Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There were 49 call options and 49 put options available with exercise prices ranging from INR 2,300 to INR 4,750 and with an exercise date

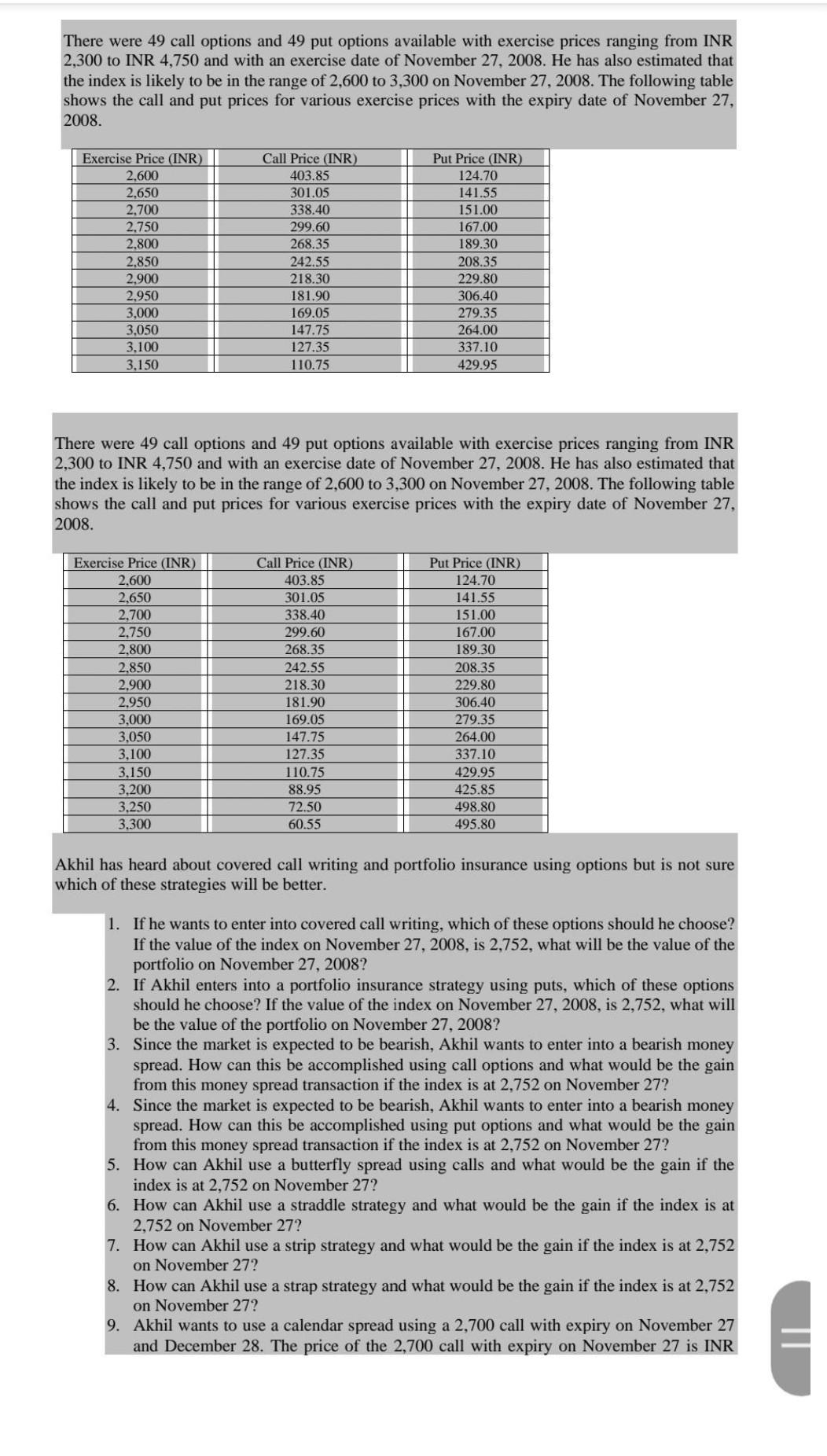

There were 49 call options and 49 put options available with exercise prices ranging from INR 2,300 to INR 4,750 and with an exercise date of November 27, 2008. He has also estimated that the index is likely to be in the range of 2,600 to 3,300 on November 27, 2008. The following table shows the call and put prices for various exercise prices with the expiry date of November 27, 2008. Exercise Price (INR) 2.600 2,650 2,700 2.750 2.800 2.850 2.900 2,950 3.000 3,050 3.100 3,150 Call Price (INR) 403.85 301.05 338.40 299.60 268.35 242.55 218.30 181.90 169.05 147.75 127.35 110.75 Put Price (INR) 124.70 141.55 151.00 167.00 189.30 208.35 229.80 306.40 279.35 264.00 337.10 429.95 There were 49 call options and 49 put options available with exercise prices ranging from INR 2,300 to INR 4,750 and with an exercise date of November 27, 2008. He has also estimated that the index is likely to be in the range of 2,600 to 3,300 on November 27, 2008. The following table shows the call and put prices for various exercise prices with the expiry date of November 27, 2008. Exercise Price (INR) 2.600 2,650 2.700 2,750 2.800 2.850 2,900 2.950 3,000 3,050 3,100 3,150 3.200 3,250 3.300 Call Price (INR) 403.85 301.05 338.40 299.60 268.35 242.55 218.30 181.90 169.05 147.75 127.35 110.75 88.95 72.50 60.55 Put Price (INR) 124.70 141.55 151.00 167.00 189.30 208.35 229.80 306.40 279.35 264.00 337.10 429.95 425.85 498.80 495.80 Akhil has heard about covered call writing and portfolio insurance using options but is not sure which of these strategies will be better. 1. If he wants to enter into covered call writing, which of these options should he choose? If the value of the index on November 27, 2008, is 2,752, what will be the value of the portfolio on November 27, 2008? 2. If Akhil enters into a portfolio insurance strategy using puts, which of these options should he choose? If the value of the index on November 27, 2008, is 2,752, what will be the value of the portfolio on November 27, 2008? 3. Since the market is expected to be bearish, Akhil wants to enter into a bearish money spread. How can this be accomplished using call options and what would be the gain from this money spread transaction if the index is at 2,752 on November 27? 4. Since the market is expected to be bearish, Akhil wants to enter into a bearish money spread. How can this be accomplished using put options and what would be the pain from this money spread transaction if the index is at 2,752 on November 27? 5. How can Akhil use a butterfly spread using calls and what would be the gain if the index is at 2,752 on November 27? 6. How can Akhil use a straddle strategy and what would be the gain if the index is at 2,752 on November 27? 7. How can Akhil use a strip strategy and what would be the gain if the index is at 2,752 on November 27? 8. How can Akhil use a strap strategy and what would be the gain if the index is at 2,752 on November 27? 