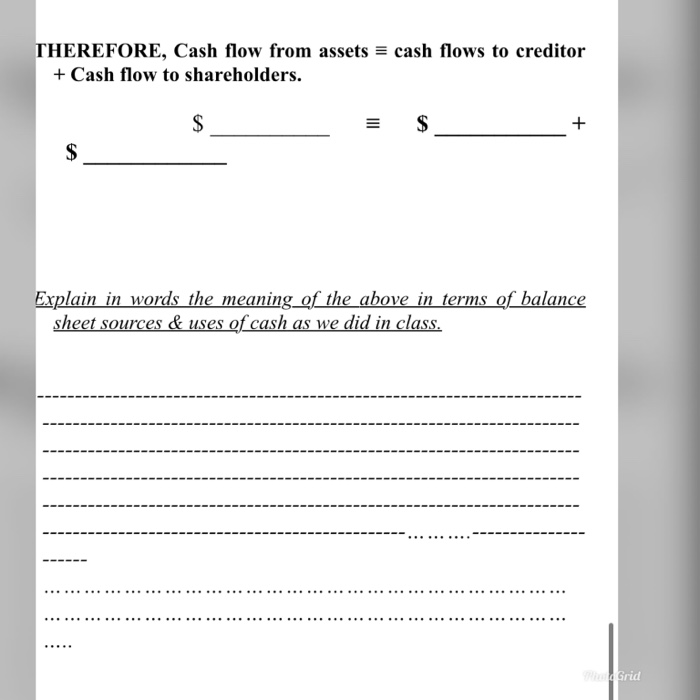

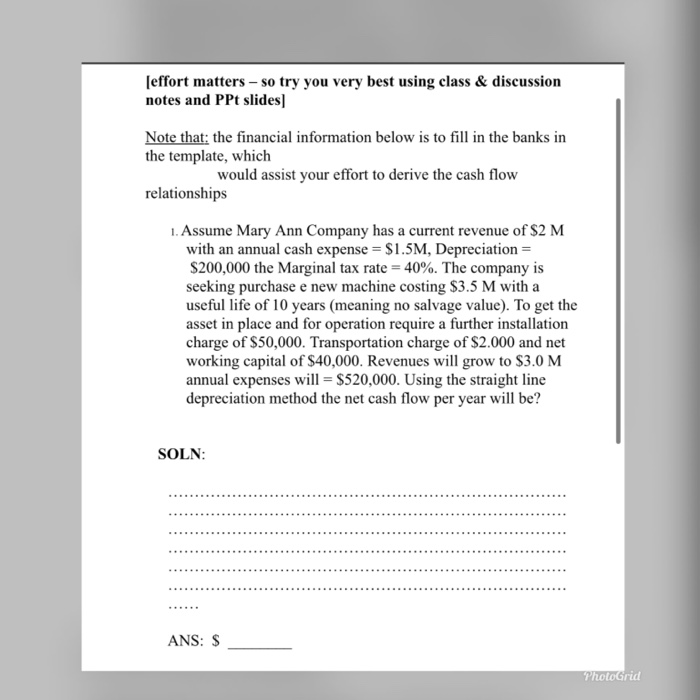

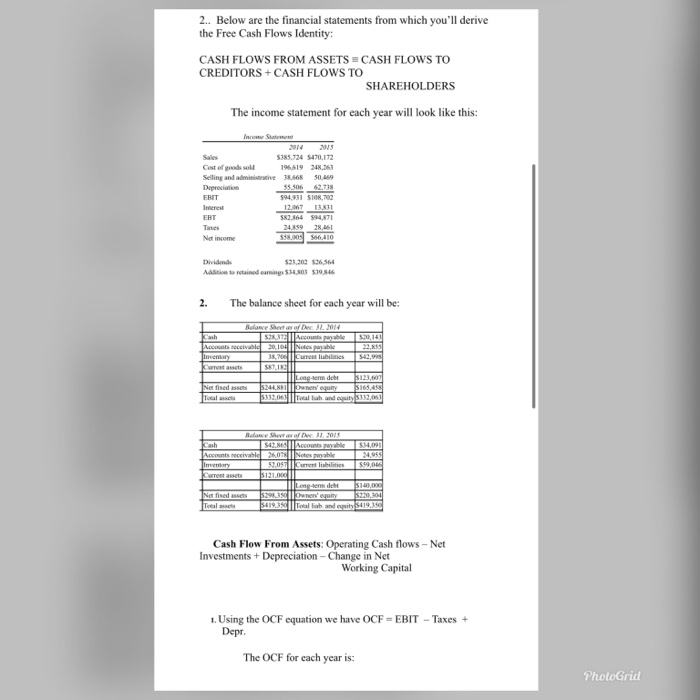

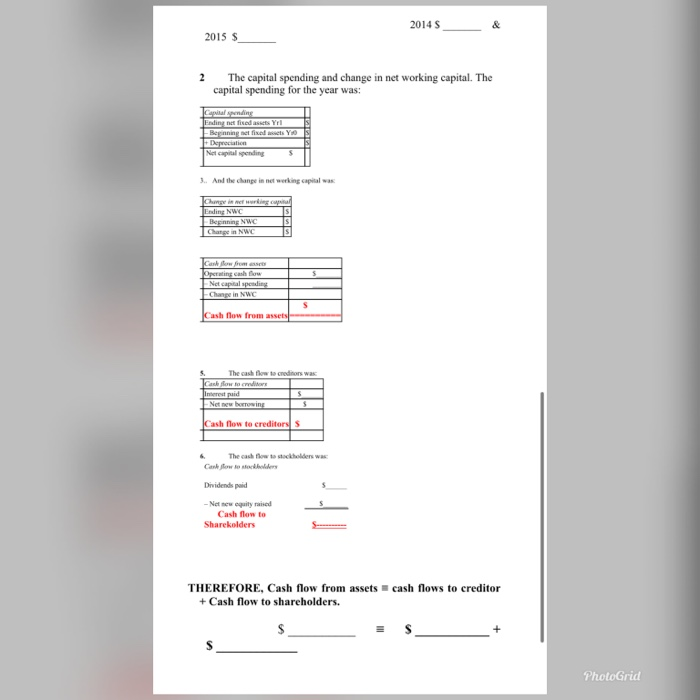

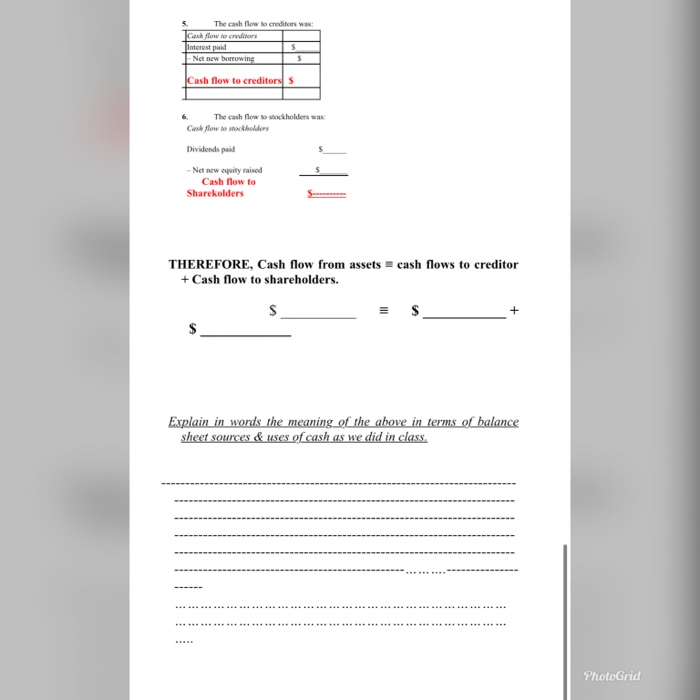

THEREFORE, Cash flow from assets = cash flows to creditor + Cash flow to shareholders. $ $ + Explain in words the meaning of the above in terms of balance sheet sources & uses of cash as we did in class. hd Grid [effort matters - so try you very best using class & discussion notes and PPt slides Note that the financial information below is to fill in the banks in the template, which would assist your effort to derive the cash flow relationships 1. Assume Mary Ann Company has a current revenue of $2 M with an annual cash expense = $1.5M, Depreciation = $200,000 the Marginal tax rate = 40%. The company is seeking purchase e new machine costing $3.5 M with a useful life of 10 years (meaning no salvage value). To get the asset in place and for operation require a further installation charge of $50,000. Transportation charge of $2.000 and net working capital of $40,000. Revenues will grow to $3.0 M annual expenses will = $520,000. Using the straight line depreciation method the net cash flow per year will be? SOLN: ANS: $ PhotoGrid 2. Below are the financial statements from which you'll derive the Free Cash Flows Identity: CASH FLOWS FROM ASSETS = CASH FLOWS TO CREDITORS + CASH FLOWS TO SHAREHOLDERS The income statement for each year will look like this: Income $385.724 $470,172 Costed sold 19,619 248,363 Selling and admitive 33.568 50.000 Depreciation 55.506 62.738 EBIT 594,931 510,702 Interest EBT 582.564 594871 28,451 Net income 558,00 556.410 Dividende Addition to retained earnings 534,303 $19.946 2. The balance sheet for each year will be: Balance Sheet