There are two ways a corporation can distribute cash to its shareholders: by paying a cash dividend or by repurchasing the companys shares in the

There are two ways a corporation can distribute cash to its shareholders: by paying a

cash dividend or by repurchasing the companys shares in the stock market. When a

company pays a cash dividend, all shareholders receive cash in amounts proportional

to the number of shares they own. In a share repurchase, the company pays cash to buy

shares of its stock in the stock market, thereby reducing the number of share

outstanding.

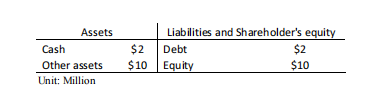

Consider a balance sheet of the CP public company

The CP company has 500,000 number of shares outstanding with $20 per share.

a) If CP distributes a cash dividend of $2 per share, what would be the market value

of its assets and its equity? What would be the number of shares outstanding? What

is CP stock price?

b) If CP repurchases shares worth $ 1 million, what would be the market value of its

assets and its equity? What would be the number of shares outstanding? What is

CP stock price?

c) Suppose management thinks the company has extraordinary investment

opportunities and decides to keep the $1 million in cash that it would otherwise pay

out. Instead, management decides to pay a 10% stock dividend. This means that

shareholders will receive one new share for every 10 old shares they own. What

would be the market value of its assets and its equity? What would be the number

of shares outstanding? What is CP stock price?

Assets Cash Other assets Unit: Million Liabilities and Shareholder's equity $2 Debt $2 $ $10 Equity $10 Assets Cash Other assets Unit: Million Liabilities and Shareholder's equity $2 Debt $2 $ $10 Equity $10Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started