Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There isn't any more information arl Trudell and Troy Brinkman began a new consulting business on January 1, 2021 . (Click the icon to view

There isn't any more information

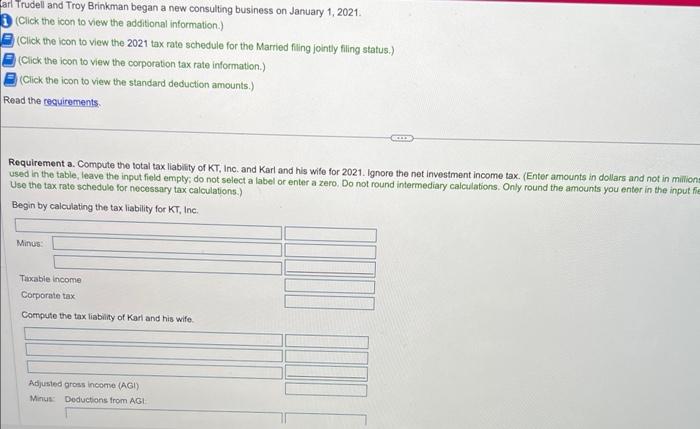

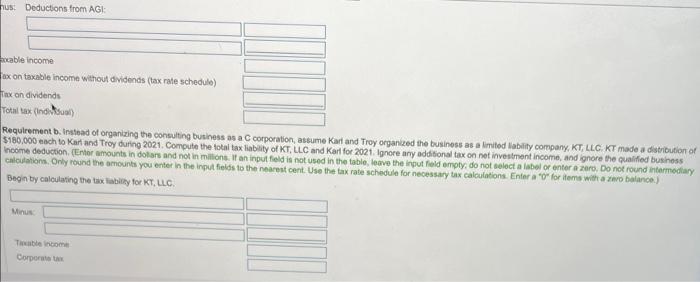

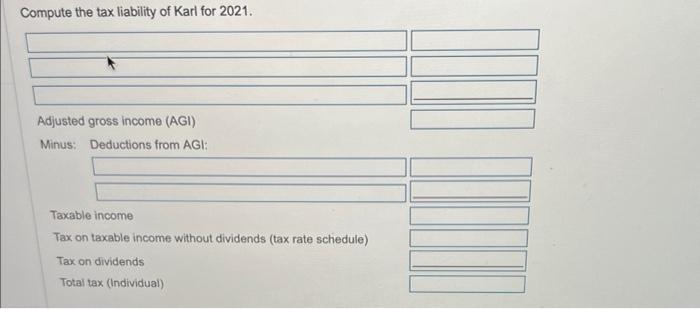

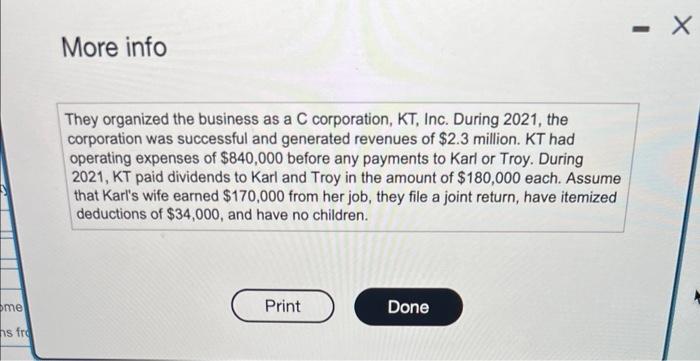

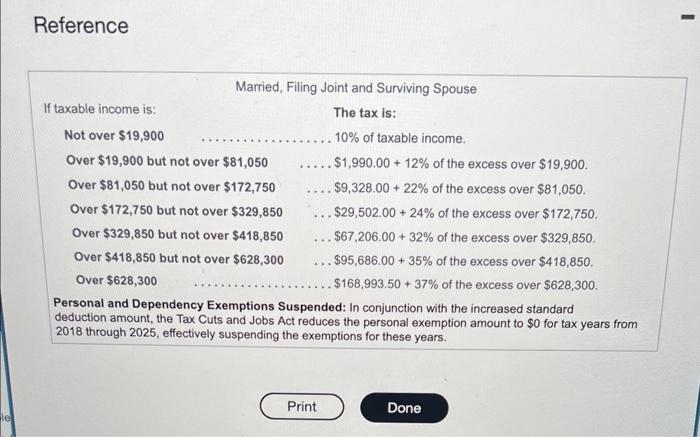

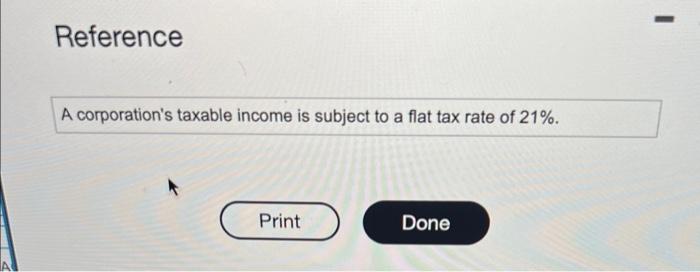

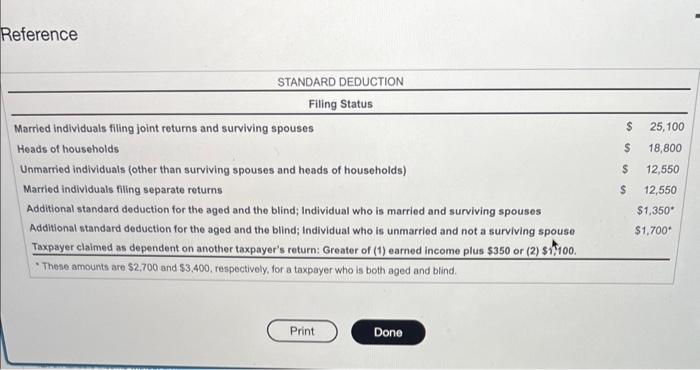

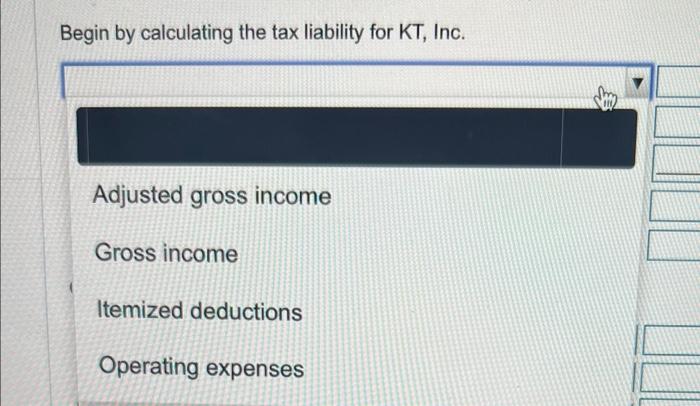

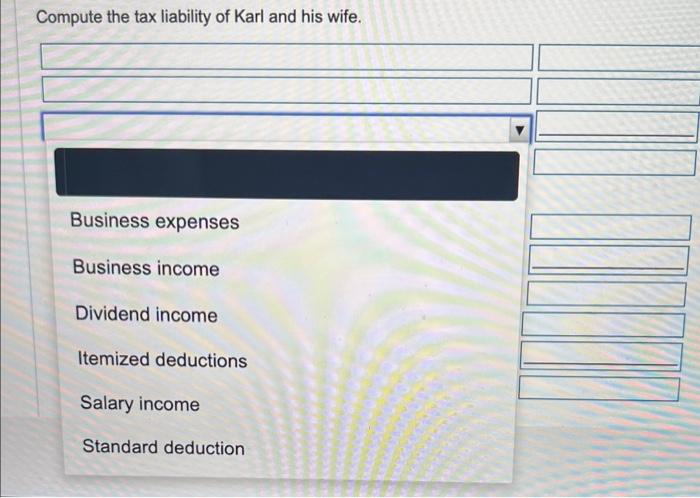

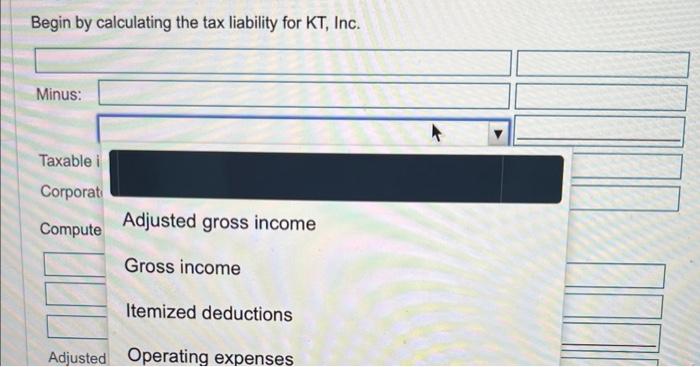

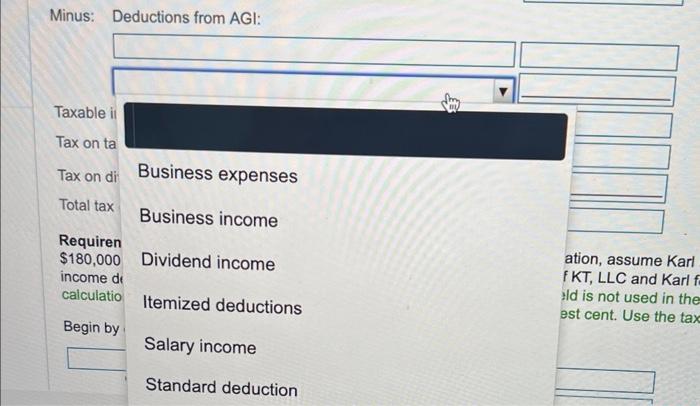

