Answered step by step

Verified Expert Solution

Question

1 Approved Answer

These are the options for the COGS Stmt: These are the options for the Income Stmt. please select the options to fill in the two

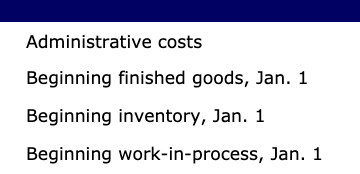

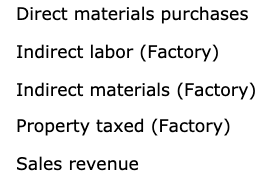

These are the options for the COGS Stmt:

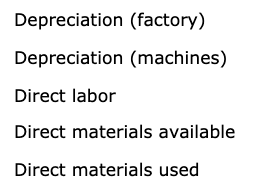

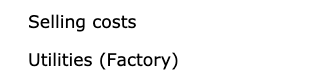

These are the options for the Income Stmt.

please select the options to fill in the two different sheets and thank you!

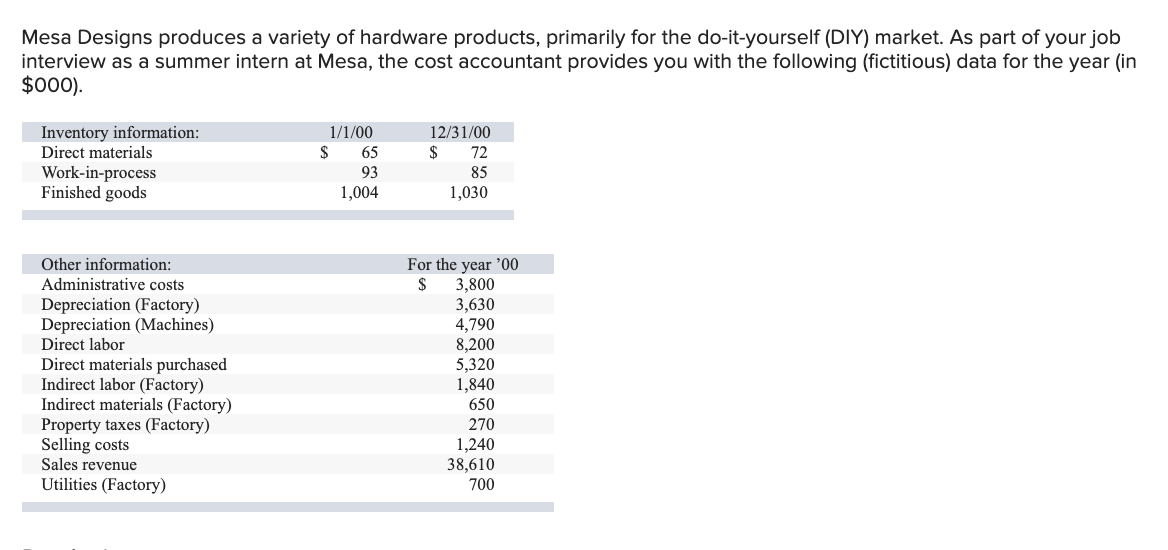

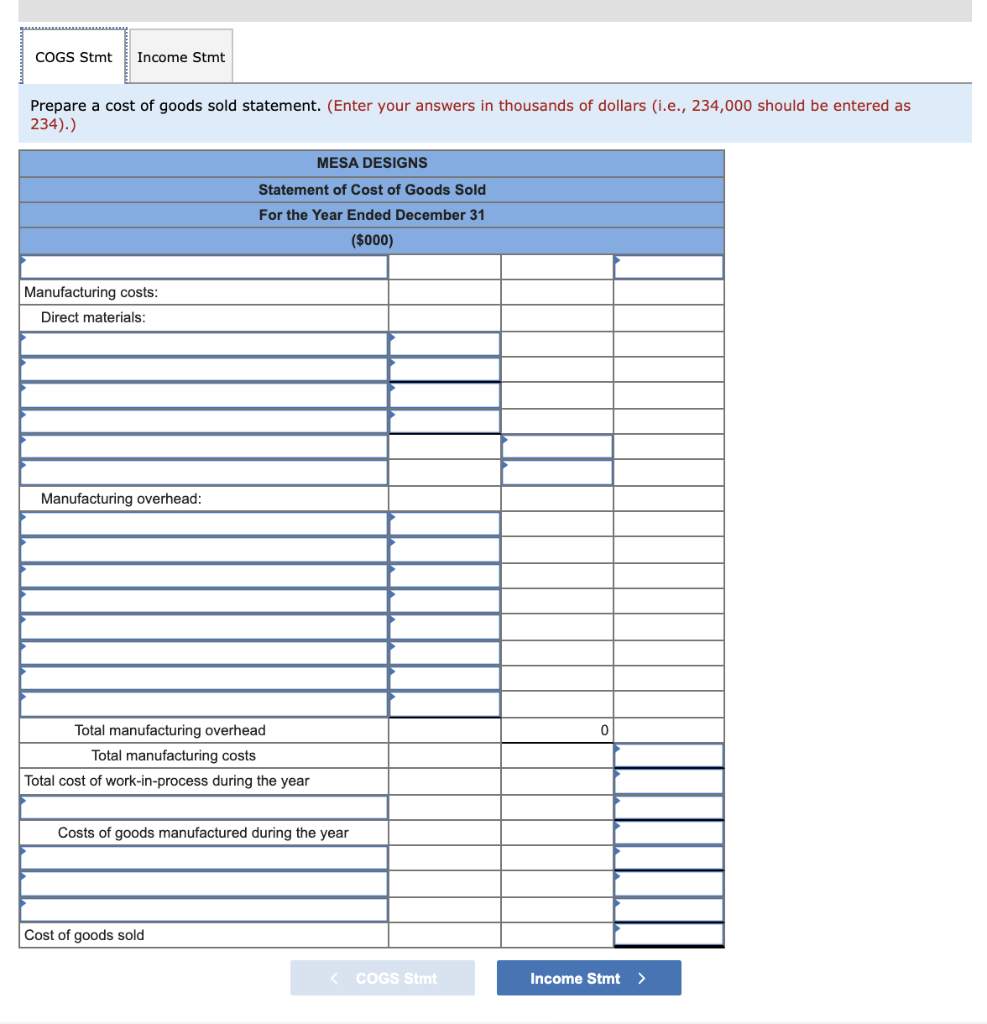

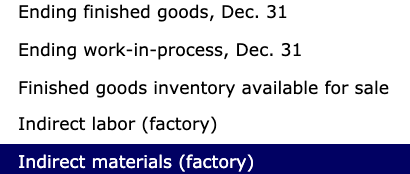

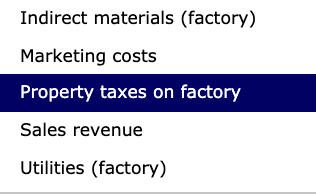

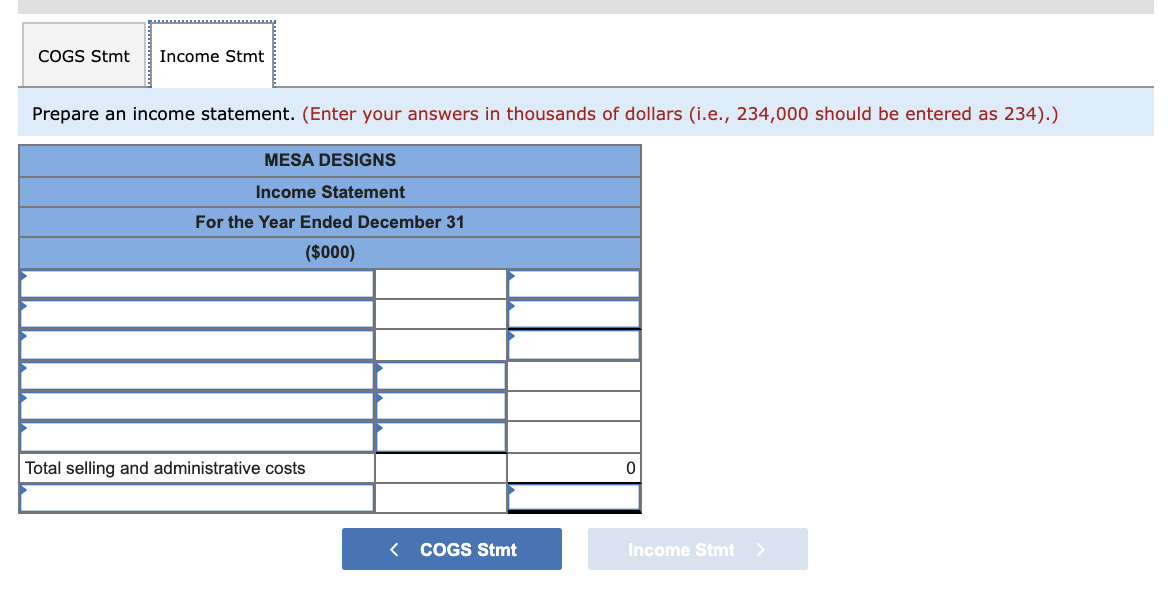

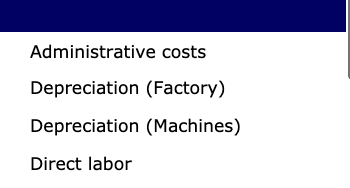

Mesa Designs produces a variety of hardware products, primarily for the do-it-yourself (DIY) market. As part of your job interview as a summer intern at Mesa, the cost accountant provides you with the following (fictitious) data for the year (in $000). Inventory information: Direct materials Work-in-process Finished goods 1/1/00 $ 65 93 1,004 12/31/00 $ 72 85 1,030 Other information: Administrative costs Depreciation (Factory) Depreciation (Machines) Direct labor Direct materials purchased Indirect labor (Factory) Indirect materials (Factory) Property taxes (Factory) Selling costs Sales