these are two different questions please help.

i added new photos

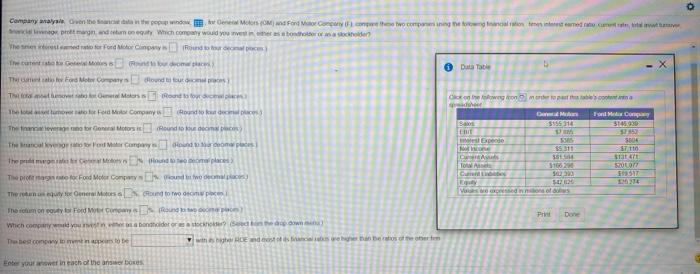

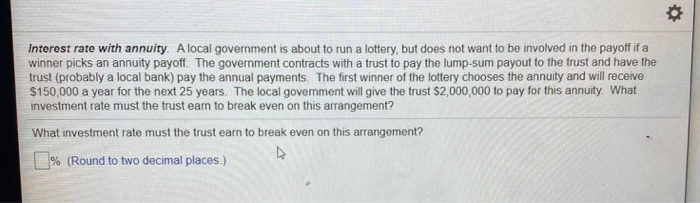

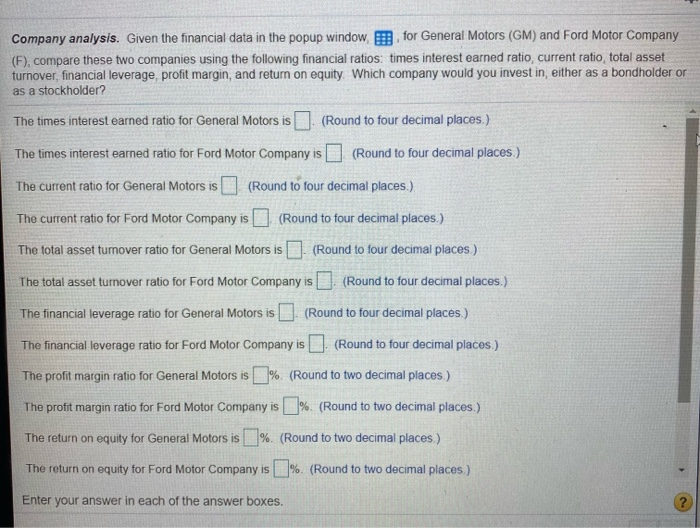

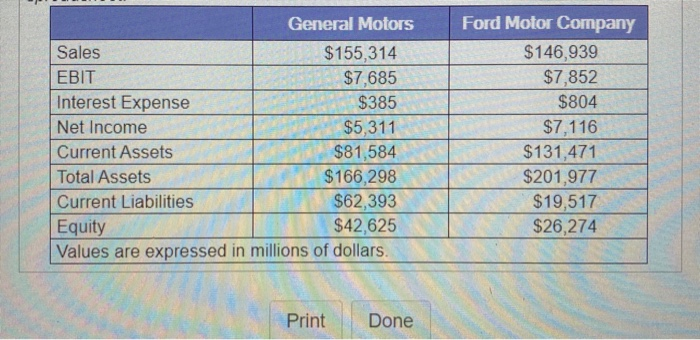

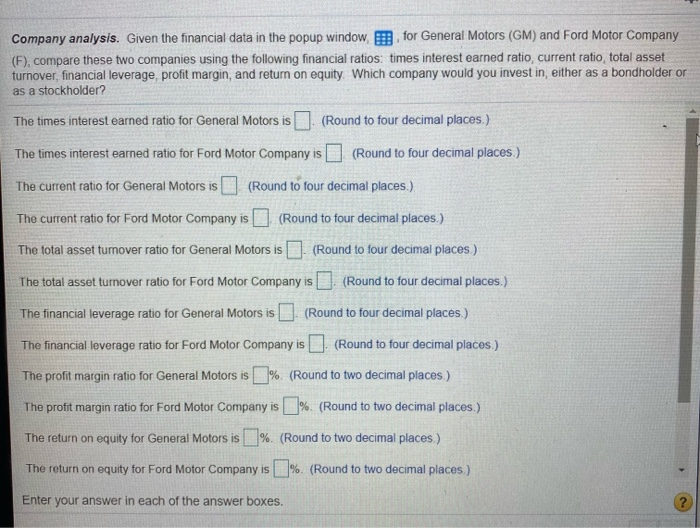

. The c o lor Ford Motor Company found to be The stum bo for General Motors is found to bude The m o tor Ford Motor Company is to The two leverage rabo for General Motors is Round to four decap The taler for Ford Motor Comp o und doom The processo Gel Mens Ford Motor Com EEL NS $5311 516620 s Trot There for Ford Motor Company Hound towe fore Motors sound to two dom The only for Ford Motor Com S R The best to be Interest rate with annuity. A local government is about to run a lottery, but does not want to be involved in the payoff if a winner picks an annuity payoff. The government contracts with a trust to pay the lump-sum payout to the trust and have the trust (probably a local bank) pay the annual payments. The first winner of the lottery chooses the annuity and will receive $150,000 a year for the next 25 years. The local government will give the trust $2,000,000 to pay for this annuity. What investment rate must the trust earn to break even on this arrangement? What investment rate must the trust earn to break even on this arrangement? % (Round to two decimal places.) Company analysis. Given the financial data in the popup window for General Motors (GM) and Ford Motor Company (F), compare these two companies using the following financial ratios: times interest earned ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The times interest earned ratio for General Motors is (Round to four decimal places.) The times interest earned ratio for Ford Motor Company is (Round to four decimal places.) The current ratio for General Motors is (Round to four decimal places.) The current ratio for Ford Motor Company is (Round to four decimal places.) The total asset turnover ratio for General Motors is (Round to four decimal places) The total asset turnover ratio for Ford Motor Company is . (Round to four decimal places.) The financial leverage ratio for General Motors is (Round to four decimal places.) The financial loverage ratio for Ford Motor Company is (Round to four decimal places.) The profit margin ratio for General Motors is % (Round to two decimal places) The profit margin ratio for Ford Motor Company is l%. (Round to two decimal places.) The return on equity for General Motors is %. (Round to two decimal places.) The return on equity for Ford Motor Company is %. (Round to two decimal places.) Enter your answer in each of the answer boxes. The best company to invest in appears to be General Motors in with its higher ROE and most of its financial ratios are higher than the ratios of the other firm. General Motors Enter your answer in each of the answer bc Ford Motor Company General Motors Sales $155,314 EBIT $7,685 Interest Expense $385 Net Income $5,311 Current Assets $81,584 Total Assets $ 166,298 Current Liabilities $62,393 Equity $42,625 Values are expressed in millions of dollars. Ford Motor Company $146,939 $7,852 $804 $7,116 $131.471 $201.977 $19,517 $26,274 Print Done