Answered step by step

Verified Expert Solution

Question

1 Approved Answer

These are the answers, please show how you got the solutions in steps and draw the diagrams as well. c)NPV = $0.65 million d)For NPV

These are the answers, please show how you got the solutions in steps and draw the diagrams as well.

c)NPV = $0.65 million

d)For NPV = $2 million, profit must be $4.27 million

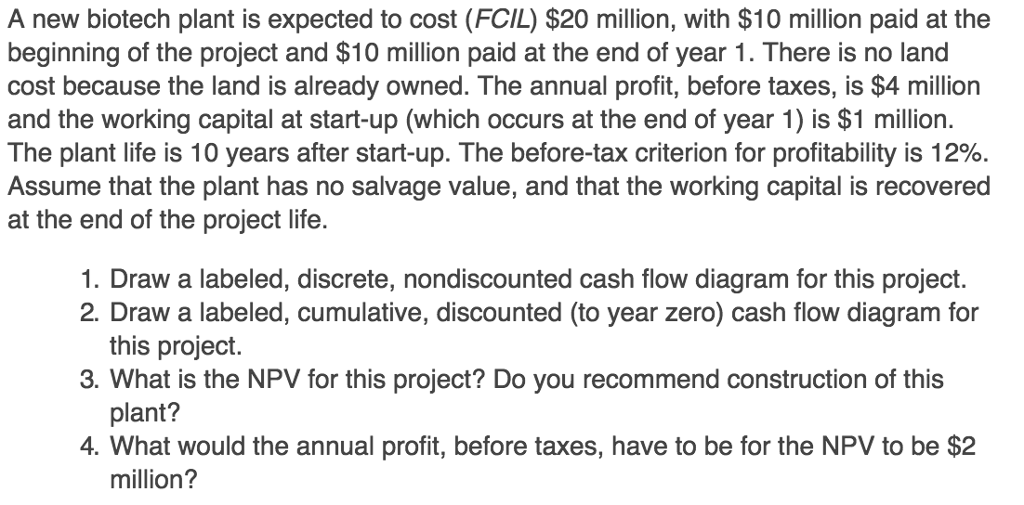

A new biotech plant is expected to cost (FCIL) $20 million, with $10 million paid at the beginning of the project and $10 million paid at the end of year 1. There is no land cost because the land is already owned. The annual profit, before taxes, is $4 million and the working capital at start-up (which occurs at the end of year 1) is $1 million. The plant life is 10 years after start-up. The before-tax criterion for profitability is 12%. Assume that the plant has no salvage value, and that the working capital is recovered at the end of the project life. 1. Draw a labeled, discrete, nondiscounted cash flow diagram for this project. ra for this project. plant? million? 3. What is the NPV for this project? Do you recommend construction of this 4. What would the annual profit, before taxes, have to be for the NPV to be $2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started