there is no other info needed, please help answer. this question has been sent back about 3 times

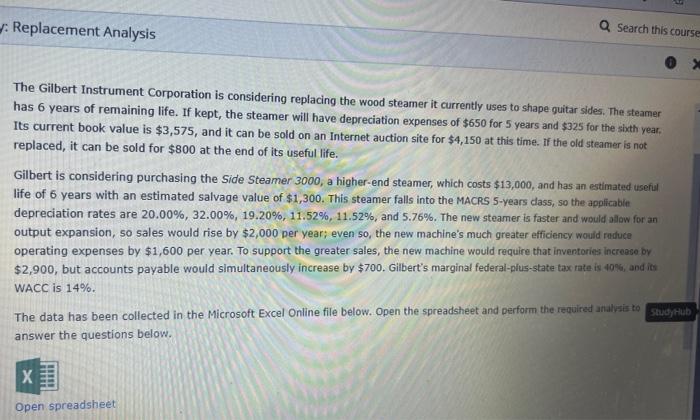

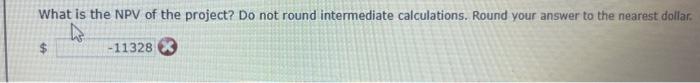

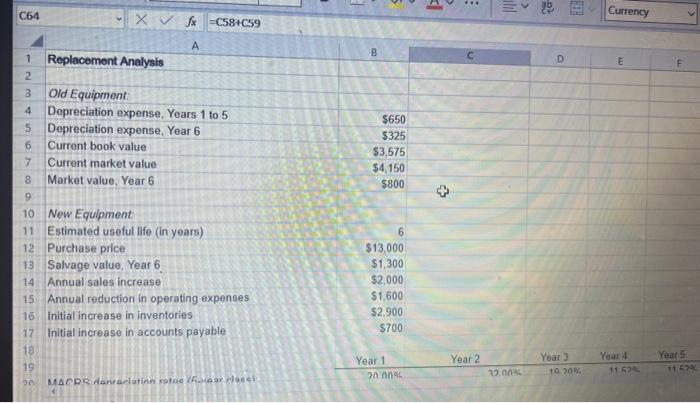

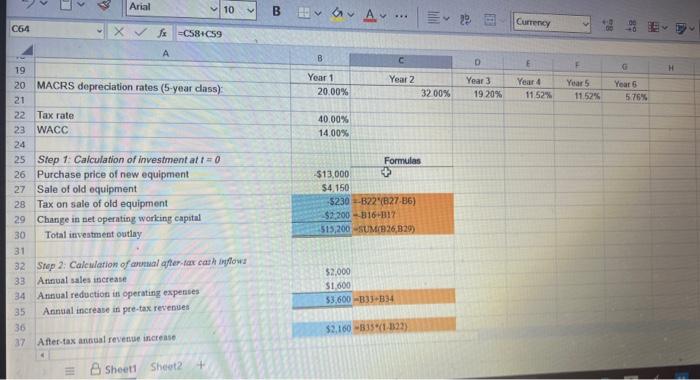

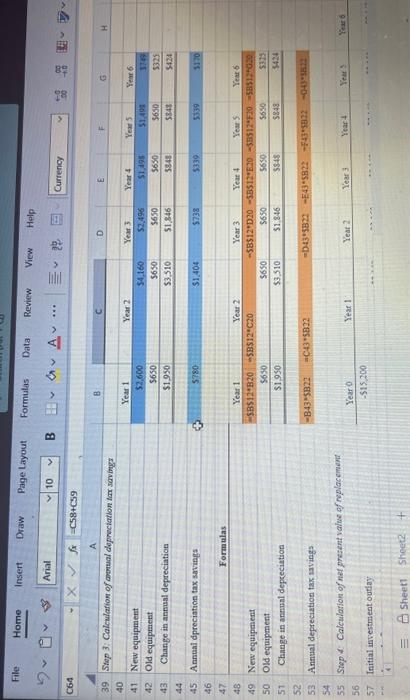

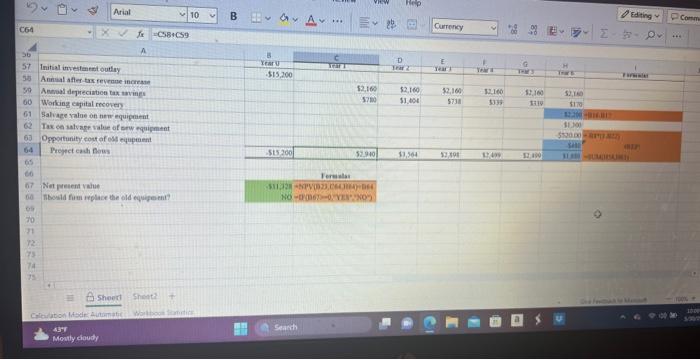

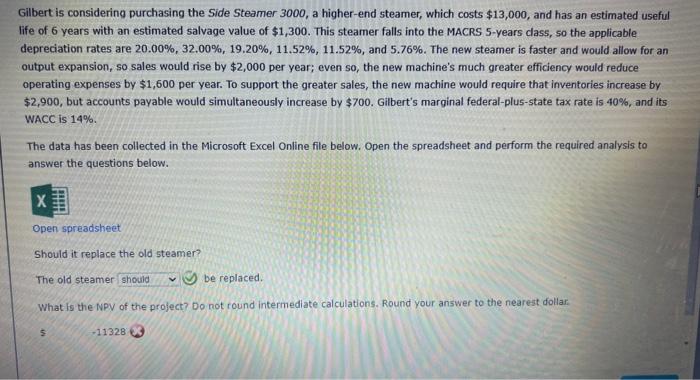

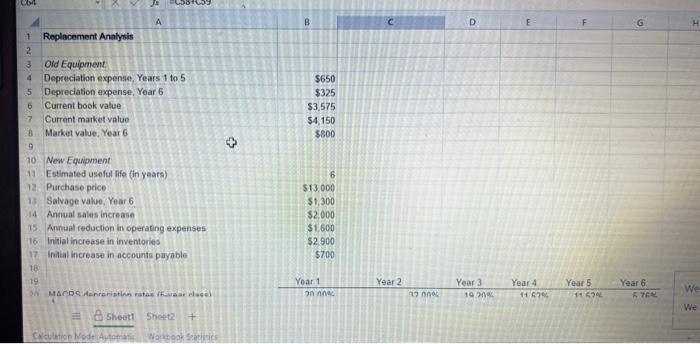

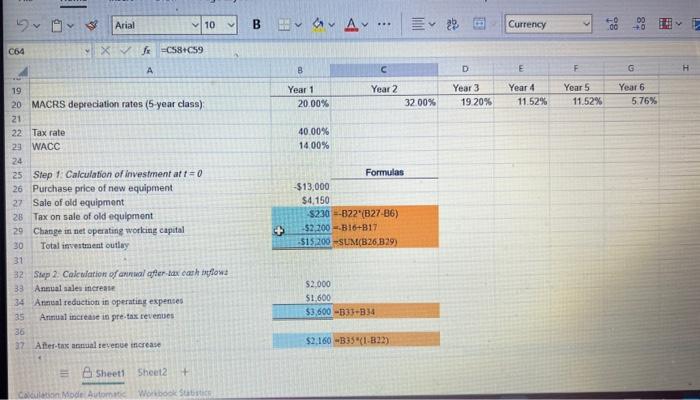

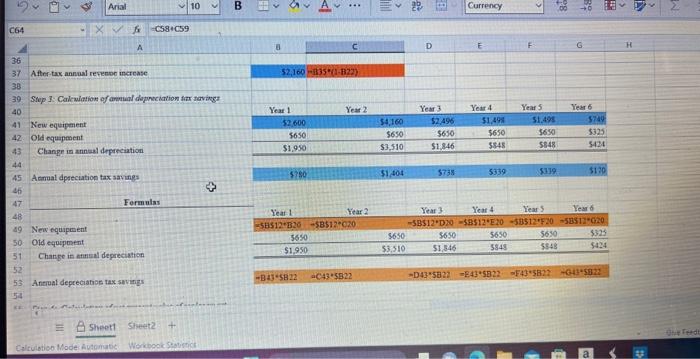

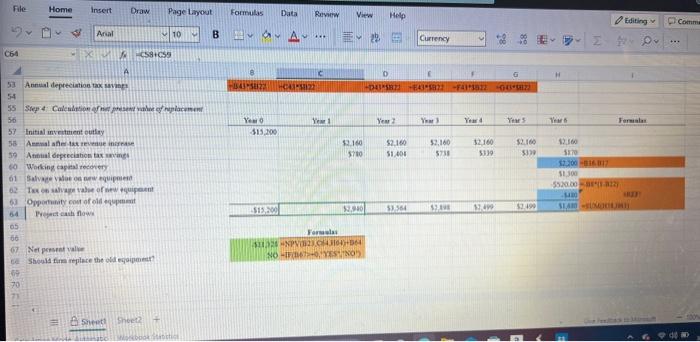

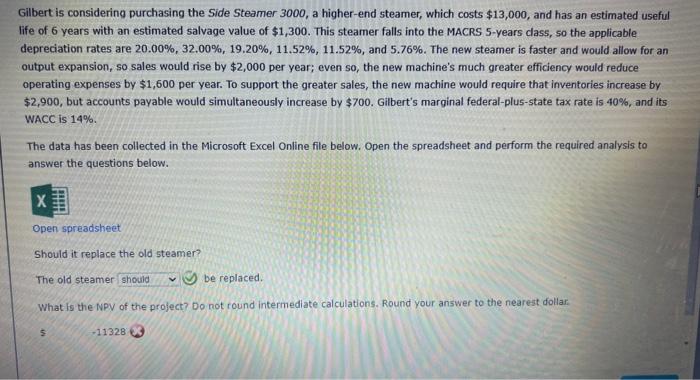

The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $650 for 5 years and $325 for the sixth year. Its current book value is $3,575, and it can be sold on an internet auction site for $4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000 , a higher-end steamer, which costs $13,000, and has an estimated useful life of 6 years with an estimated salvage value of $1,300. This steamer falls into the MACRS 5 -years clas5, so the applicabie depreciation rates are 20.00%,32.00%,19.20%,11.52%,11.52%, and 5.76%. The new steamer is faster and would allow for an output expansion, so sales would rise by $2,000 per year; even 50 , the new machine's much greater efficiency would raduce operating expenses by $1,600 per year. To support the greater sales, the new machine would require that inventories increese by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax nate is 40%, and its WACC is 14% The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required anahisis to answer the questions below. What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Gilbert is considering purchasing the Side Steamer 3000 , a