These are our reference questions for the upcoming test, please provide detailed explanation with formulas used to derive answers, please revert ASAP:

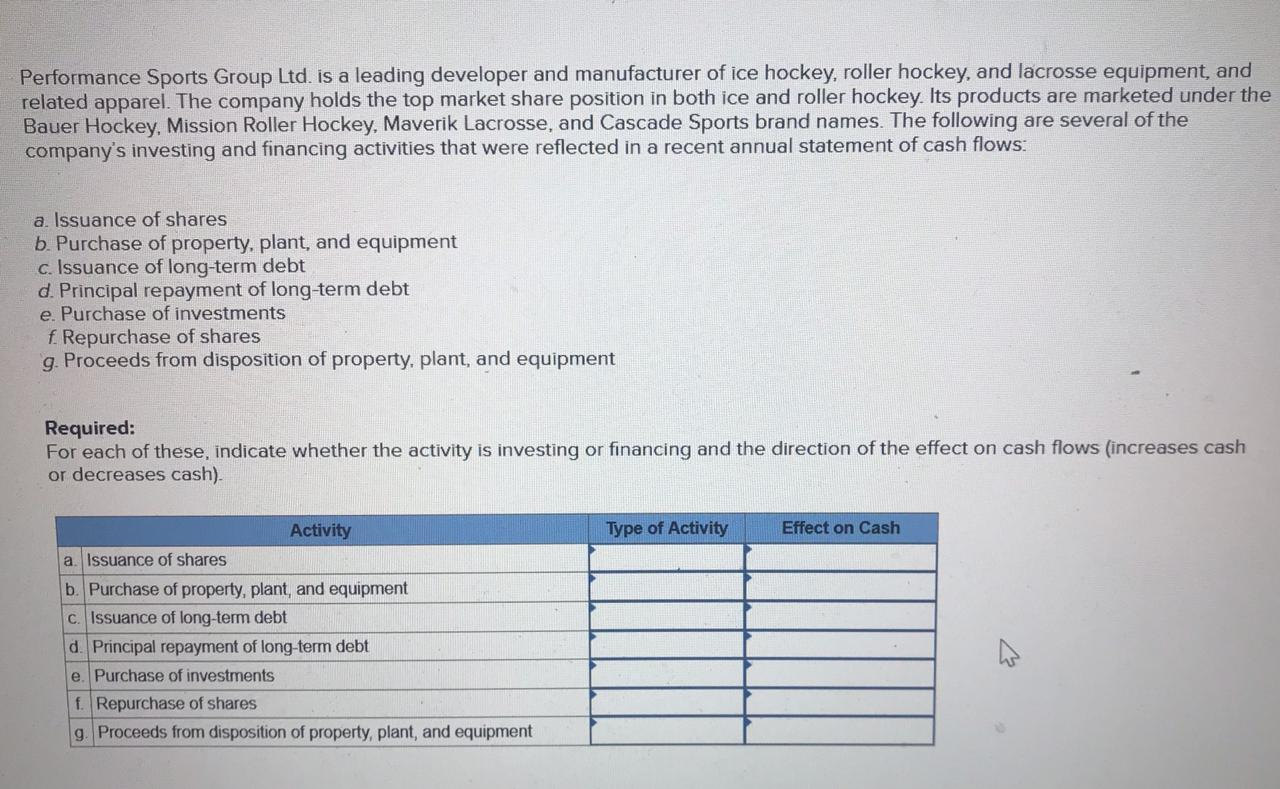

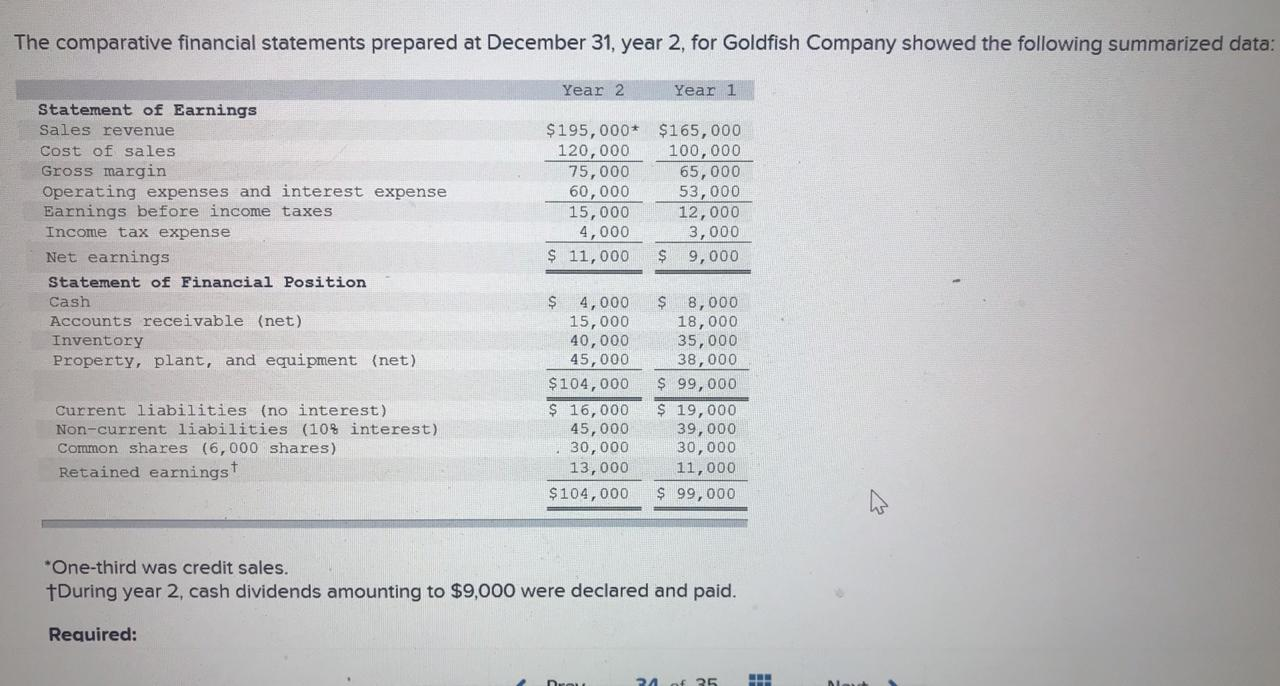

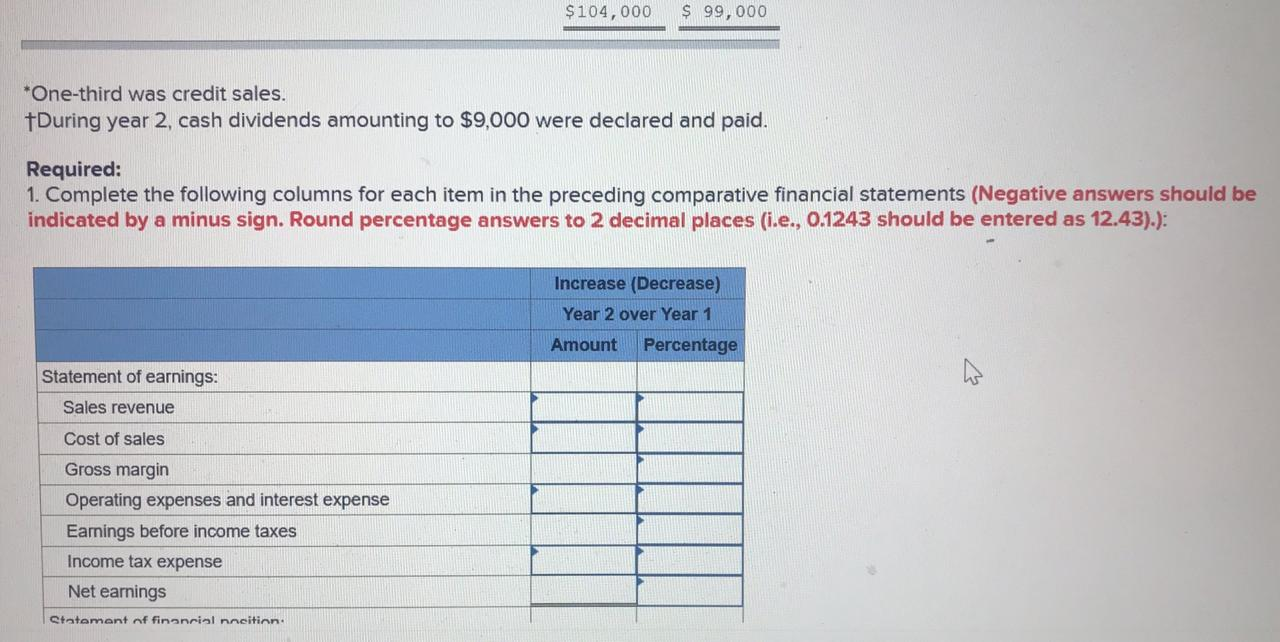

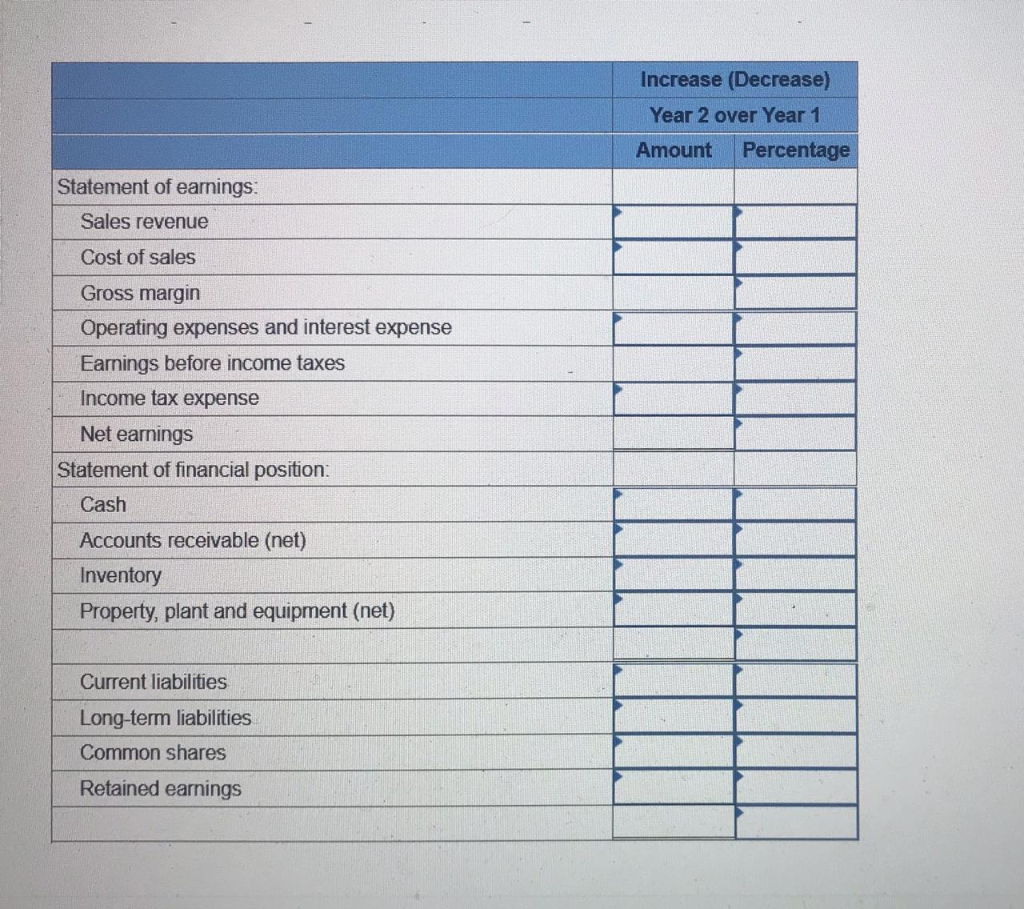

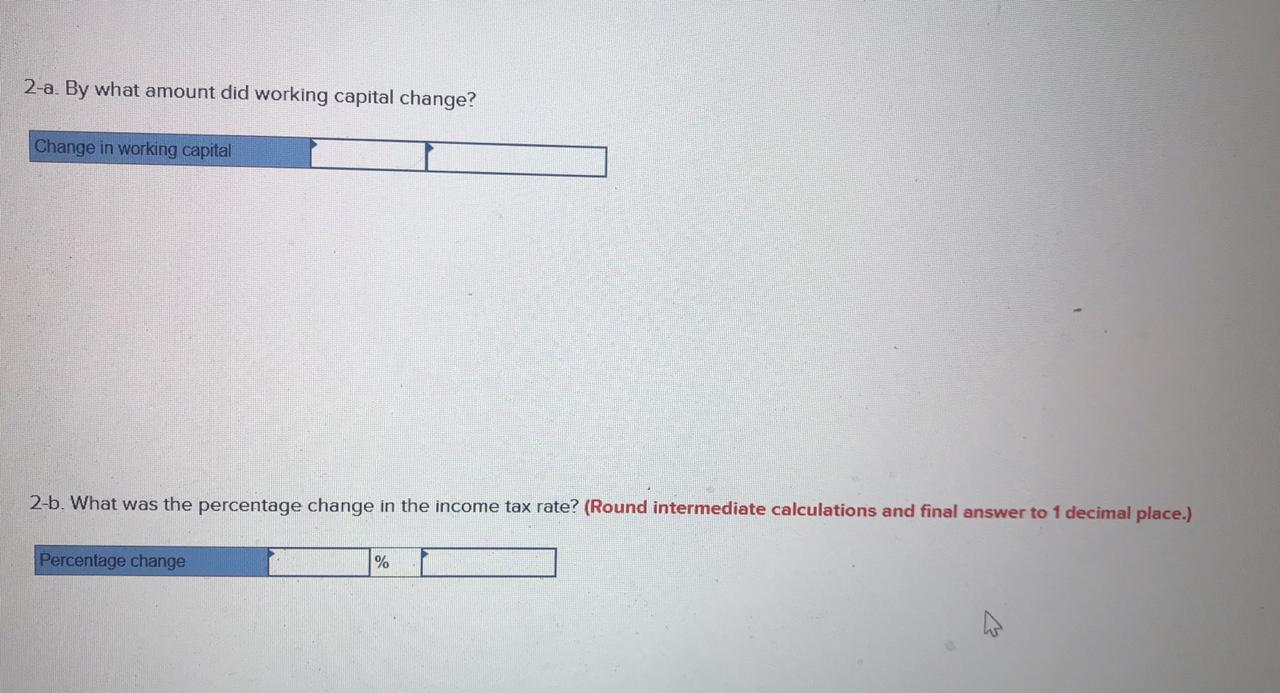

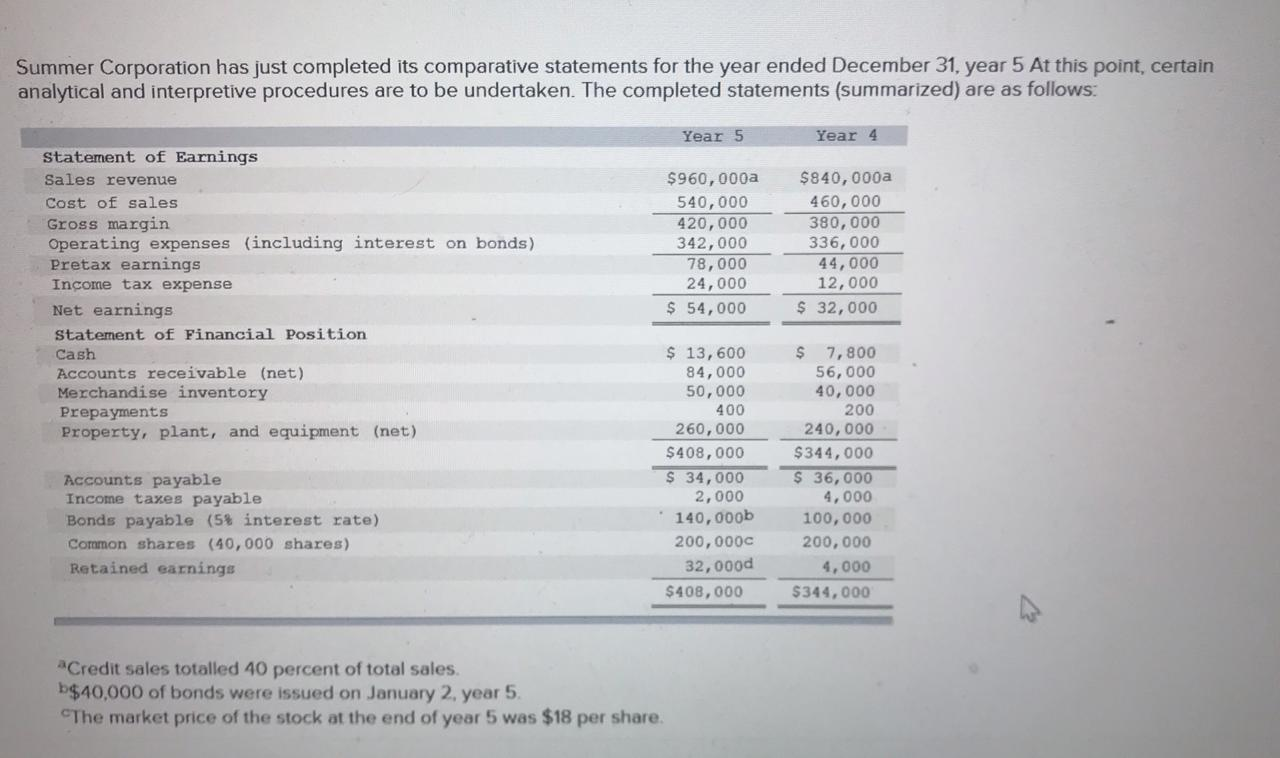

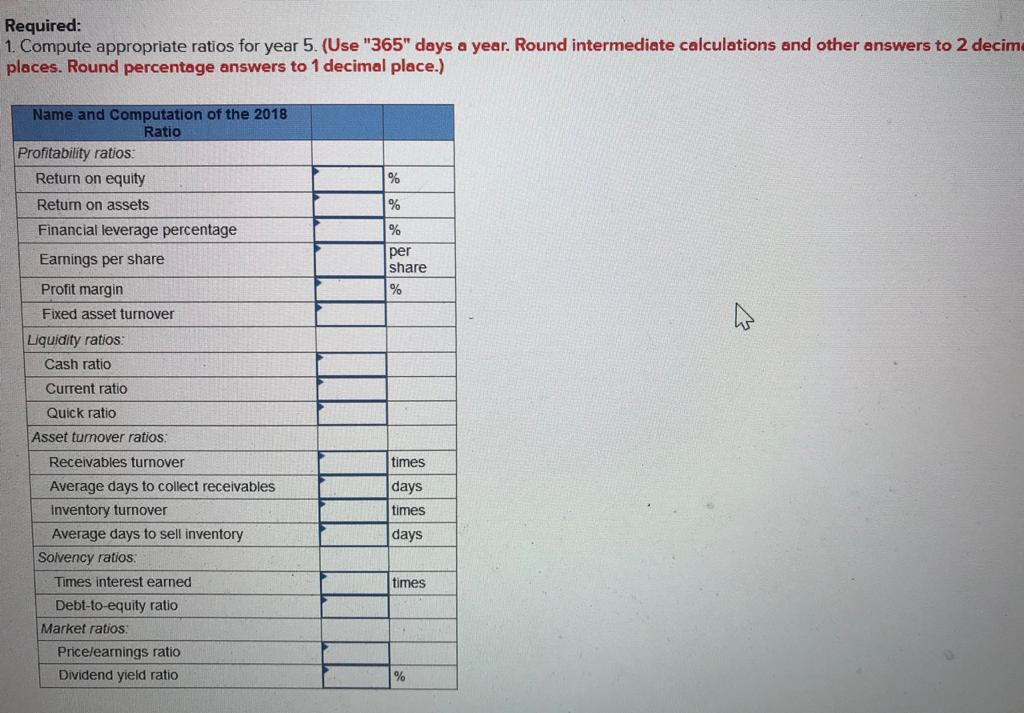

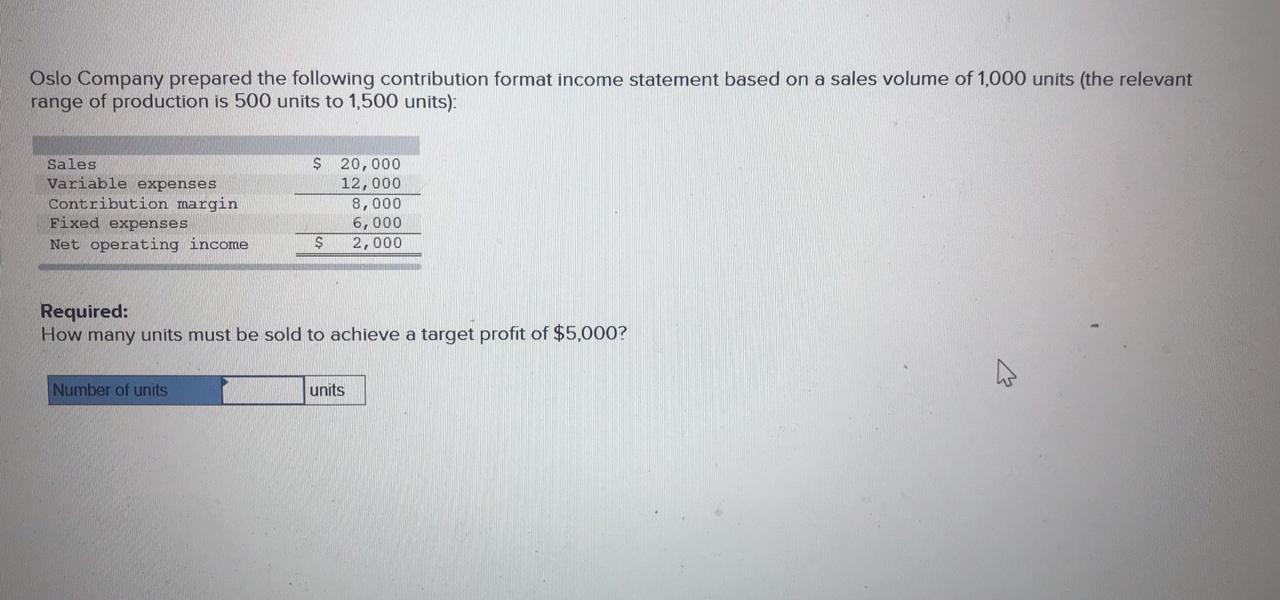

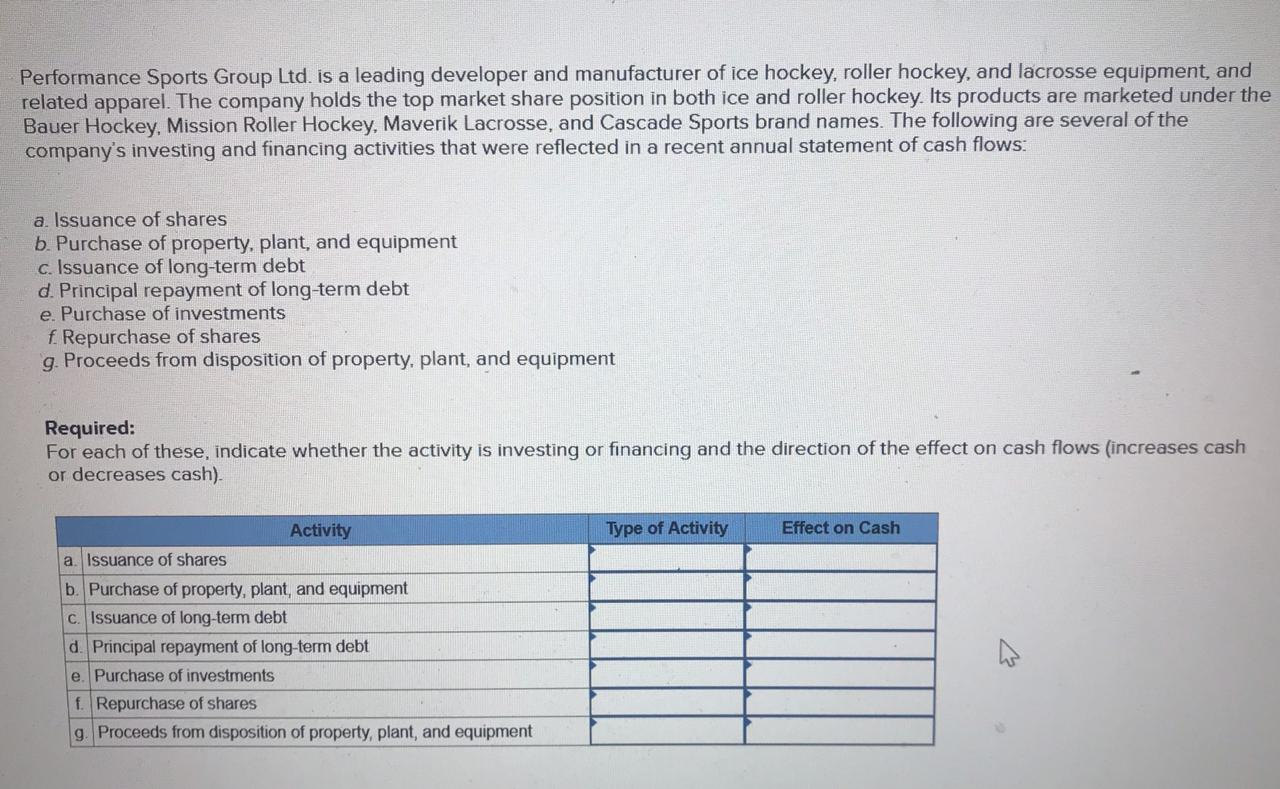

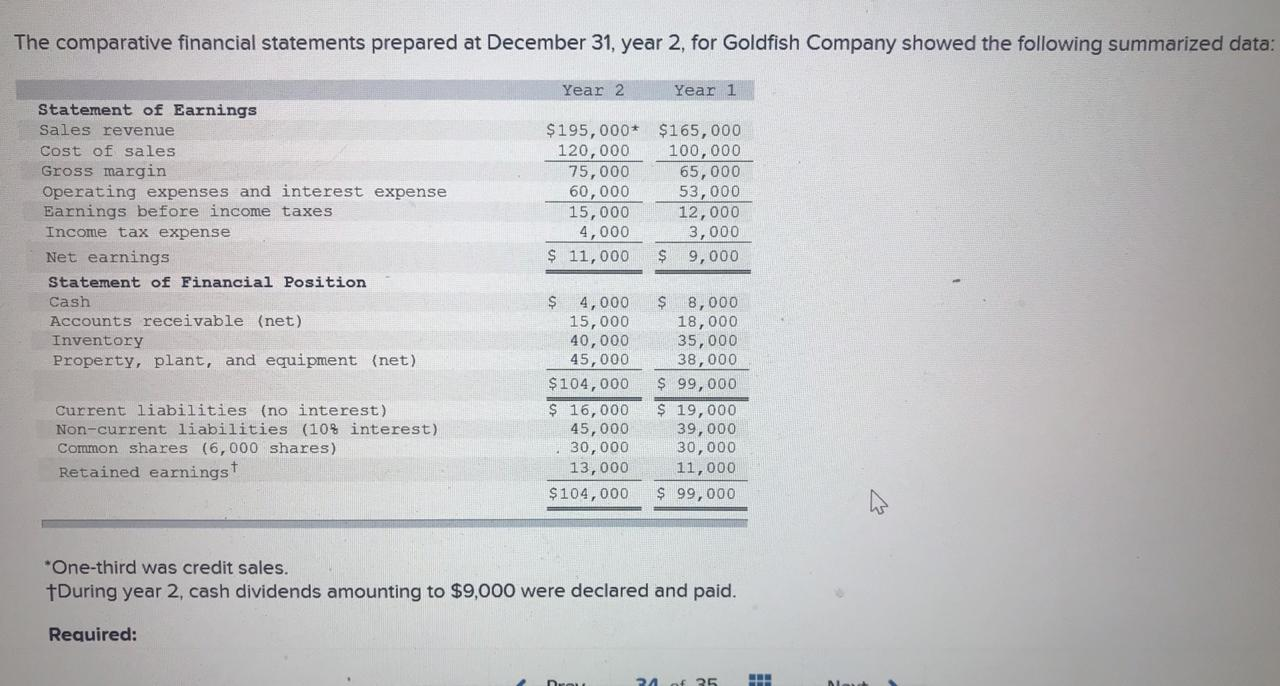

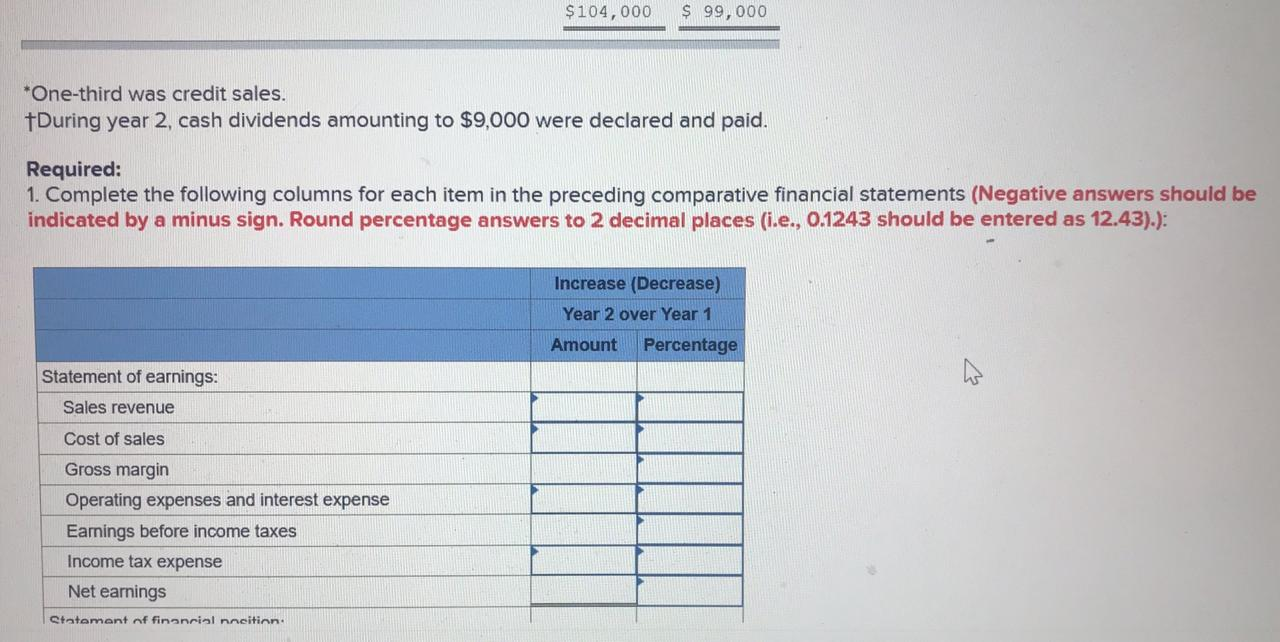

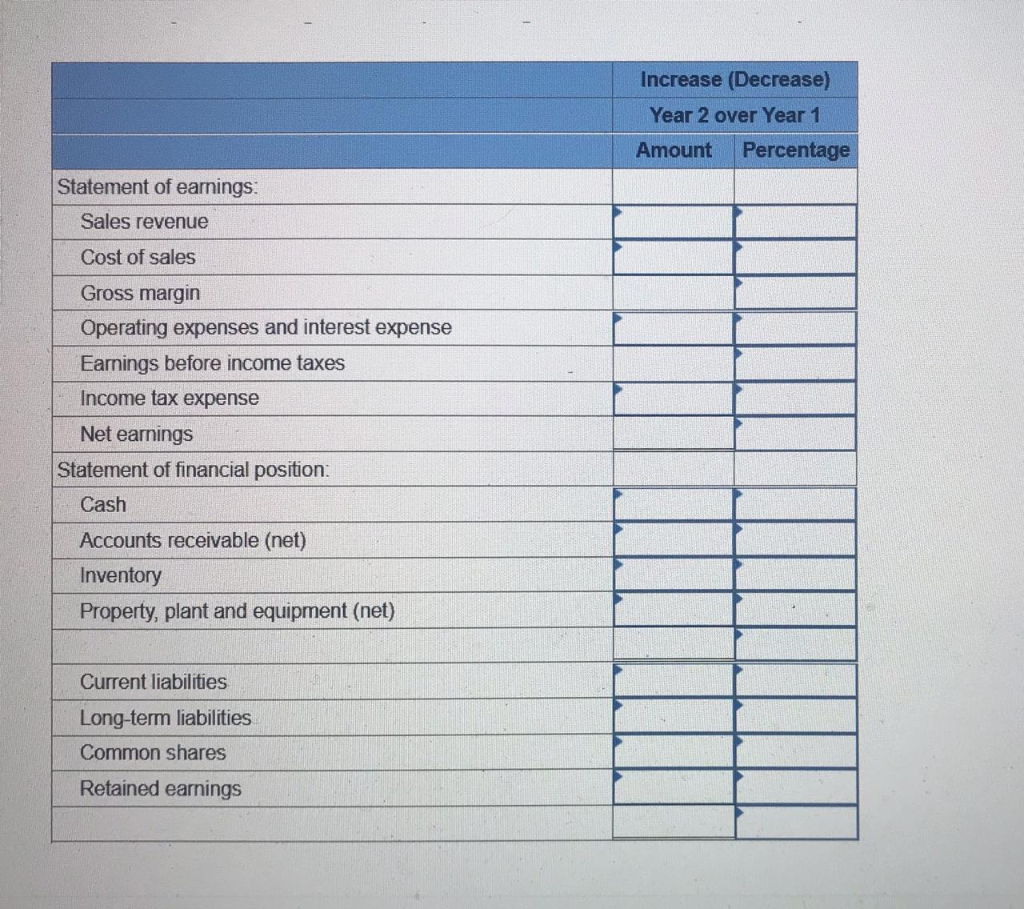

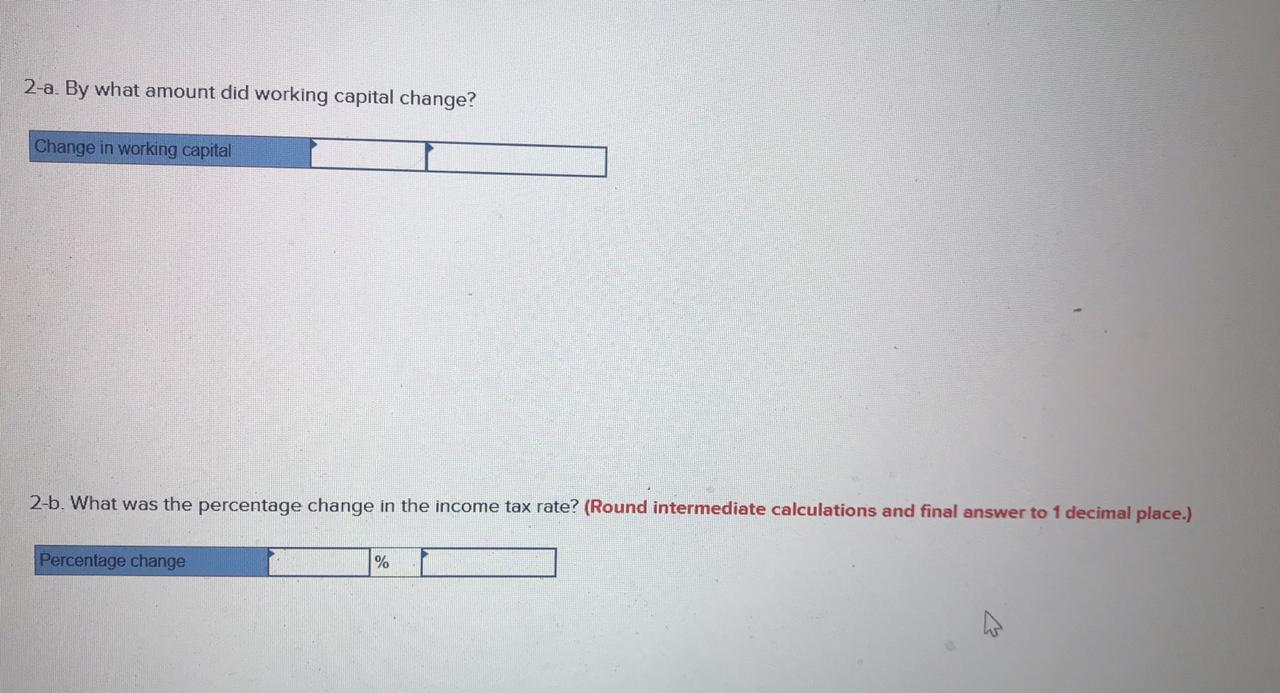

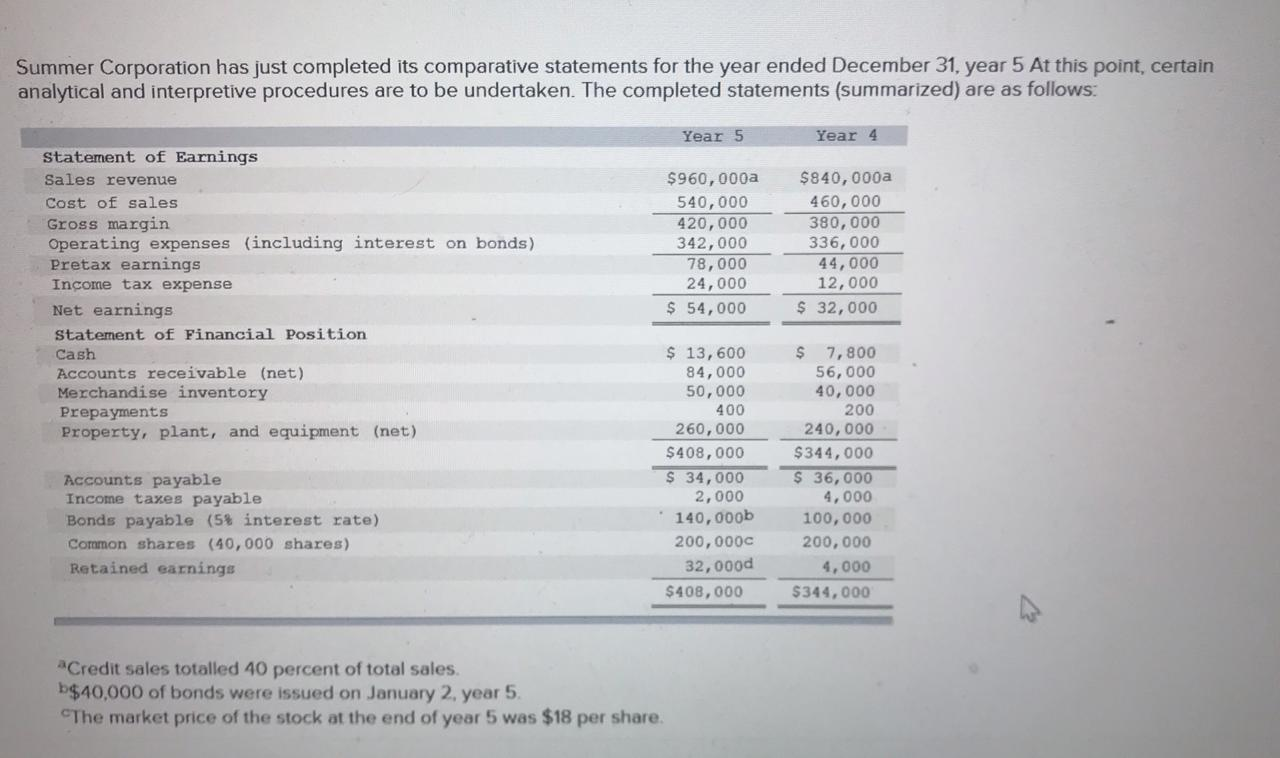