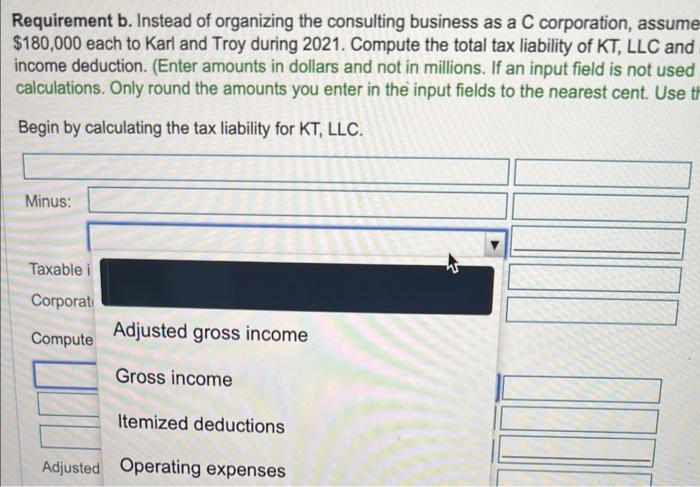

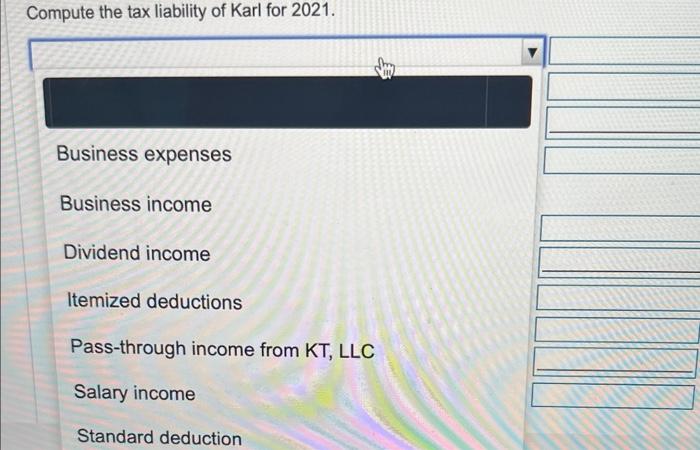

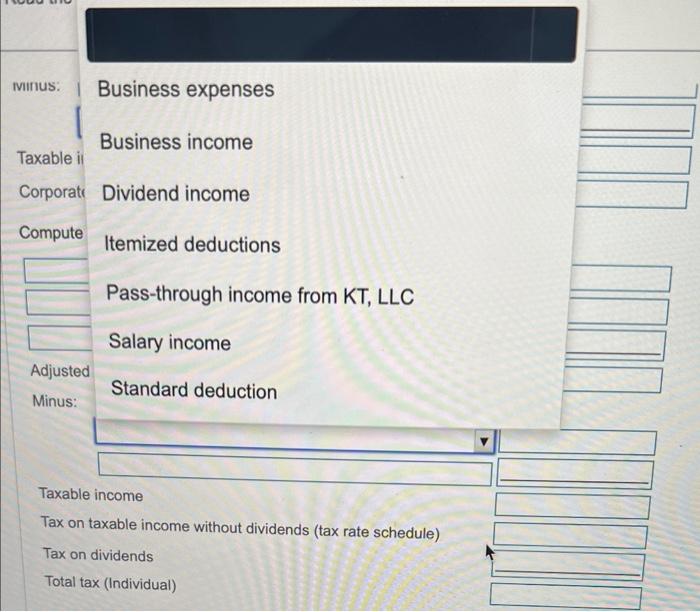

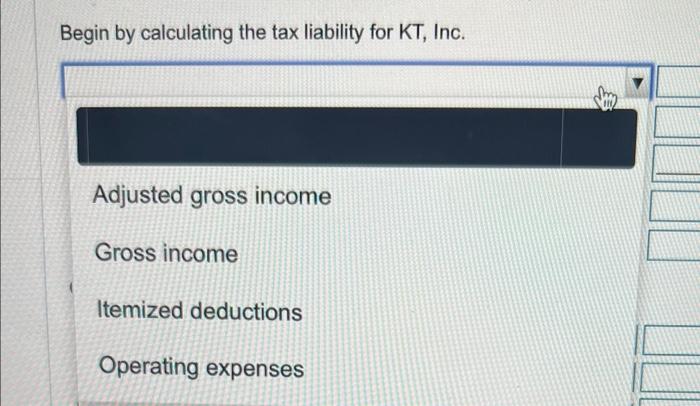

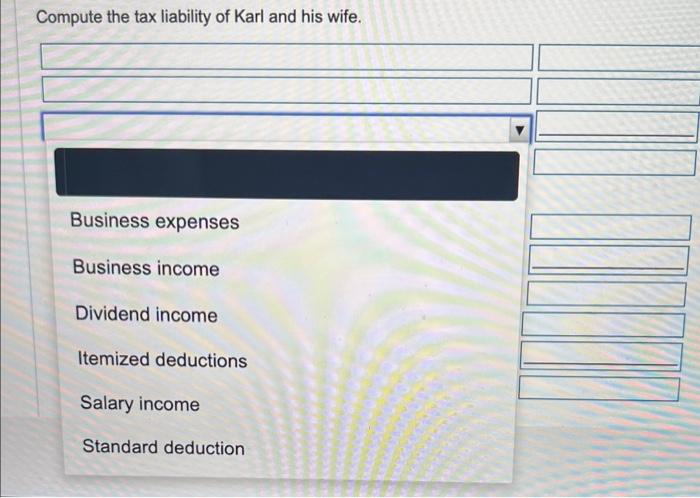

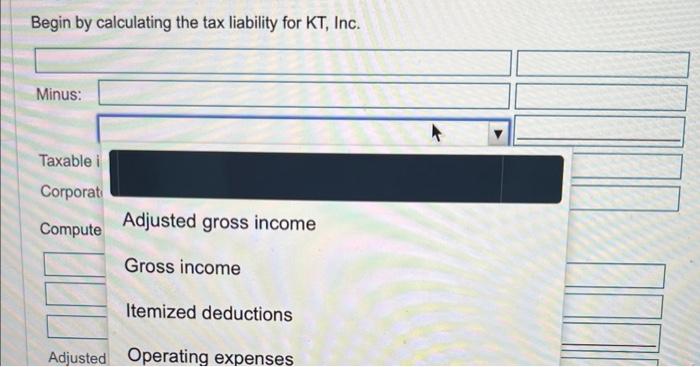

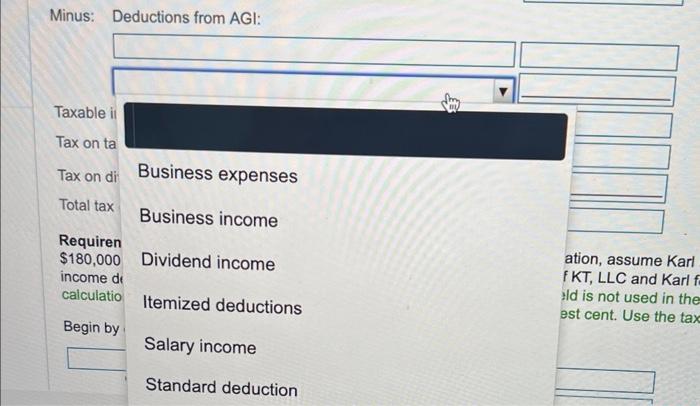

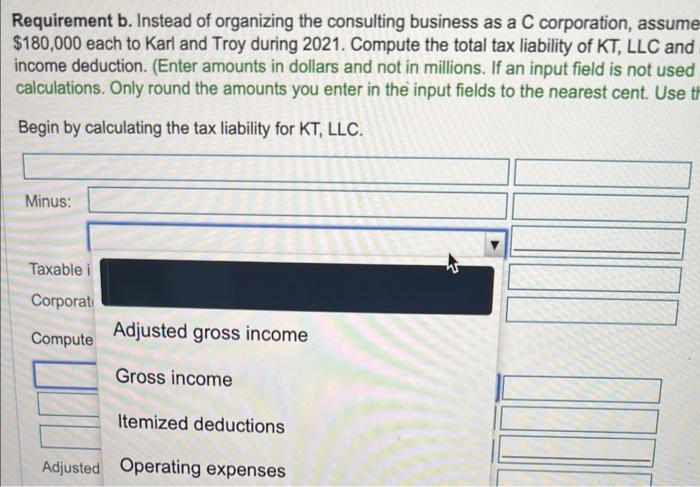

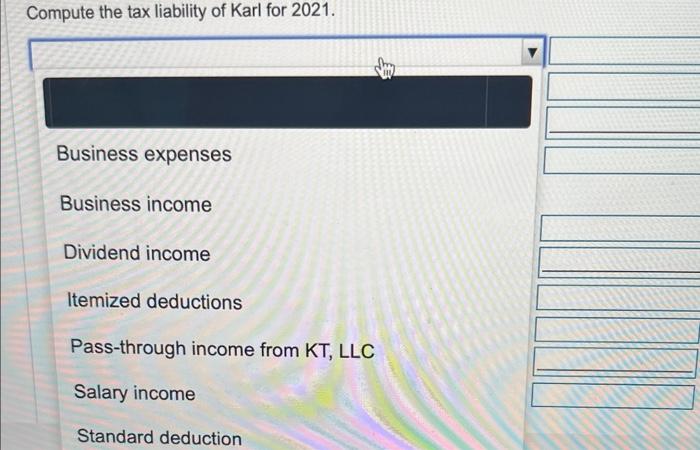

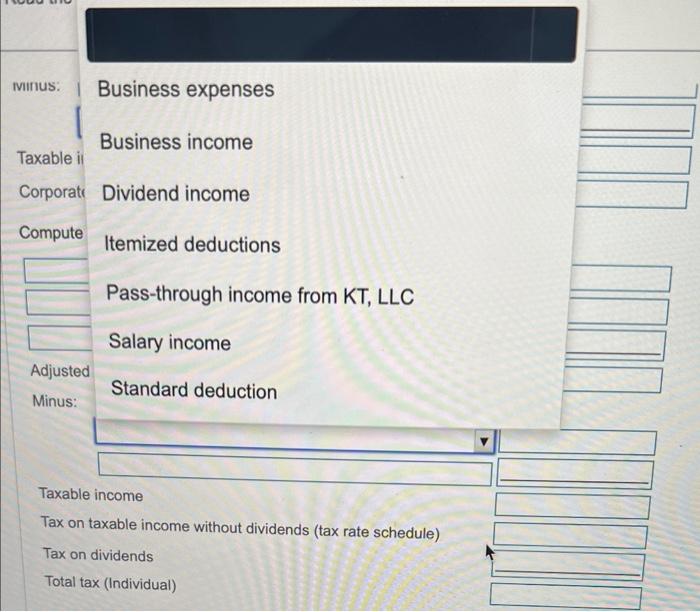

arl Trudell and Troy Brinkman began a new consulting business on January 1, 2021 . (Click the icon to view the additional information.) (Click the icon to view the 2021 tax rate schedule for the Married filing jointly filing status.) (Click the icon to view the