Answered step by step

Verified Expert Solution

Question

1 Approved Answer

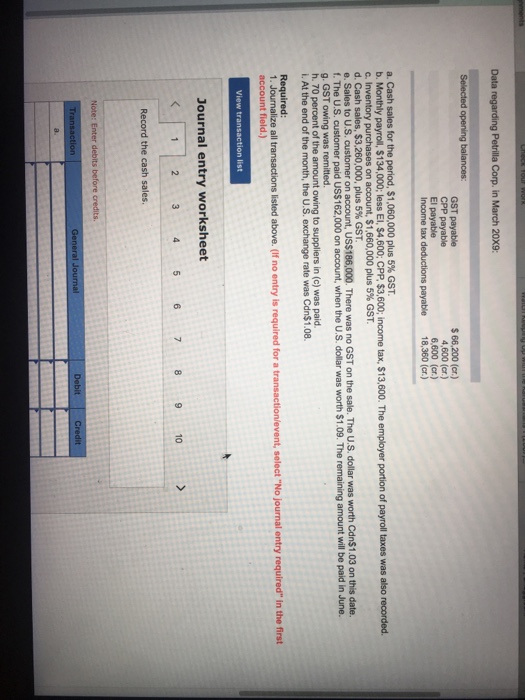

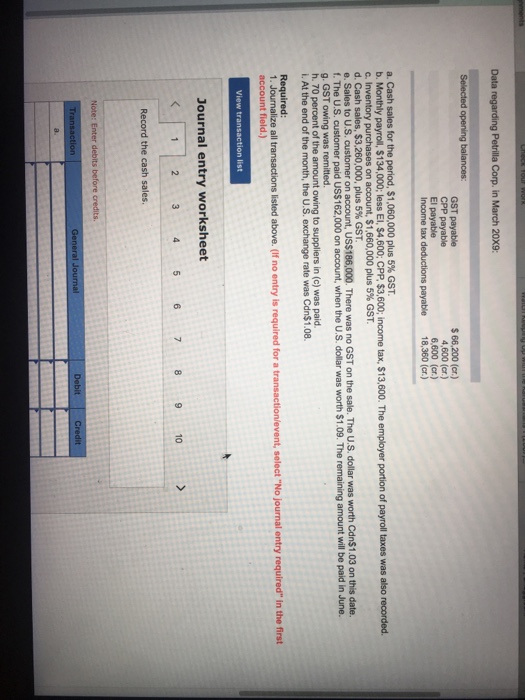

There should be 10 journal entries for part1 1. Record the cash sales 2.Record the salary expense and employees share of payroll taxes 3.Record the

There should be 10 journal entries for part1

1. Record the cash sales

2.Record the salary expense and employees share of payroll taxes

3.Record the employees portion of payroll taxes

4.Record the inventory purchases

5.Record the cash sales

6.Record the sales to US customers on account

7.Record the part payment by US customer

8.Record the entry to remittance of GST owed

9.Record the payment of 60% of money owed on inventory purchase

10. Record the entry to adjust the changes in the exchange rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started