Answered step by step

Verified Expert Solution

Question

1 Approved Answer

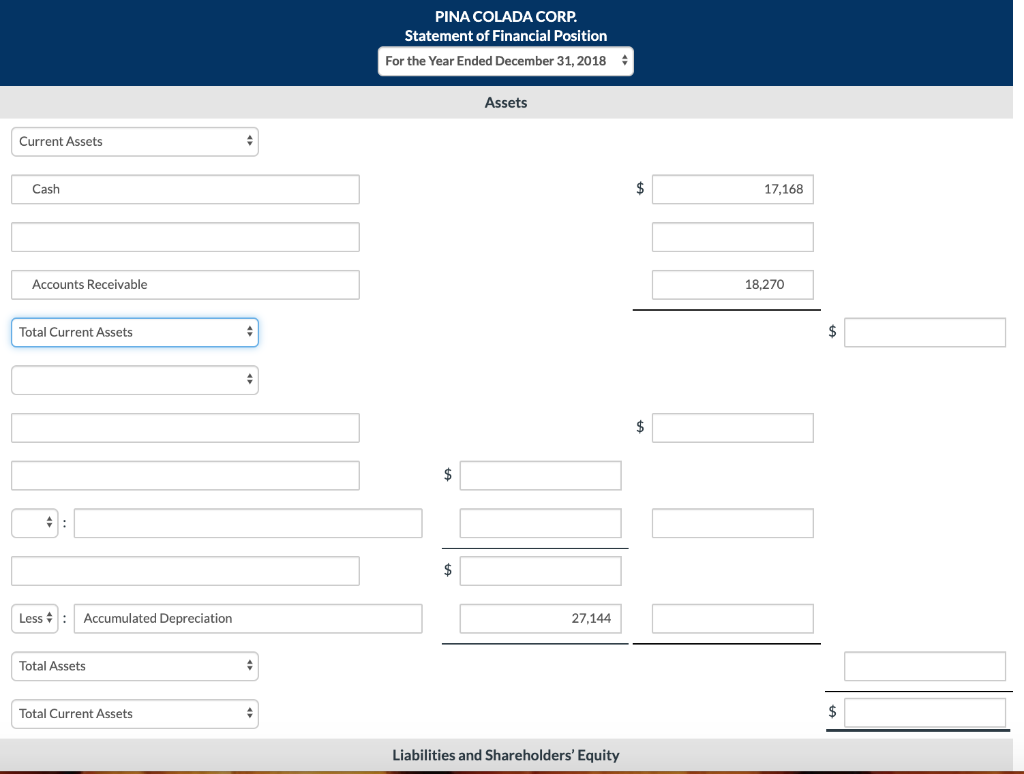

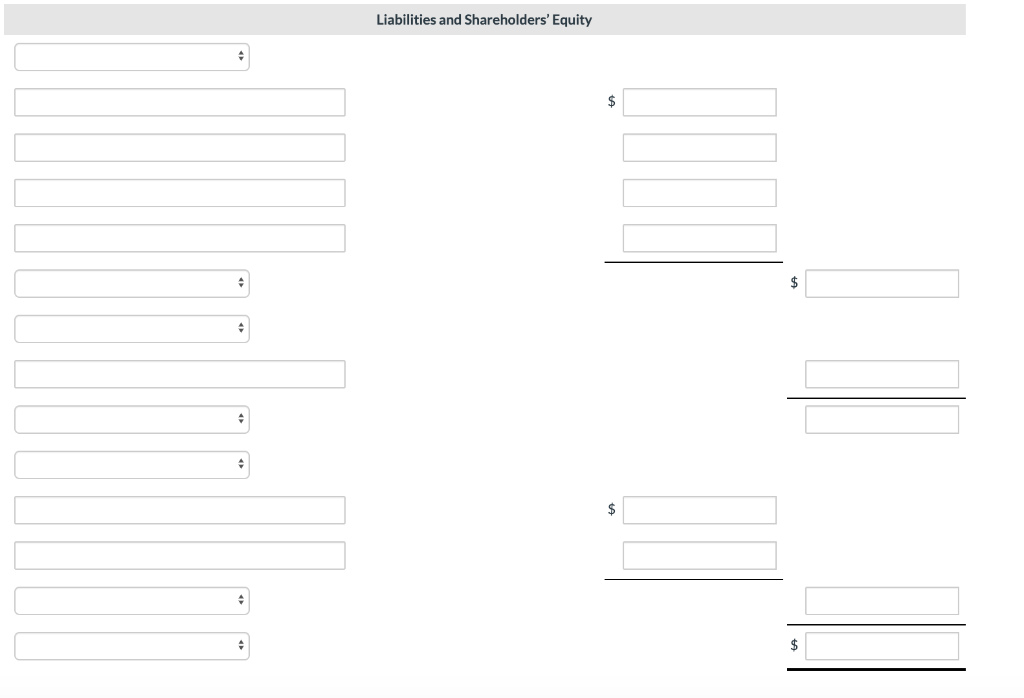

These items are taken from the financial statements of Pina Colada Corp. at December 31, 2018. Buildings $153,410 Accounts receivable 18,270 Prepaid insurance 6,786 Cash

These items are taken from the financial statements of Pina Colada Corp. at December 31, 2018.

| Buildings | $153,410 | ||

|---|---|---|---|

| Accounts receivable | 18,270 | ||

| Prepaid insurance | 6,786 | ||

| Cash | 17,168 | ||

| Equipment | 119,480 | ||

| Land | 88,740 | ||

| Office expense | 841 | ||

| Income tax expense | 290 | ||

| Depreciation expense | 7,685 | ||

| Interest expense | 3,770 | ||

| Common shares | 89,900 | ||

| Retained earnings (January 1, 2018) | 58,000 | ||

| Accumulated depreciationbuilding | 66,120 | ||

| Accounts payable | 12,180 | ||

| Income taxes payable | 1,595 | ||

| Bank loan payable (due July 1, 2020) | 135,720 | ||

| Accumulated depreciationequipment | 27,144 | ||

| Interest payable | 5,220 | ||

| Sales | 20,561 |

Prepare a classified statement of financial position. Assume that $19,720 of the bank loan payable will be paid in 2019. (List Property, plant and equipment in order of land, buildings and equipment. List Current Assets in order of liquidity.)

PINA COLADA CORP. Statement of Financial Position For the Year Ended December 31, 2018 Assets Current Assets $ Cash 17,168 Accounts Receivable 18,270 $ Total Current Assets $ $ $ Accumulated Depreciation Less 27,144 Total Assets $ Total Current Assets Liabilities and Shareholders' Equity Liabilities and Shareholders' Equity $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started