Answered step by step

Verified Expert Solution

Question

1 Approved Answer

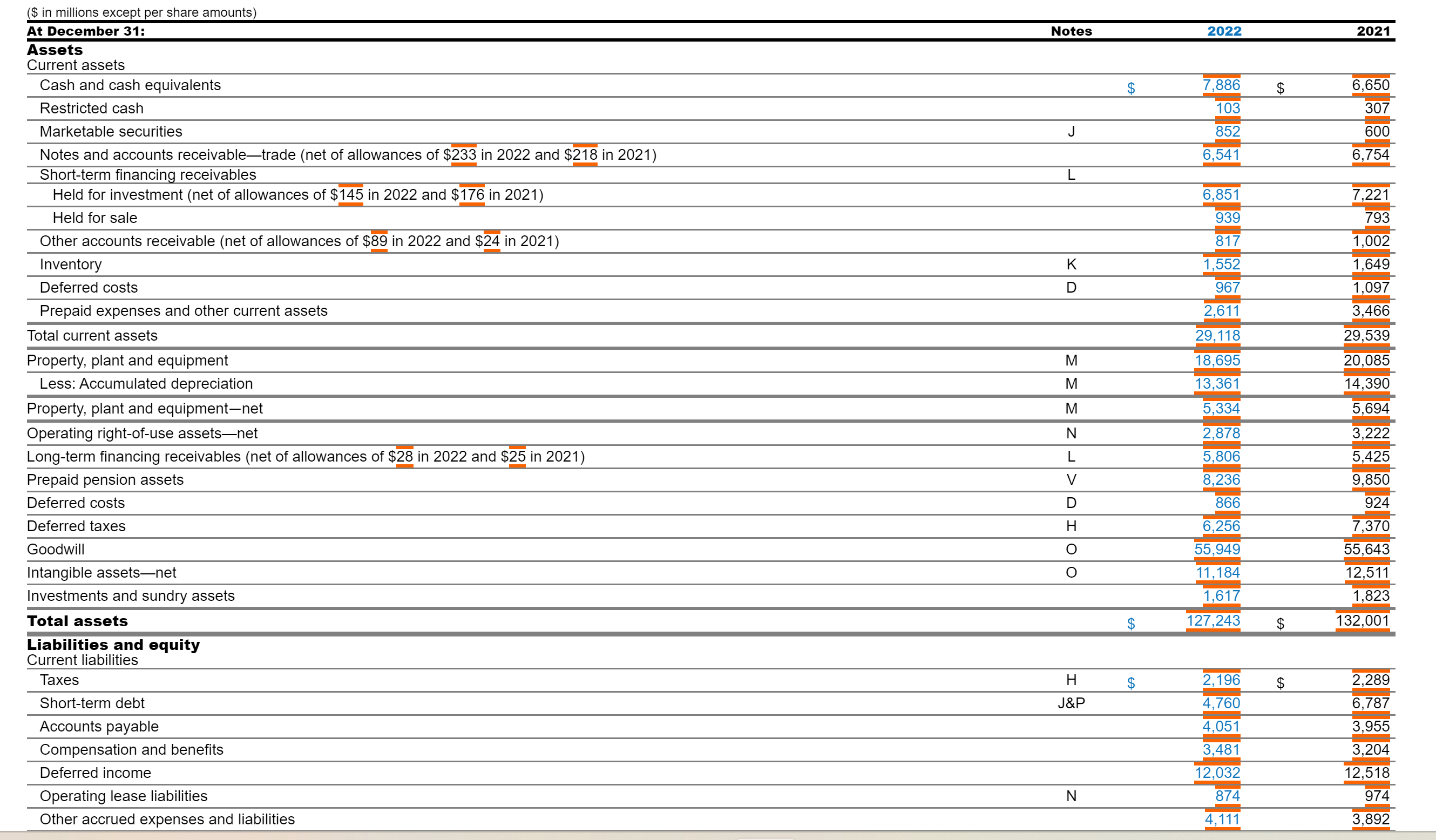

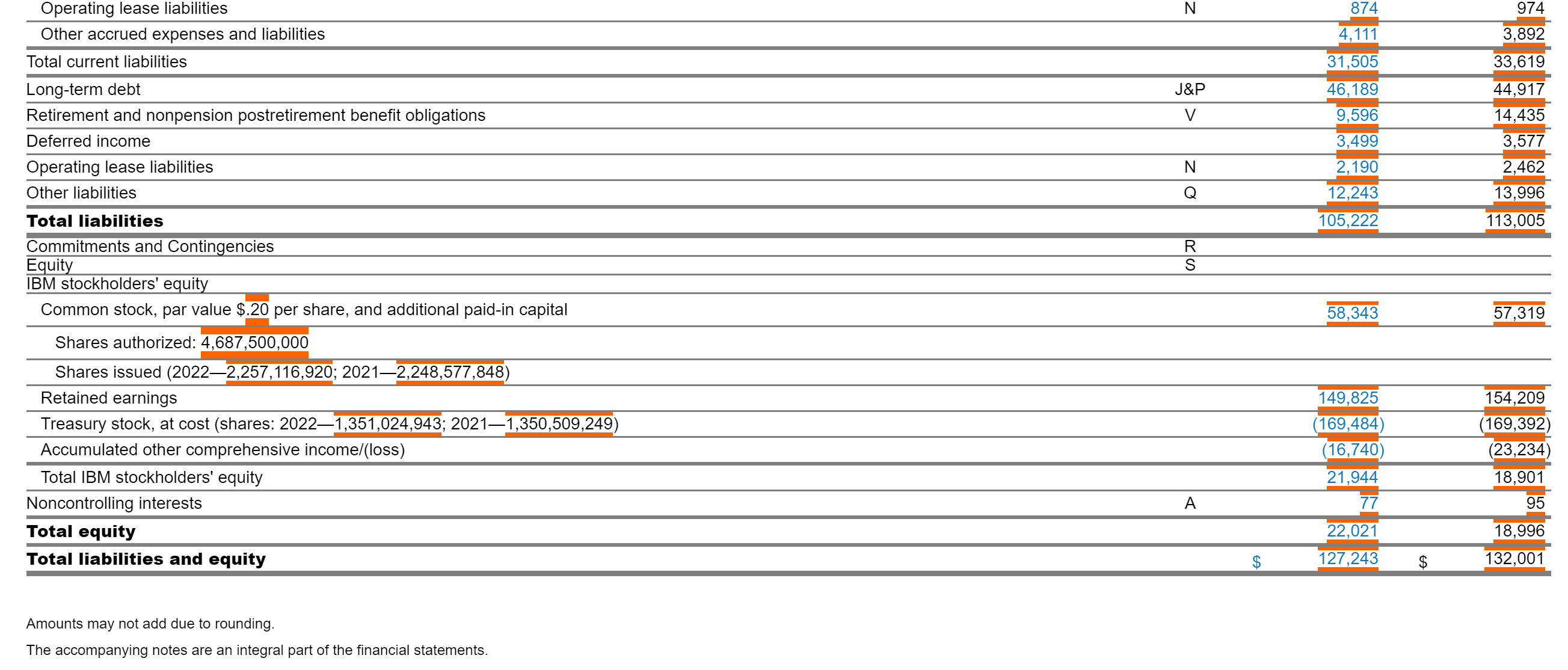

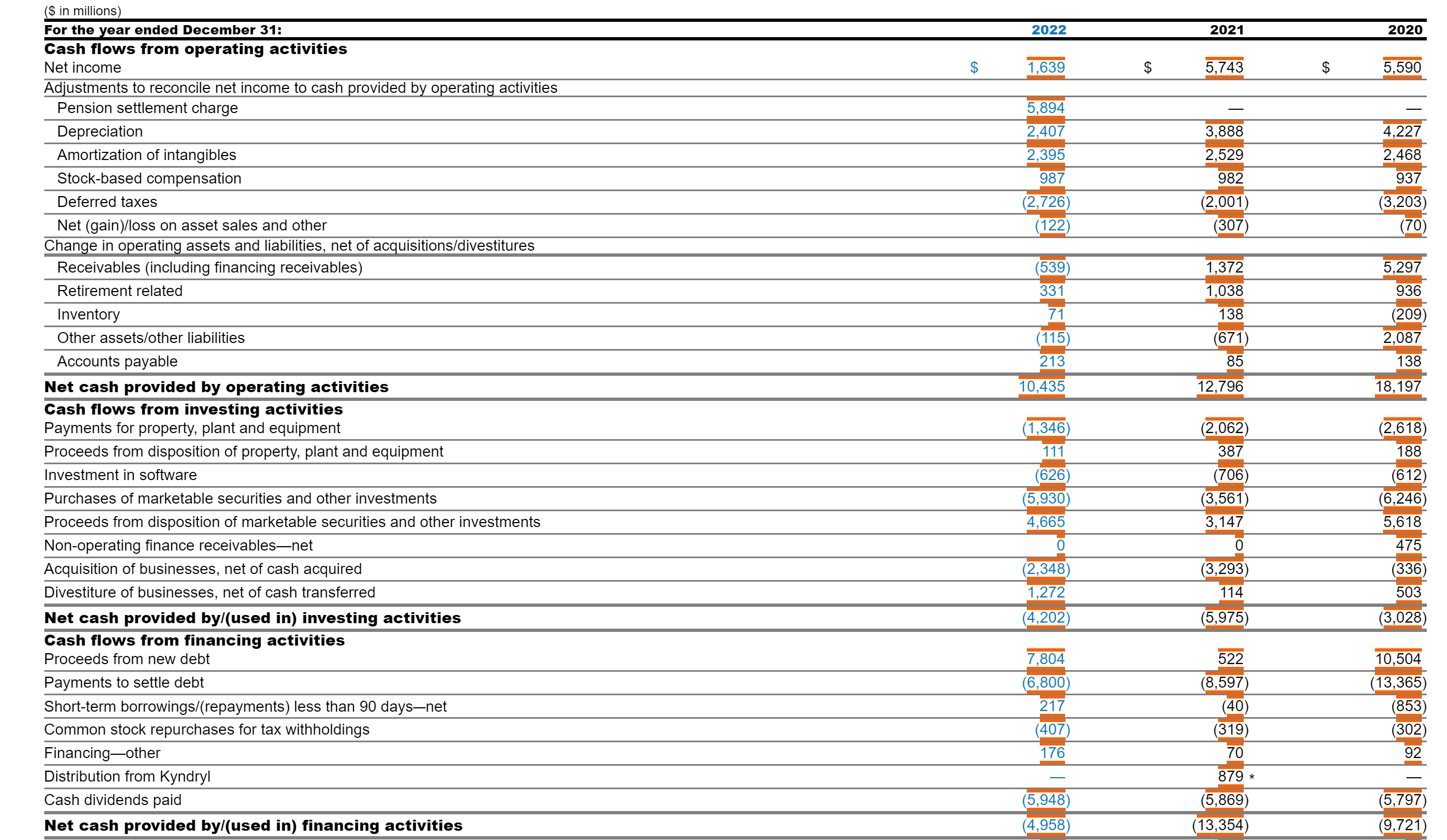

