Answered step by step

Verified Expert Solution

Question

1 Approved Answer

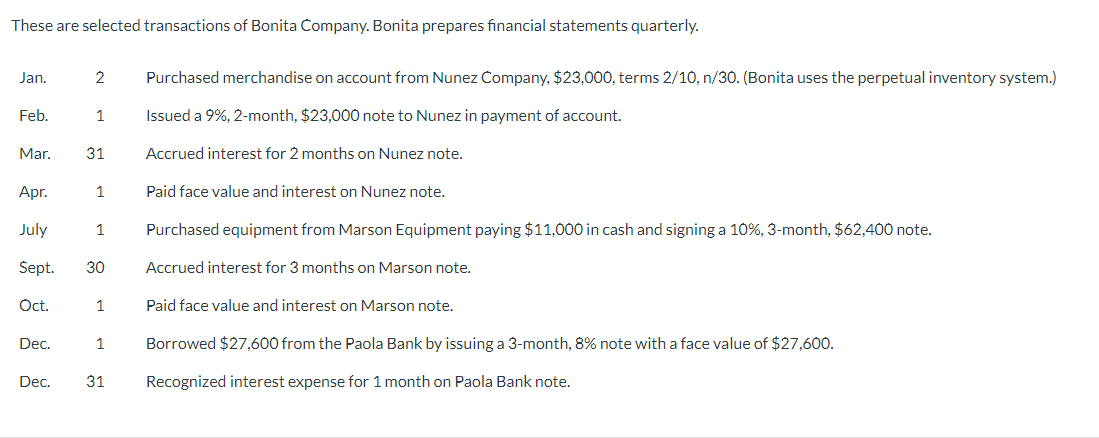

These are selected transactions of Bonita Company. Bonita prepares financial statements quarterly. Jan. 2 Purchased merchandise on account from Nunez Company, $23,000, terms 2/10,

