Answered step by step

Verified Expert Solution

Question

1 Approved Answer

These are not two separate questions. The two questions rely on one another. This is Part A and B of the same question. Part A:

These are not two separate questions. The two questions rely on one another. This is Part A and B of the same question.

Part A:

Part B:

PLEASE BE CLEAR IN YOUR EXPLANATION. I KNOW THE RIGHT ANSWERS BUT I DO NOT UNDERSTAND HOW TO DO THE PROBLEM.

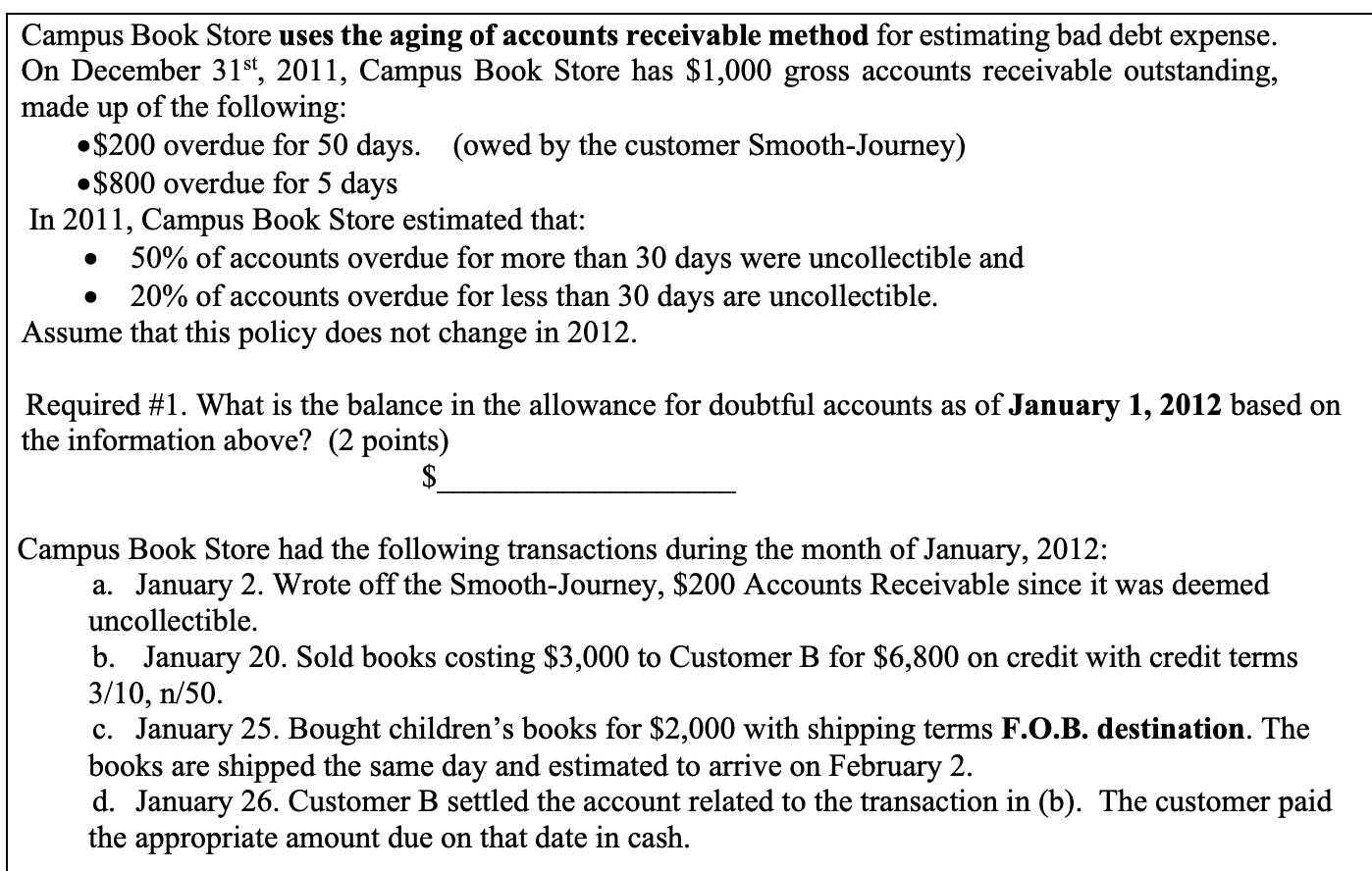

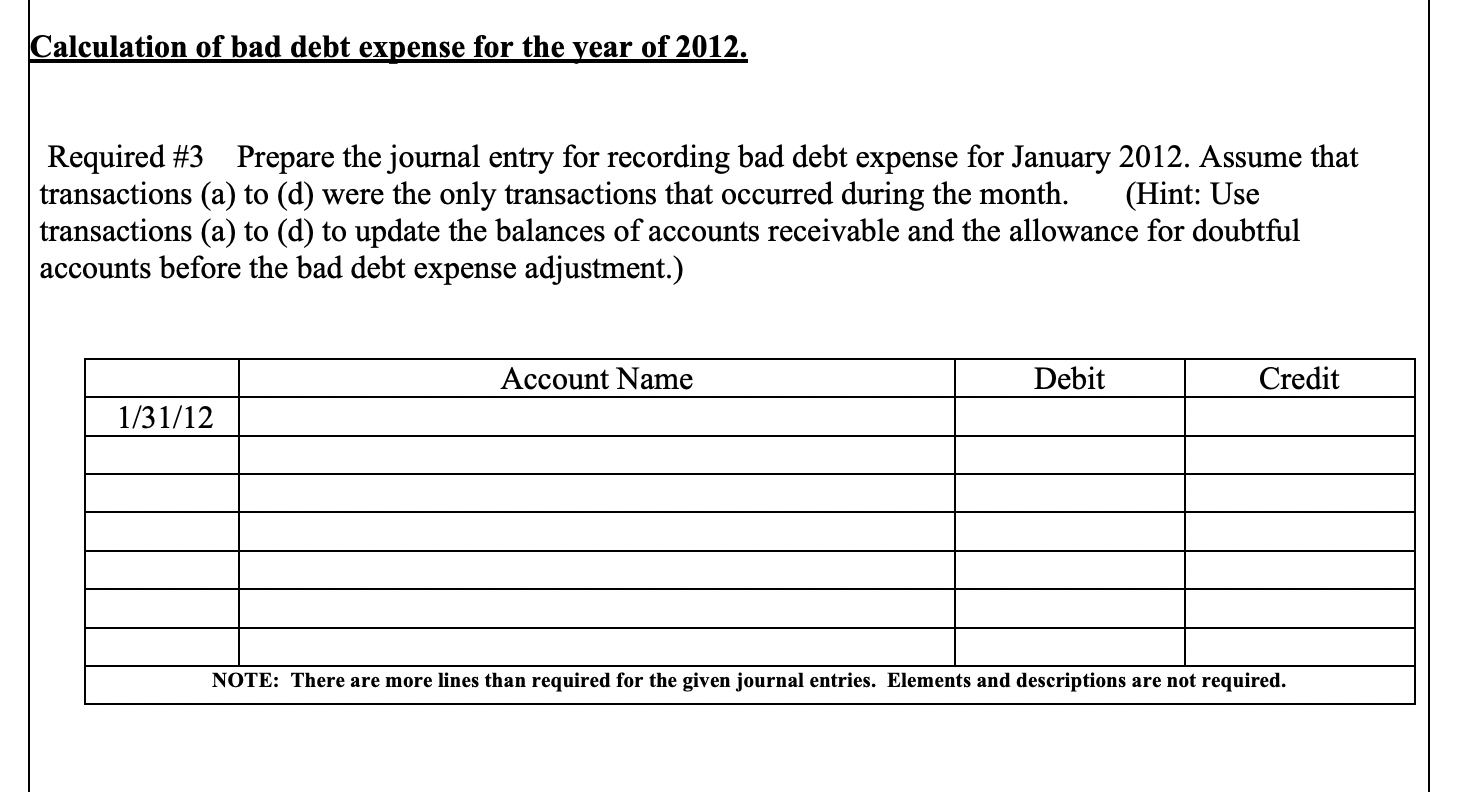

Campus Book Store uses the aging of accounts receivable method for estimating bad debt expense. On December 31st,2011, Campus Book Store has $1,000 gross accounts receivable outstanding, made up of the following: - $200 overdue for 50 days. (owed by the customer Smooth-Journey) - $800 overdue for 5 days In 2011, Campus Book Store estimated that: - 50% of accounts overdue for more than 30 days were uncollectible and - 20% of accounts overdue for less than 30 days are uncollectible. Assume that this policy does not change in 2012. Required #1. What is the balance in the allowance for doubtful accounts as of January 1,2012 based on the information above? (2 points) $ Campus Book Store had the following transactions during the month of January, 2012: a. January 2. Wrote off the Smooth-Journey, $200 Accounts Receivable since it was deemed uncollectible. b. January 20 . Sold books costing $3,000 to Customer B for $6,800 on credit with credit terms 3/10,n/50. c. January 25 . Bought children's books for $2,000 with shipping terms F.O.B. destination. The books are shipped the same day and estimated to arrive on February 2. d. January 26. Customer B settled the account related to the transaction in (b). The customer paid the appropriate amount due on that date in cash. alculation of bad debt expense for the year of 2012 . Required #3 Prepare the journal entry for recording bad debt expense for January 2012. Assume that