Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There is only this much information available please can u solve it asap thank you Cherry Pickings Farms Inc. is considering whether to borrow funds

There is only this much information available please can u solve it asap thank you

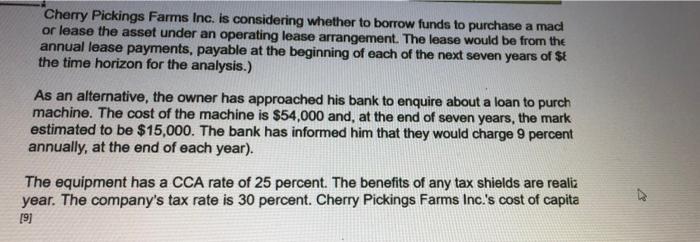

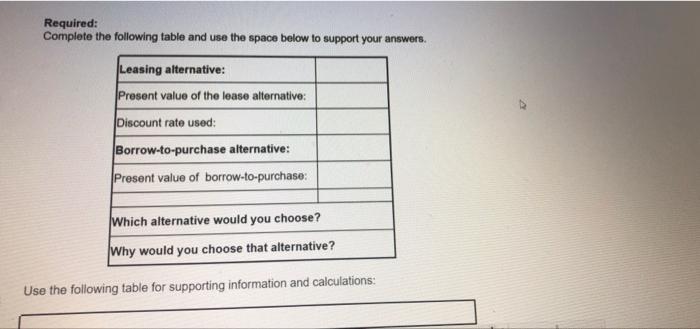

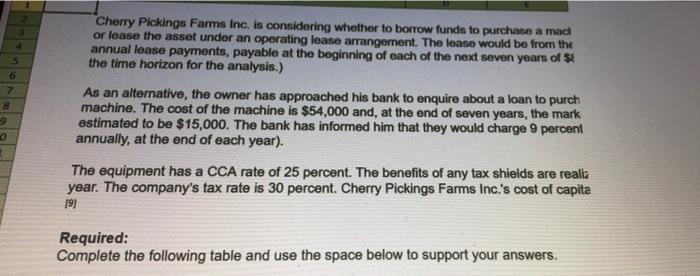

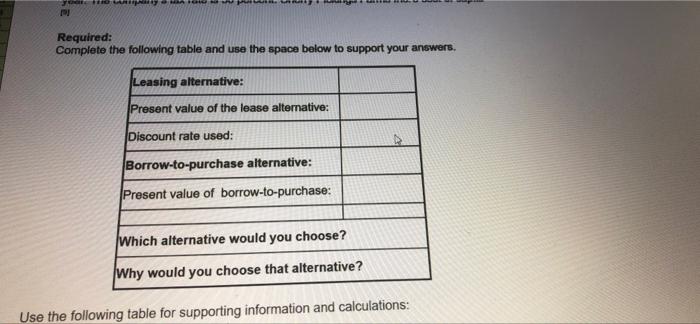

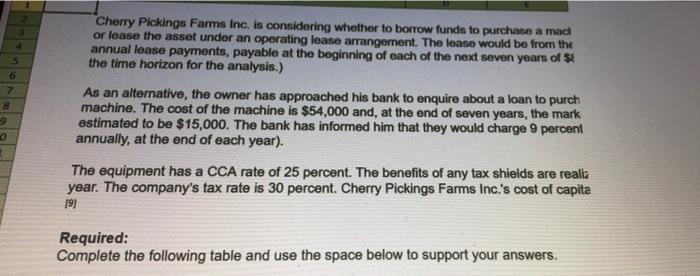

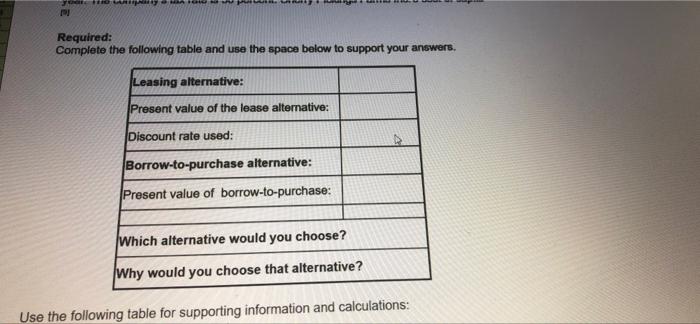

Cherry Pickings Farms Inc. is considering whether to borrow funds to purchase a mad or lease the asset under an operating lease arrangement. The lease would be from the annual lease payments, payable at the beginning of each of the next seven years of $ the time horizon for the analysis.) As an alternative, the owner has approached his bank to enquire about a loan to purch machine. The cost of the machine is $54,000 and, at the end of seven years, the mark estimated to be $15,000. The bank has informed him that they would charge 9 percent annually, at the end of each year). The equipment has a CCA rate of 25 percent. The benefits of any tax shields are realiz year. The company's tax rate is 30 percent. Cherry Pickings Farms Inc.'s cost of capita 191 Required: Complete the following table and use the space below to support your answers. Leasing alternative: Present value of the lease alternative: Discount rate used: Borrow-to-purchase alternative: Present value of borrow-to-purchase: Which alternative would you choose? Why would you choose that alternative? Use the following table for supporting information and calculations: Cherry Pickings Farms Inc. is considering whether to borrow funds to purchase a maci or lease the asset under an operating lease arrangement. The lease would be from the annual lease payments, payable at the beginning of each of the next seven years of $ the time horizon for the analysis.) 5 6 7 B 9 0 As an alternative, the owner has approached his bank to enquire about a loan to purch machine. The cost of the machine is $54,000 and, at the end of seven years, the mark estimated to be $15,000. The bank has informed him that they would charge 9 percent annually, at the end of each year). The equipment has a CCA rate of 25 percent. The benefits of any tax shields are realia year. The company's tax rate is 30 percent. Cherry Pickings Farms Inc.'s cost of capita 191 Required: Complete the following table and use the space below to support your answers. MA Required: Complete the following table and use the space below to support your answers. Leasing alternative: Present value of the lease