These all tie into one question about business/principles of what finance is.

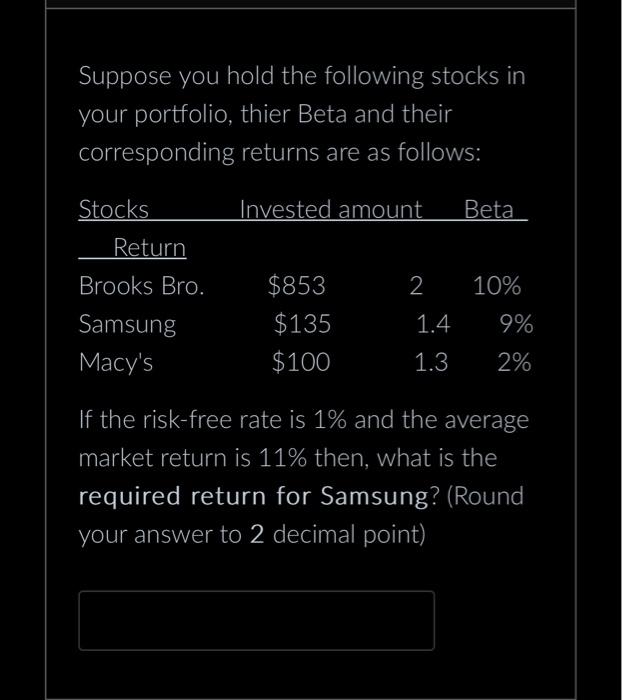

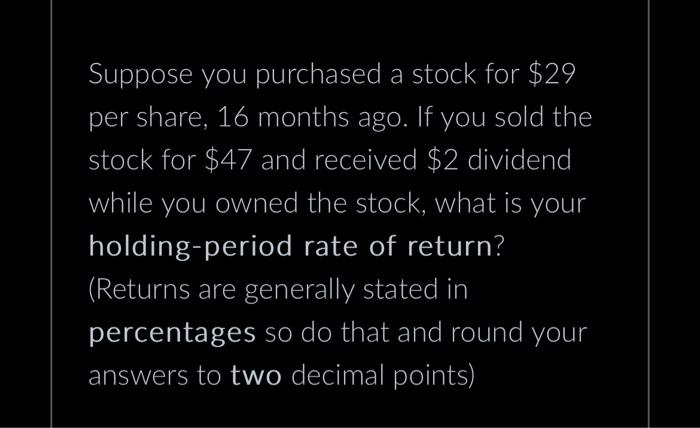

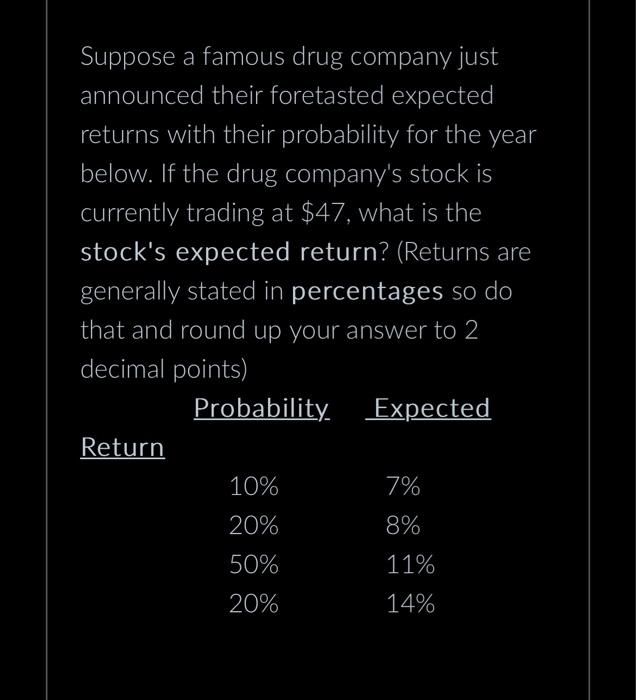

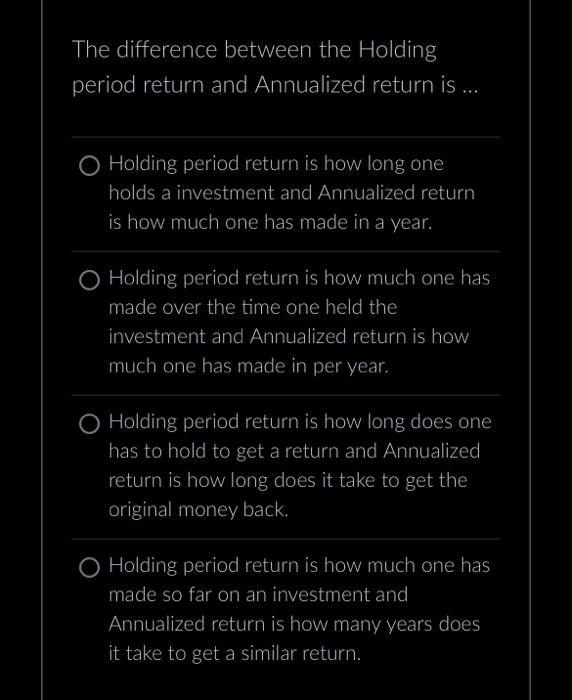

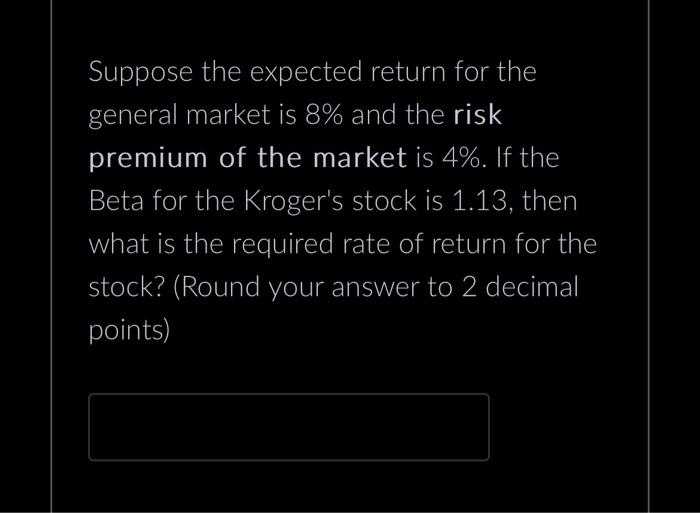

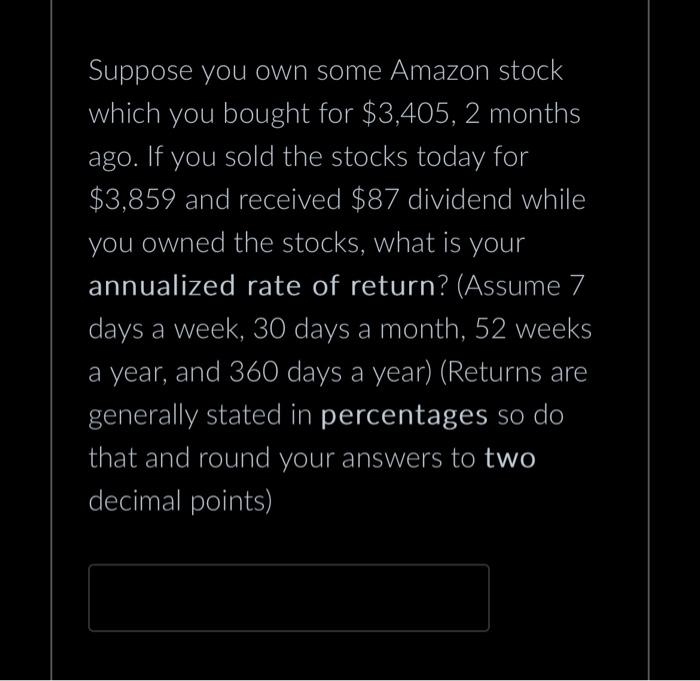

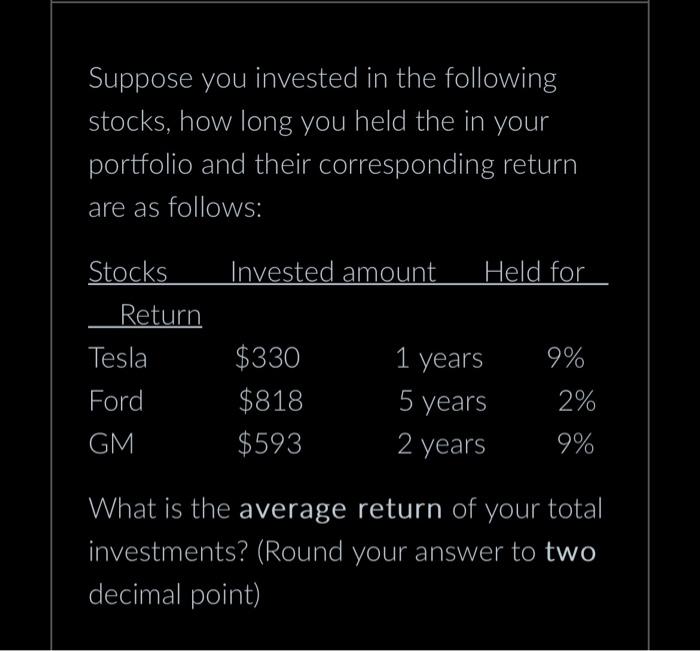

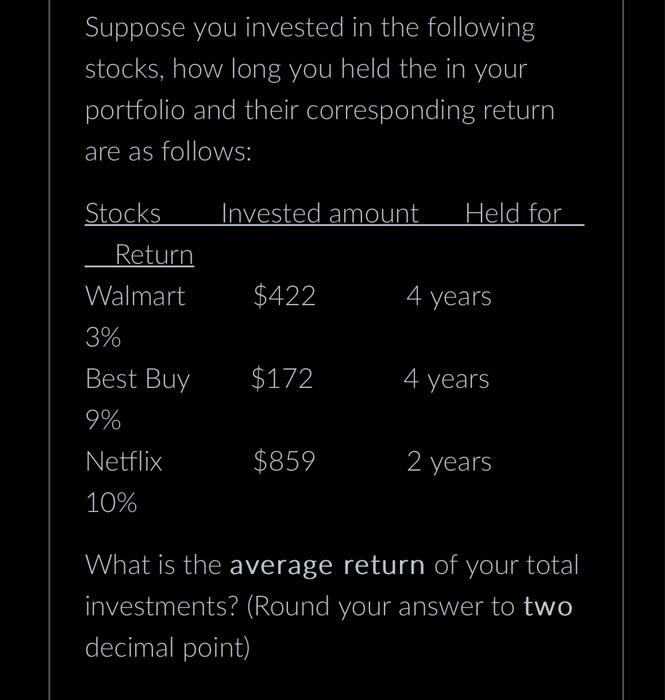

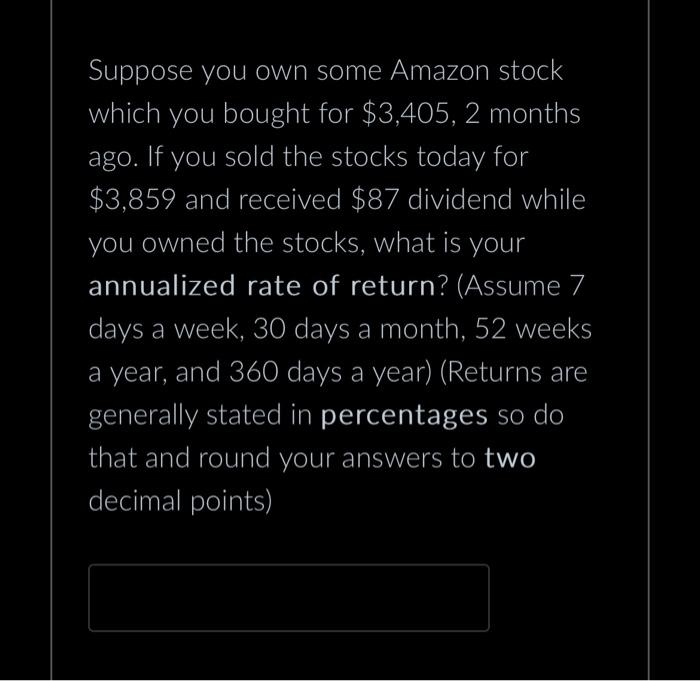

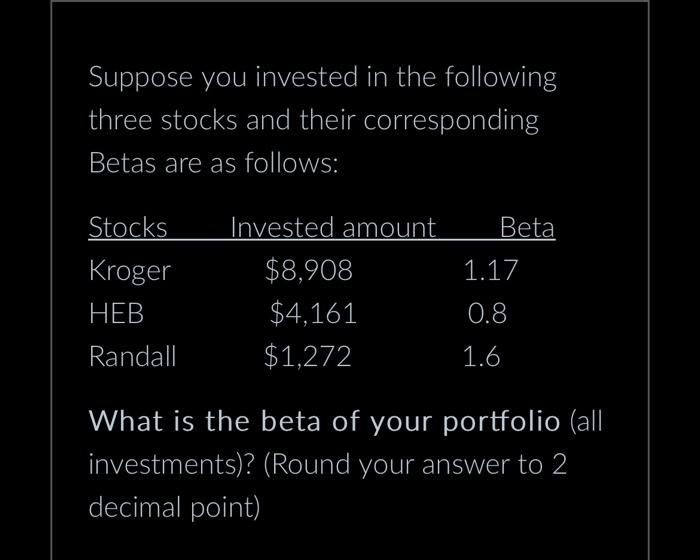

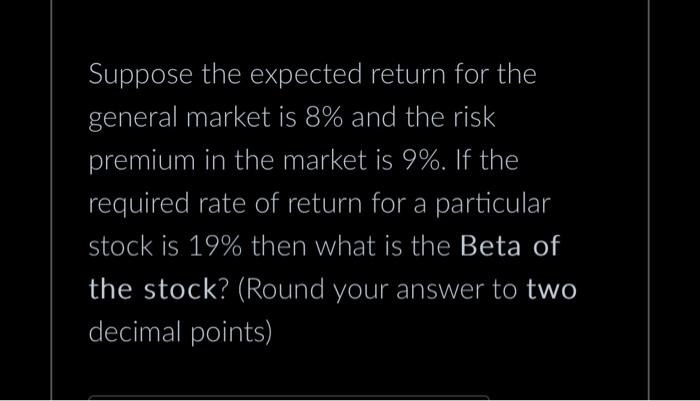

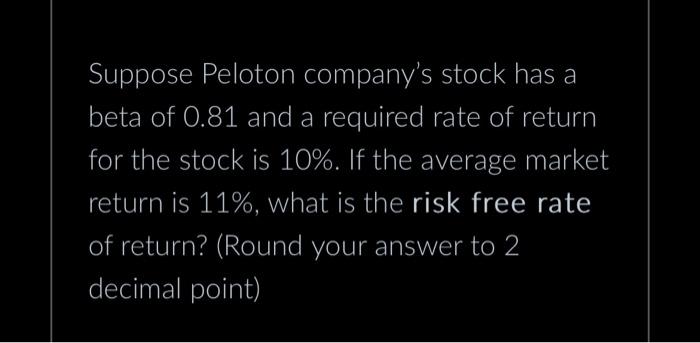

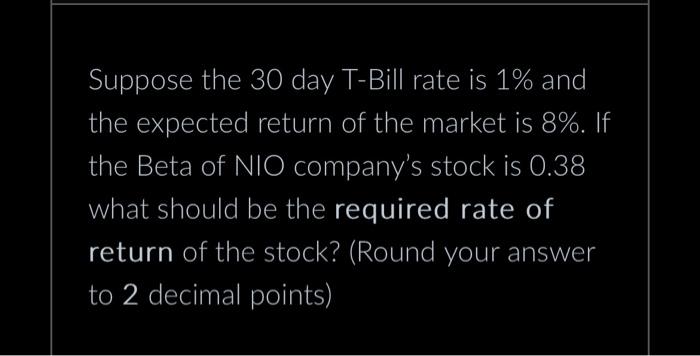

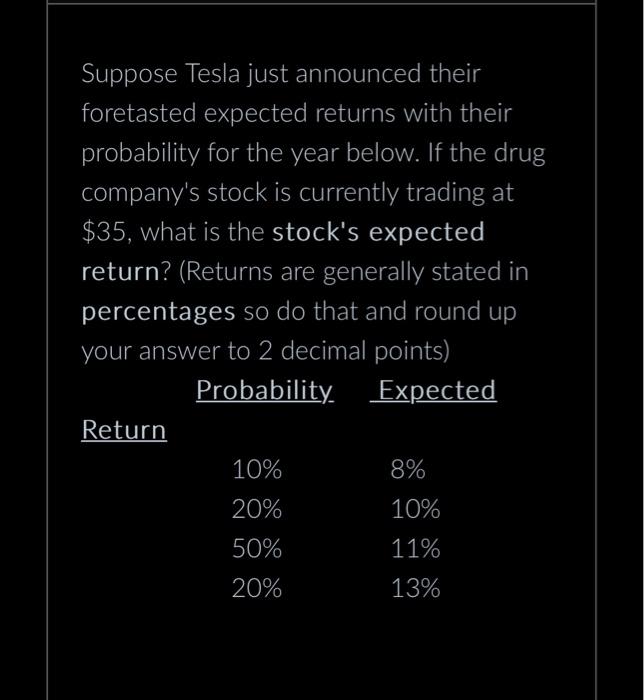

Suppose you hold the following stocks in your portfolio, thier Beta and their corresponding returns are as follows: If the risk-free rate is 1% and the average market return is 11% then, what is the required return for Samsung? (Round your answer