as of Dec 31, 2014 528373 || Acces 5,133 Accounts receivable 20.104 Notepable Inse 38,70 Current liabilities 5571 Logo debe S123,600 Net nedsets 524.8 Owners' equity S165,458 Toalet $32,00 Telliah and city 5132,061 Relance Shevtex of Pue 3.1.2015 Cash S42 | Acable $14.00 Accounts receivable 26.073 | Notes payable 4,055 mary 53.05 II Current assets 5121.00 10,000 Net findes 5293 Illes culty 541935 Illah and equity S419.10 Cash Flow From Assets: Operating Cash flows - Net Investments + Depreciation - Change in Net Working Capital Using the OCF equation we have OCF = EBIT - Taxes + Depr. The OCF for each year is: PhotoGrid 2014 $ 2015 $ 2 The capital spending and change in net working capital. The capital spending for the year was: Capital spending Ending net fixed asset Yril Barining net fixed wets YO Depreciation Nel capital pending 3. And the change in networking capital was Change in rurking capital Ending NWC Beginning NWC Change in NWC S Cashow Operating cash flow Net capital spending - Change in NWC S Cash flow from assets The cash flow to creditors was Cow to Interest paid New bowing Cash flow to creditors The cash flow to stockholders was Castelow to the Dividends paid -Net new equity raised Cash flow to Share kolders THEREFORE, Cash flow from assets = cash flows to creditor + Cash flow to shareholders. $ PhotoGrid The cash flow to creditors was Case flow to creditors interest paid $ Net new borrowing $ Cash flow to creditors The cash flow to stockholders was Cash flow to stockholders Dividends paid -Net new equity raised Cash flow to Sharekolders THEREFORE, Cash flow from assets = cash flows to creditor + Cash flow to shareholders. $ Explain in words the meaning of the above in terms of balance sheet sources & uses of cash as we did in class. . PhotoGrid