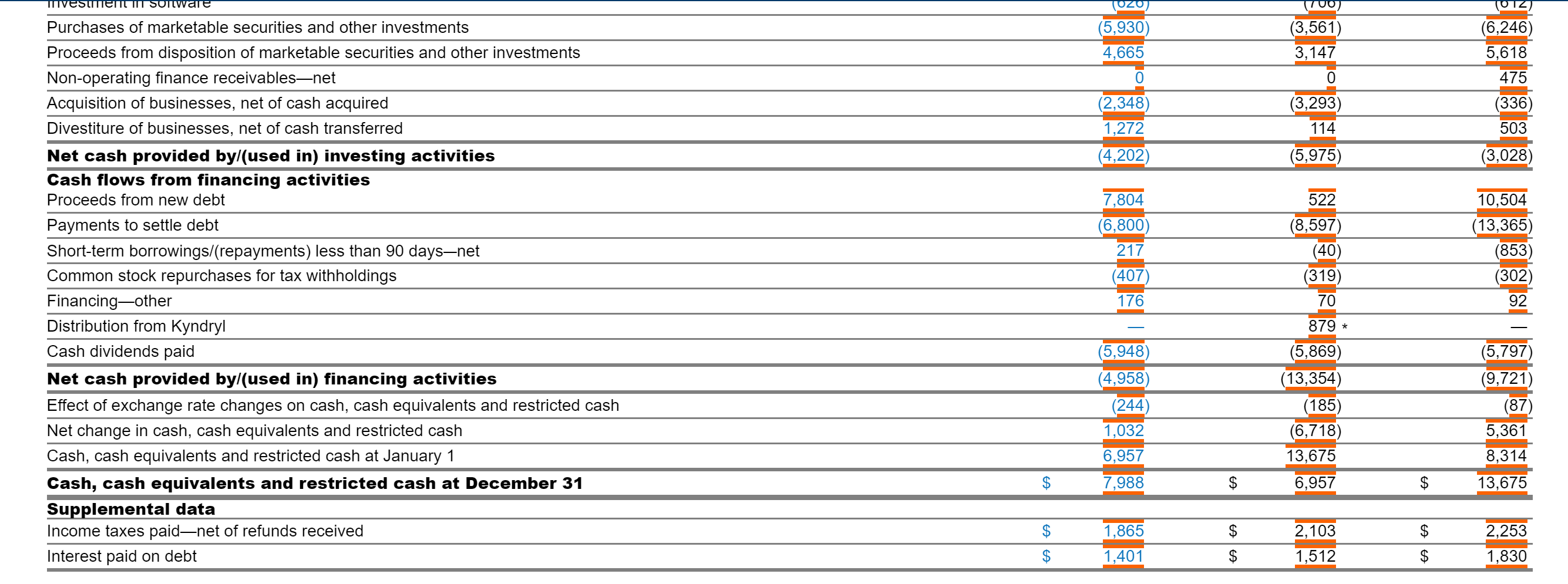

These are screenshots from IBM's 10K report published 2/28/23. What I am looking for is a specific explanation of how each balance sheet account affects

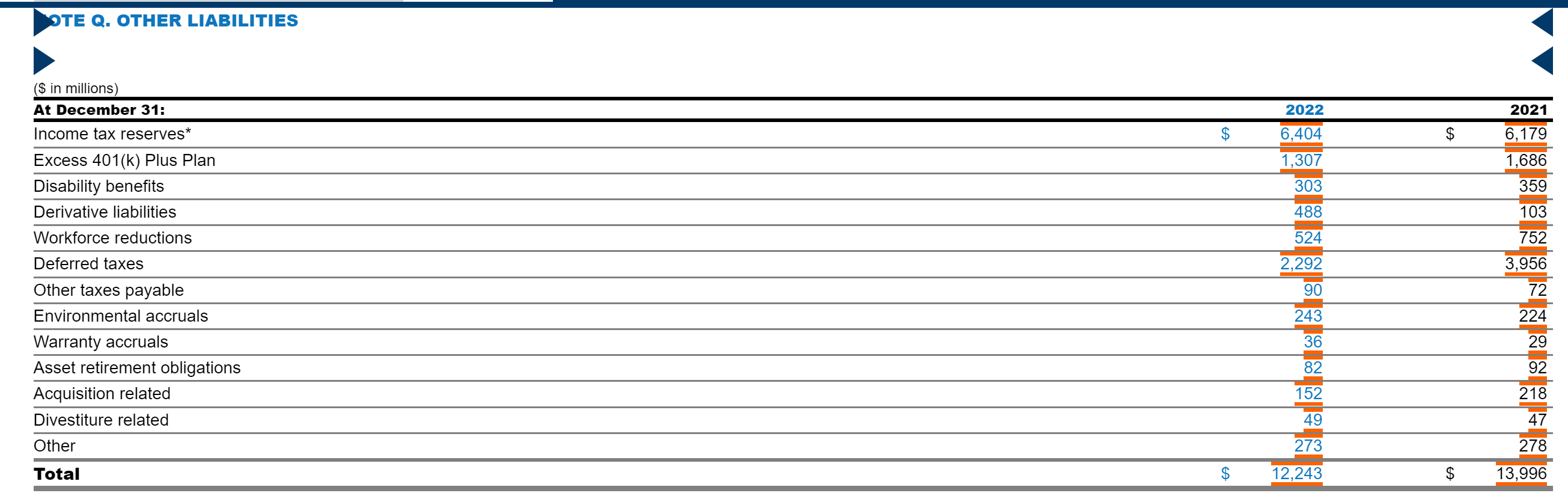

These are screenshots from IBM's 10K report published 2/28/23. What I am looking for is a specific explanation of how each balance sheet account affects the statement of cash flows. If you want to provide calculations for how to get to the increase or decrease on the balance sheet, you can, but I am really looking for an explanation of each individual line item and how it affects the statement of cash flows.

