Answered step by step

Verified Expert Solution

Question

1 Approved Answer

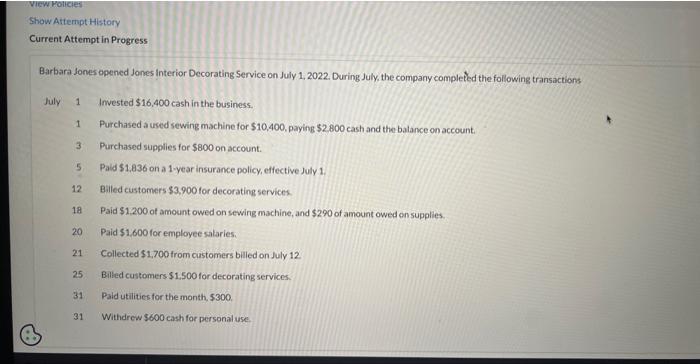

these are my questions Barbara Jones opened Jones interior Decorating Service on July 1, 2022. During July, the company completed the following transactions July 1

these are my questions

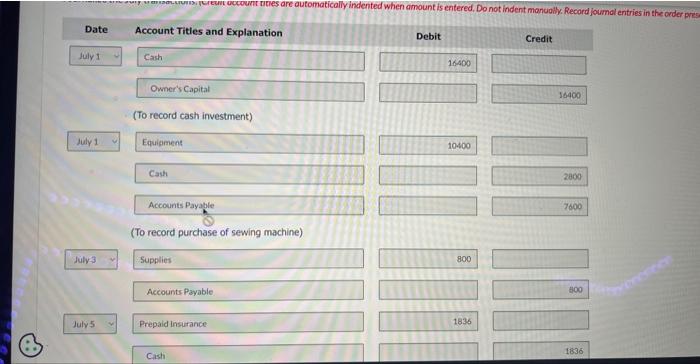

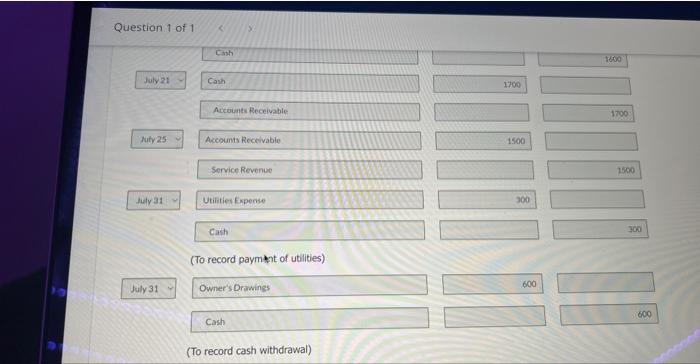

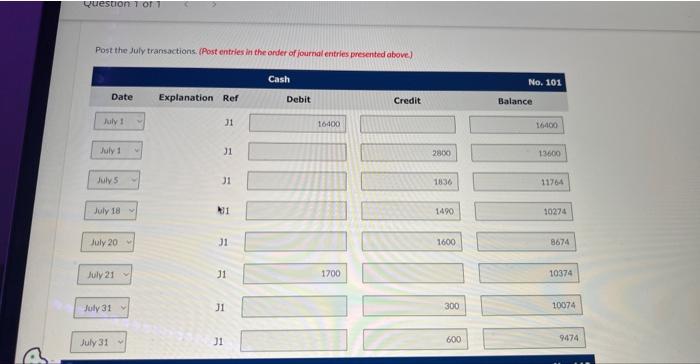

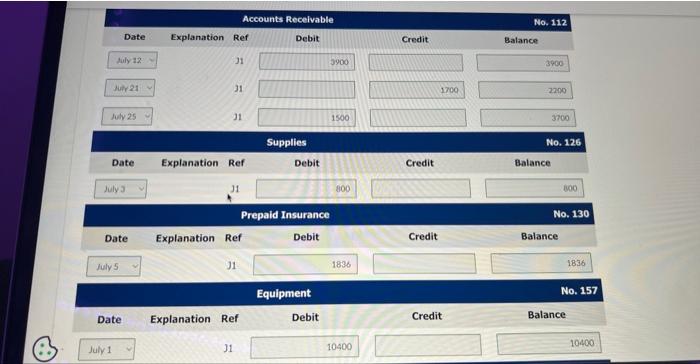

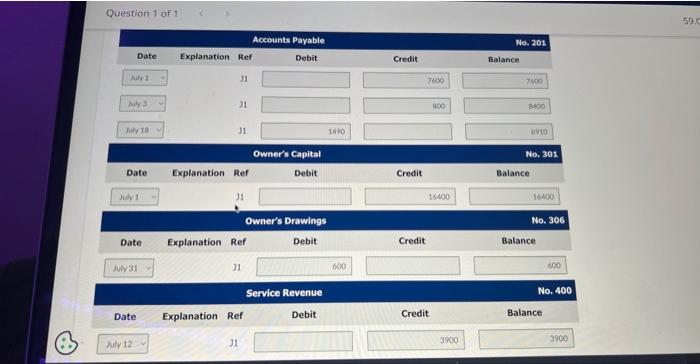

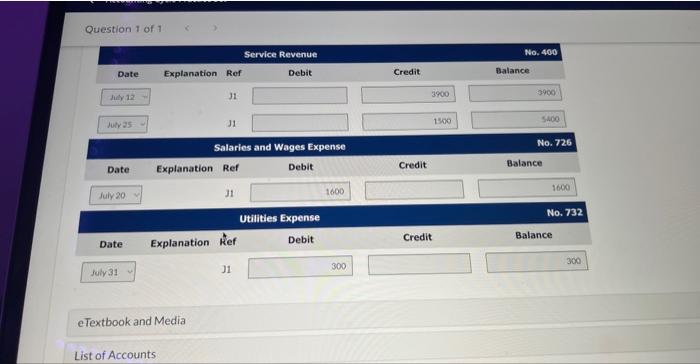

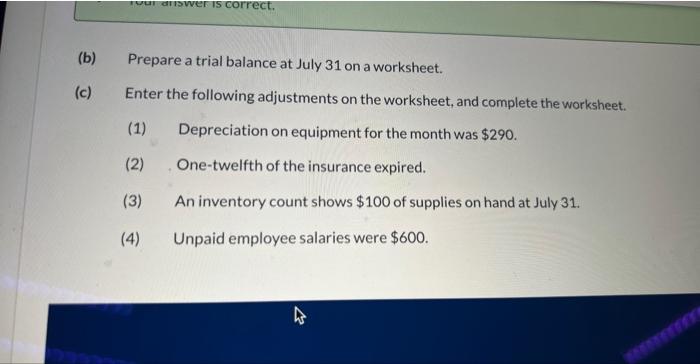

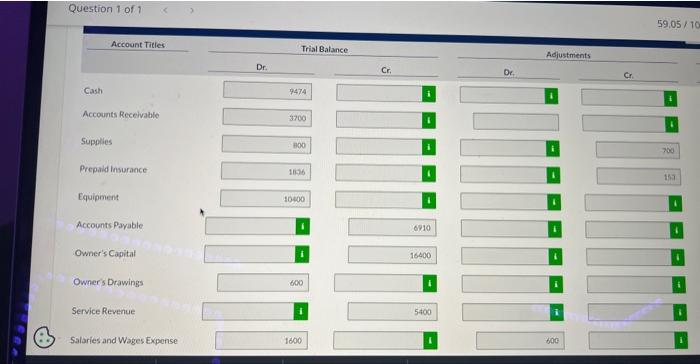

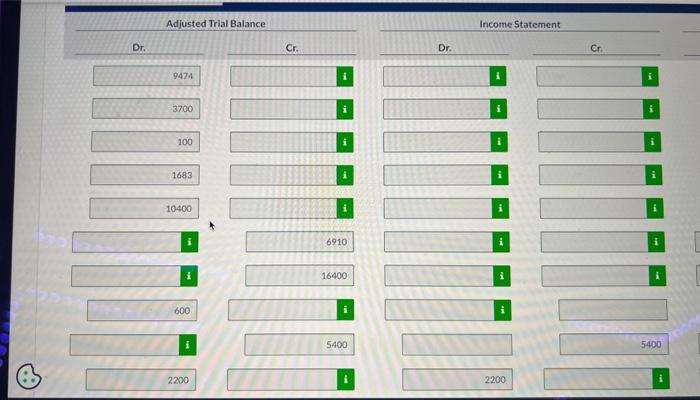

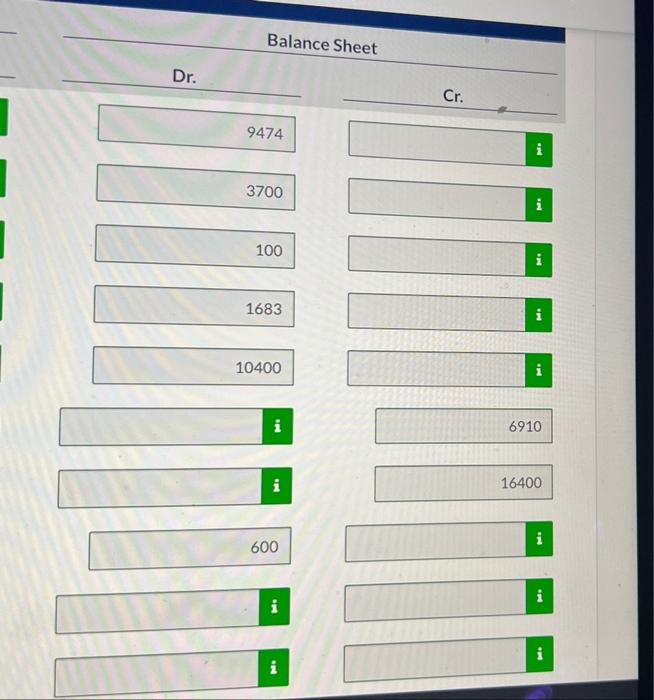

