Answered step by step

Verified Expert Solution

Question

1 Approved Answer

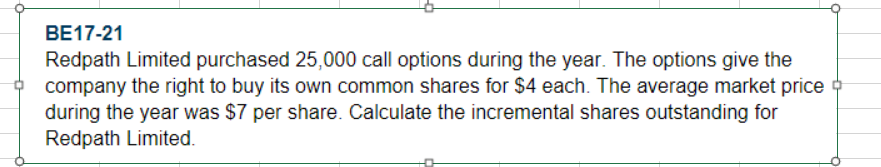

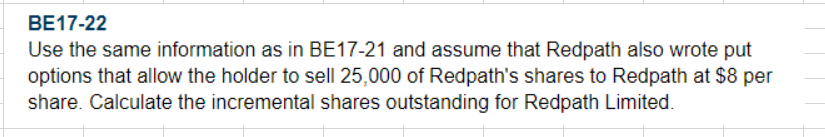

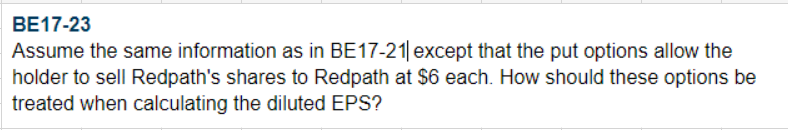

these 3 are a single question please answer all BE17-21 Redpath Limited purchased 25,000 call options during the year. The options give the company the

these 3 are a single question please answer all

BE17-21 Redpath Limited purchased 25,000 call options during the year. The options give the company the right to buy its own common shares for $4 each. The average market price during the year was $7 per share. Calculate the incremental shares outstanding for Redpath Limited. BE17-23 Assume the same information as in BE17-21| except that the put options allow the holder to sell Redpath's shares to Redpath at $6 each. How should these options be treated when calculating the diluted EPS? BE17-22 Use the same information as in BE17-21 and assume that Redpath also wrote put options that allow the holder to sell 25,000 of Redpath's shares to Redpath at $8 per share. Calculate the incremental shares outstanding for Redpath LimitedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started