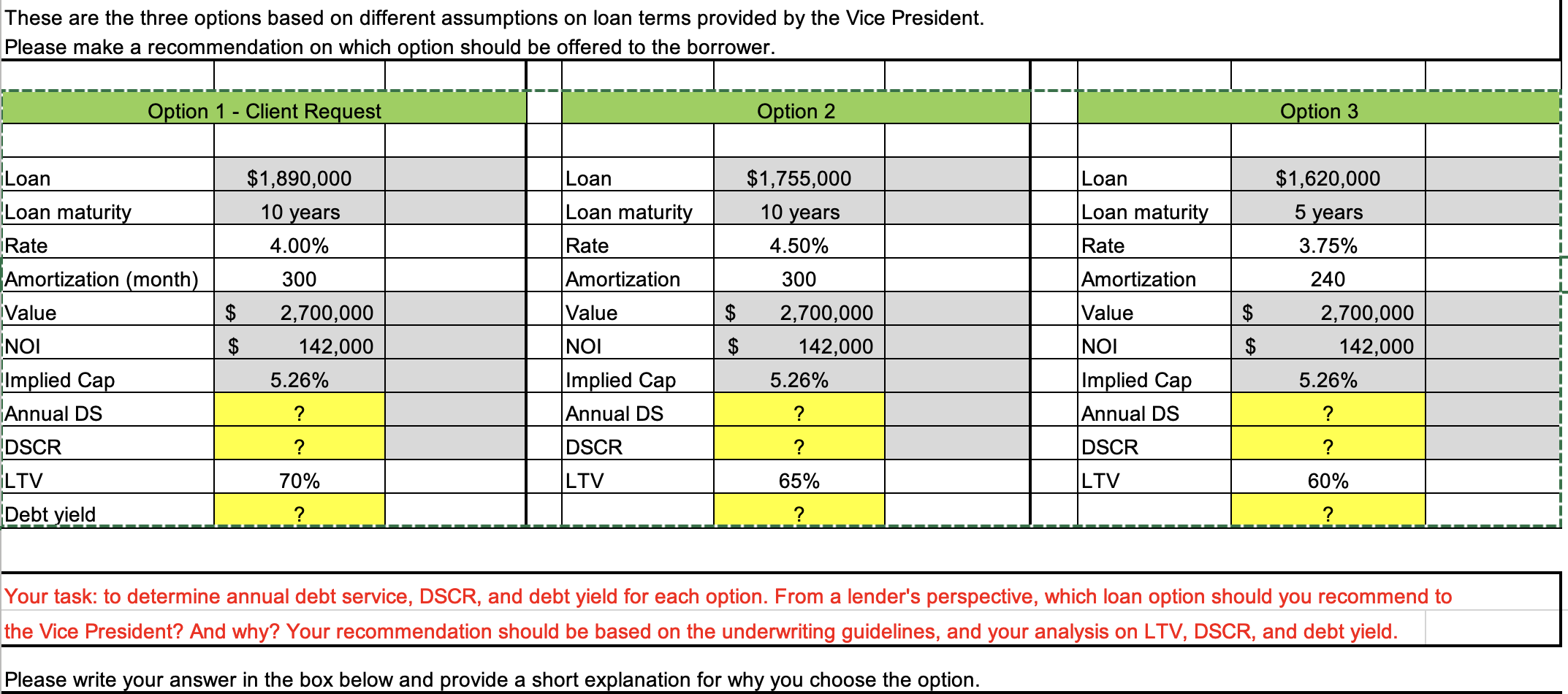

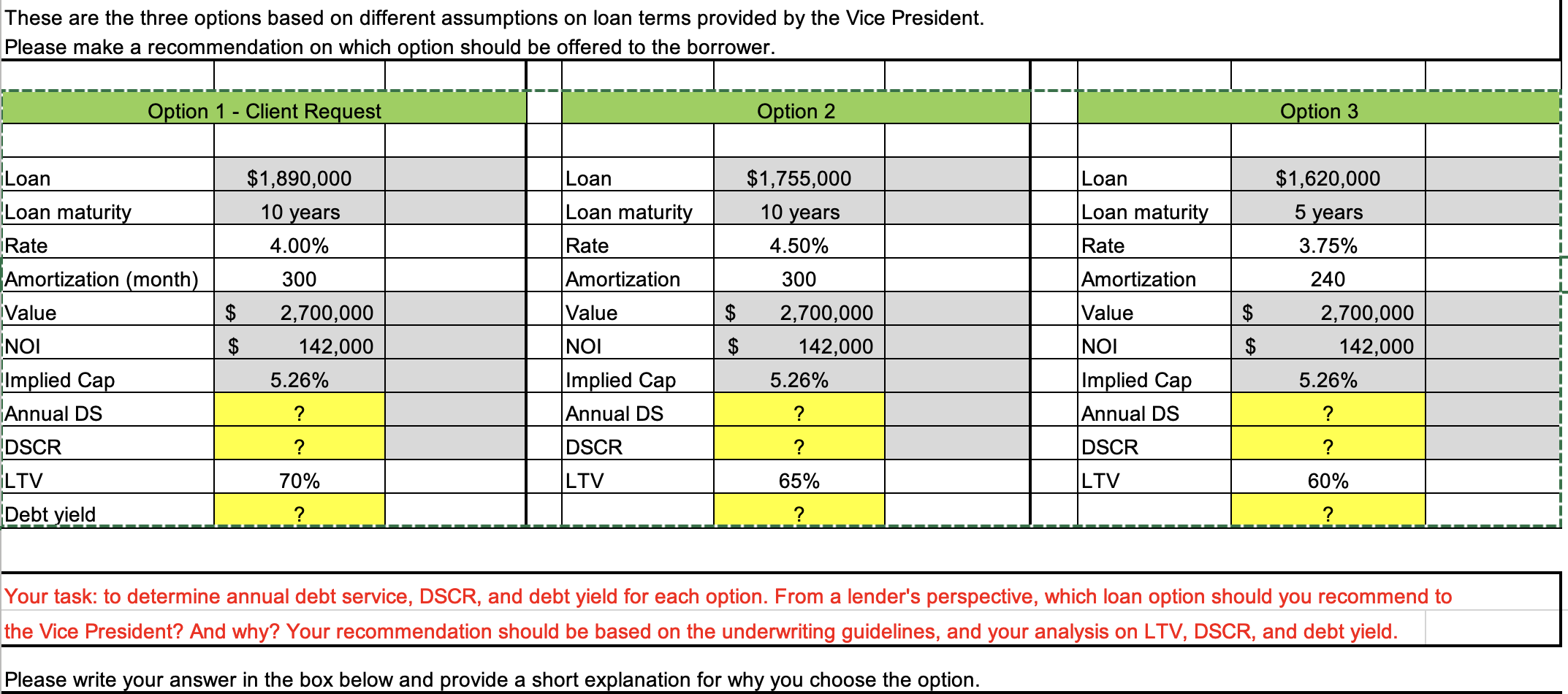

These are the three options based on different assumptions on loan terms provided by the Vice President. Please make a recommendation on which option should be offered to the borrower. Option 1 - Client Request Option 2 Option 3 $1,890,000 Loan $1,755,000 Loan $1,620,000 10 years Loan maturity 10 years Loan maturity Rate 4.00% Rate 4.50% 300 Amortization 300 Amortization 5 years 3.75% 240 2,700,000 142,000 5.26% $ Value Loan Loan maturity Rate Amortization (month). Value NOI Implied Cap Annual DS DSCR LTV Debt yield $ 2,700,000 142,000 5.26% Value NOI $ $ $ 2,700,000 142,000 5.26% NOI $ Implied Cap Annual DS Implied Cap Annual DS ? ? ? ? DSCR ? DSCR ? 70% LTV 65% LTV 60% ? ? ? Your task: to determine annual debt service, DSCR, and debt yield for each option. From a lender's perspective, which loan option should you recommend to the Vice President? And why? Your recommendation should be based on the underwriting guidelines, and your analysis on LTV, DSCR, and debt yield. Please write your answer in the box below and provide a short explanation for why you choose the option. These are the three options based on different assumptions on loan terms provided by the Vice President. Please make a recommendation on which option should be offered to the borrower. Option 1 - Client Request Option 2 Option 3 $1,890,000 Loan $1,755,000 Loan $1,620,000 10 years Loan maturity 10 years Loan maturity Rate 4.00% Rate 4.50% 300 Amortization 300 Amortization 5 years 3.75% 240 2,700,000 142,000 5.26% $ Value Loan Loan maturity Rate Amortization (month). Value NOI Implied Cap Annual DS DSCR LTV Debt yield $ 2,700,000 142,000 5.26% Value NOI $ $ $ 2,700,000 142,000 5.26% NOI $ Implied Cap Annual DS Implied Cap Annual DS ? ? ? ? DSCR ? DSCR ? 70% LTV 65% LTV 60% ? ? ? Your task: to determine annual debt service, DSCR, and debt yield for each option. From a lender's perspective, which loan option should you recommend to the Vice President? And why? Your recommendation should be based on the underwriting guidelines, and your analysis on LTV, DSCR, and debt yield. Please write your answer in the box below and provide a short explanation for why you choose the option