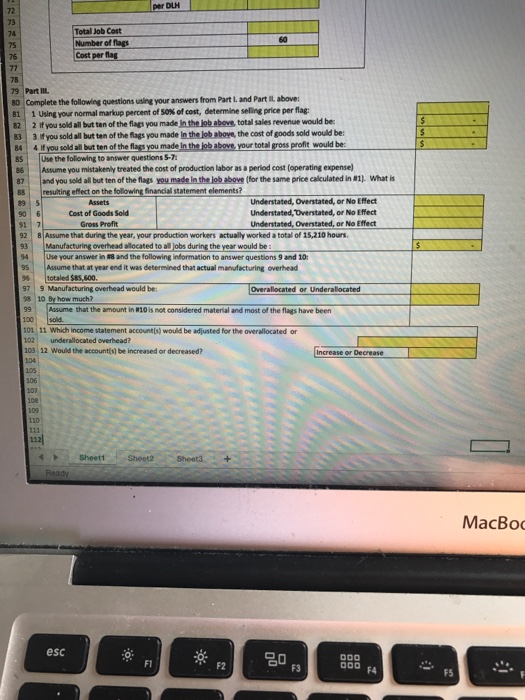

These are the 3 parts of the question

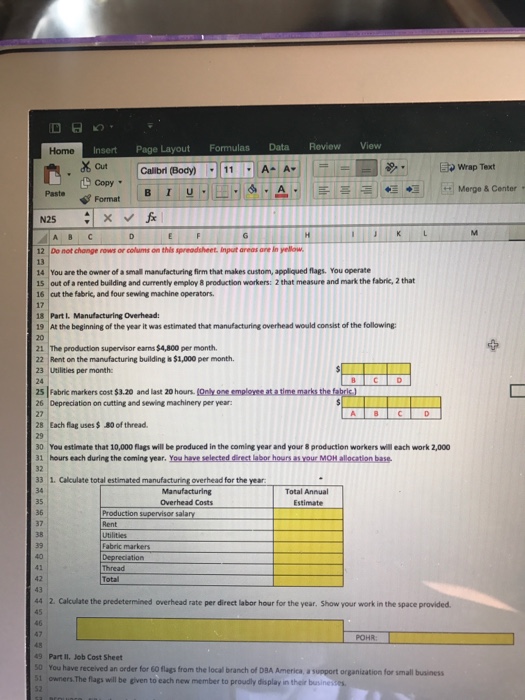

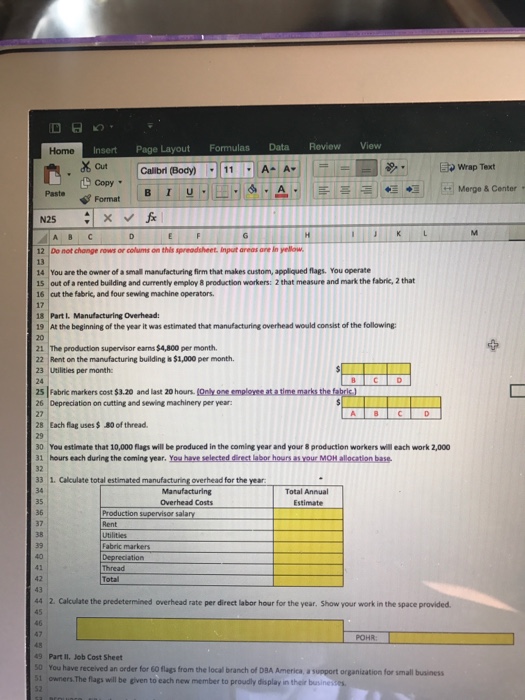

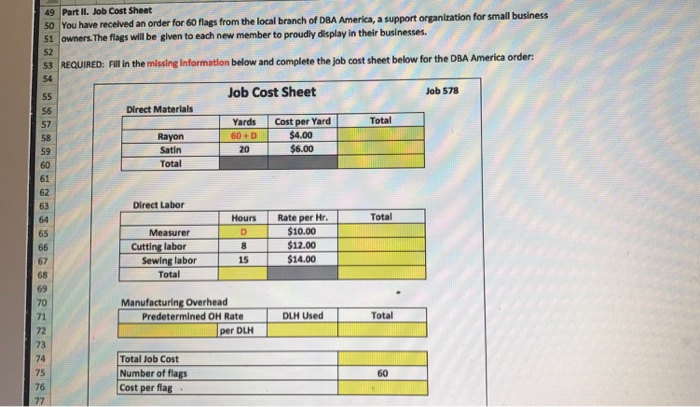

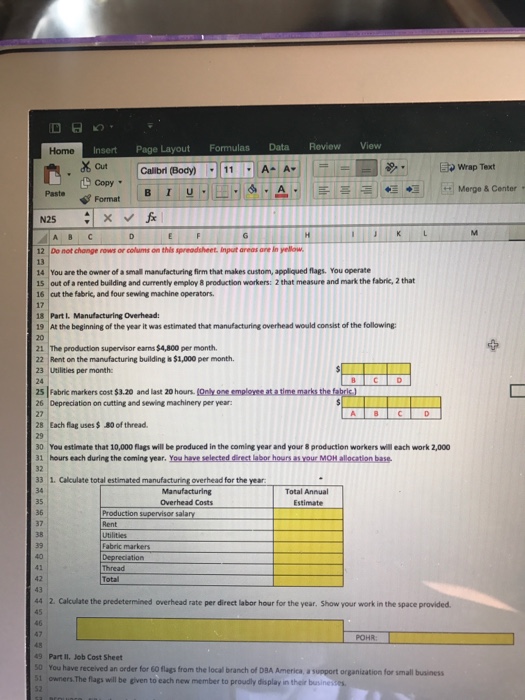

Insert Page Layout Fomulas Data ReviewView X cut | Calibri(Body),111' AAr Home Ir , wrap Text copy .. t.. Merge & Center Paste BIUA Format 12 Do not change rows or colums on this spreadsheet, Input areas ore in yellow 13 14 You are the owner of a small manufacturing firm that makes custom, appliqued flags. You operate 15 out of a rented building and currently employ 8 production workers: 2 that measure and mark the fabric, 2 that 16 cut the fabric, and four sewing machine operators. 17 18 Part I. Manufacturing Overhead: 19 At the beginning of the year it was estimated that manufacturing overhead would consist of the following 21 The production supervisor earns $4,800 per month. 22 Rent on the manufacturing building s $1,000 per month. 23 Utilities per month: 24 25 I Fabric markers cost $3.20 and last 20 hours.nteontemplenutatimemarksrhettrl 26 Depreciation on cutting and sewing machinery per year: 28 Each flag uses$30 of thread. 30 You estimate that 10,000 flags will be produced in the coming year and your 8 production workers will each work 2,000 31 hours each during the coming year. You have selected direct labor hours 33 1. Calculate total estimated manufaturing overhead for the year 34 Manufacturing Overhead Costs Total Annual 36 37 Production supervisor salary Rent Fabric markers 42 Total 44 2. Calculate the predetermined overhead rate per direct labor hour for the year. Show your work in the space provided 45 POHR 49 Part ll. Job Cost Sheet O You have received an order for 60 flags from the local branch of DaA America, a