These are our reference questions for the upcoming test, please provide detailed explanation with formulas used to derive answers, please revert as soon as possible

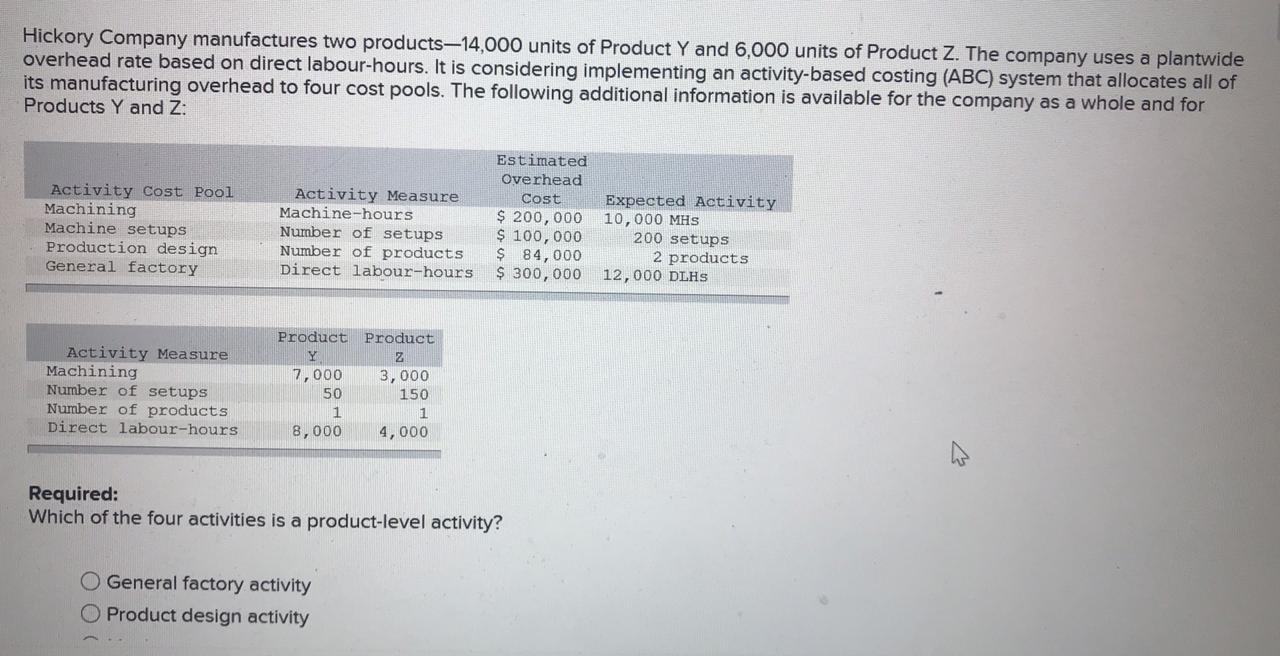

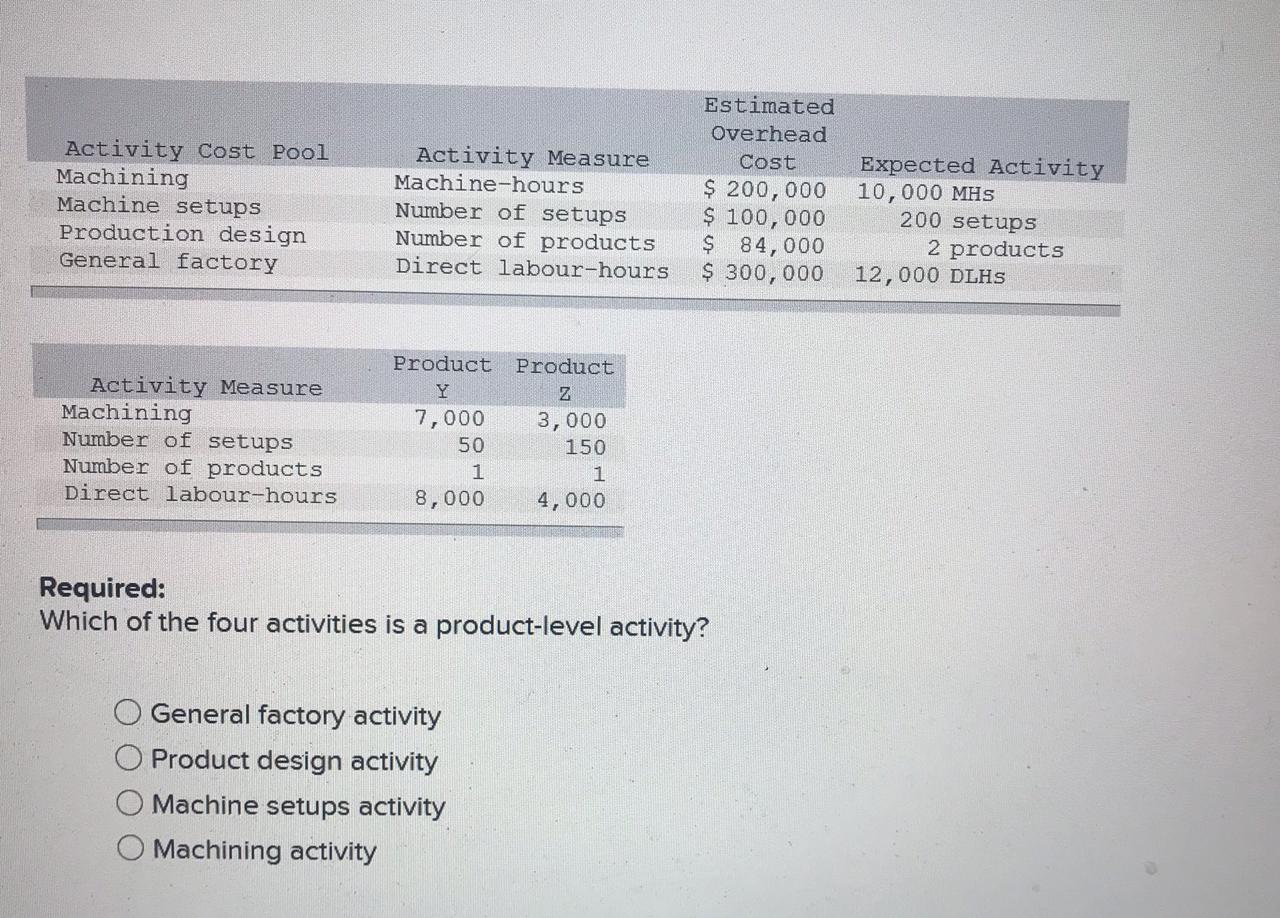

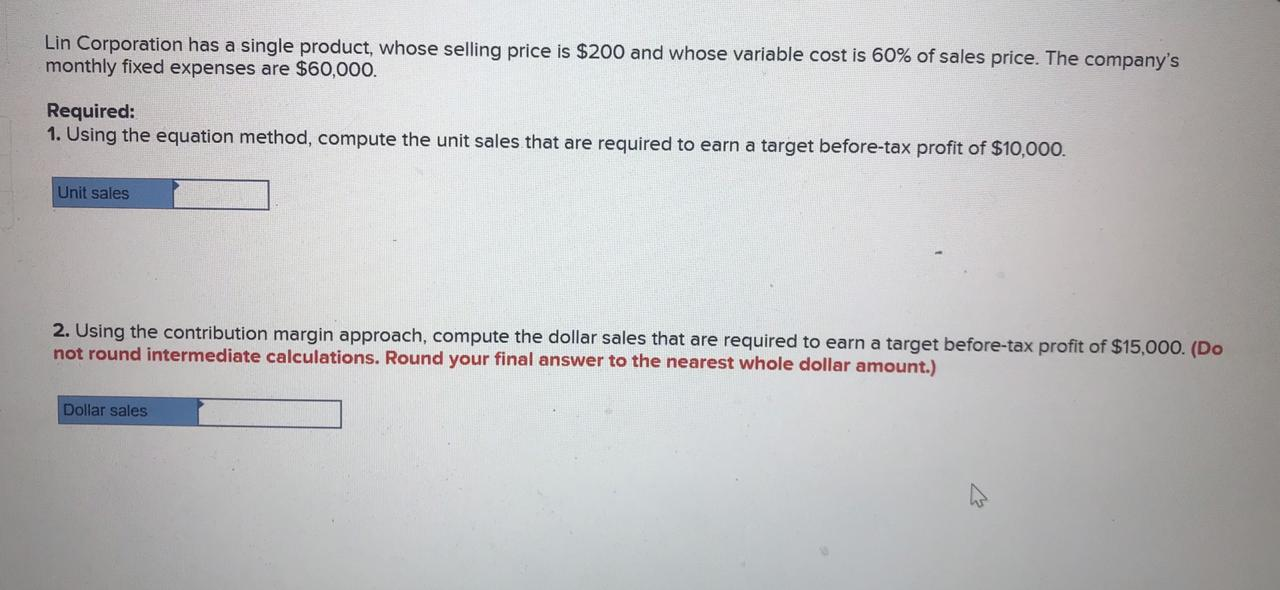

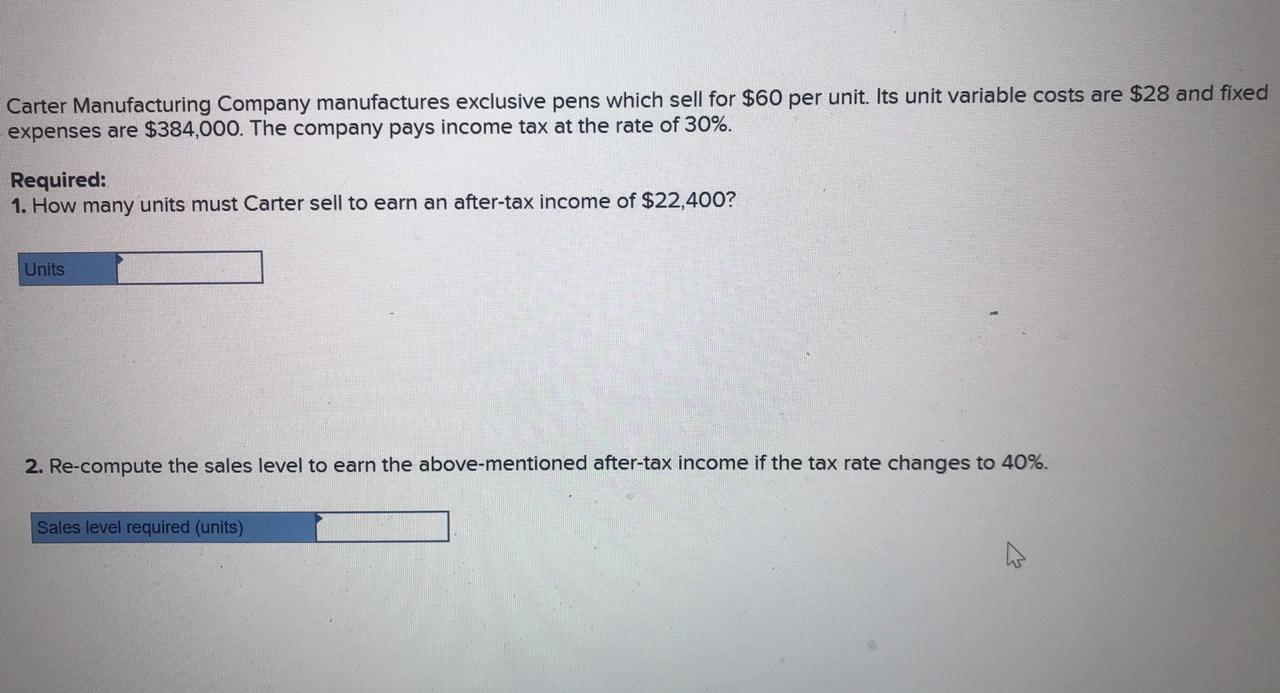

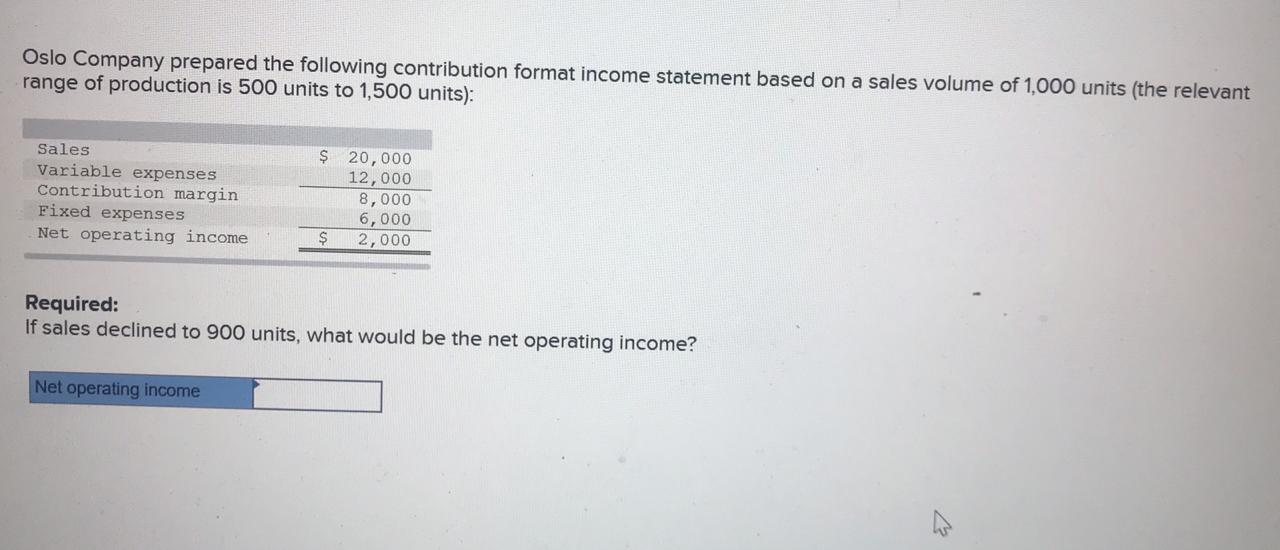

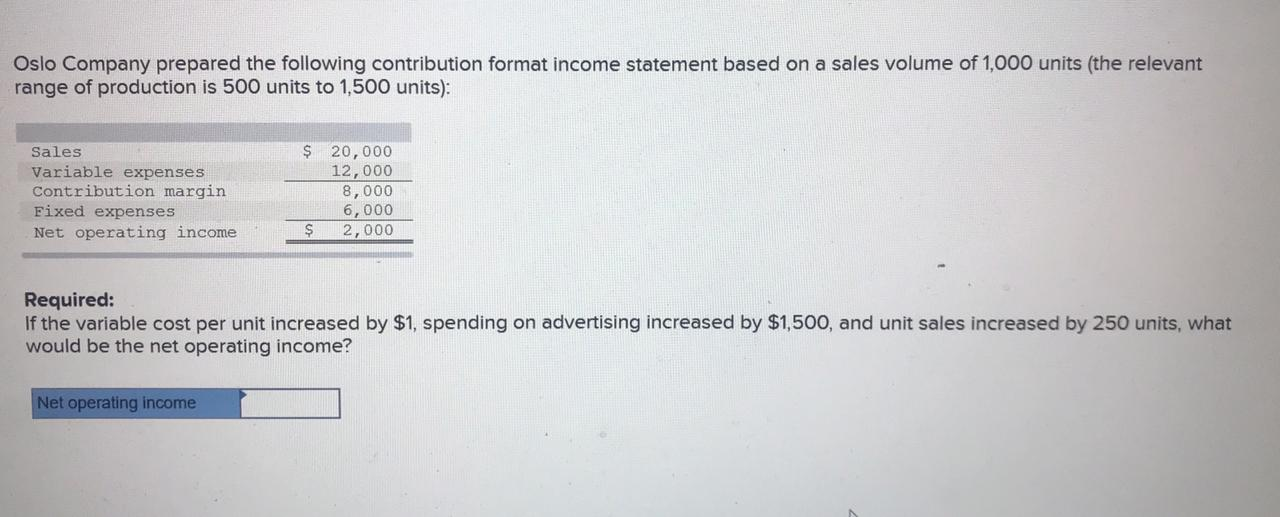

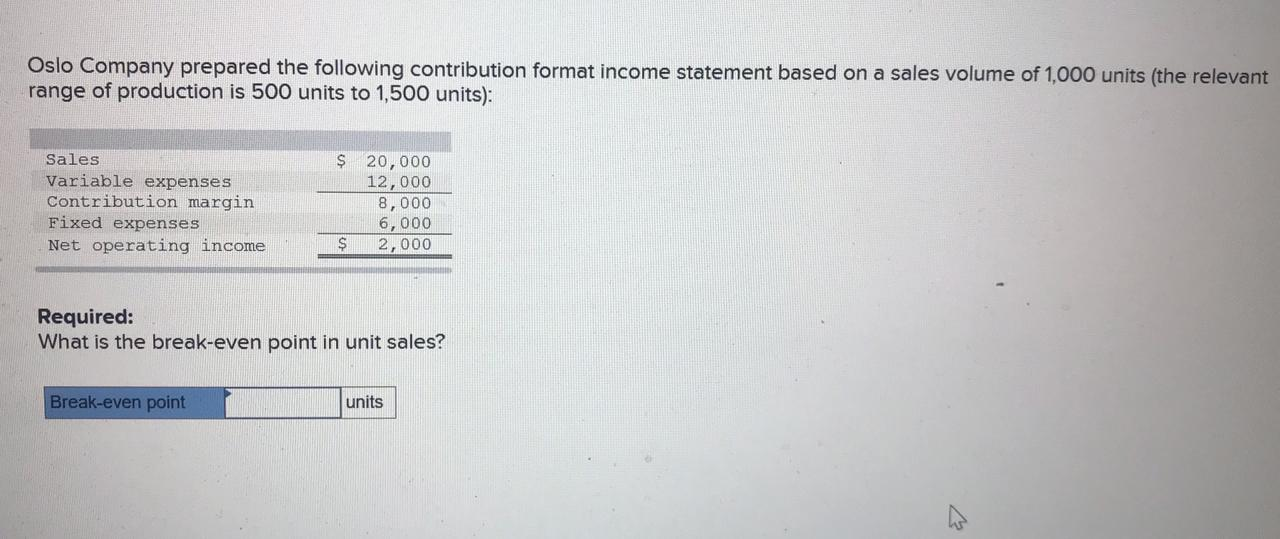