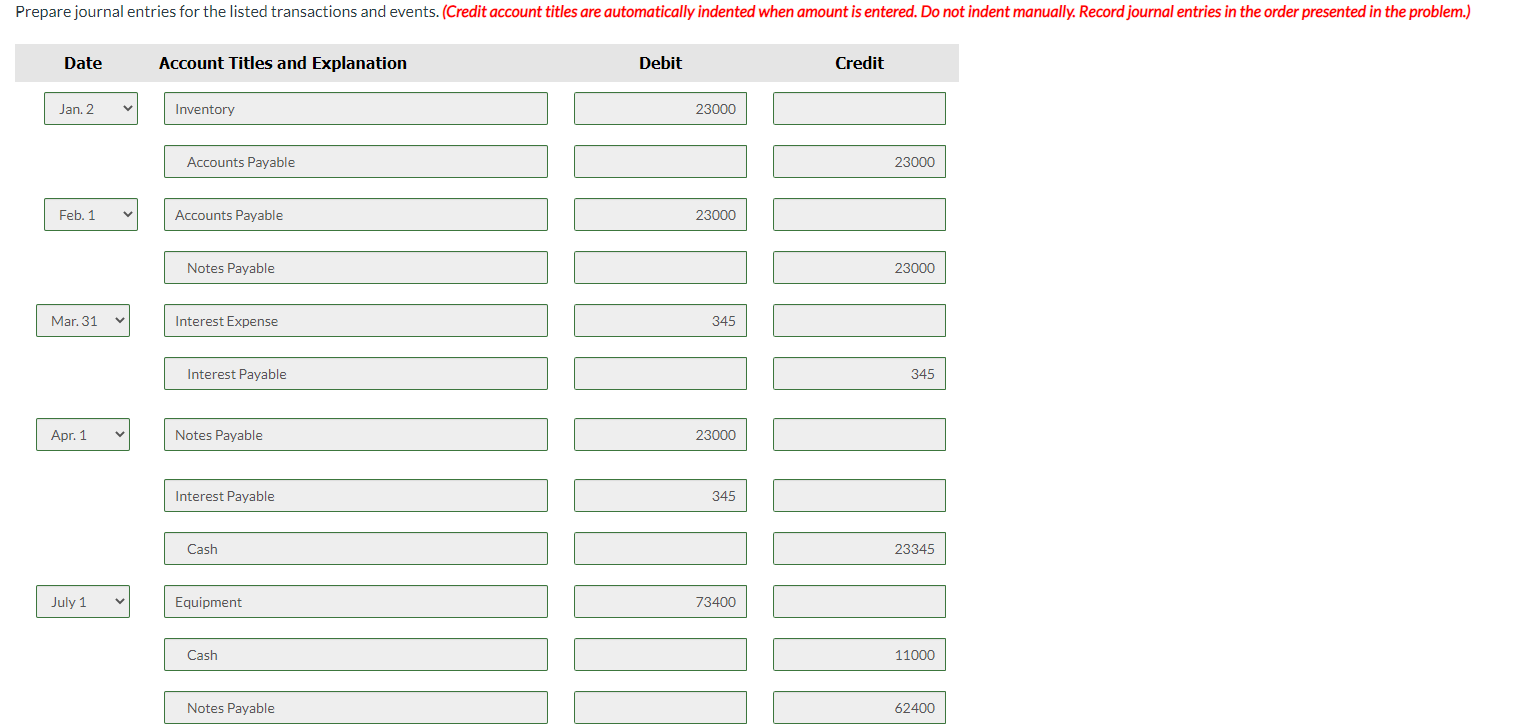

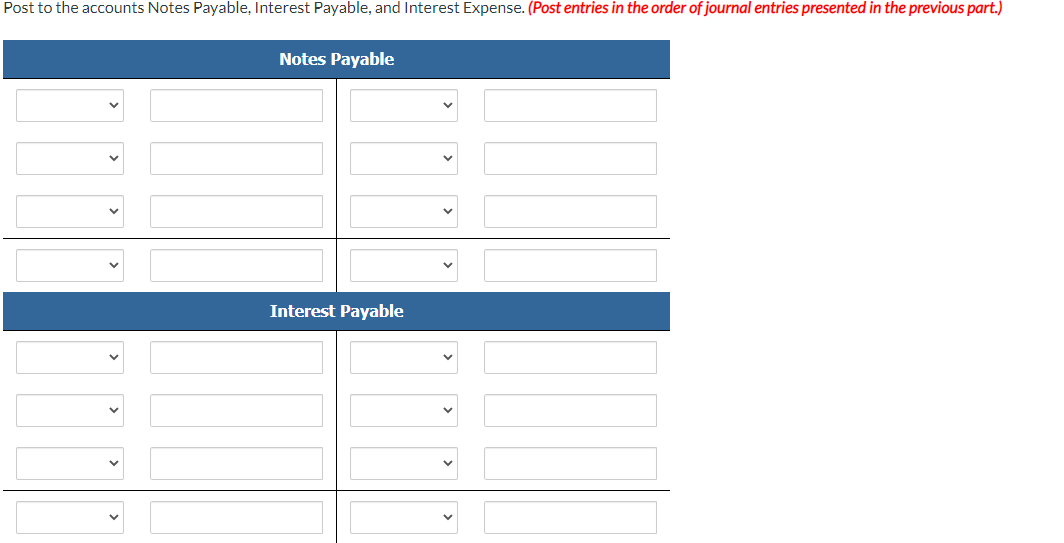

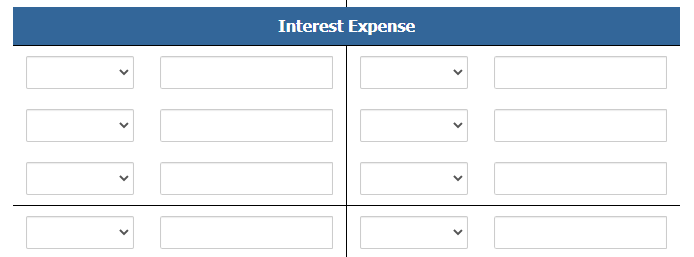

These are selected transactions of Bonita Company. Bonita prepares financial statements quarterly. Jan. 2 Purchased merchandise on account from Nunez Company, $23,000, terms 2/10, n/30. (Bonita uses the perpetual inventory system.) Feb. 1 Issued a 9%, 2-month, $23,000 note to Nunez in payment of account. Mar. 31 Accrued interest for 2 months on Nunez note. Apr. 1 Paid face value and interest on Nunez note. July 1 Purchased equipment from Marson Equipment paying $11,000 in cash and signing a 10%, 3-month, $62,400 note. Sept. 30 Accrued interest for 3 months on Marson note. Oct. 1 Paid face value and interest on Marson note. Dec. 1 Borrowed $27,600 from the Paola Bank by issuing a 3-month, 8% note with a face value of $27,600. Dec. 31 Recognized interest expense for 1 month on Paola Bank note. Prepare journal entries for the listed transactions and events. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Jan. 2 Inventory Accounts Payable Feb. 1 Accounts Payable Notes Payable Mar. 31 Interest Expense Interest Payable Apr. 1 Notes Payable July 1 Interest Payable Cash Equipment Cash Notes Payable Debit 23000 23000 345 23000 345 73400 Credit 23000 23000 345 23345 11000 62400 Sept. 30 Interest Expense Oct. 1 > Interest Payable Notes Payable Interest Payable Cash Dec. 1 Cash Dec. 31 > Notes Payable Interest Expense Interest Payable 1560 62400 1560 27600 184 1560 63960 27600 184 Post to the accounts Notes Payable, Interest Payable, and Interest Expense. (Post entries in the order of journal entries presented in the previous part.) Notes Payable Interest Payable Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started