corporation tax rate information.) (Click the icon to view the standard deduction amounts.) Read the recuirements. Requirement a. Compute the total tax liability of KT, Inc. and Karl and his wife for 2021. Ignore the net investment income tax. (Enter amounts in dollars and not in milion used in the table, leave the input field emply; do not select a label or enter a zero. Do not round intermediary calculations. Only round the amounts you enter in the input ff Use the tax rate schedule for necessary tax calculations.) woqurement b. rystibad of organizing the consulting butiness as a C corporabion, assume Kari and Troy organized the business as a limitod Ilablity company, KT, LLC. KT made a distribution of seome deduction. Entor troy during 2021. Compute the total tax liabaity of KT, LLC and Karl for 2021. lgnore any additional tax on net invesiment income, and ignore the qualifed bushess calcidations. Only reund the amounts you enter in the inilions. If an input feld is not usod in the table, leave the input feld empty; do not seloct a label or enter a zaro. Do not round intermediary Begin by calculating the tax labiry for KT. LLC. 8 More info They organized the business as a C corporation, KT, Inc. During 2021, the corporation was successful and generated revenues of $2.3 million. KT had operating expenses of $840,000 before any payments to Karl or Troy. During 2021, KT paid dividends to Karl and Troy in the amount of $180,000 each. Assume that Karl's wife earned $170,000 from her job, they file a joint return, have itemized deductions of $34,000, and have no children. Reference Reference A corporation's taxable income is subject to a flat tax rate of 21%. Reference Begin by calculating the tax liability for KT, Inc. Compute the tax liability of Karl and his wife. Business expenses Business income Dividend income Itemized deductions Salary income Standard deduction Begin by calculating the tax liability for KT, Inc. Minus: Taxable i Corporati Compute Adjusted gross income Gross income Itemized deductions Adjusted Operating expenses Minus: Deductions from AGI: Taxable 1 Tax on te Tax ond Total tax Require $180,00 ition, assume Karl income calculati KT, LLC and Karl f d is not used in the Begin b Requirement b. Instead of organizing the consulting business as a C corporation, assume $180,000 each to Karl and Troy during 2021. Compute the total tax liability of KT, LLC and income deduction. (Enter amounts in dollars and not in millions. If an input field is not used calculations. Only round the amounts you enter in the input fields to the nearest cent. Use Begin by calculating the tax liability for KT, LLC. Compute the tax liability of Karl for 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started