Answered step by step

Verified Expert Solution

Question

1 Approved Answer

these are questions in picture 4 Question 1 (100 marks) - HRM Kim's Nursery sells a wide variety of plants and offers courses on summer

these are questions in picture 4

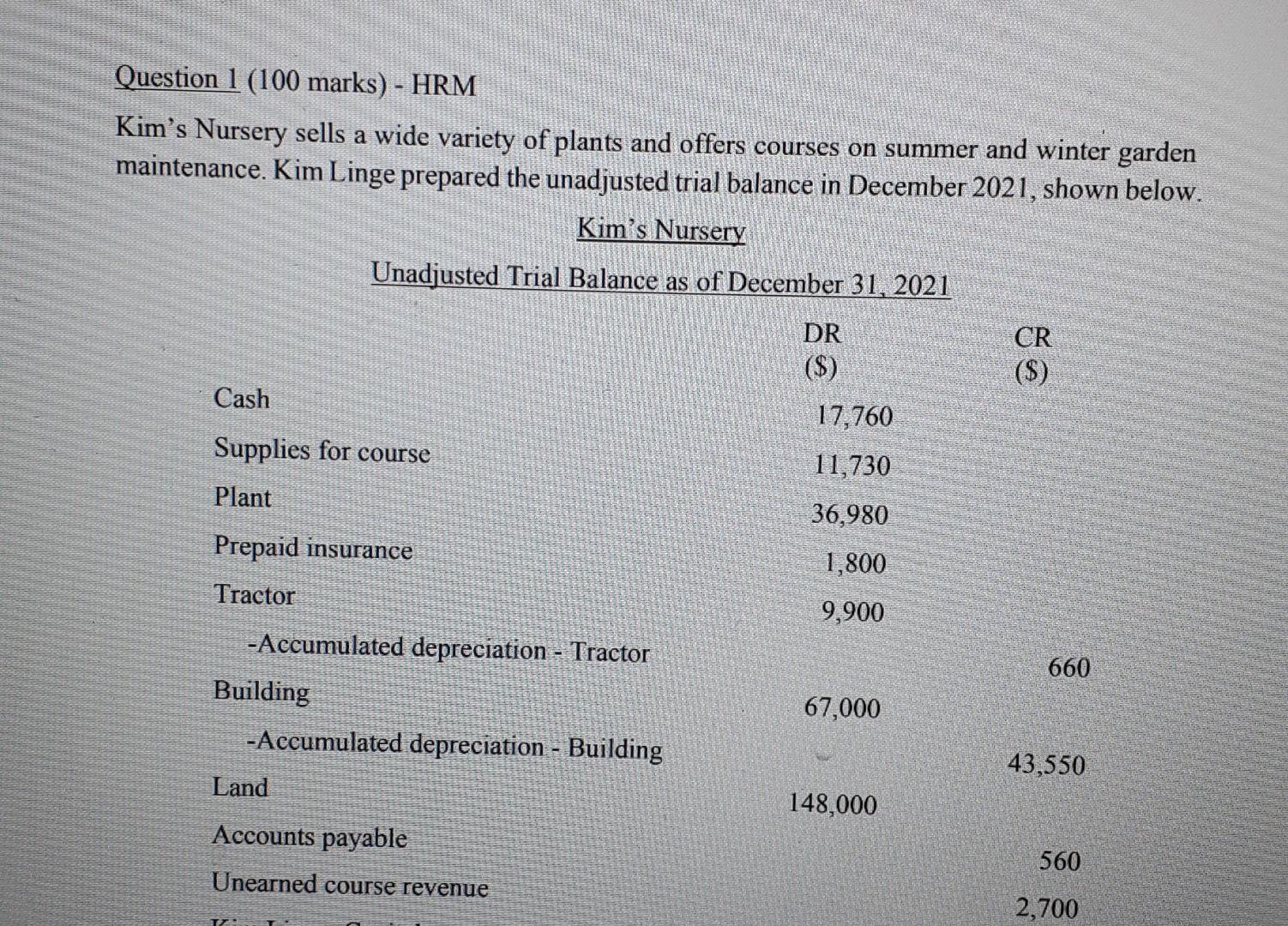

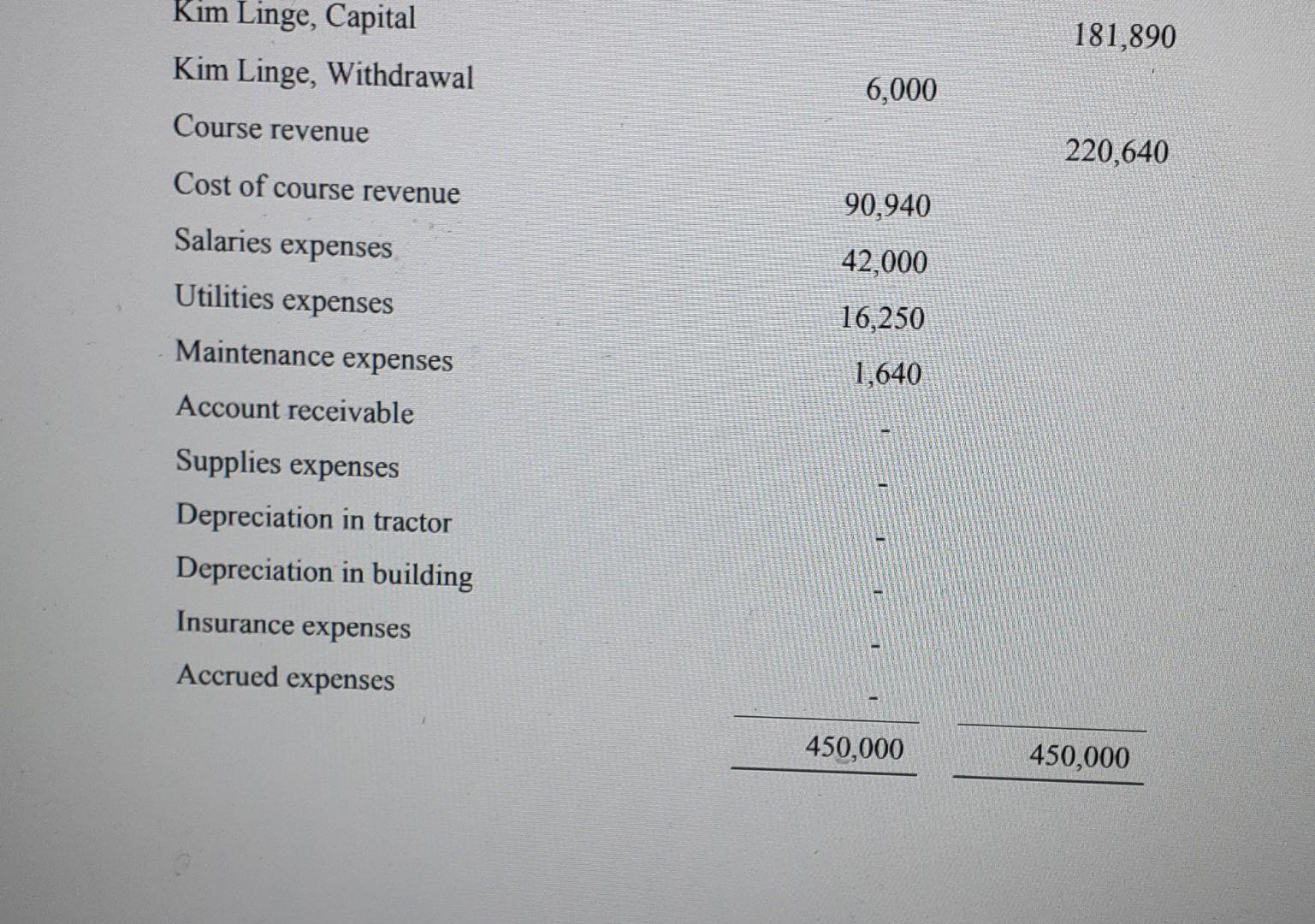

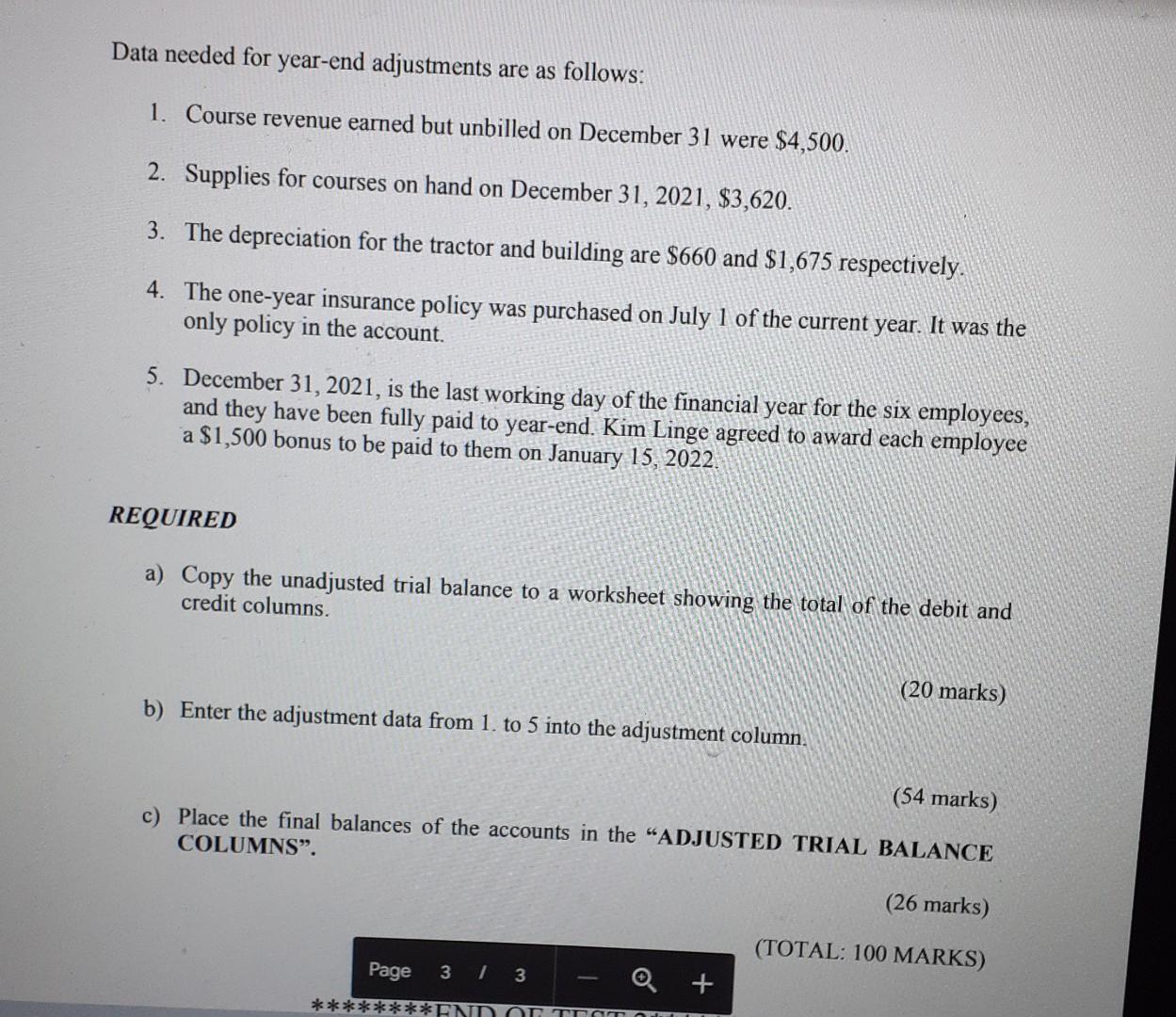

Question 1 (100 marks) - HRM Kim's Nursery sells a wide variety of plants and offers courses on summer and winter garden maintenance. Kim Linge prepared the unadjusted trial balance in December 2021 , shown below. Kim Linge, Capital 181,890 Kim Linge, Withdrawal 6,000 Course revenue 220,640 Cost of course revenue 90,940 Salaries expenses 42,000 Utilities expenses 16,250 Maintenance expenses 1,640 Account receivable Supplies expenses Depreciation in tractor Depreciation in building Insurance expenses Accrued expenses 450,000450,000 Data needed for year-end adjustments are as follows: 1. Course revenue earned but unbilled on December 31 were $4,500. 2. Supplies for courses on hand on December 31,2021,$3,620. 3. The depreciation for the tractor and building are $660 and $1,675 respectively. 4. The one-year insurance policy was purchased on July 1 of the current year. It was the only policy in the account. 5. December 31,2021 , is the last working day of the financial year for the six employees, and they have been fully paid to year-end. Kim Linge agreed to award each employee a $1,500 bonus to be paid to them on January 15, 2022. REQUIRED a) Copy the unadjusted trial balance to a worksheet showing the total of the debit and credit columns. (20 marks) b) Enter the adjustment data from 1. to 5 into the adjustment column. a) Copy the unadjusted trial balance to a worksheet showing the total of the debit and credit columns. (20 marks) b) Enter the adjustment data from 1. to 5 into the adjustment column. (54 marks) c) Place the final balances of the accounts in the "ADJUSTED TRIAL BALANCE COLUMNS". (26 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started