to 2 decimal point) Suppose you purchased a stock for $29 per share, 16 months ago. If you sold the stock for $47 and received $2 dividend while you owned the stock, what is your holding-period rate of return? (Returns are generally stated in percentages so do that and round your answers to two decimal points) Suppose a famous drug company just announced their foretasted expected returns with their probability for the year below. If the drug company's stock is currently trading at $47, what is the stock's expected return? (Returns are generally stated in percentages so do that and round up your answer to 2 decimal points) Probability Expected Return 10%20%50%20%7%8%11%14% The difference between the Holding period return and Annualized return is ... Holding period return is how much one has made over the time one held the investment and Annualized return is how much one has made in per year. Holding period return is how long does one has to hold to get a return and Annualized return is how long does it take to get the original money back. Holding period return is how much one has made so far on an investment and Annualized return is how many years does it take to get a similar return. Suppose the expected return for the general market is 8% and the risk premium of the market is 4%. If the Beta for the Kroger's stock is 1.13, then what is the required rate of return for the stock? (Round your answer to 2 decimal points) Suppose you own some Amazon stock which you bought for $3,405,2 months ago. If you sold the stocks today for $3,859 and received $87 dividend while you owned the stocks, what is your annualized rate of return? (Assume 7 days a week, 30 days a month, 52 weeks a year, and 360 days a year) (Returns are generally stated in percentages so do that and round your answers to two decimal