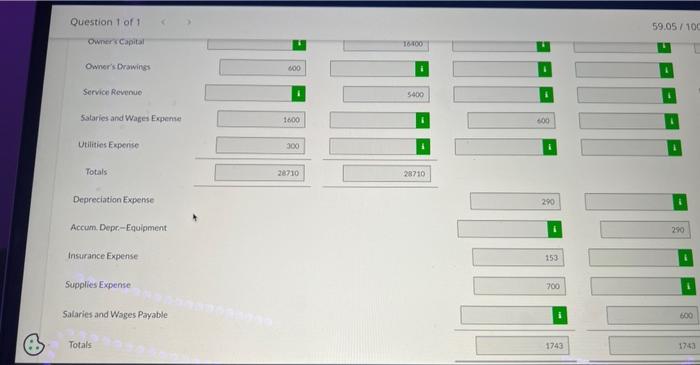

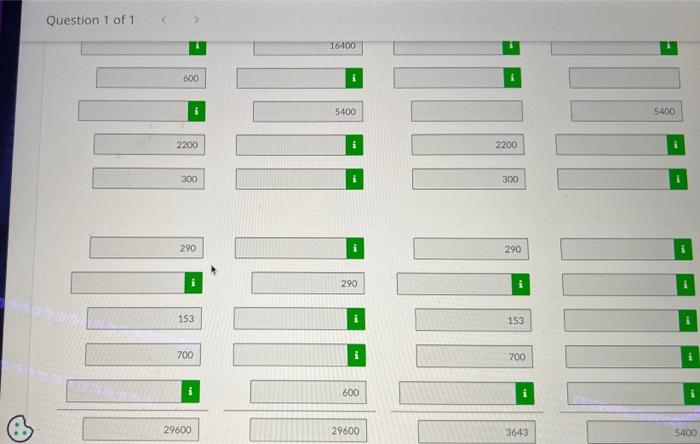

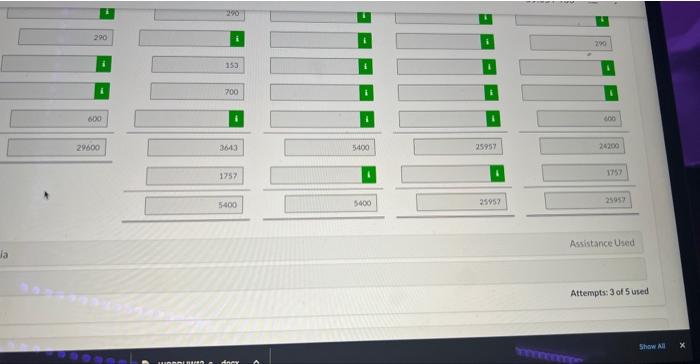

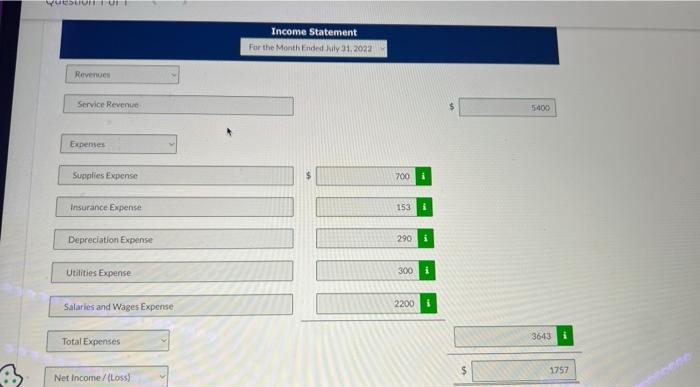

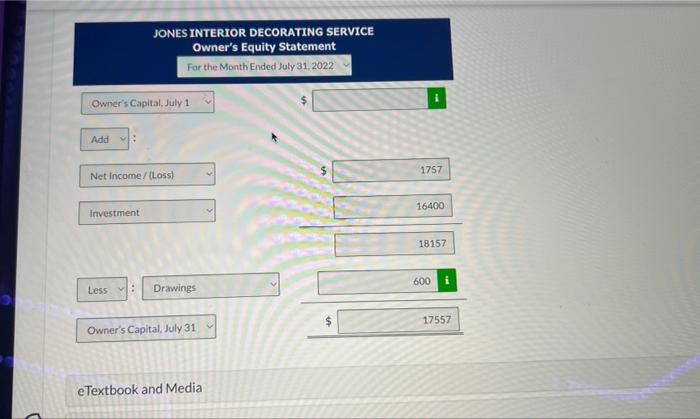

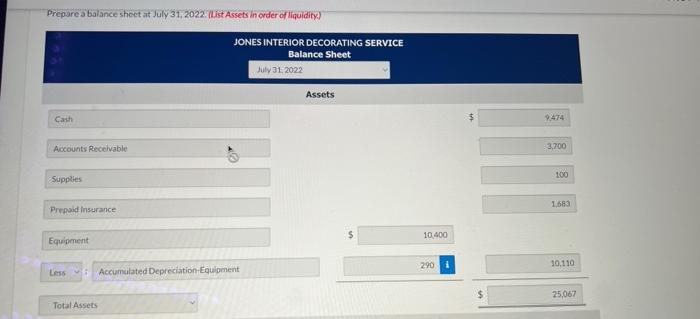

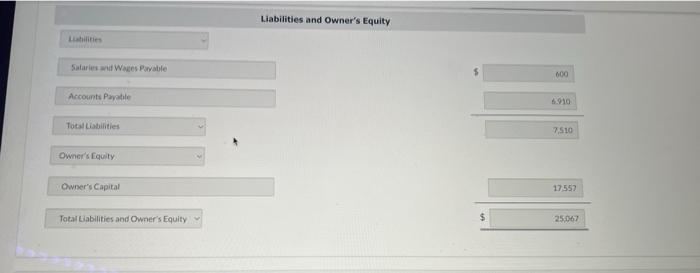

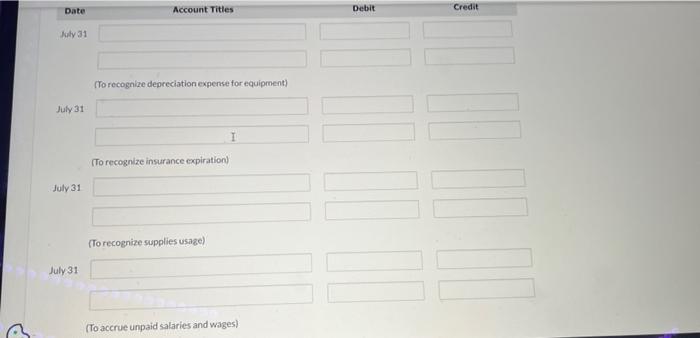

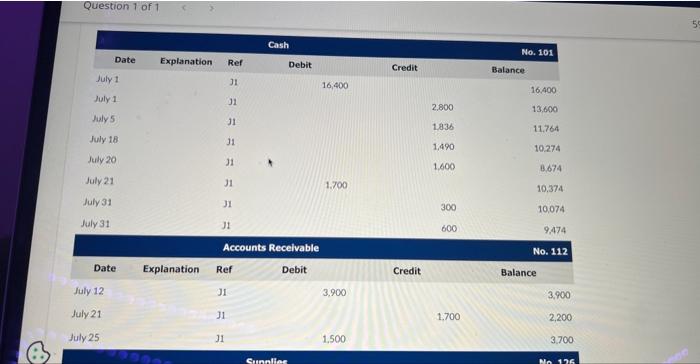

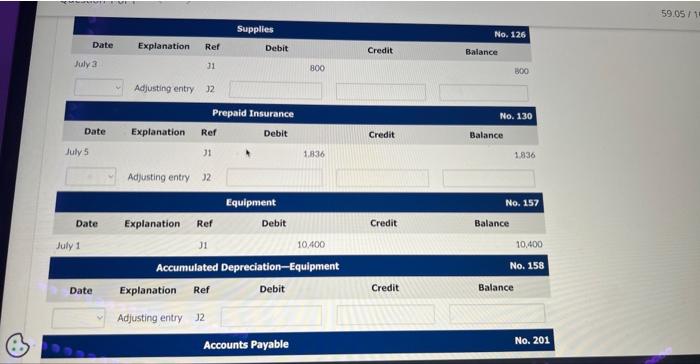

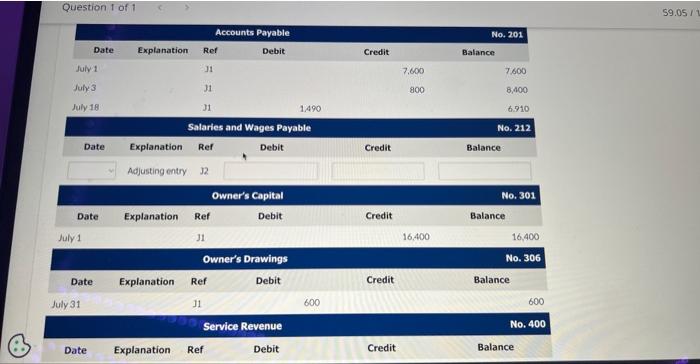

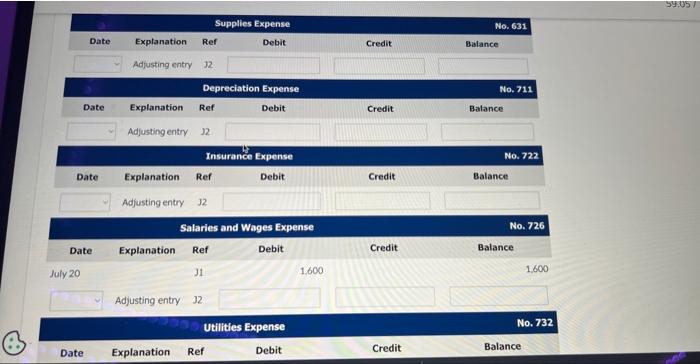

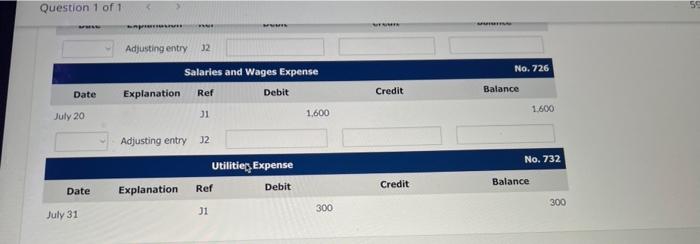

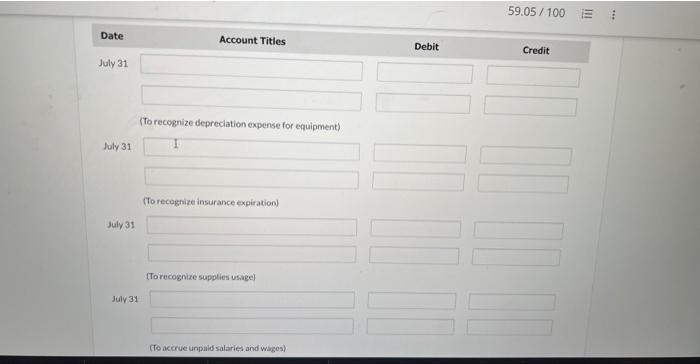

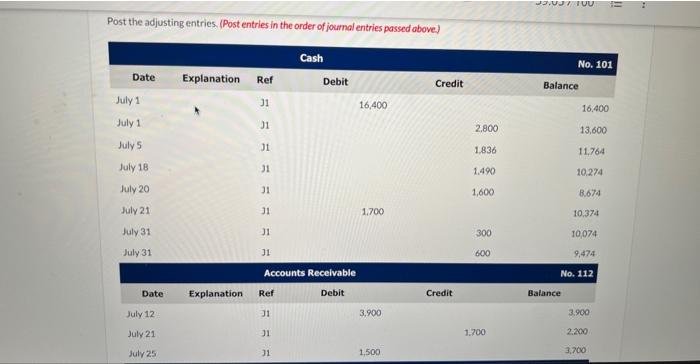

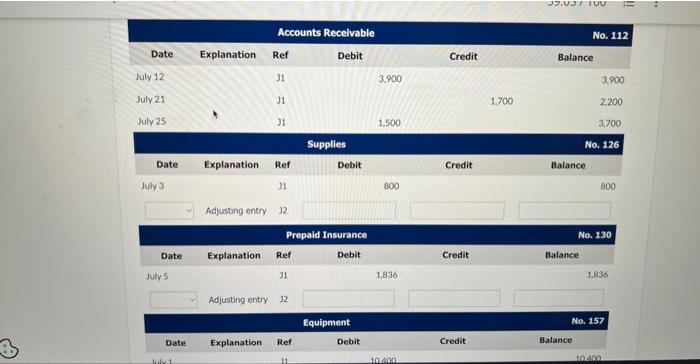

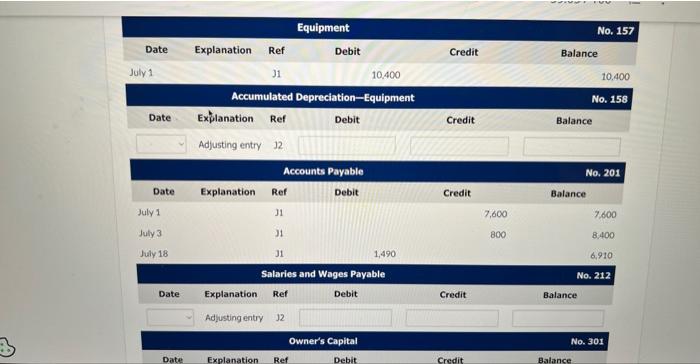