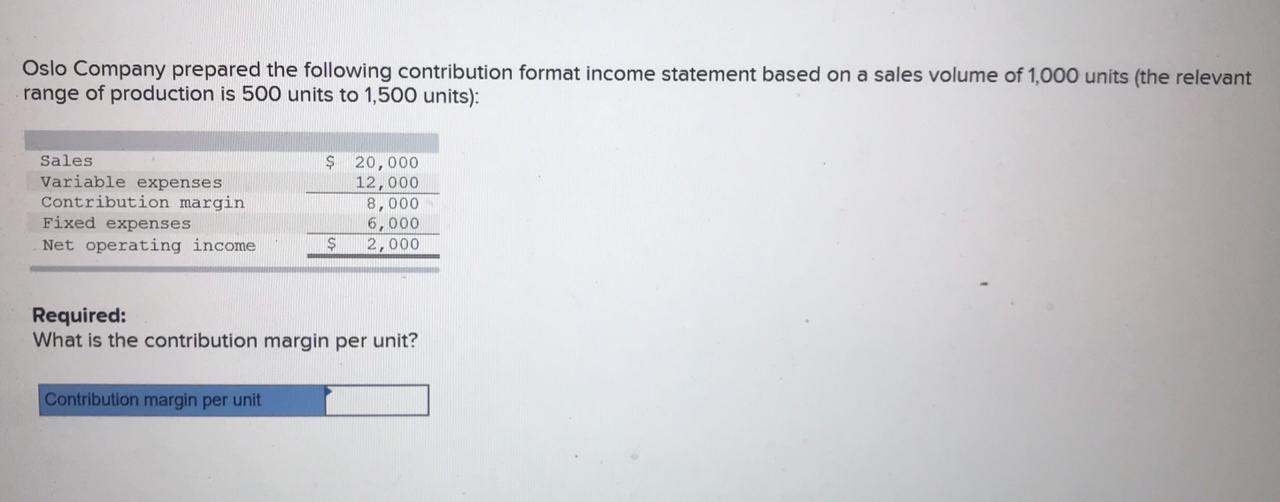

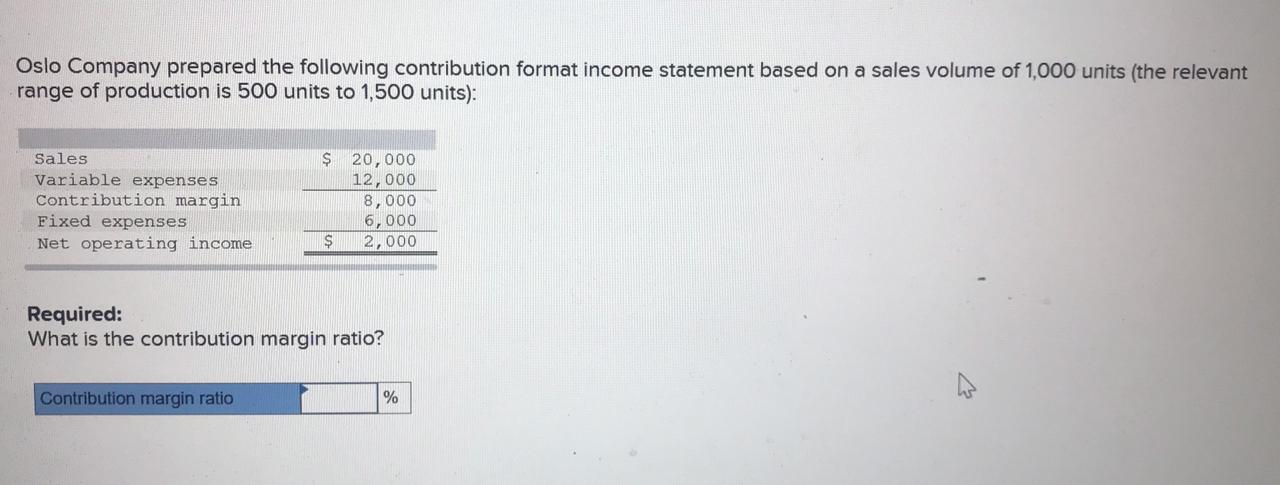

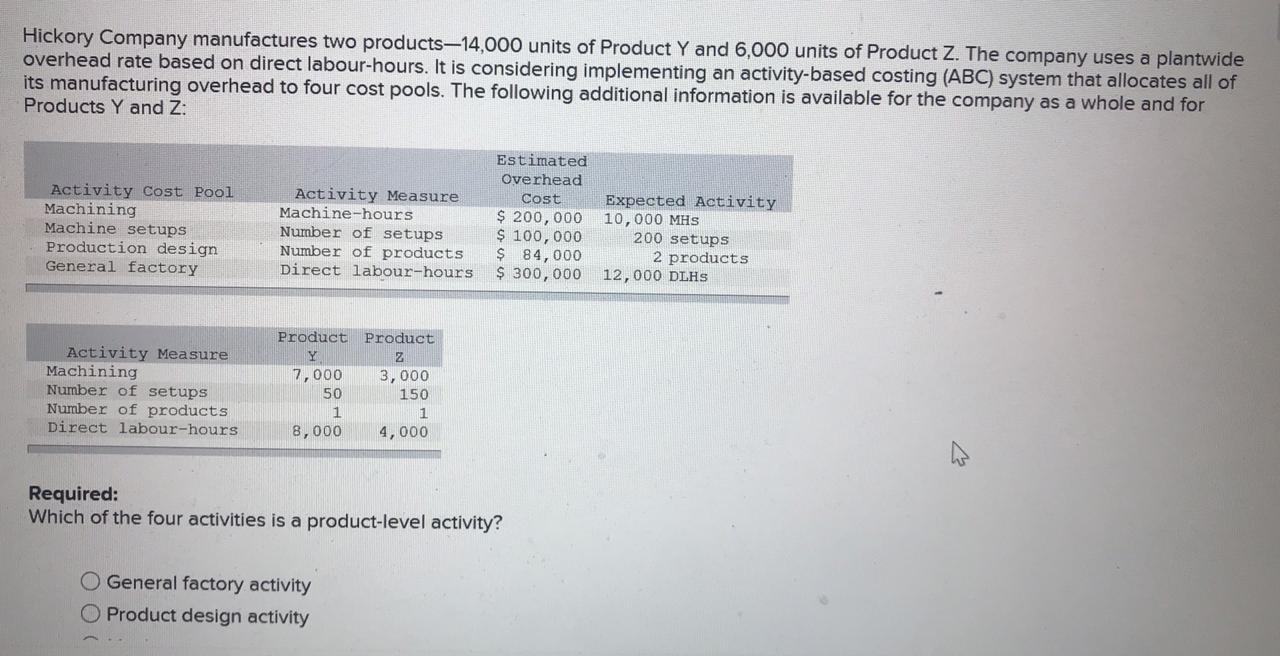

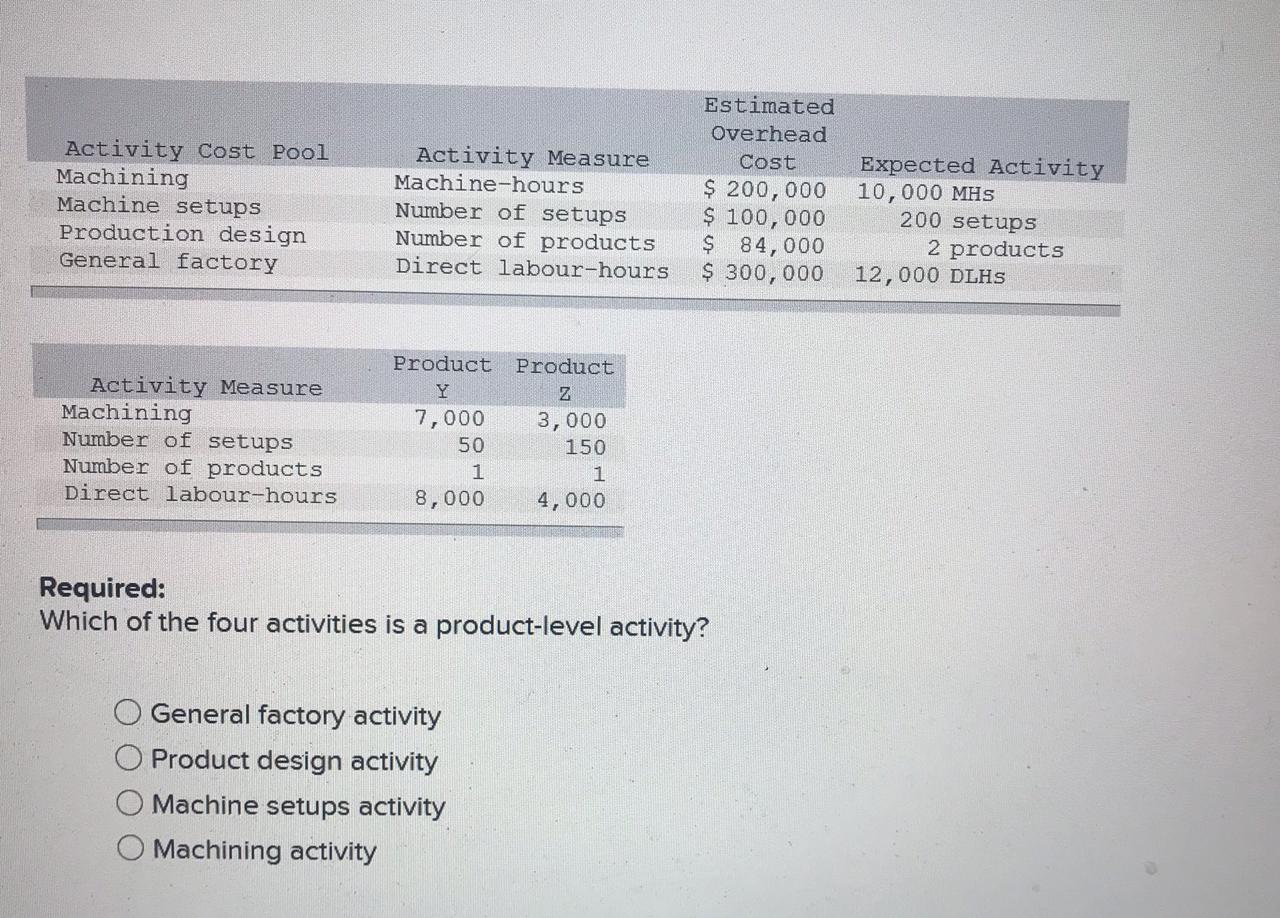

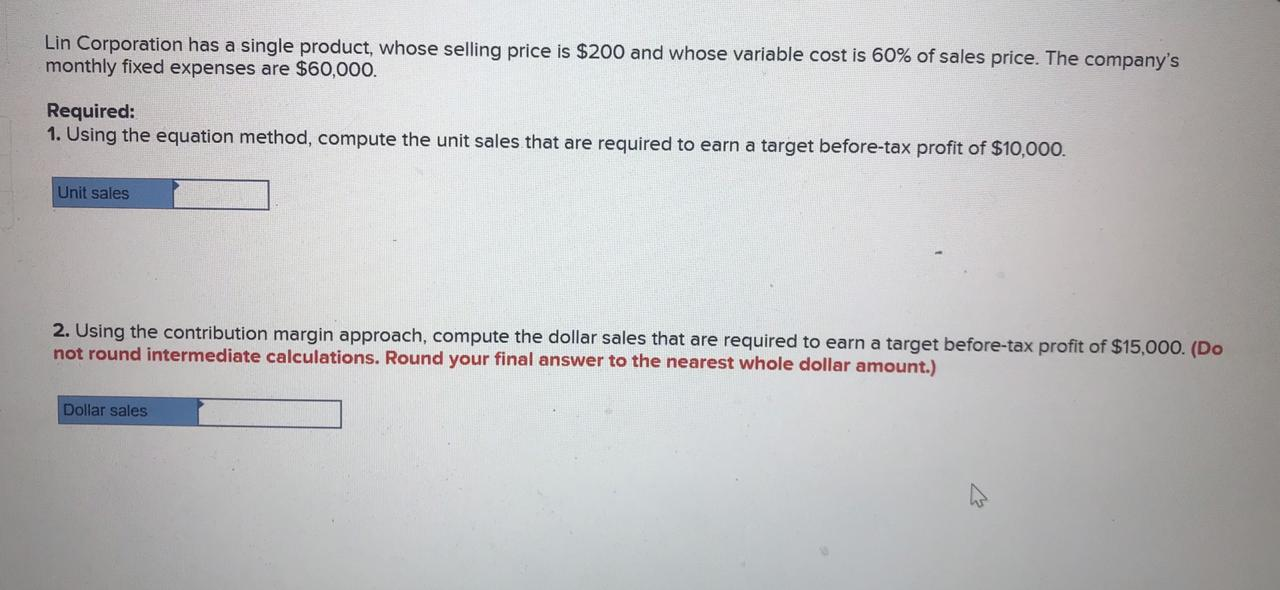

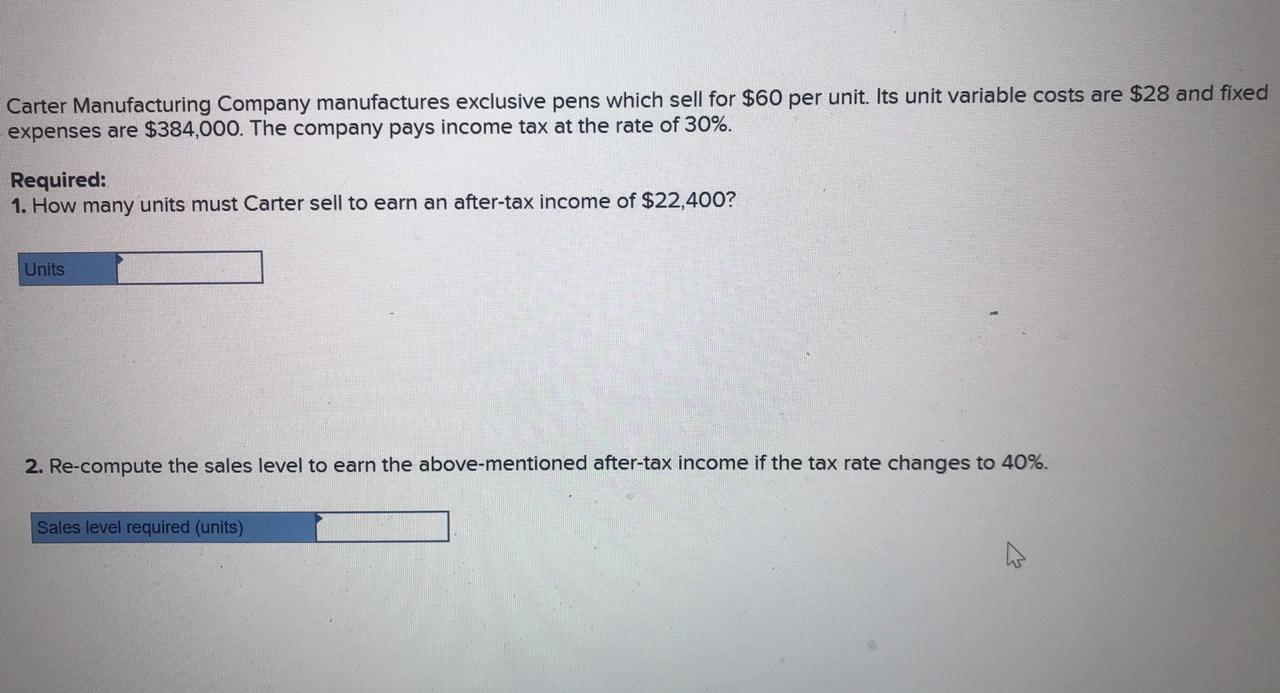

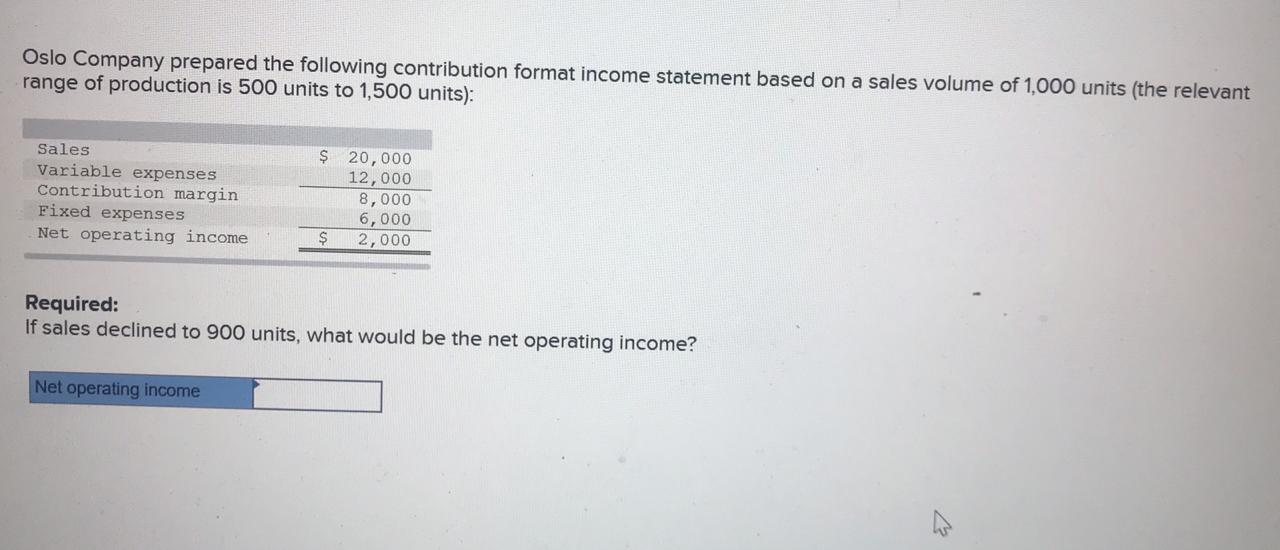

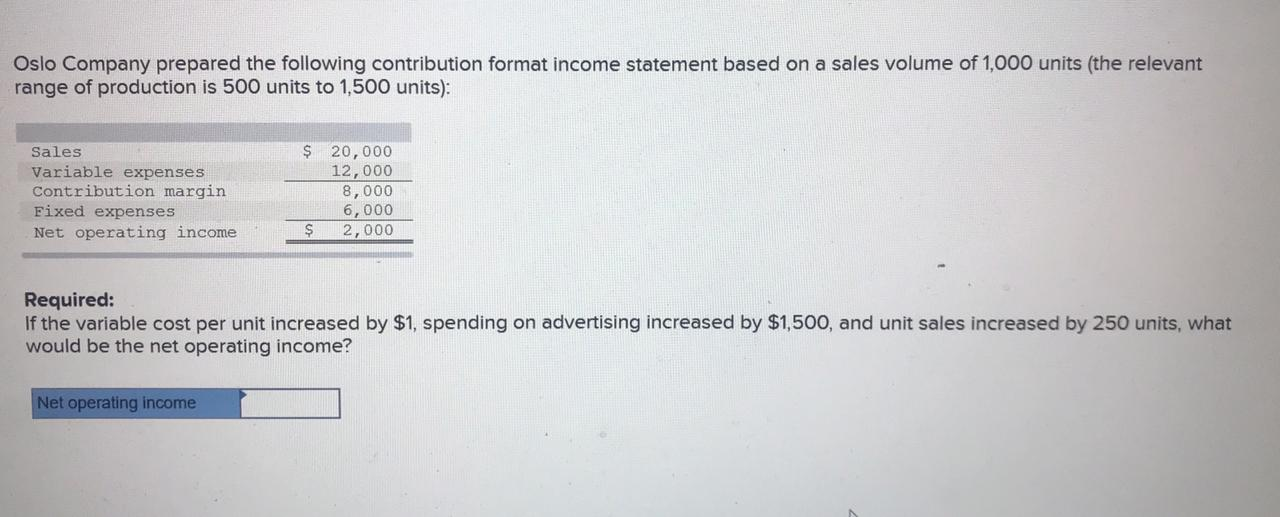

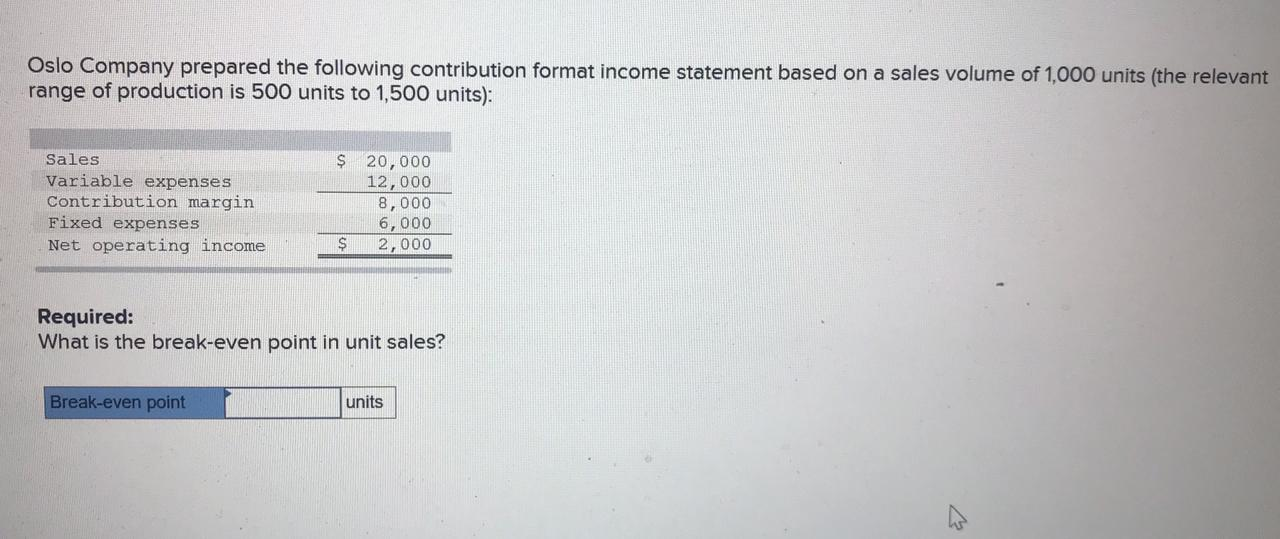

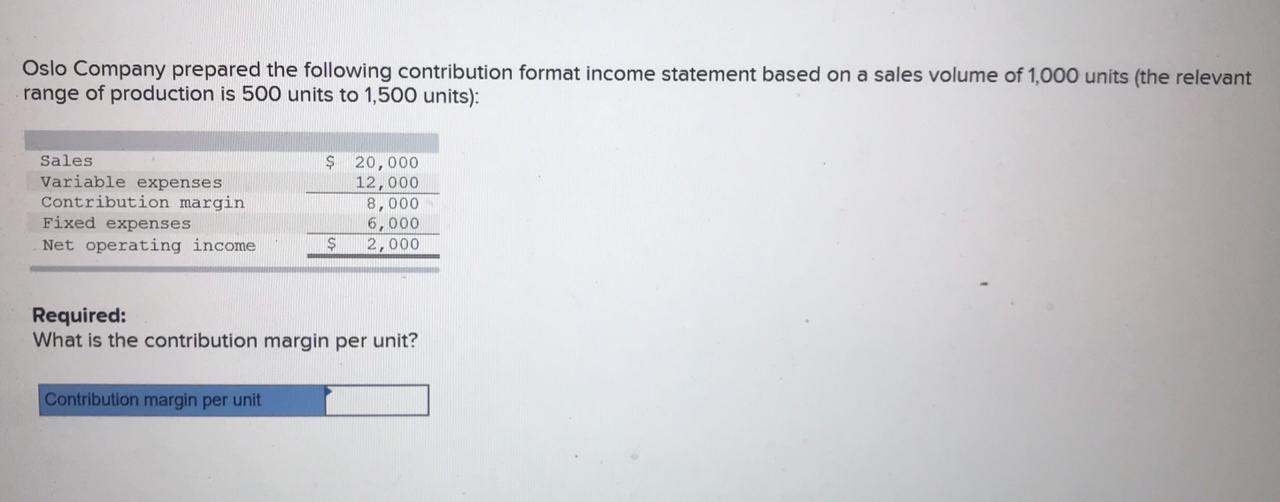

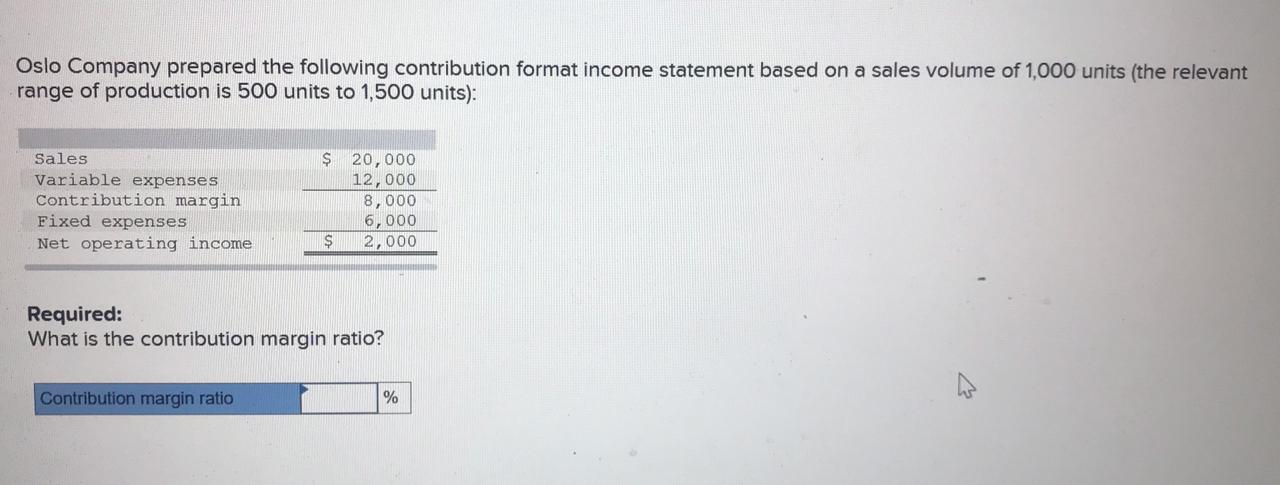