alternative: Discount rate used: Borrow-to-purchase alternative: Present value of borrow-to-purchase: Which alternative would you choose? Why would you choose that alternative? Use the following table for supporting information and calculations: Cherry Pickings Farms Inc. is considering whether to borrow funds to purchase a mad or lease the asset under an operating lease arrangement. The lease would be from the annual lease payments, payable at the beginning of each of the next seven years of $ the time horizon for the analysis.) As an alternative, the owner has approached his bank to enquire about a loan to purch machine. The cost of the machine is $54,000 and, at the end of seven years, the mark estimated to be $15,000. The bank has informed him that they would charge 9 percent annually, at the end of each year). The equipment has a CCA rate of 25 percent. The benefits of any tax shields are realiz year. The company's tax rate is 30 percent. Cherry Pickings Farms Inc.'s cost of capita 191 Required: Complete the following table and use the space below to support your answers. Leasing alternative: Present value of the lease alternative: Discount rate used: Borrow-to-purchase alternative: Present value of borrow-to-purchase: Which alternative would you choose? Why would you choose that alternative? Use the following table for supporting information and calculations: Cherry Pickings Farms Inc. is considering whether to borrow funds to purchase a maci or lease the asset under an operating lease arrangement. The lease would be from the annual lease payments, payable at the beginning of each of the next seven years of $ the time horizon for the analysis.) 5 6 7 B 9 0 As an alternative, the owner has approached his bank to enquire about a loan to purch machine. The cost of the machine is $54,000 and, at the end of seven years, the mark estimated to be $15,000. The bank has informed him that they would charge 9 percent annually, at the end of each year). The equipment has a CCA rate of 25 percent. The benefits of any tax shields are realia year. The company's tax rate is 30 percent. Cherry Pickings Farms Inc.'s cost of capita 191 Required: Complete the following table and use the space below to support your answers. MA Required: Complete the following table and use the space below to support your answers. Leasing alternative: Present value of the lease alternative: Discount rate used: Borrow-to-purchase alternative: Present value of borrow-to-purchase: Which alternative would you choose? Why would you choose that alternative? Use the following table for supporting information and calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started