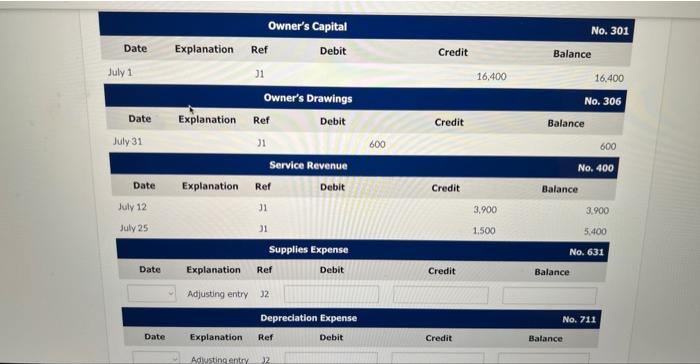

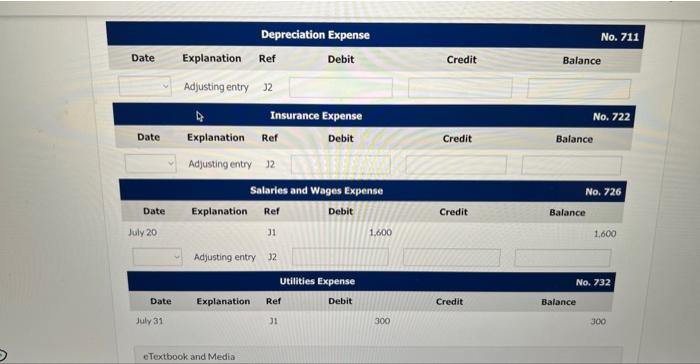

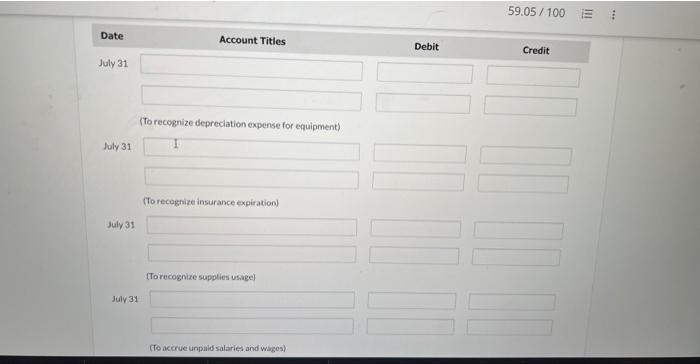

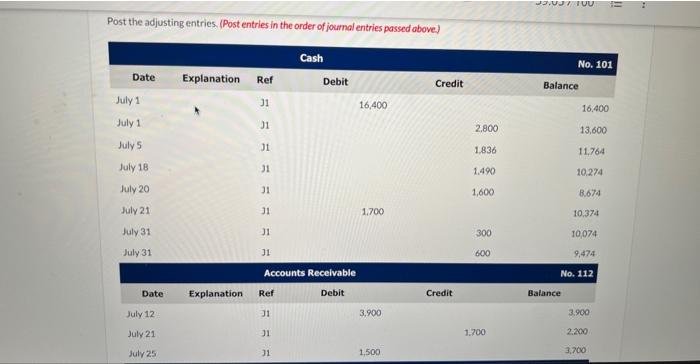

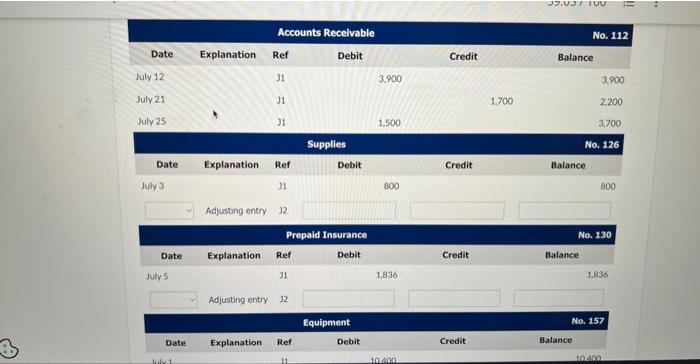

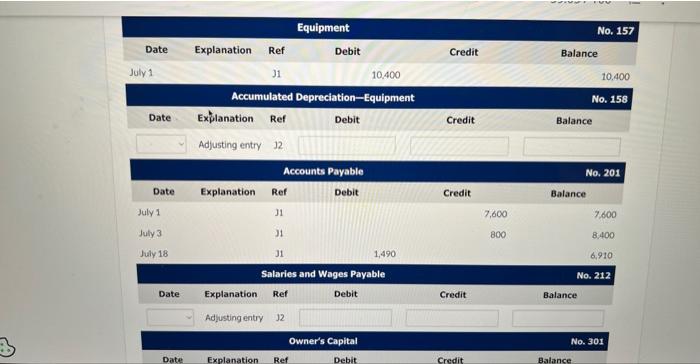

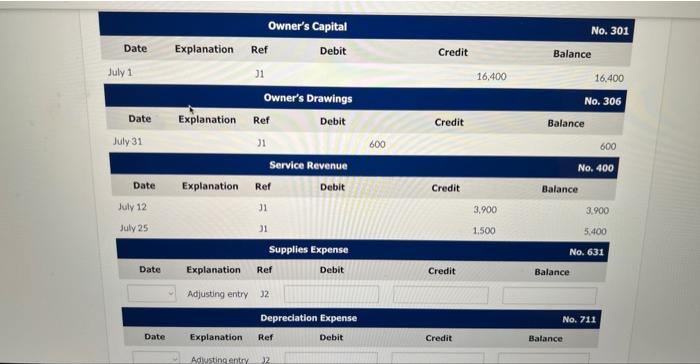

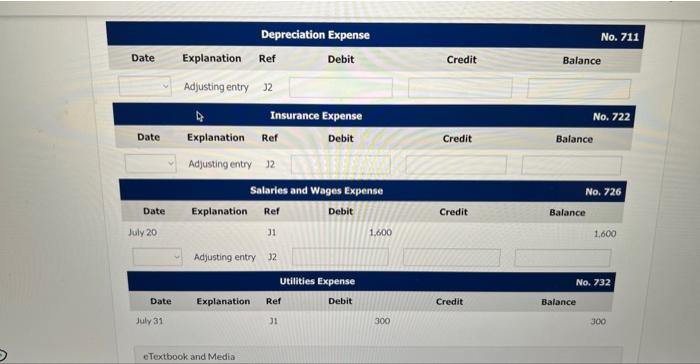

Barbara Jones opened Jones interior Decorating Service on July 1, 2022. During July, the company completed the following transactions July 1 Invested $16,400 cash in the business. 1 Purchased a used sewing machine for $10,400, paying $2.800 cash and the balance on account. 3 Purchased supplies for $800 on account. 5 Paid $1,836 on a 1-year insurance policy, effective July 1. 