Hickory Company manufactures two products-14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labour-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labour-hours Estimated Overhead Cost Expected Activity $ 200,000 10,000 MHs $ 100,000 200 setups $ 84,000 2 products $ 300,000 12,000 DLHs Activity Measure Machining Number of setups Number of products Direct labour-hours Product Product Y Z 7,000 3,000 50 150 1 1 8,000 4,000 Required: Which of the four activities is a product-level activity? General factory activity O Product design activity Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labour-hours Estimated Overhead Cost $ 200,000 $ 100,000 $ 84,000 $ 300,000 Expected Activity 10,000 MHs 200 setups 2 products 12,000 DLHS Activity Measure Machining Number of setups Number of products Direct labour-hours Product Product Z 7,000 3,000 50 150 1 1 8,000 4,000 Required: Which of the four activities is a product-level activity? O General factory activity Product design activity Machine setups activity Machining activity Lin Corporation has a single product, whose selling price is $200 and whose variable cost is 60% of sales price. The company's monthly fixed expenses are $60,000. Required: 1. Using the equation method, compute the unit sales that are required to earn a target before-tax profit of $10,000. Unit sales 2. Using the contribution margin approach, compute the dollar sales that are required to earn a target before-tax profit of $15,000. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Dollar sales Carter Manufacturing Company manufactures exclusive pens which sell for $60 per unit. Its unit variable costs are $28 and fixed expenses are $384,000. The company pays income tax at the rate of 30%. Required: 1. How many units must Carter sell to earn an after-tax income of $22,400? Units 2. Re-compute the sales level to earn the above-mer ned after-tax inc me if the tax rate changes 40%. Sales level required (units) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 Required: If sales declined to 900 units, what would be the net operating income? Net operating income Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 Required: If the variable cost per unit increased by $1, spending on advertising increased by $1,500, and unit sales increased by 250 units, what would be the net operating income? Net operating income Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 Required: What is the break-even point in unit sales? Break-even point units Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 Required: What is the contribution margin per unit? Contribution margin per unit Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 Required: What is the contribution margin ratio? Contribution margin ratio %