(\$ in millions except per share amounts) \begin{tabular}{|c|c|c|c|c|c|} \hline At December 31: & Notes & & 2022 & & 2021 \\ \hline \multicolumn{6}{|l|}{\begin{tabular}{l} Assets \\ Current assets \end{tabular}} \\ \hline Cash and cash equivalents & & $ & 7,886 & $ & 6,650 \\ \hline Restricted cash & & & 103 & & 307 \\ \hline Marketable securities & J & & 852 & & 600 \\ \hline Notes and accounts receivable_trade (net of allowances of $233 in 2022 and $218 in 2021) & & & 6,541 & & 6,754 \\ \hline Short-term financing receivables & L & & & & \\ \hline Held for investment (net of allowances of $145 in 2022 and $176 in 2021) & & & 6,851 & & 7,221 \\ \hline Held for sale & & & 939 & & 793 \\ \hline Other accounts receivable (net of allowances of $89 in 2022 and $24 in 2021) & & & 817 & & 1,002 \\ \hline Inventory & K & & 1,552 & & 1,649 \\ \hline Deferred costs & D & & 967 & & 1,097 \\ \hline Prepaid expenses and other current assets & & & 2,611 & & 3,466 \\ \hline Total current assets & & & 29,118 & & 29,539 \\ \hline Property, plant and equipment & M & & 18,695 & & 20,085 \\ \hline Less: Accumulated depreciation & M & & 13,361 & & 14,390 \\ \hline Property, plant and equipment-net & M & & 5,334 & & 5,694 \\ \hline Operating right-of-use assetsnet & N & & 2,878 & & 3,222 \\ \hline Long-term financing receivables (net of allowances of $28 in 2022 and $25 in 2021) & L & & 5,806 & & 5,425 \\ \hline Prepaid pension assets & V & & 8,236 & & 9,850 \\ \hline Deferred costs & D & & 866 & & 924 \\ \hline Deferred taxes & H & & 6,256 & & 7,370 \\ \hline Goodwill & O & & 55,949 & & 55,643 \\ \hline Intangible assets-net & O & & 11,184 & & 12,511 \\ \hline Investments and sundry assets & & & 1,617 & & 1,823 \\ \hline Total assets & & $ & 127,243 & $ & 132,001 \\ \hline \multicolumn{6}{|l|}{\begin{tabular}{l} Liabilities and equity \\ Current liabilities \end{tabular}} \\ \hline Taxes & H & $ & 2,196 & $ & 2,289 \\ \hline Short-term debt & J\&P & & 4,760 & & 6,787 \\ \hline Accounts payable & & & 4,051 & & 3,955 \\ \hline Compensation and benefits & & & 3,481 & & 3,204 \\ \hline Deferred income & & & 12,032 & & 12,518 \\ \hline Operating lease liabilities & N & & 874 & & 974 \\ \hline Other accrued expenses and liabilities & & & 4,111 & & 3,892 \\ \hline \end{tabular} Amounts may not add due to rounding. The accompanying notes are an integral part of the financial statements. (\$ in millions) \begin{tabular}{|c|c|c|c|} \hline For the year ended December 31: & 2022 & 2021 & 2020 \\ \hline \multicolumn{4}{|l|}{ Cash flows from operating activities } \\ \hline Net income & 1,639 & 5,743 & 5,590 \\ \hline \multicolumn{4}{|l|}{ Adjustments to reconcile net income to cash provided by operating activities } \\ \hline Pension settlement charge & 5,894 & - & - \\ \hline Depreciation & 2,407 & 3,888 & 4,227 \\ \hline Amortization of intangibles & 2,395 & 2,529 & 2,468 \\ \hline Stock-based compensation & 987 & 982 & 937 \\ \hline Deferred taxes & (2,726) & (2,001) & (3,203) \\ \hline Net (gain)/loss on asset sales and other & (122) & (307) & (70) \\ \hline \multicolumn{4}{|l|}{ Change in operating assets and liabilities, net of acquisitions/divestitures } \\ \hline Receivables (including financing receivables) & (539) & 1,372 & 5,297 \\ \hline Retirement related & 331 & 1,038 & 936 \\ \hline Inventory & 71 & 138 & (209) \\ \hline Other assets/other liabilities & (115) & (671) & 2,087 \\ \hline Accounts payable & 213 & 85 & 138 \\ \hline Net cash provided by operating activities & 10,435 & 12,796 & 18,197 \\ \hline \begin{tabular}{l} Cash flows from investing activities \\ Payments for property, plant and equipment \end{tabular} & (1,346) & (2,062) & (2,618) \\ \hline Proceeds from disposition of property, plant and equipment & 111 & 387 & 188 \\ \hline Investment in software & (626) & (706) & (612) \\ \hline Purchases of marketable securities and other investments & (5,930) & (3,561) & (6,246) \\ \hline Proceeds from disposition of marketable securities and other investments & 4,665 & 3,147 & 5,618 \\ \hline Non-operating finance receivables_-net & 0 & 0 & 475 \\ \hline Acquisition of businesses, net of cash acquired & (2,348) & (3,293) & (336) \\ \hline Divestiture of businesses, net of cash transferred & 1,272 & 114 & 503 \\ \hline Net cash provided by/(used in) investing activities & (4,202) & (5,975) & (3,028) \\ \hline \multicolumn{4}{|l|}{ Cash flows from financing activities } \\ \hline Proceeds from new debt & 7,804 & 522 & 10,504 \\ \hline Payments to settle debt & (6,800) & (8,597) & (13,365) \\ \hline Short-term borrowings/(repayments) less than 90 days-net & 217 & (40) & (853) \\ \hline Common stock repurchases for tax withholdings & (407) & (319) & (302) \\ \hline Financing-other & 176 & 70 & 92 \\ \hline Distribution from Kyndryl & - & 879 * & - \\ \hline Cash dividends paid & (5,948) & (5,869) & (5,797) \\ \hline Net cash provided by/(used in) financing activities & (4,958) & (13,354) & (9,721) \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} Purchases of marketable securities and other investments \\ Proceeds from disposition of marketable securities and other investments \end{tabular}} & & \multirow{2}{*}{(5,930)} & \multicolumn{2}{|r|}{(3,561)} & & (6,246) \\ \hline & & & & 3,147 & & 5,618 \\ \hline Non-operating finance receivables-net & & 0 & & 0 & & 475 \\ \hline Acquisition of businesses, net of cash acquired & & (2,348) & & (3,293) & & (336) \\ \hline Divestiture of businesses, net of cash transferred & & 1,272 & & 114 & & 503 \\ \hline Net cash provided by/(used in) investing activities & & (4,202) & & (5,975) & & (3,028) \\ \hline \multicolumn{2}{|l|}{\begin{tabular}{l} Cash flows from financing activities \\ Proceeds from new debt \end{tabular}} & 7,804 & & 522 & & 10,504 \\ \hline Payments to settle debt & & (6,800) & & (8,597) & & (13,365) \\ \hline Short-term borrowings/(repayments) less than 90 days-net & & 217 & & (40) & & (853) \\ \hline Common stock repurchases for tax withholdings & & (407) & & (319) & & (302) \\ \hline Financing-other & & 176 & & 70 & & 92 \\ \hline Distribution from Kyndryl & & - & & 879 * & & - \\ \hline Cash dividends paid & & (5,948) & & (5,869) & & (5,797) \\ \hline Net cash provided by/(used in) financing activities & & (4,958) & & (13,354) & & (9,721) \\ \hline Effect of exchange rate changes on cash, cash equivalents and restricted cash & & (244) & & (185) & & (87) \\ \hline Net change in cash, cash equivalents and restricted cash & & 1,032 & & (6,718) & & 5,361 \\ \hline Cash, cash equivalents and restricted cash at January 1 & & 6,957 & & 13,675 & & 8,314 \\ \hline Cash, cash equivalents and restricted cash at December 31 & $ & 7,988 & $ & 6,957 & $ & 13,675 \\ \hline \multicolumn{7}{|l|}{ Supplemental data } \\ \hline Income taxes paid-net of refunds received & $ & 1,865 & $ & 2,103 & $ & 2,253 \\ \hline Interest paid on debt & $ & 1,401 & $ & 1,512 & $ & 1,830 \\ \hline \end{tabular} DTE Q. OTHER LIABILITIES (\$ in millions) \begin{tabular}{|c|c|c|c|c|} \hline At December 31: & & 2022 & & 2021 \\ \hline Income tax reserves* & $ & 6,404 & $ & 6,179 \\ \hline Excess 401(k) Plus Plan & & 1,307 & & 1,686 \\ \hline Disability benefits & & 303 & & 359 \\ \hline Derivative liabilities & & 488 & & 103 \\ \hline Deferred taxes & & 2,292 & & 3,956 \\ \hline Other taxes payable & & 90 & & 72 \\ \hline Environmental accruals & & 243 & & 224 \\ \hline Warranty accruals & & 36 & & 29 \\ \hline Acquisition related & & 152 & & 218 \\ \hline Divestiture related & & 49 & & 47 \\ \hline Other & & 273 & & 278 \\ \hline Total & $ & 12,243 & $ & 13,996 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started