Answered step by step

Verified Expert Solution

Question

1 Approved Answer

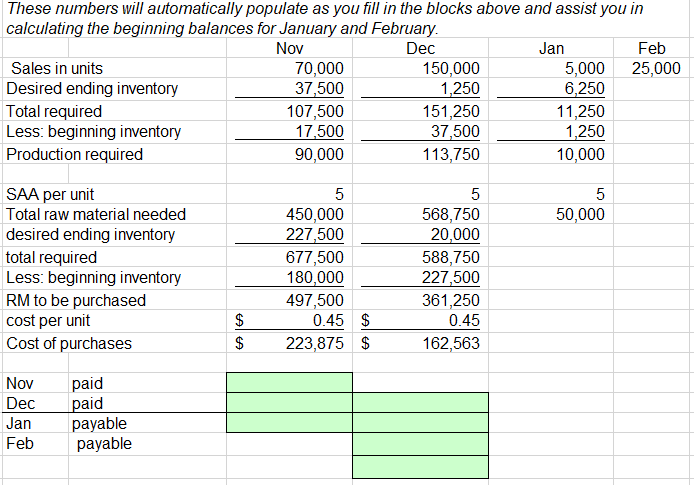

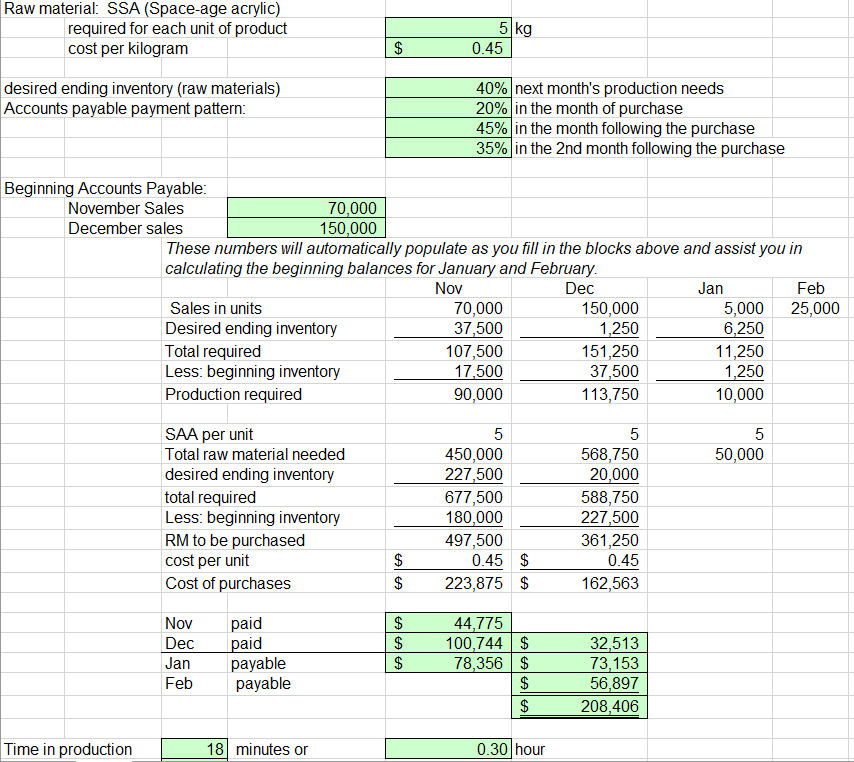

These numbers will automatically populate as you fill in the blocks above and assist you in calculating the beginning balances for January and February.