higher-end steamer, which costs $13,000, and has an estimated useful life of 6 years with an estimated salvage value of $1,300. This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00%,32.00%,19.20%,11.52%,11.52%, and 5.76%. The new steamer is faster and would allow for an output expansion, so sales would rise by $2,000 per year; even so, the new machine's much greater efficiency would reduce operating expenses by $1,600 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 40%, and its WACC is 14% The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Should it replace the old steamer? The old steamer be replaced. What is the NPV of the project? Do not cound intermediate calculations. Round your answer to the nearest dollar. 113286 32. Step 2: Calcwiation of anmail afier hax carh inflowd 33. Annual aalen increase 34 Araual teduction in operatieg expenses 35 Annual increase is pre-tax revenues E 8 sheet1 sheet2 + 52,160+1135+(1132) 39. Stop 1. Calculation of ammanl dlopuciation ter tavivg? 45 Acmal dpseciation tax arvings 46 47 48 49 New equipontit 50 Otd equiptent 51 Change in antinal depreciation 52 53 Antrual depreciatios tax swings Sheet1Sheet2+ The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $650 for 5 years and $325 for the sixth year. Its current book value is $3,575, and it can be sold on an internet auction site for $4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000 , a higher-end steamer, which costs $13,000, and has an estimated useful life of 6 years with an estimated salvage value of $1,300. This steamer falls into the MACRS 5 -years clas5, so the applicabie depreciation rates are 20.00%,32.00%,19.20%,11.52%,11.52%, and 5.76%. The new steamer is faster and would allow for an