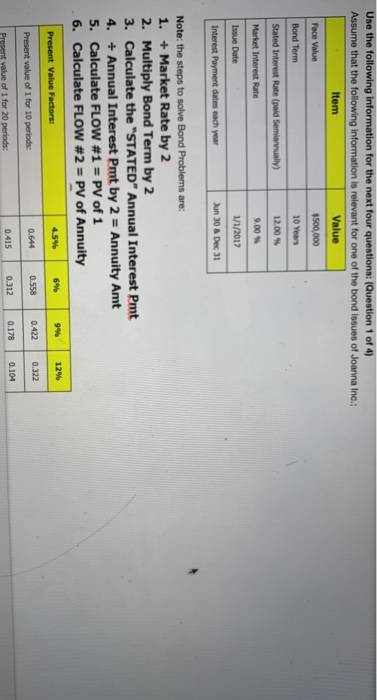

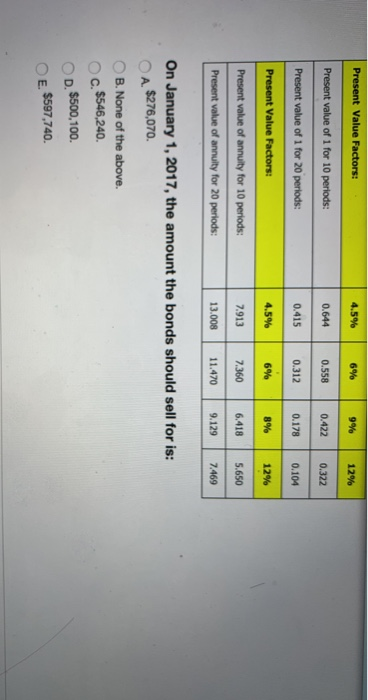

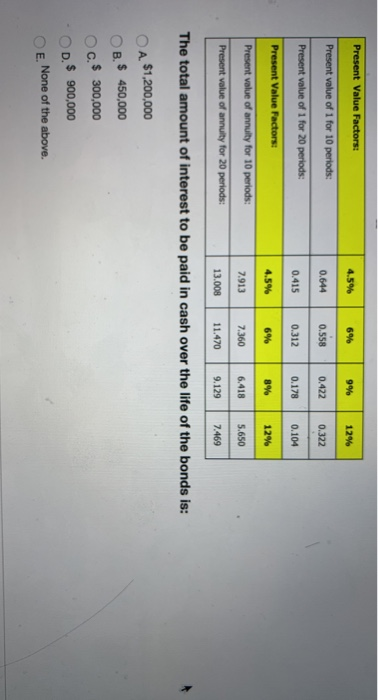

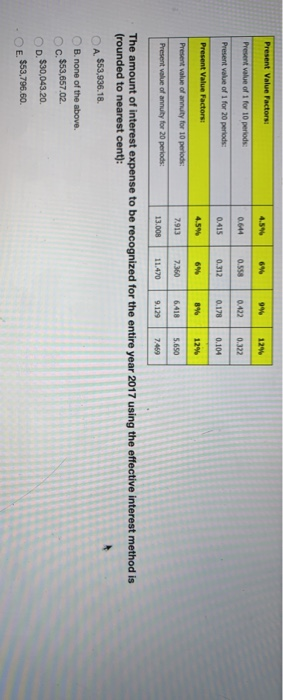

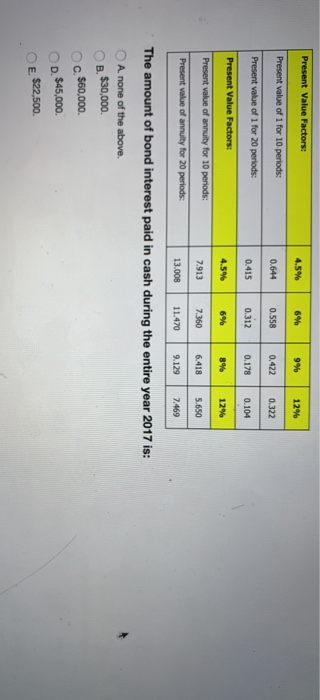

Use the following information for the next four questions: (Question 1 of 4) Assume that the following information is relevant for one of the bond issues of Joanna Inc.: Item Value Face Value $500,000 Bond Term 10 Years Stated Interest Rate (paid Semiannually) 12.00% Market Interest Rate 9.00 % 1/1/2017 Issue Date Interest Payment dates each year Jun 30 & Dec 31 Note: the steps to solve Bond Problems are: 1. + Market Rate by 2 2. Multiply Bond Term by 2 3. Calculate the "STATED" Annual Interest Pmt 4. + Annual Interest Pmt by 2 = Annuity Amt 5. Calculate FLOW #1 = PV of 1 6. Calculate FLOW #2 = PV of Annuity 4.5% 9% Present Value Factors: 6% 12% Present value of 1 for 10 periods: 0.644 0.558 0.322 | 0.422 0.415 0.312 0.178 0.104 Present value of 1 for 20 periods: Present Value Factors: 4.5% 6% 9% 12% Present value of 1 for 10 periods: 0.644 0.558 0.4220.322 Present value of 1 for 20 periods: 0.415 0.312 0.1780.104 Present Value Factors: 4.5% 6% 8% 12% Present value of annuity for 10 periods: 7.9137.360 6.418 5.650 Present value of annuity for 20 periods: 13.008 11.4709.129 7.469 On January 1, 2017, the amount the bonds should sell for is: A $276,070 OB. None of the above. c. $546,240 D. $500,100 E $597,740 Present Value Factors: 4.5% I 6% 9% 12% Present value of 1 for 10 periods: 0.644 0.558 0.422 0.322 Present value of 1 for 20 periods: 0.415 0.312 0.178 0.104 Present Value Factors: 4.5% 16% 8% 12% Present value of annuity for 10 periods: 6,418 5.650 7.9137 13.008 .360 11.470 Present value of annuity for 20 periods: 9.129 7.469 The total amount of interest to be paid in cash over the life of the bonds is: O A $1,200,000 OB. $ 450,000 c. $ 300,000 OD. $ 900,000 E. None of the above. Present Value Factors: 4.5% 6% 9% 12% Present value of 1 for 10 periods Present value of 1 for 20 periods Present Value Factors: 4.5% 8% 12% Present value of annuity for 10 periods 7.913 7.360 6.418 5.650 Present value of annuity for 20 periods: 13.008 11.470 9.129 7.45 The amount of interest expense to be recognized for the entire year 2017 using the effective interest method is (rounded to nearest cent): CA $53,936.18 B. none of the above. c. $53,657.02 D. $30,043.20 E $53.796.60 - Present Value Factors: 4.5% 6% 94 12% Present value of 1 for 10 periods: 0.644 0 Present value of 1 for 20 periods: 0.558 0.312 0.422 0.178 .322 0.104 0.415 Present Value Factors: 4.5% 6% 8% 12% Present value of annuity for 10 periods: 7 .360 6.418 5.650 Present value of annuity for 20 periods: 7.913 13.008 11.470 9.129 7.469 The amount of bond interest paid in cash during the entire year 2017 is: A. none of the above. B. $30,000 c. $60,000 OD. $45,000 O E $22,500