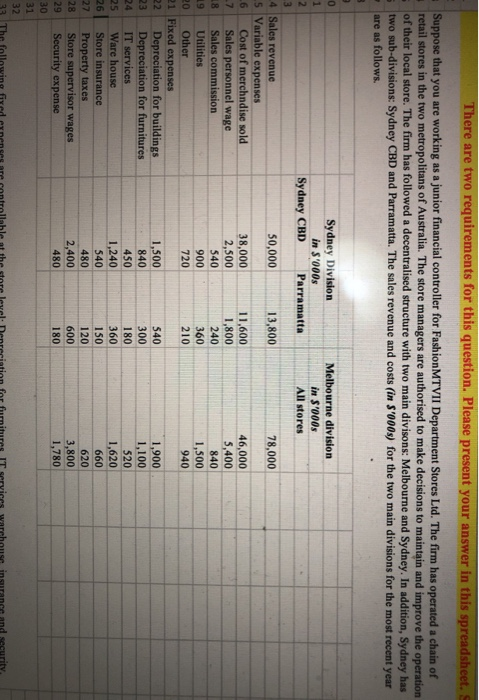

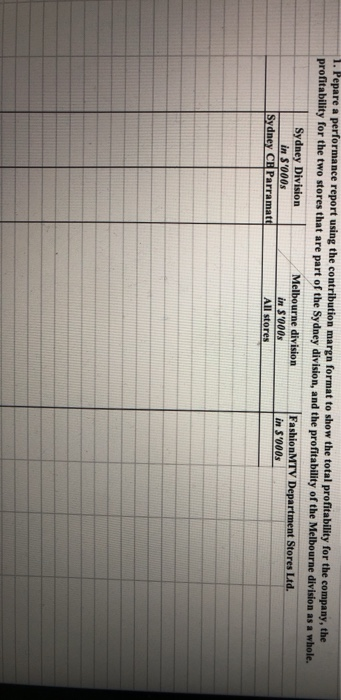

There are two requirements for this question. Please present your answer in this spreadsheet. S Suppose that you are working as a junior financial controller for FashionMTVII Department Stores Ltd. The firm has operated a chain of retail stores in the two metropolitans of Australia. The store managers are authorised to make decisions to maintain and improve the operation of their local store. The firm has followed a decentralised structure with two main divisons: Melbourne and Sydney. In addition, Sydney has two sub-divisions: Sydney CBD and Parramatta. The sales revenue and costs (in s'000s) for the two main divisions for the most recent year are as follows. . 3 Sydney Division in S'000s Sydney CBD Parramatta Melbourne division in S'000s All stores 50,000 13,800 78,000 38,000 2,500 540 900 720 11,600 1,800 240 360 210 46,000 5,400 840 1,500 940 0 1 2 3 4 Sales revenue 5 Variable expenses .6 Cost of merchndise sold 7 Sales personnel wage 18 Sales commission 9 Utilities 20 Other 21 Fixed expenses 22 Depreciation for buildings 23 Depreciation for furnitures 24 IT services 25 Ware house 26 Store insurance 27 Property taxes 28 Store supervisor wages 29 Security expense 30 31 32 33 The 1,500 840 450 1,240 540 480 2,400 540 300 180 360 150 120 600 180 1,900 1,100 520 1,620 660 620 3,800 1,780 480 29 Security expense 480 180 1.780 30 31 32 33 The following fixed expenses are controllable at the store level: Depreciation for furnitures, IT services, warehouse, insurance and security. 34 35 36 37 The following fixed expenses are traceable to divisions or stores, but controllable only at the company level: Depreciation for buildings, 38 property taxes and store supervisor wages. FashionMTVII Department Stores incurs common fixed expenses of $2 600 000, which are not 39 allocated to the two divisions. 40 41 42 43 Required: 45 46 47 1. Pepare a performance report using the contribution margn format to show the total profitability for the company, the profitability for the two stores that are part of the Sydney division, and the profitability of the Melbourne division as a whole. (10 marks) 50 WN 49 2. As your role of a financial controller, explain to the managing director on how this report could be used to manage the company (5 marks) 51 (Please write your answer to the question (2) here: 52 53 54 55 56 57 58 59 60 61 62 63 64 65 1. Pepare a performance report using the contribution margn format to show the total profitability for the company, the profitability for the two stores that are part of the Sydney division, and the profitability of the Melbourne division as a whole. Sydney Division Melbourne division FashionMTV Department Stores Ltd. in S'000s in S'000 in 5'000s Sydney CE Parramatt All stores