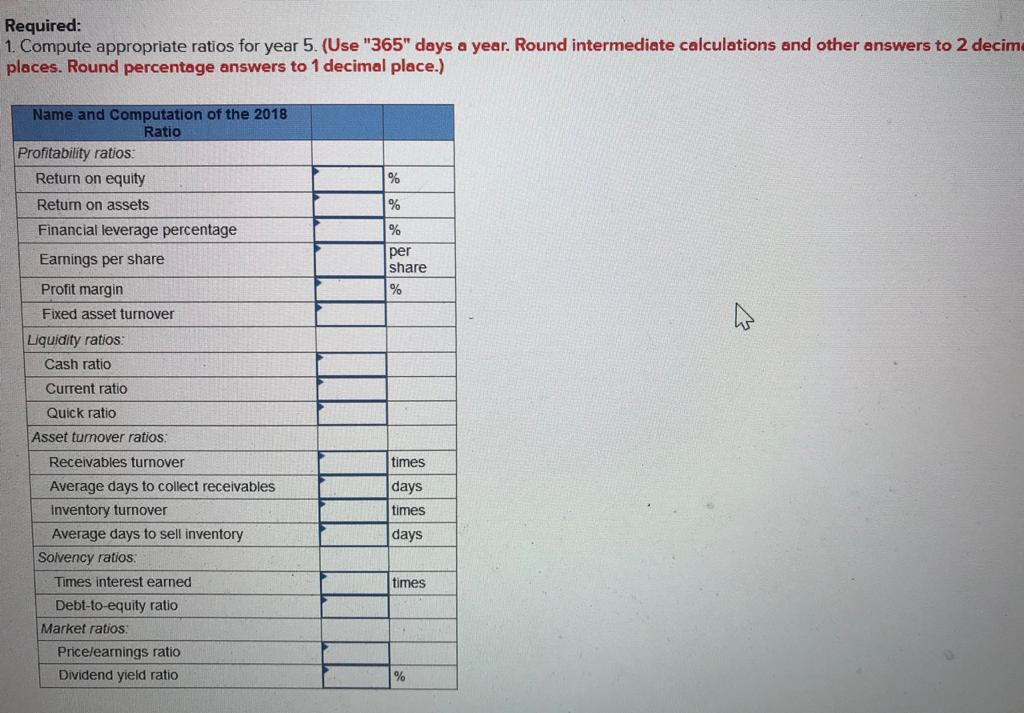

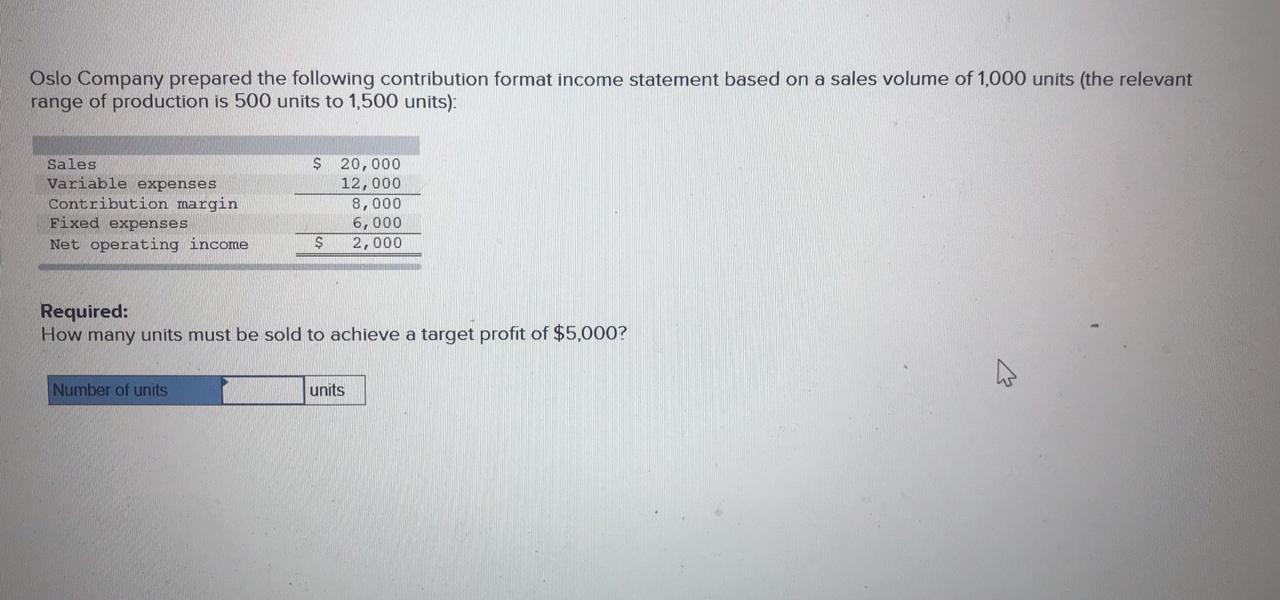

Performance Sports Group Ltd. is a leading developer and manufacturer of ice hockey, roller hockey, and lacrosse equipment, and related apparel. The company holds the top market share position in both ice and roller hockey. Its products are marketed under the Bauer Hockey, Mission Roller Hockey, Maverik Lacrosse, and Cascade Sports brand names. The following are several of the company's investing and financing activities that were reflected in a recent annual statement of cash flows: a. Issuance of shares b. Purchase of property, plant, and equipment c. Issuance of long-term debt d. Principal repayment of long-term debt e. Purchase of investments f Repurchase of shares g. Proceeds from