12 Billed customers $3,900 for decorating services. 18 Paid $1,200 of amount owed on sewing machine, and $290 of amount owed on supplies. 20 Paid \$1,600 for employee silaries. 21 Collected $1,700 from customers billed on July 12 25 Billed customers $1,500 for decorating services. 31 Pald utilities for the month, $300. 31 Withdrew $600 eash for personal use. \begin{tabular}{l} Date Account Titles and Explanation \\ \hline July 1 \\ \hline \end{tabular} 16400 Owner's Capital (To record cash investment) 10400 Cash Accounts Payable (To record purchase of sewing machine) 7600 July 3 \& Supplies 800 Accounts Payable Question 1 of 1 Question 1 of 1 (To record paymant of utilities) Cash (To record cash withdrawal) Post the July transactions. (Post entries in the onder of jourrial entries presented above] \begin{tabular}{|l|l|l|} \hline \multicolumn{3}{|c|}{ Accounts Recelvable } \\ \hline Date Explanation & Ref & Debit \\ \hline Saly 12 & & \\ \hline Jatrit & & \\ \hline \end{tabular} No. 112 3700No.126Balance No. 130 Question 1 of 1 . Question 1 of 1 \begin{tabular}{|c|} \hline No. 400 \\ \hline Balance \\ \hline 9900 \\ \hline \end{tabular} 1600 No. 732 (b) Prepare a trial balance at July 31 on a worksheet. (c) Enter the following adjustments on the worksheet, and complete the worksheet. (1) Depreciation on equipment for the month was $290. (2) One-twelfth of the insurance expired. (3) An inventory count