There is a problem about the financial reporting, ACCA F7, can you write the detailed and clear solutions? Thanks.

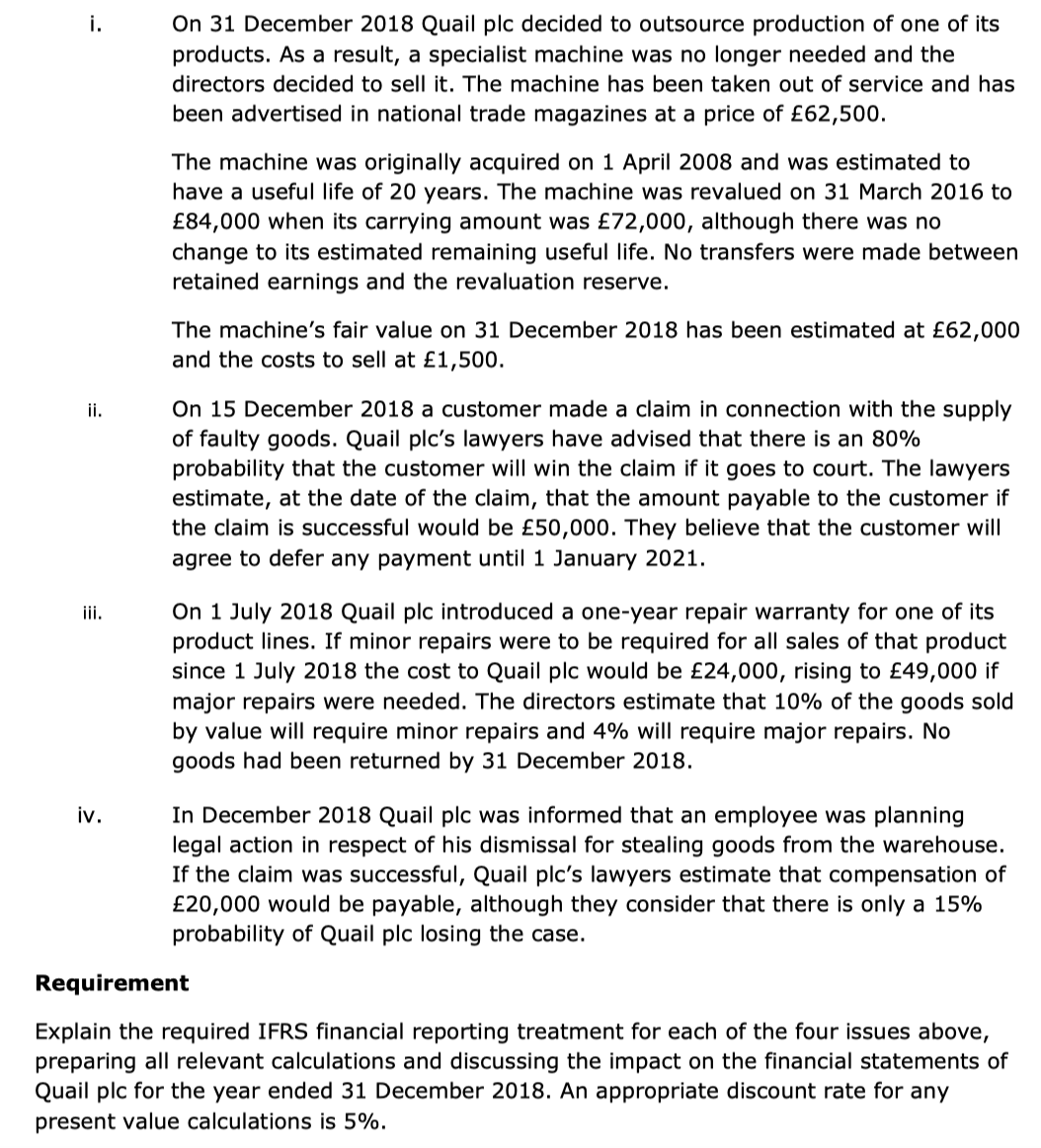

i. On 31 December 2018 Quail pic decided to outsource production of one of its products. As a result, a specialist machine was no longer needed and the directors decided to sell it. The machine has been taken out of service and has been advertised in national trade magazines at a price of 62,500. The machine was originally acquired on 1 April 2008 and was estimated to have a useful life of 20 years. The machine was revalued on 31 March 2016 to 84,000 when its carrying amount was 72,000, although there was no change to its estimated remaining useful life. No transfers were made between retained earnings and the revaluation reserve. The machine's fair value on 31 December 2018 has been estimated at 62,000 and the costs to sell at 1,500. II. On 15 December 2018 a customer made a claim in connection with the supply of faulty goods. Quail plc's lawyers have advised that there is an 80% probability that the customer will win the claim if it goes to court. The lawyers estimate, at the date of the claim, that the amount payable to the customer if the claim is successful would be 50,000. They believe that the customer will agree to defer any payment until 1 January 2021. III. On 1 July 2018 Quail pic introduced a one-year repair warranty for one of its product lines. If minor repairs were to be required for all sales of that product since 1 July 2018 the cost to Quail pic would be 24,000, rising to 49,000 if major repairs were needed. The directors estimate that 10% of the goods sold by value will require minor repairs and 4% will require major repairs. No goods had been returned by 31 December 2018. iv. In December 2018 Quail pic was informed that an employee was planning legal action in respect of his dismissal for stealing goods from the warehouse. If the claim was successful, Quail pic's lawyers estimate that compensation of 20,000 would be payable, although they consider that there is only a 15% probability of Quail plc losing the case. Requirement Explain the required IFRS nancial reporting treatment for each of the four issues above, preparing all relevant calculations and discussing the impact on the financial statements of Quail pic for the year ended 31 December 2018. An appropriate discount rate for any present value calculations is 5%