disposition of property, plant, and equipment Required: For each of these, indicate whether the activity is investing or financing and the direction of the effect on cash flows (increases cash or decreases cash). Type of Activity Effect on Cash Activity a. Issuance of shares b. Purchase of property, plant, and equipment C. Issuance of long-term debt d. Principal repayment of long-term debt e. Purchase of investments f. Repurchase of shares 9. Proceeds from disposition of property, plant, and equipment The comparative financial statements prepared at December 31, year 2, for Goldfish Company showed the following summarized data: Year 2 Year 1 Statement of Earnings Sales revenue Cost of sales Gross margin Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings Statement of Financial Position Cash Accounts receivable (net) Inventory Property, plant, and equipment (net) $195,000* $165,000 120,000 100,000 75,000 65,000 60,000 53,000 15,000 12,000 4,000 3,000 $ 11,000 $ 9,000 $ 4,000 15,000 40,000 45,000 $ 104,000 $ 16,000 45,000 30,000 13,000 $104,000 $ 8,000 18,000 35,000 38,000 $ 99,000 $ 19,000 39,000 30,000 11,000 $ 99,000 Current liabilities (no interest) Non-current liabilities (10% interest) Common shares (6,000 shares) Retained earningst *One-third was credit sales. During year 2, cash dividends amounting to $9,000 were declared and paid. Required: PA 25. TH $104,000 $ 99,000 *One-third was credit sales. During year 2, cash dividends amounting to $9,000 were declared and paid. Required: 