Question

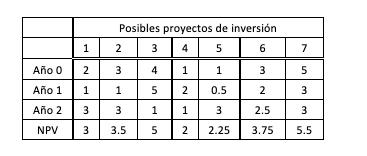

There is a portfolio of 7 possible investments to choose from, the net present value (NPV), of the profit of each of the possible investments

There is a portfolio of 7 possible investments to choose from, the net present value (NPV), of the profit of each of the possible investments as well as the capital that you have to invest per year if you decide to participate, is found in the table that it shows. All values are in millions. An example of the interpretation of the table is the following; For the third possible investment, if you decide to invest in it, you have a profit of $5 million. For this, you need to invest $4 million in year 0, $5 million in year 1, and $1 million in year 2. The budget to invest in year 0 is a minimum of $8 million, while for years 1 and 2 it is a maximum of $10 and $9 million, respectively. Projects 2 and 4 are mutually exclusive.

It should also be considered that project 1 cannot be done without project 4 is done. With the information provided, formulate a mixed integer programming model that maximizes the profits from the investments. Write the binary mathematical model that maximizes revenue.

(Use the following variables Xi = 1 yes I invest in a project i; 0 I do not invest in a project i where i = 1, 2, 3, 4, 5, 6, 7).

1 Ao 0 2 Ao 1 1 Ao 2 3 NPV 3 Posibles proyectos de inversin 23 4 5 6 1 0.5 3 2.25 3 1 3 3.5 4 5 1 5 1 2 1 2 3 2 2.5 3.75 7 5 3 3 5.5

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The variables and objective function remain the same Variables Xi Binary varia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started