Answered step by step

Verified Expert Solution

Question

1 Approved Answer

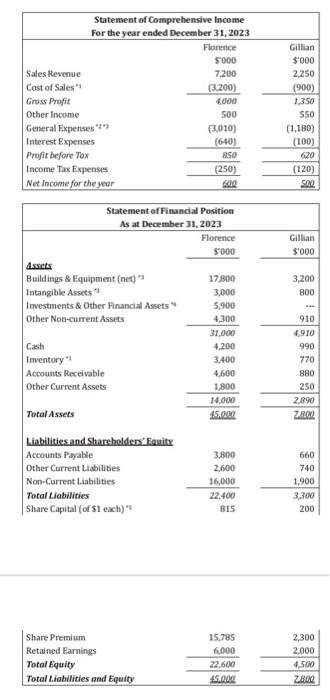

There were no any intercompany transactions between Florence and Gillian during 2022 and 2023. On June 30, 2023, Gillian resold the acquisition date undervalued building

There were no any intercompany transactions between Florence and Gillian during 2022 and

2023. On June 30, 2023, Gillian resold the acquisition date undervalued building to an external third party for $1.6 million. the book value of that building was 1,540,000; the fair value of that building was 1,980,000. And no dividends were paid or declared by both companies. The

statements of comprehensive income and statements of financial position for the year ended

December 31, 2023 for both companies are shown below:

Notes:

*1

First-in first-out inventory policy has been used by both companies.

*2

Amortisation and depreciation expense were included in the operating expenses

*3

All depreciable property, plant and equipment are accounted for by cost method. And straight-line depreciation with no residual value is used for all depreciable property, plant and equipment.

*4

'Investment & Other Financial Assets' includes the investment in Gillian and also other investment accounts. Other investments are all classified as non-strategic investments and are accounted for by FVPL.

*5

Since acquisition on January 1, 2022, both companies have neither issued nor reacquired any of its own shares.

(a) Acquisition fair value differentials refer to the difference between the fair value and the

carrying value of the identifiable net assets of the acquired company at the date of

acquisition. Explain if the subsequent treatment of the acquisition fair value differentials in the consolidation financial statements follows the matching principle.

(b) Prepare necessary consolidation adjustment entries for the preparation of the consolidated statements for the year ended December 31, 2023.

(c) Prepare and complete the consolidation workpaper for the year ended December 31, 2023.

(d) Net income for the year ended December 31, 2024 of Florence and Gillian were $700,000 and $400,000, respectively. Determine the net income attributable to Non-controlling Interest and that to the parents shareholders for the year ended December 31, 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started