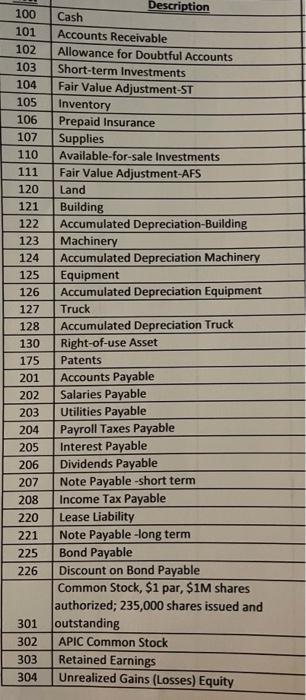

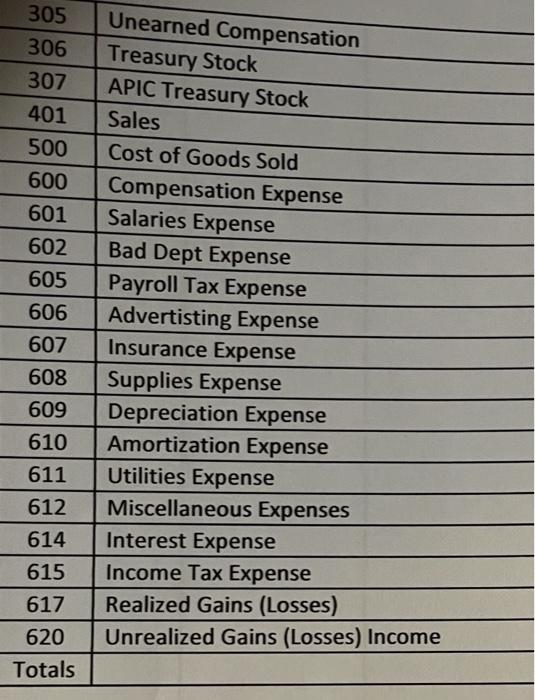

these are the accounts that need to be used

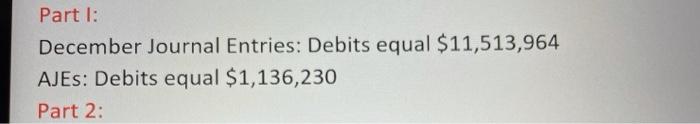

note:

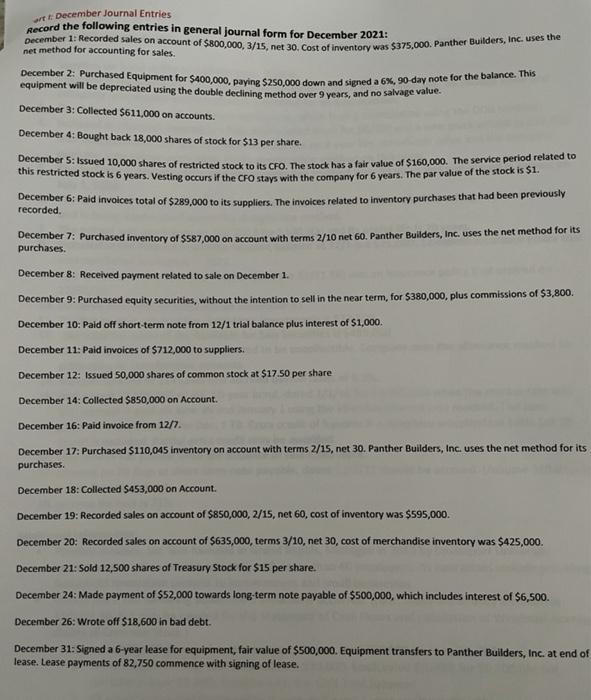

December 1: Recorded sales on account of $800,000, 3/15, net 30. Cost of inventory was $375,000. Panther Builders, Inc. uses the December 2: Purchased Equipment for $400,000, paying $250,000 down and signed a 6%, 90-day note for the balance. This December 5: Issued 10,000 shares of restricted stock to its CFO. The stock has a fair value of $160,000. The service period related to artt December Journal Entries Record the following entries in general journal form for December 2021: method for accounting for sales. equipment will be depreciated using the double declining method over 9 years, and no salvage value. December 3: Collected $611,000 on accounts. December 4: Bought back 18,000 shares of stock for $13 per share. this restricted stock is 6 years. Vesting occurs if the CFO stays with the company for 6 years. The par value of the stock is $1. December 6: Paid invoices total of $289,000 to its suppliers. The invoices related to inventory purchases that had been previously recorded. December 7: Purchased inventory of $587,000 on account with terms 2/10 net 60. Panther Builders, Inc. uses the net method for its purchases. December 8: Received payment related to sale on December 1. December 9: Purchased equity Securities, without the intention to sell in the near term, for $380,000, plus commissions of $3,800. December 10: Paid off short-term note from 12/1 trial balance plus interest of $1,000. December 11: Paid invoices of $712,000 to suppliers. December 12: Issued 50,000 shares of common stock at $17.50 per share December 14: Collected $850,000 on Account December 16: Paid invoice from 12/7. December 17: Purchased $110,045 inventory on account with terms 2/15, net 30. Panther Builders, Inc. uses the net method for its purchases. December 18: Collected $453,000 on Account December 19: Recorded sales on account of $850,000,2/15, net 60, cost of inventory was $595,000. December 20: Recorded sales on account of $635,000, terms 3/10, net 30, cost of merchandise inventory was $425,000. December 21: Sold 12,500 shares of Treasury Stock for $15 per share. December 24: Made payment of $52,000 towards long-term note payable of $500,000, which includes interest of $6,500. December 26: Wrote off $18,600 in bad debt. December 31: Signed a 6-year lease for equipment, fair value of $500,000. Equipment transfers to Panther Builders, Inc. at end of lease. Lease payments of 82,750 commence with signing of lease. 100 101 102 103 104 105 106 107 110 111 120 121 122 123 124 125 126 127 128 130 175 201 202 203 204 205 206 207 208 220 221 225 226 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available-for-sale Investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable -short term Income Tax Payable Lease Liability Note Payable-long term Bond Payable Discount on Bond Payable Common Stock, $1 par, $1M shares authorized; 235,000 shares issued and outstanding APIC Common Stock Retained Earnings Unrealized Gains (Losses) Equity 301 302 303 304 306 305 Unearned Compensation Treasury Stock 307 APIC Treasury Stock 401 Sales 500 Cost of Goods Sold 600 Compensation Expense 601 Salaries Expense 602 Bad Dept Expense 605 Payroll Tax Expense 606 Advertisting Expense 607 Insurance Expense 608 Supplies Expense 609 Depreciation Expense 610 Amortization Expense 611 Utilities Expense 612 Miscellaneous Expenses 614 Interest Expense 615 Income Tax Expense 617 Realized Gains (Losses) 620 Unrealized Gains (Losses) Income Totals Part I: December Journal Entries: Debits equal $11,513,964 AJES: Debits equal $1,136,230 Part 2