These all seem to connect.

I missed it in my first post.

I hope this doesnt take an extra post from my account.

Thank you for your help on this problem.

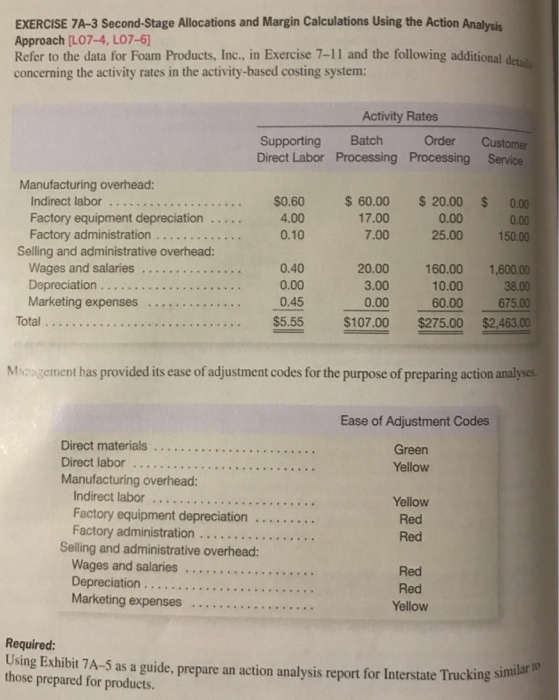

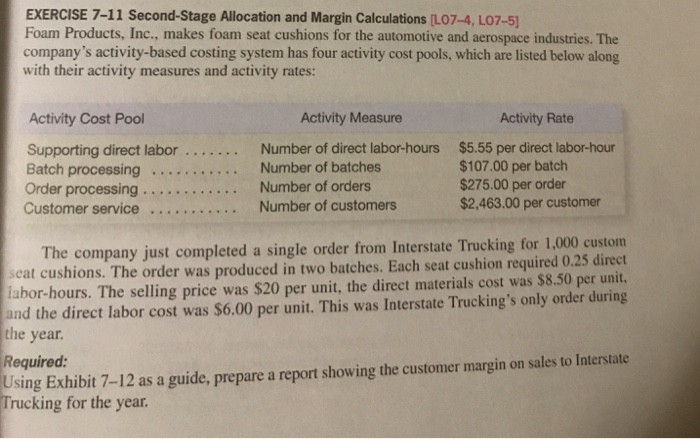

EXERCISE 7A-3 Second-Stage Allocations and Margin Calculations Using the Action Analysis Approach [LO7-4, L07-6 Refer to the data for Foam Products, Inc., in Exercise 7-11 and the following additional detai concerning the activity rates in the activity-based costing system: Activity Rates Order Customer Direct Labor Processing Processing Service Manufacturing overhead Indirect labor $0.60 $60.00 20.00 0.00 ationS0.60 4.00 0.10 17.00 7.00 0.00 25.00 Factory administration . 150.00 Selling and administrative overhead 0.40 0.00 20.00 160.00 1,600.00 38.00 0.450.00 60.00 675.00 $107.00 $275.00 $2,463.00 10.00 Depreciation Marketing expenses 3.00 Total... $5.55 Mxzagement has provided its ease of adjustment codes for the purpose of preparing action analyses Ease of Adjustment Codes Direct materials Direct labor Manufacturing overhead: Green Yellow Indirect labor Yellow Red Red ation Factory administration. Selling and administrative overhead: Wages and salaries . Depreciation Marketing expenses Red Red Yellow Required: Using Eshibin 7A-5 as a guide,prepare an action analysis report for Interstate Trucking those prepared for products. sinm milar t0 EXERCISE 7A-3 Second-Stage Allocations and Margin Calculations Using the Action Analysis Approach [LO7-4, L07-6 Refer to the data for Foam Products, Inc., in Exercise 7-11 and the following additional detai concerning the activity rates in the activity-based costing system: Activity Rates Order Customer Direct Labor Processing Processing Service Manufacturing overhead Indirect labor $0.60 $60.00 20.00 0.00 ationS0.60 4.00 0.10 17.00 7.00 0.00 25.00 Factory administration . 150.00 Selling and administrative overhead 0.40 0.00 20.00 160.00 1,600.00 38.00 0.450.00 60.00 675.00 $107.00 $275.00 $2,463.00 10.00 Depreciation Marketing expenses 3.00 Total... $5.55 Mxzagement has provided its ease of adjustment codes for the purpose of preparing action analyses Ease of Adjustment Codes Direct materials Direct labor Manufacturing overhead: Green Yellow Indirect labor Yellow Red Red ation Factory administration. Selling and administrative overhead: Wages and salaries . Depreciation Marketing expenses Red Red Yellow Required: Using Eshibin 7A-5 as a guide,prepare an action analysis report for Interstate Trucking those prepared for products. sinm milar t0