Answered step by step

Verified Expert Solution

Question

1 Approved Answer

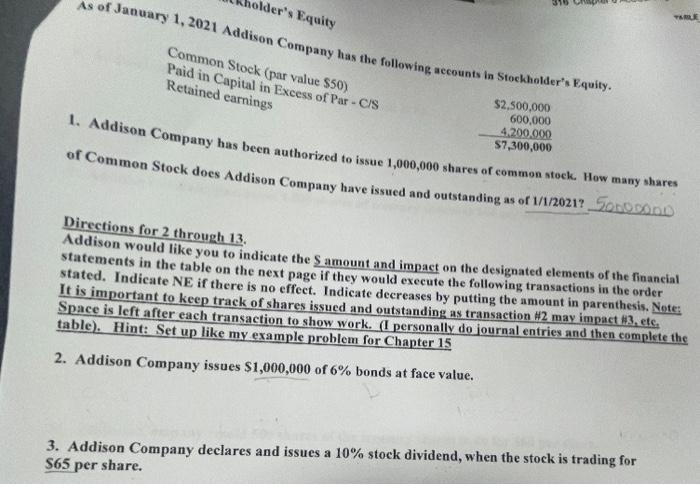

theres no additional parts.this is full question As of January 1, 2021 Addison Company has the following accounts in Stockholder's Equity. Common Stock (par value

theres no additional parts.this is full question

As of January 1, 2021 Addison Company has the following accounts in Stockholder's Equity. Common Stock (par value $50 ) \begin{tabular}{rr} Paid in Capital in Excess of Par - CS & $2,500,000 \\ & 600,000 \\ & 4,200,000 \\ \hline 7,300,000 \end{tabular} authorized to issue 1,000,000 shares of common stoek. How many shares of Common Stock does Addison Company have issued and outstanding as of 1/1/2021? 50 Co 0000 Directions for 2 through 13. Addison would like you to indicate the $ amount and impact on the designated elements of the finaneial statements in the table on the next page if they would execute the following transactions in the order stated. Indicate NE if there is no effect. Indicate decreases by putting the amount in parenthesis. Note: It is important to keep track of shares issued and outstanding as transaction H 2 may impact H3, etc. Space is left after each transaction to show work. (I personally do journal entries and then complete the table). Hint: Set up like my example problem for Chapter 15 2. Addison Company issues $1,000,000 of 6% bonds at face value. 3. Addison Company declares and issues a 10% stock dividend, when the stock is trading for S65 per share Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started