These are my calculations. It would be much apprecited to have them checked and if one is able to suggest their own method?

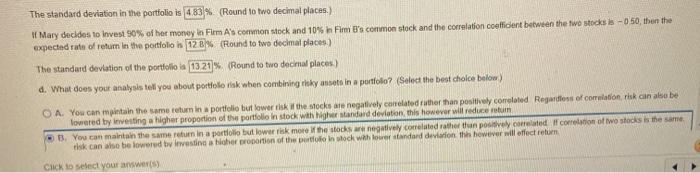

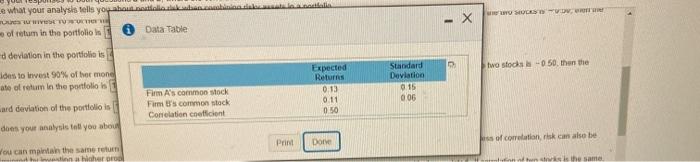

Computing the standard deviation for a portfolio of two risky investments) Mary Guillott recently graduated from college and is evaluating an investment in two companies common stock She has collected the following information about the common stock ot Firm A and Firm B a. Mary decides to invest 10 percent of hoe money in Fim A's common stock and 90 percent in Fim Ds common stock, what is the expected rate of retum and the standard deviation of the portfolio Tetum? b. Mary decides to invest 90 percent of her money in Fim As common stock and 10 percent in Fim B's common stock, what is the expected rate of retum and the standard deviation of the portiollo retur? c. Recompute your responses to both questions and b, where the corelation between the two fems stock returns is 0.50 d. Summarize what your analysis to you about portfolio risk when combining diaky assets in a portfolio a. I Mary decides to invest 10% of her money in FirmA's common stock and 90% in Firm's common stock and the correlation coefficient between the two stocks la 0 50, then the expected rate of retum in the portfolios 11.2% (Round to two decimal places) The standard deviation in the portiollo in 629 (Round to two decimal places b. Mary decides to invest 90% of her money in Form A's common stock and 10% in Firm's common stock and the correlation contient between the two stocks is a 50 then the expected tale of return in the portiollos 120% (Round to two decimal places The standard deviation in the pontolio 13 61% Round to two decina plocen) C. Mary decides to invest 10% of the money in Fim Amon stock and 90% in Firm's common stack and the core office the stocki-050, then the expected tale of return in the portfolio is 112% (Round in two decimal places) The standard deviation in the portfolio tond to two decimal process har mandini in the thin Click to select your ne The standard deviation in the portfolio is 483% (Round to two decimal places.) If Mary decides to invest 90% of her money in Flem A's common stock and 10% in Firm's common stock and the correlation coelligent between the two stocki-050, then the expected rate of return in the portfolio i 12% (Round to two decimal places) The standard deviation of the portfolio la 1321% (Round to two decimal places) d. What does your analysis tell you about portfolio risk when combining risk assets in a portfolio? (Select the best choice below) O A. You can mpintain the same return in a portfolio but lower risk the stocks are negatively correlated rather than positively comelted Regardless of correlation, risk can also be lowered by investing a higher proportion of the portfolio in stock with high standard deviation, this however will reduce rotun 1. You can maintain the same return in a portfolio but lower risk more the stocks are negatively correlated rather than positively correlated if conation of two stes is the same risk can also be lowered to investing a loher proportion of the store in stock with lower standard deviation this however will effect retom Click to select your answer(s) WW SOD. e what your analysis tells you about to TURUT of retum in the portfolio Data Table d deviation in the portfoliis two sfods -0.50 then the as to invest 90% of ber mond ate of return in the portfolio Expected Returns 0.13 0.11 050 Standard Deviation 015 006 Firm A's common stock Firm's common stock Correlation coefficient ard deviation of the portfolio is does your analysis tell you abou Print Dove oss of combatian, riskas also be Wou can maintain the same return which pro is the same