Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there is no more information because I posted three different question and all the information on rroDiem -10 Froject Evaiuation (LU2 Blooper Industries must replace

there is no more information because I posted three different question and all the information on

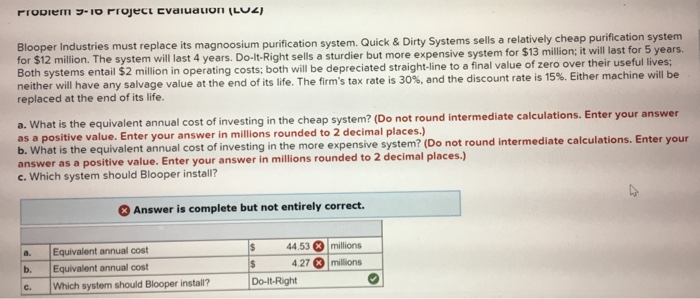

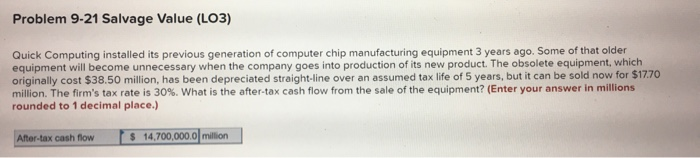

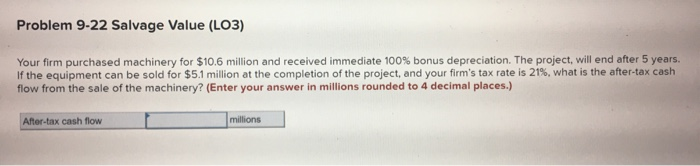

rroDiem -10 Froject Evaiuation (LU2 Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a relatively cheap purification system for $12 million. The system will last 4 years. Do-lt-Right sells a sturdier but more expensive system for $13 million; it willl last for 5 years. Both systems entail $2 million in operating costs; both will be depreciated straight-line to a final value of zero over their useful lives; neither will have any salvage value at the end of its life. The firm's tax rate is 30%, and the discount rate is 15%. Either machine will be replaced at the end of its life. a. What is the equivalent annual cost of investing in the cheap system? (Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.) b. What is the equivalent annual cost of investing in the more expensive system? (Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.) c. Which system should Blooper install? Answer is complete but not entirely correct. 44.53 millions Equivalent annual cost a. 4.27 millions Equivalent annual cost b. Do-It-Right Which system should Blooper install? C. Problem 9-21 Salvage Value (LO3) Quick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some of that older equipment will become unnecessary when the company goes into production of its new product. The obsolete equipment, which originally cost $38.50 million, has been depreciated straight-line over an assumed tax life of 5 years, but it can be sold now for $17.70 million. The firm's tax rate is 30 %. What is the after-tax cash flow from the sale of the equipment? (Enter your answer in millions rounded to 1 decimal place.) 14,700,000.0 million After-tax cash flow Problem 9-22 Salvage Value (LO3) Your firm purchased machinery for $10.6 million and received immediate 100% bonus depreciation. The project, will end after 5 years. If the equipment can be sold for $5.1 million at the completion of the project, and your firm's tax rate is 21 % , what is the after-tax cash flow from the sale of the machinery? (Enter your answer in millions rounded to 4 decimal places.) millions After-tax cash flow Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started