Answered step by step

Verified Expert Solution

Question

1 Approved Answer

these are all connected to #7 pls answer asap for upvote. 7 is $0 i need 8 and 9 Marathon inc: (a C copporation) reported

these are all connected to #7 pls answer asap for upvote. 7 is $0 i need 8 and 9

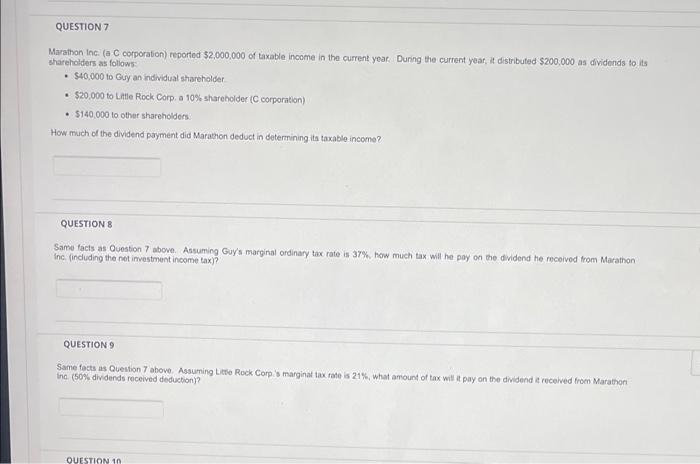

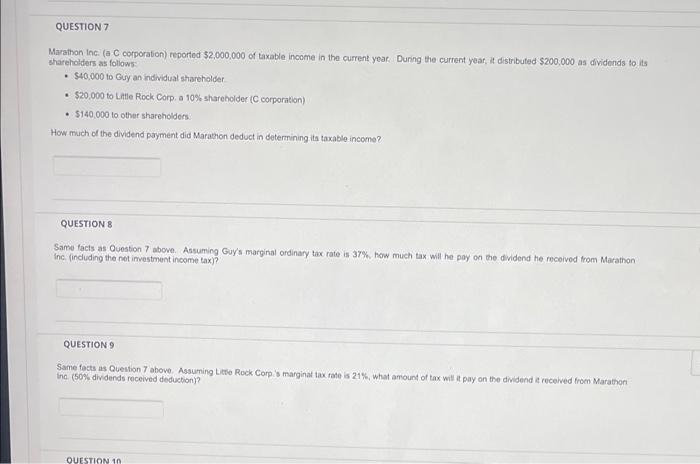

Marathon inc: (a C copporation) reported $2,000,000 of taxable income in the current year. Dunng the current year, it distributed $200,000 as dividends to its shareholders as follows - $40,000 to Guy an individuat shareholder - $20,000 to Little Rock Corp. a 10% shareholder (C corporation) - \$140,000 lo other shareholders: How much do the dividend payment did Marazion deduct in deternining its taxable income? QUESTION 8 Same tacts as Ouostion 7 above. Assuming Guy's marginal ordinay tax rate is 37%, how much tax will he pay on the dividend he tecoived trom Marathon Ince (induding the net imestment income tax)? QUESTION 9 Same facts as Queution 7 above. Assuming titto Rock Corp is marginat tax rate is 21%, what amount of tax wit it pay on the dividend is received froen Marathon tha. (50\%) divedends received deduction)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started