Answered step by step

Verified Expert Solution

Question

1 Approved Answer

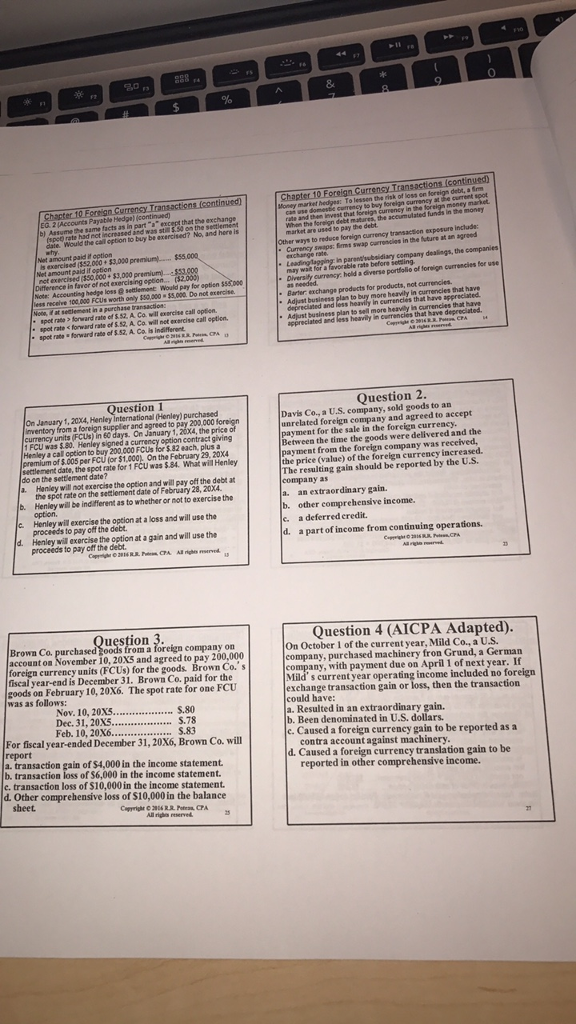

these multiple choice questions are on foreign currency transcations.. my answers are C, D, C,D.. can someone help and tell me if im wrong or

these multiple choice questions are on foreign currency transcations.. my answers are C, D, C,D.. can someone help and tell me if im wrong or not?

EG 2 Accounts Payatle as part that exchange. Aesume same facts was and here is had buy exercised? No, Would the Net amount paid option Net amount Paid favor ornot exercising opeen... apsen Accounting hedne losse seelement would pay for in a Purchase will roereise call opsen. forward rate A Co call option. rate ef SN, A Co will neterercise spot rate fonward rate efssa, A Co is indmerent. spot rate e Question 1 20x4, Henley agreed to pa the price supplier 20x4, rency units (FCUsl option contract Henley acal option to buy 200.000 FCUs each, plus a premium of $.005 per $1,000 On the What wilHenley spot rate for 1FCU was $84. do on the settlement date? a will not exercise option and the debt at the spot rate on the settlement 20X4. Henley will be indifferent as whether or not to exercise the will exercise the option at a loss and will use the d. proceeds to pay the use the Henley Mil at a gain and will proceeds to pay off the debt. account goods, Brown Co. foreign currency units FCUs) for the fiscal year-end is December 31. Brown Co. paid for the goods on February 10, 20X6. The spot rate for one FCU ollows $.800 Nov. 10, 20X5. S.78 Dec. 31, 20X5 S.83 20X6 For fiscal year-ended December 31, 20x6, Brown Co. will a transaction gain of$4,000 in the income statement. transaction loss of $6,000 in the income statement. e, transaction loss of$10,000in the income statement. d other comprehensive loss of $10,000 in the balance sheet. Chapter 10 Foreign lessen the risk of loss the accumulated used to pay the debt When the in the Mture at in agreed other ways to reduce foreign firms swap company dealings, the companies able rate before Barter exchange products for products, in currencies that have that have cumencies that have Adjust business Question 2 to an Davis Co, a U.S. company, to accept unrelated foreign company nd agreed payment for the sale in the foreign currency. the and the time the goods was received, paymen from the foreig increased. lae) of th oreign currency the US. The resulting gain should be reported by dinary gain. an extra b. other comprehensive income. a deferred credit. from continuing opera d, a part of income Question 4 (AICPA Adapted) On october 1 of the a any, purchased machinery fron Grund, a German company, with payment on April 1 ofnext year. operating income included no foreign exchange transaction gain or loss, then the transaction ould have a. Resulted in an extraordinary gain. b. Been denominated dollars. e. a foreign currency gain to be reported as a contra account against machinery. d. a foreign currency translation gain to be reported in other comprehensive income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started