9. Akhil wants to use a calendar spread using a 2,700 call with expiry on November 27 and December 28. The price of the 2,700 call with expiry on November 27 is INR There were 49 call options and 49 put options available with exercise prices ranging from INR 2,300 to INR 4,750 and with an exercise date of November 27, 2008. He has also estimated that the index is likely to be in the range of 2,600 to 3,300 on November 27, 2008. The following table shows the call and put prices for various exercise prices with the expiry date of November 27, 2008. Exercise Price (INR) 2.600 2,650 2,700 2.750 2.800 2.850 2.900 2,950 3.000 3,050 3.100 3,150 Call Price (INR) 403.85 301.05 338.40 299.60 268.35 242.55 218.30 181.90 169.05 147.75 127.35 110.75 Put Price (INR) 124.70 141.55 151.00 167.00 189.30 208.35 229.80 306.40 279.35 264.00 337.10 429.95 There were 49 call options and 49 put options available with exercise prices ranging from INR 2,300 to INR 4,750 and with an exercise date of November 27, 2008. He has also estimated that the index is likely to be in the range of 2,600 to 3,300 on November 27, 2008. The following table shows the call and put prices for various exercise prices with the expiry date of November 27, 2008. Exercise Price (INR) 2.600 2,650 2.700 2,750 2.800 2.850 2,900 2.950 3,000 3,050 3,100 3,150 3.200 3,250 3.300 Call Price (INR) 403.85 301.05 338.40 299.60 268.35 242.55 218.30 181.90 169.05 147.75 127.35 110.75 88.95 72.50 60.55 Put Price (INR) 124.70 141.55 151.00 167.00 189.30 208.35 229.80 306.40 279.35 264.00 337.10 429.95 425.85 498.80 495.80 Akhil has heard about covered call writing and portfolio insurance using options but is not sure which of these strategies will be better. 1. If he wants to enter into covered call writing, which of these options should he choose? If the value of the index on November 27, 2008, is 2,752, what will be the value of the portfolio on November 27, 2008? 2. If Akhil enters into a portfolio insurance strategy using puts, which of these options should he choose? If the value of the index on November 27, 2008, is 2,752, what will be the value of the portfolio on November 27, 2008? 3. Since the market is expected to be bearish, Akhil wants to enter into a bearish money spread. How can this be accomplished using call options and what would be the gain from this money spread transaction if the index is at 2,752 on November 27? 4. Since the market is expected to be bearish, Akhil wants to enter into a bearish money spread. How can this be accomplished using put options and what would be the pain from this money spread transaction if the index is at 2,752 on November 27? 5. How can Akhil use a butterfly spread using calls and what would be the gain if the index is at 2,752 on November 27? 6. How can Akhil use a straddle strategy and what would be the gain if the index is at 2,752 on November 27? 7. How can Akhil use a strip strategy and what would be the gain if the index is at 2,752 on November 27? 8. How can Akhil use a strap strategy and what would be the gain if the index is at 2,752 on November 27? 9. Akhil wants to use a calendar spread using a 2,700 call with expiry on November 27 and December 28. The price of the 2,700 call with expiry on November 27 is INR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started