These are adjusted journal entries I am to write to use in a general worksheet for the month of December, 31, 20X1

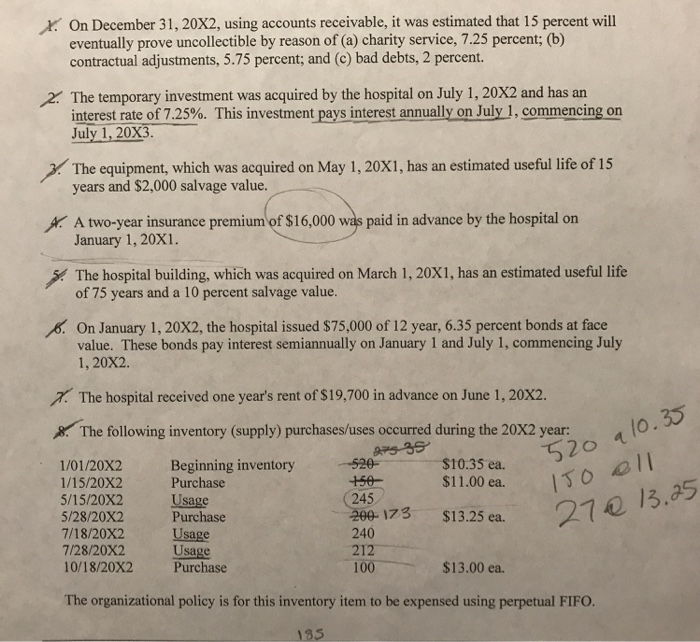

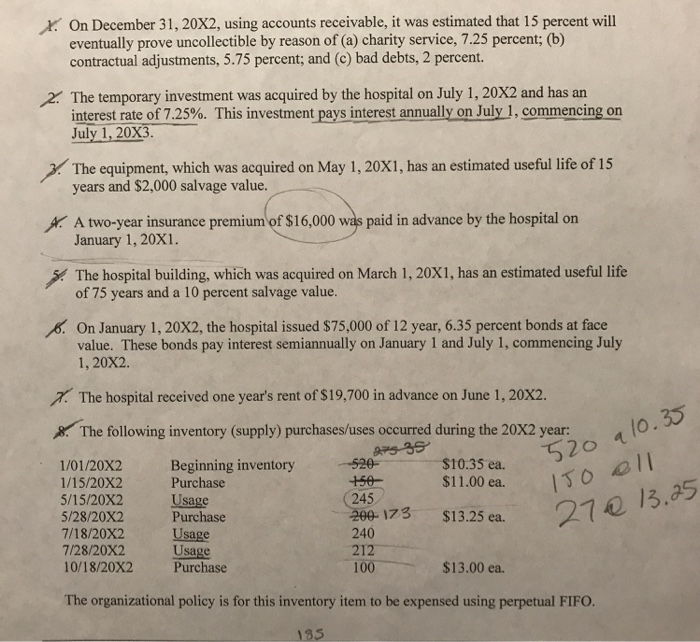

XOn December 31, 20X2, using accounts receivable, it was estimated that 15 percent will eventually prove uncollectible by reason of (a) charity service, 7.25 percent; (b) contractual adjustments, 5.75 percent; and (c) bad debts, 2 percent 2 The temporary investment was acquired by the hospital interest rate of 7.25%. This investment pays interest annually on July 1, commencing on July 1, 20X3. July 1, 20X2 and has an on The equipment, which was acquired on May 1, 20X1, has an estimated useful life of 15 years and $2,000 salvage value. AA two-year insurance premium of $16,000 January 1, 20X1 paid in advance by the hospital on was 5The hospital building, which was of 75 years and a 10 percent salvage value. on March 1, 20X1, has an estimated useful life sacquired 6. On January 1, 20X2, the hospital issued $75,000 of 12 year, 6.35 percent bonds at face value. These bonds pay interest semiannually on January 1 and July 1, commencing July 1, 20X2 HThe hospital received one year's rent of $19,700 in advance on June 1, 20X2. The following inventory (supply) purchases/uses occurred during the 20X2 year: 7s 35 520 520 410.33 Beginning inventory Purchase $10.35 ea. $11.00 ea. 1/01/20X2 +50 1/15/20X2 245 200-173 $13.25 ea. 5/15/20X2 Usage Purchase 27e 13.95 5/28/20X2 240 7/18/20X2 Usage Usage Purchase 7/28/20X2 10/18/20X2 212 $13.00 ea. 100 The organizational policy is for this inventory item to be expensed using perpetual FIFO 185 XOn December 31, 20X2, using accounts receivable, it was estimated that 15 percent will eventually prove uncollectible by reason of (a) charity service, 7.25 percent; (b) contractual adjustments, 5.75 percent; and (c) bad debts, 2 percent 2 The temporary investment was acquired by the hospital interest rate of 7.25%. This investment pays interest annually on July 1, commencing on July 1, 20X3. July 1, 20X2 and has an on The equipment, which was acquired on May 1, 20X1, has an estimated useful life of 15 years and $2,000 salvage value. AA two-year insurance premium of $16,000 January 1, 20X1 paid in advance by the hospital on was 5The hospital building, which was of 75 years and a 10 percent salvage value. on March 1, 20X1, has an estimated useful life sacquired 6. On January 1, 20X2, the hospital issued $75,000 of 12 year, 6.35 percent bonds at face value. These bonds pay interest semiannually on January 1 and July 1, commencing July 1, 20X2 HThe hospital received one year's rent of $19,700 in advance on June 1, 20X2. The following inventory (supply) purchases/uses occurred during the 20X2 year: 7s 35 520 520 410.33 Beginning inventory Purchase $10.35 ea. $11.00 ea. 1/01/20X2 +50 1/15/20X2 245 200-173 $13.25 ea. 5/15/20X2 Usage Purchase 27e 13.95 5/28/20X2 240 7/18/20X2 Usage Usage Purchase 7/28/20X2 10/18/20X2 212 $13.00 ea. 100 The organizational policy is for this inventory item to be expensed using perpetual FIFO 185