1. Complete the following columns for each item in the preceding comparative financial statements (Negative answers should be indicated by a minus sign. Round percentage answers to 2 decimal places (i.e., 0.1243 should be entered as 12.43).): Increase (Decrease) Year 2 over Year 1 Amount Percentage Statement of earnings: Sales revenue Cost of sales Gross margin Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings Statement of financial necitinn. Increase (Decrease) Year 2 over Year 1 Amount Percentage Statement of earnings: Sales revenue Cost of sales Gross margin Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings Statement of financial position: Cash Accounts receivable (net) Inventory Property, plant and equipment (net) Current liabilities Long-term liabilities Common shares Retained earnings 2-a. By what amount did working capital change? Change in working capital 2-b. What was the percentage change in the income tax rate? (Round intermediate calculations and final answer to 1 decimal place.) Percentage change % Summer Corporation has just completed its comparative statements for the year ended December 31, year 5 At this point, certain analytical and interpretive procedures are to be undertaken. The completed statements (summarized) are as follows: Year 5 Year 4 Statement of Earnings Sales revenue Cost of sales Gross margin Operating expenses (including interest on bonds) Pretax earnings Income tax expense Net earnings Statement of Financial Position Cash Accounts receivable (net) Merchandise inventory Prepayments Property, plant, and equipment (net) $960,000a 540,000 420,000 342,000 78,000 24,000 $ 54,000 $840,000a 460,000 380,000 336,000 44,000 12,000 $ 32,000 Accounts payable Income taxes payable Bonds payable (5% interest rate) Common shares (40,000 shares) Retained earnings $ 13,600 84,000 50,000 400 260,000 $408,000 $ 34,000 2,000 140,000b 200,0000 32,000d $408,000 $ 7,800 56,000 40,000 200 240,000 $344,000 $ 36,000 4,000 100,000 200,000 4,000 $344,000 *Credit sales totalled 40 percent of total sales. b$40,000 of bonds were issued on January 2, year 5. The market price of the stock at the end of year 5 was $18 per share. Required: 1. Compute appropriate ratios for year 5. (Use "365" days a year. Round intermediate calculations and other answers to 2 decim places. Round percentage answers to 1 decimal place.) % Name and Computation of the 2018 Ratio Profitability ratios: Return on equity Return on assets Financial leverage percentage Earnings per share Profit margin Fixed asset turnover Liquidity ratios Cash ratio % % per share % w Current ratio Quick ratio times days times days Asset turnover ratios: Receivables turnover Average days to collect receivables Inventory turnover Average days to sell inventory Solvency ratios Times interest earned Debt-to-equity ratio Market ratios Pricelearnings ratio Dividend yield ratio times Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 Required: How many units must be sold to achieve a target profit of $5,000? Number of units units