revenue Utilities (Factory) For the year '00 $ 3,800 3,630 4,790 8,200 5,320 1,840 650 270 1,240 38,610 700 COGS Stmt Income Stmt Prepare a cost of goods sold statement. (Enter your answers in thousands of dollars (i.e., 234,000 should be entered as 234).) MESA DESIGNS Statement of Cost of Goods Sold For the Year Ended December 31 ($000) Manufacturing costs: Direct materials: Manufacturing overhead: 0 Total manufacturing overhead Total manufacturing costs Total cost of work-in-process during the year Costs of goods manufactured during the year Cost of goods sold COGS Stmt Income Stmt> Administrative costs Beginning finished goods, Jan. 1 Beginning inventory, Jan. 1 Beginning work-in-process, Jan. 1 Depreciation (factory) Depreciation (machines) Direct labor Direct materials available Direct materials used Ending finished goods, Dec. 31 Ending work-in-process, Dec. 31 Finished goods inventory available for sale Indirect labor (factory) Indirect materials (factory) Indirect materials (factory) Marketing costs Property taxes on factory Sales revenue Utilities (factory) COGS Stmt Income Stmt Prepare an income statement. (Enter your answers in thousands of dollars (i.e., 234,000 should be entered as 234).) MESA DESIGNS Income Statement For the Year Ended December 31 ($000) Total selling and administrative costs 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started