points) Suppose you invested in the following stocks, how long you held the in your portfolio and their corresponding return are as follows: What is the average return of your total investments? (Round your answer to two decimal point) Suppose you invested in the following Suppose you own some Amazon stock which you bought for $3,405,2 months ago. If you sold the stocks today for $3,859 and received $87 dividend while you owned the stocks, what is your annualized rate of return? (Assume 7 days a week, 30 days a month, 52 weeks a year, and 360 days a year) (Returns are generally stated in percentages so do that and round your answers to two decimal points) Suppose you invested in the following three stocks and their corresponding Betas are as follows: What is the beta of your portfolio (all investments)? (Round your answer to 2 decimal point) Suppose the expected return for the general market is 8% and the risk premium in the market is 9%. If the required rate of return for a particular stock is 19% then what is the Beta of the stock? (Round your answer to two decimal points) Suppose Peloton company's stock has a beta of 0.81 and a required rate of return for the stock is 10%. If the average market return is 11%, what is the risk free rate of return? (Round your answer to 2 decimal point) Suppose the 30 day T-Bill rate is 1% and the expected return of the market is 8%. If the Beta of NIO company's stock is 0.38 what should be the required rate of return of the stock? (Round your answer to 2 decimal points) Suppose Tesla just announced their foretasted expected returns with their probability for the year below. If the drug company's stock is currently trading at $35, what is the stock's expected return? (Returns are generally stated in percentages so do that and round up your answer to 2 decimal points)