output expansion, so sales would rise by $2,000 per year; even 50 , the new machine's much greater efficiency would raduce operating expenses by $1,600 per year. To support the greater sales, the new machine would require that inventories increese by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax nate is 40%, and its WACC is 14% The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required anahisis to answer the questions below. What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Gilbert is considering purchasing the Side Steamer 3000 , a higher-end steamer, which costs $13,000, and has an estimated useful life of 6 years with an estimated salvage value of $1,300. This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00%,32.00%,19.20%,11.52%,11.52%, and 5.76%. The new steamer is faster and would allow for an output expansion, so sales would rise by $2,000 per year; even so, the new machine's much greater efficiency would reduce operating expenses by $1,600 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 40%, and its WACC is 14% The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Should it replace the old steamer? The old steamer be replaced. What is the NPV of the project? Do not cound intermediate calculations. Round your answer to the nearest dollar. 113286 32. Step 2: Calcwiation of anmail afier hax carh inflowd 33. Annual aalen increase 34 Araual teduction in operatieg expenses 35 Annual increase is pre-tax revenues E 8 sheet1 sheet2 + 52,160+1135+(1132) 39. Stop 1. Calculation of ammanl dlopuciation ter tavivg? 45 Acmal dpseciation tax arvings 46 47 48 49 New equipontit 50 Otd equiptent 51 Change in antinal depreciation 52 53 Antrual depreciatios tax swings Sheet1Sheet2+