Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There is a difference between the method of computation of interest on capital and computation of interest on drawings. In most cases, interest on capital

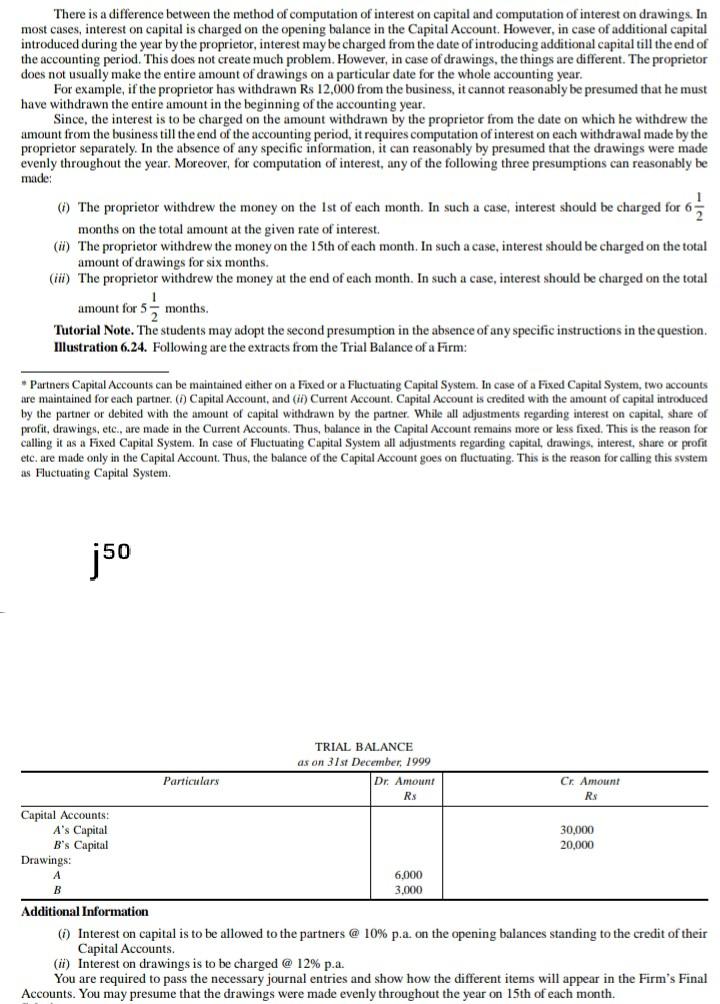

There is a difference between the method of computation of interest on capital and computation of interest on drawings. In most cases, interest on capital is charged on the opening balance in the Capital Account. However, in case of additional capital introduced during the year by the proprietor, interest may be charged from the date of introducing additional capital till the end of the accounting period. This does not create much problem. However, in case of drawings, the things are different. The proprietor does not usually make the entire amount of drawings on a particular date for the whole accounting year. For example, if the proprietor has withdrawn Rs 12,000 from the business, it cannot reasonably be presumed that he must have withdrawn the entire amount in the beginning of the accounting year. Since, the interest is to be charged on the amount withdrawn by the proprietor from the date on which he withdrew the amount from the business till the end of the accounting period, it requires computation of interest on each withdrawal made by the proprietor separately. In the absence of any specific information, it can reasonably by presumed that the drawings were made evenly throughout the year. Moreover, for computation of interest, any of the following three presumptions can reasonably be made: 6) The proprietor withdrew the money on the Ist of each month. In such a case, interest should be charged for o months on the total amount at the given rate of interest, (ii) The proprietor withdrew the money on the 15th of each month. In such a case, interest should be charged on the total amount of drawings for six months. (iii) The proprietor withdrew the money at the end of each month. In such a case, interest should be charged on the total amount for months. Tutorial Note. The students may adopt the second presumption in the absence of any specific instructions in the question. Illustration 6.24. Following are the extracts from the Trial Balance of a Firm: sz Partners Capital Accounts can be maintained either on a Fixed or a Fluctuating Capital System. In case of a Fixed Capital System, two accounts are maintained for each partner. (1) Capital Account, and (ii) Current Account Capital Account is credited with the amount of capital introduced by the partner or debited with the amount of capital withdrawn by the partner. While all adjustments regarding interest on capital, share of profit, drawings, etc., are made in the Current Accounts. Thus, balance in the Capital Account remains more or less fixed. This is the reason for calling it as a Fixed Capital System. In case of Fluctuating Capital System all adjustments regarding capital, drawings, interest, share or profit etc. are made only in the Capital Account. Thus, the balance of the Capital Account goes on fluctuating. This is the reason for calling this system as Fluctuating Capital System. j50 TRIAL BALANCE as on 31st December, 1999 Particulars Dr. Amount C Amount RS Rs Capital Accounts: A's Capital 30,000 B's Capital 20,000 Drawings: A 6,000 3,000 Additional Information () Interest on capital is to be allowed to the partners @ 10% p.a on the opening balances standing to the credit of their Capital Accounts (ii) Interest on drawings is to be charged @ 12% p.a. You are required to pass the necessary journal entries and show how the different items will appear in the Firm's Final Accounts. You may presume that the drawings were made evenly throughout the year on 15th of each month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started