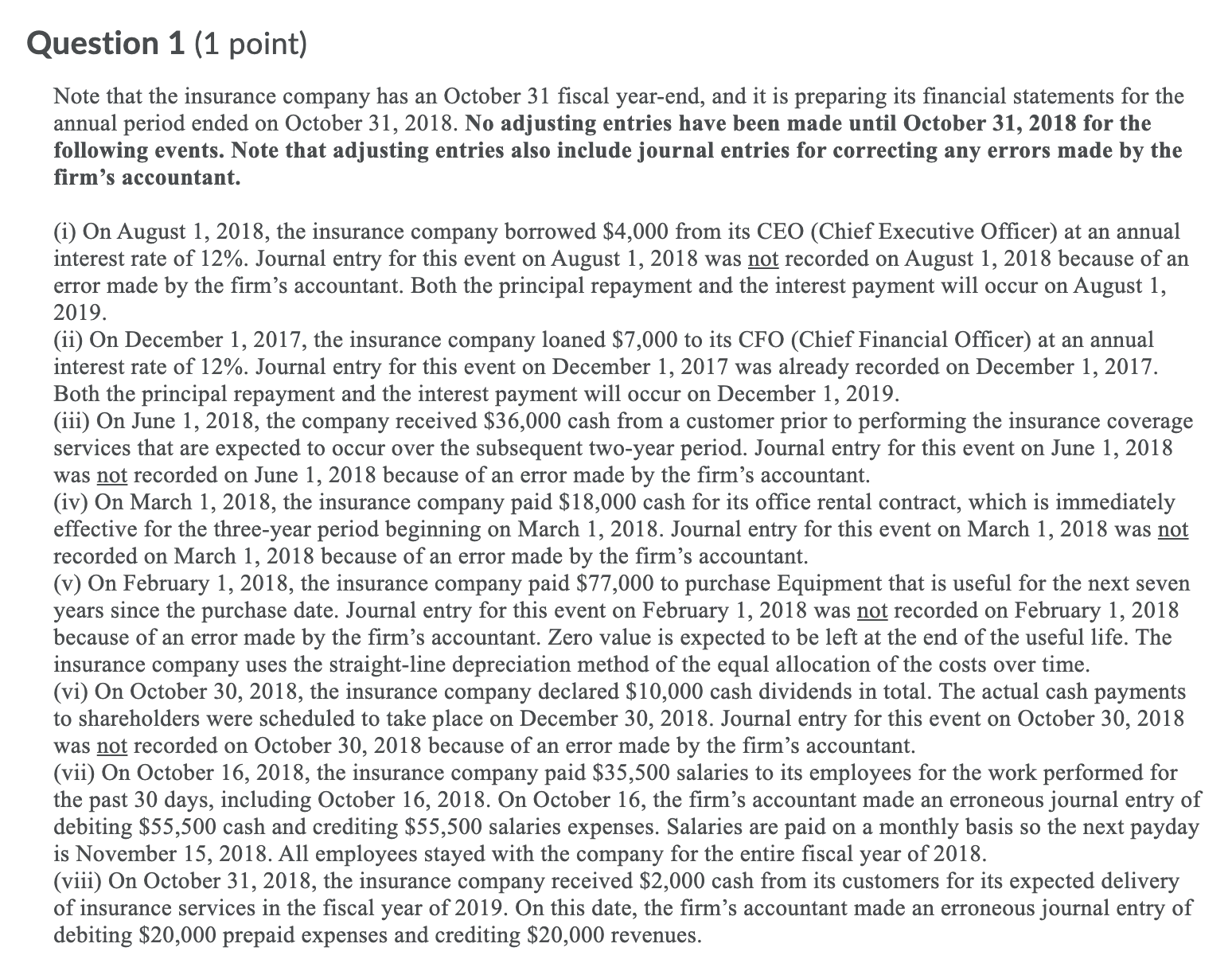

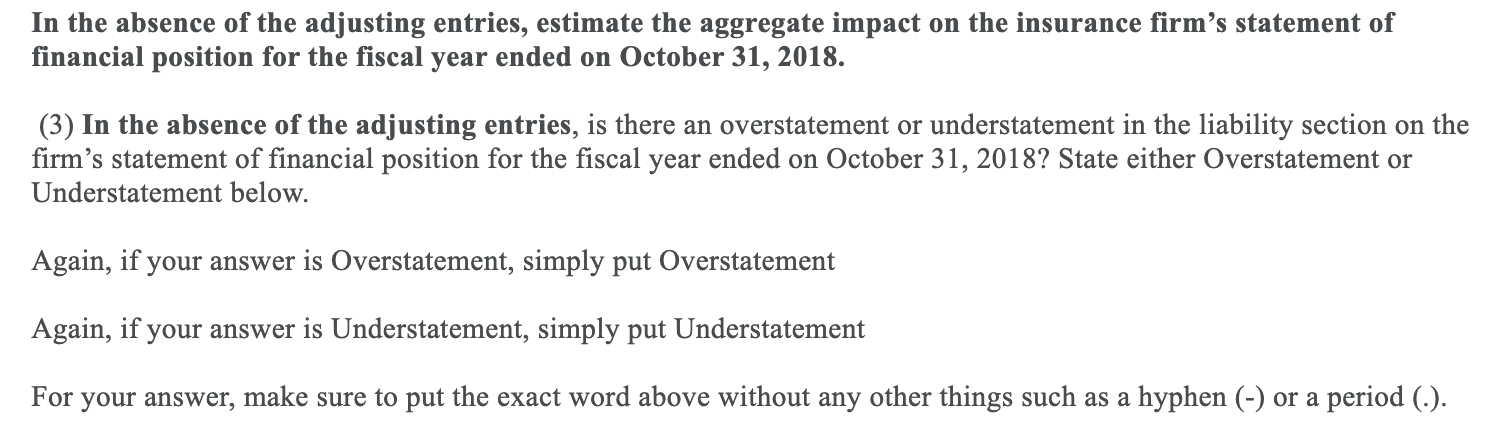

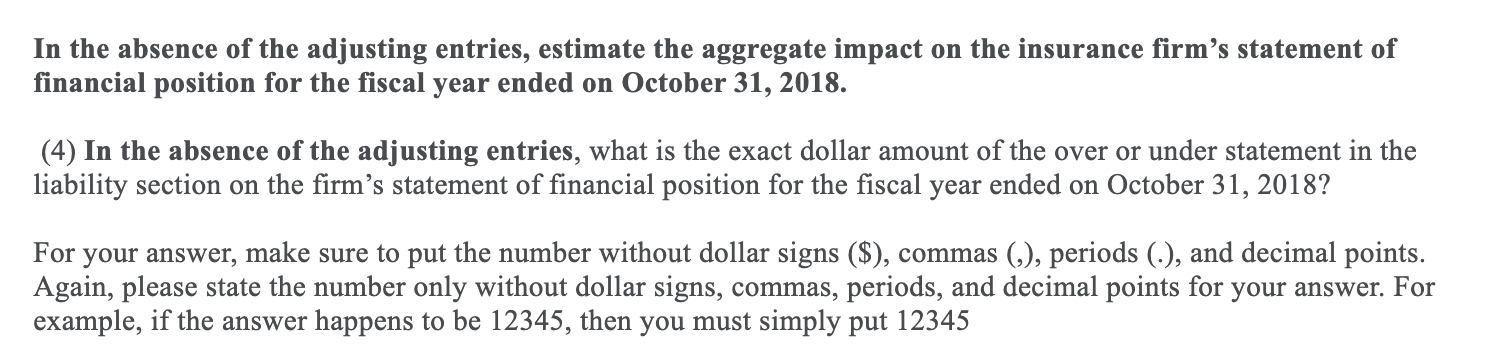

Question 1 (1 point) Note that the insurance company has an October 31 scal year-end, and it is preparing its nancial statements for the annual period ended on October 31, 2018. No adjusting entries have been made until October 31, 2018 for the following events. Note that adjusting entries also include journal entries for correcting any errors made by the rm's accountant. (i) On August 1, 2018, the insurance company borrowed $4,000 from its CEO (Chief Executive Ofcer) at an annual interest rate of 12%. Journal entry for this event on August 1, 2018 was n_ot recorded on August 1, 2018 because of an error made by the rm's accountant. Both the principal repayment and the interest payment will occur on August 1, 2019. (ii) On December 1, 2017, the insurance company loaned $7,000 to its CFO (Chief Financial Ofcer) at an annual interest rate of 12%. Journal entry for this event on December 1, 2017 was already recorded on December 1, 2017. Both the principal repayment and the interest payment will occur on December 1, 2019. (iii) On June 1, 2018, the company received $3 6,000 cash from a customer prior to performing the insurance coverage services that are expected to occur over the subsequent two-year period. Journal entry for this event on June 1, 2018 was n_ot recorded on June 1, 2018 because of an error made by the rm's accountant. (iv) On March 1, 2018, the insurance company paid $18,000 cash for its office rental