shows $100 of supplies on hand at July 31. (4) Unpaid employee salaries were $600. Question 1 of 1 Question 1 of 1 Attempts: 3 of 5 used Income 5 tatement Fon the Montht neded hily 31,202 2. Reventuen Service Revenue Expenses \begin{tabular}{l} \hline Supplies Expense \\ Insurance Expense \\ \hline \end{tabular} \begin{tabular}{|lll|} \hline & 153 \\ \hline \end{tabular} Depreciation Expense \begin{tabular}{|l|l|} \hline & 290 \\ \hline \end{tabular} Utilities Expense \begin{tabular}{|l|l|} \hline & 300 \\ \hline \end{tabular} \begin{tabular}{l} Salaries and Wages Expense \\ Total Expenses \\ \hline \end{tabular} JONES INTERIOR DECORATING SERVICE Owner's Equity Statement For the Month Ended July 31,2022 Owner's Capital, July 1 Add 5 Investment eTextbook and Media Prepare a balance sheet at July 31,2022. (List Assets in order of liquidity) Liabilities and Owner's Equity Date Kity 31 Account Titles Debit Credat (To recognize depreciation expense for equipment) July 31 (To recognize insurance expiration) July 31 (To recognize supplies usage) July 31 (To accrue unpaid salaries and wages) No.126BooNo.130 \begin{tabular}{|cccc|} \hline & \multicolumn{3}{c|}{ Equipment } \\ \hline Date & Explanation & Ref & Debit \\ July 1 & & 12 & 10,400 \\ \hline & \multicolumn{3}{c|}{ Accumulated Depreciation-Equipment } \\ \hline Date & Explanation & Ref & Debit \\ & Adjusting entry 12 & \\ \hline \end{tabular} Accounts Payable No. 201 Question I of 1 Question 1 of 1 \begin{tabular}{|ccccc|} \hline \multicolumn{4}{c}{ Salaries and Wages Expense } & Credit \\ \hline Date Explanation & Ref & Debit & 1,600 & \\ July 20 & & & \\ & Adjusting entry & & & \\ \hline \end{tabular} \begin{tabular}{l} \hline \\ Date \\ July 31 \end{tabular} No. 732 \begin{tabular}{l} Date Account Tities \\ July 31 \\ \hline \end{tabular} (To recognize depreciation expense for equipment) (To recognize insurance expiration) July 31 (To recognize supplies usage) July 31 (To accrue unpald salaries and wages) Post the adjusting entries. (Post entries in the order of joumal entries passed above) Owner's Capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started