suport organization for small business 1 owners The flags will be given to each new member to proudly display in their busine Insert Page Layout Fomulas Data ReviewView X cut | Calibri(Body),111' AAr Home Ir , wrap Text copy .. t.. Merge & Center Paste BIUA Format 12 Do not change rows or colums on this spreadsheet, Input areas ore in yellow 13 14 You are the owner of a small manufacturing firm that makes custom, appliqued flags. You operate 15 out of a rented building and currently employ 8 production workers: 2 that measure and mark the fabric, 2 that 16 cut the fabric, and four sewing machine operators. 17 18 Part I. Manufacturing Overhead: 19 At the beginning of the year it was estimated that manufacturing overhead would consist of the following 21 The production supervisor earns $4,800 per month. 22 Rent on the manufacturing building s $1,000 per month. 23 Utilities per month: 24 25 I Fabric markers cost $3.20 and last 20 hours.nteontemplenutatimemarksrhettrl 26 Depreciation on cutting and sewing machinery per year: 28 Each flag uses$30 of thread. 30 You estimate that 10,000 flags will be produced in the coming year and your 8 production workers will each work 2,000 31 hours each during the coming year. You have selected direct labor hours 33 1. Calculate total estimated manufaturing overhead for the year 34 Manufacturing Overhead Costs Total Annual 36 37 Production supervisor salary Rent Fabric markers 42 Total 44 2. Calculate the predetermined overhead rate per direct labor hour for the year. Show your work in the space provided 45 POHR 49 Part ll. Job Cost Sheet O You have received an order for 60 flags from the local branch of DaA America, a suport organization for small business 1 owners The flags will be given to each new member to proudly display in their busine