contract, which is immediately effective for the three-year period beginning on March 1, 2018. Journal entry for this event on March 1, 2018 was n_ot recorded on March 1, 2018 because of an error made by the rm's accountant. (v) On February 1, 2018, the insurance company paid $77,000 to purchase Equipment that is useful for the next seven years since the purchase date. Journal entry for this event on February 1, 2018 was n_ot recorded on February 1, 2018 because of an error made by the rm's accountant. Zero value is expected to be left at the end of the useful life. The insurance company uses the straight-line depreciation method of the equal allocation of the costs over time. (vi) On October 30, 2018, the insurance company declared $10,000 cash dividends in total. The actual cash payments to shareholders were scheduled to take place on December 30, 2018. Journal entry for this event on October 30, 2018 was n_ot recorded on October 30, 2018 because of an error made by the rm's accountant. (vii) On October 16, 2018, the insurance company paid $35,500 salaries to its employees for the work performed for the past 30 days, including October 16, 2018. On October 16, the rm's accountant made an erroneous journal entry of debiting $55,500 cash and crediting $55,500 salaries expenses. Salaries are paid on a monthly basis so the next payday is November 15, 2018. All employees stayed with the company for the entire scal year of 2018. (viii) On October 31, 2018, the insurance company received $2,000 cash from its customers for its expected delivery of insurance services in the scal year of 2019. On this date, the firm's accountant made an erroneous journal entry of debiting $20,000 prepaid expenses and crediting $20,000 revenues. In the absence of the adjusting entries, estimate the aggregate impact on the insurance firm's statement of financial position for the fiscal year ended on October 31, 2018. (3) In the absence of the adjusting entries, is there an overstatement or understatement in the liability section on the firm's statement of financial position for the fiscal year ended on October 31, 2018? State either Overstatement or Understatement below. Again, if your answer is Overstatement, simply put Overstatement Again, if your answer is Understatement, simply put Understatement For your answer, make sure to put the exact word above without any other things such as a hyphen (-) or a period (.).In the absence of the adjusting entries, estimate the aggregate impact on the insurance firm's statement of financial position for the fiscal year ended on October 31, 2018. (4) In the absence of the adjusting entries, what is the exact dollar amount of the over or under statement in the liability section on the firm's statement of financial position for the fiscal year ended on October 31, 2018? For your answer, make sure to put the number without dollar signs ($), commas (,), periods (.), and decimal points. Again, please state the number only without dollar signs, commas, periods, and decimal points for your answer. For example, if the answer happens to be 12345, then you must simply put 12345