ransactions (a) to (d) were the only transactions that occurred during the month. (Hint: Use ransactions (a) to (d) to update the balances of accounts receivable and the allowance for doubtful accounts before the bad debt expense adjustment.) Campus Book Store uses the aging of accounts receivable method for estimating bad debt expense. On December 31st,2011, Campus Book Store has $1,000 gross accounts receivable outstanding, made up of the following: - $200 overdue for 50 days. (owed by the customer Smooth-Journey) - $800 overdue for 5 days In 2011, Campus Book Store estimated that: - 50% of accounts overdue for more than 30 days were uncollectible and - 20% of accounts overdue for less than 30 days are uncollectible. Assume that this policy does not change in 2012. Required #1. What is the balance in the allowance for doubtful accounts as of January 1,2012 based on the information above? (2 points) $ Campus Book Store had the following transactions during the month of January, 2012: a. January 2. Wrote off the Smooth-Journey, $200 Accounts Receivable since it was deemed uncollectible. b. January 20 . Sold books costing $3,000 to Customer B for $6,800 on credit with credit terms 3/10,n/50. c. January 25 . Bought children's books for $2,000 with shipping terms F.O.B. destination. The books are shipped the same day and estimated to arrive on February 2. d. January 26. Customer B settled the account related to the transaction in (b). The customer paid the appropriate amount due on that date in cash. alculation of bad debt expense for the year of 2012 . Required #3 Prepare the journal entry for recording bad debt expense for January 2012. Assume that ransactions (a) to (d) were the only transactions that occurred during the month. (Hint: Use ransactions (a) to (d) to update the balances of accounts receivable and the allowance for doubtful accounts before the bad debt expense adjustment.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started