Answered step by step

Verified Expert Solution

Question

1 Approved Answer

These are your financial statements for the year ending today. You expect sales to increase 20% next year. Assume you are currently operating at 90%

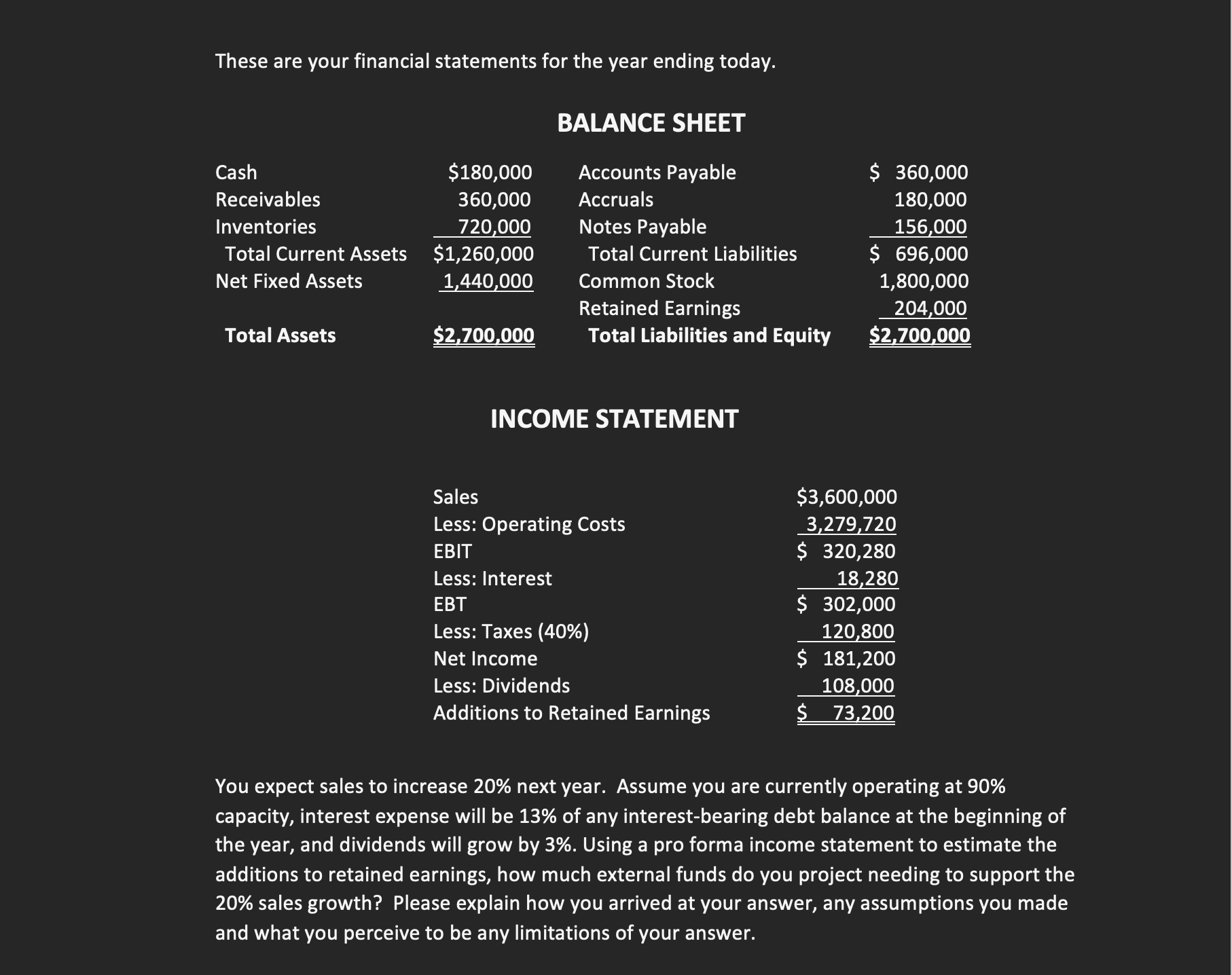

These are your financial statements for the year ending today. You expect sales to increase 20% next year. Assume you are currently operating at 90% capacity, interest expense will be 13% of any interest-bearing debt balance at the beginning of the year, and dividends will grow by 3%. Using a pro forma income statement to estimate the additions to retained earnings, how much external funds do you project needing to support the 20% sales growth? Please explain how you arrived at your answer, any assumptions you made and what you perceive to be any limitations of your

These are your financial statements for the year ending today. You expect sales to increase 20% next year. Assume you are currently operating at 90% capacity, interest expense will be 13% of any interest-bearing debt balance at the beginning of the year, and dividends will grow by 3%. Using a pro forma income statement to estimate the additions to retained earnings, how much external funds do you project needing to support the 20% sales growth? Please explain how you arrived at your answer, any assumptions you made and what you perceive to be any limitations of your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started