Question

Theresa Trueheart and Ethel Hardachre wish to add a new partner to their partnership. Dave Vader wants to join, and the current partners decide

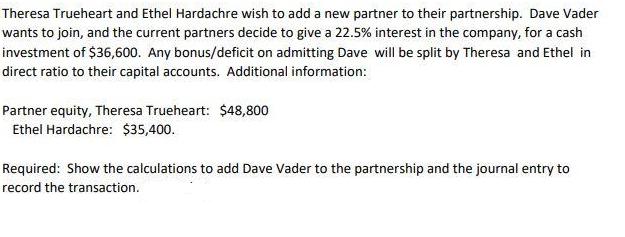

Theresa Trueheart and Ethel Hardachre wish to add a new partner to their partnership. Dave Vader wants to join, and the current partners decide to give a 22.5% interest in the company, for a cash investment of $36,600. Any bonus/deficit on admitting Dave will be split by Theresa and Ethel in direct ratio to their capital accounts. Additional information: Partner equity, Theresa Trueheart: $48,800 Ethel Hardachre: $35,400. Required: Show the calculations to add Dave Vader to the partnership and the journal entry to record the transaction.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

First we need to calculate the total capital in the partnership before admitting Dave Vader Theresa Truehearts capital 48800 Ethel Hardachres capital 35400 Total capital 48800 35400 84200 Next we will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Information Systems

Authors: George H. Bodnar, William S. Hopwood

11th Edition

0132871939, 978-0132871938

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App