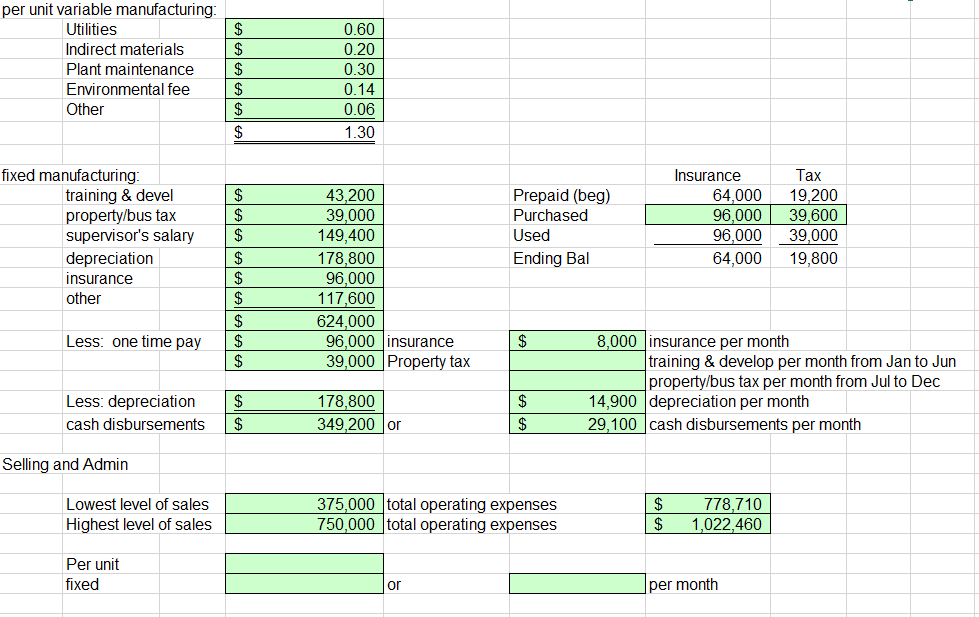

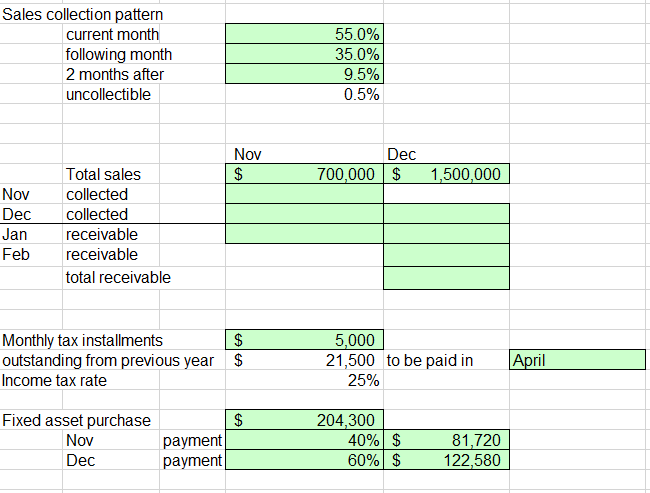

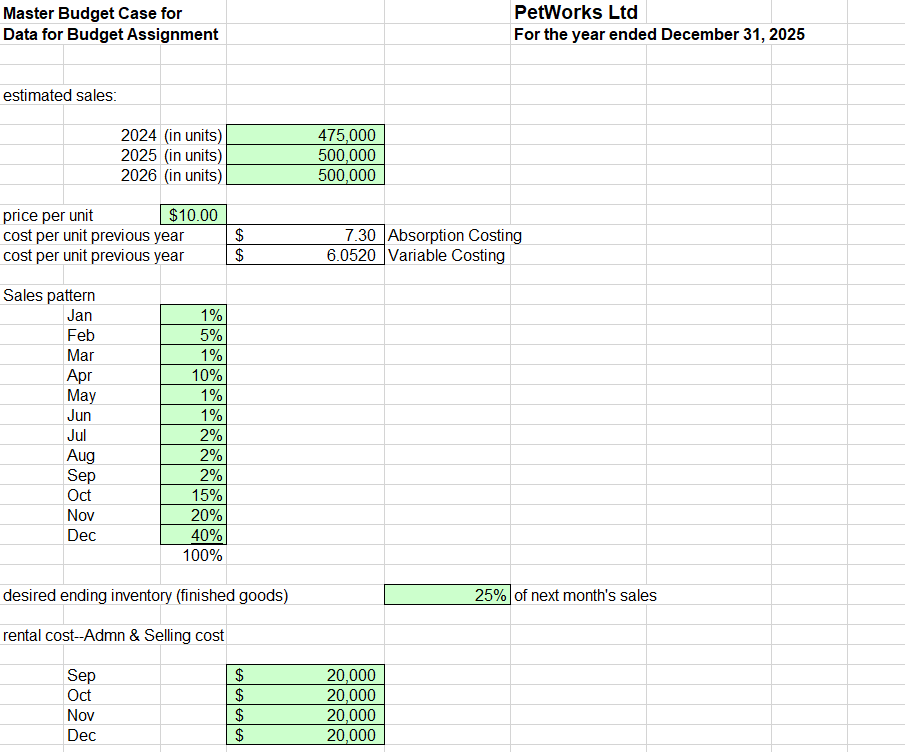

These numbers will automatically populate as you fill in the blocks above and assist you in calculating the beginning balances for January and February. Nov Dec Jan Feb Sales in units 70,000 150,000 5,000 25,000 Desired ending inventory 37,500 1,250 6,250 Total required 107,500 151,250 11,250 Less: beginning inventory 17,500 37,500 1,250 Production required 90,000 113,750 10,000 SAA per unit 5 5 5 Total raw material needed 450,000 568,750 50,000 desired ending inventory 227,500 20,000 total required 677,500 588,750 Less: beginning inventory 180,000 227,500 RM to be purchased 497,500 361,250 cost per unit Cost of purchases Nov paid Dec paid Jan payable Feb payable SASA $ 0.45 $ 0.45 $ 223,875 $ 162,563 per unit variable manufacturing: Utilities $ 0.60 Indirect materials $ 0.20 Plant maintenance $ 0.30 Environmental fee $ 0.14 Other $ 0.06 $ 1.30 fixed manufacturing: Insurance Tax training & devel $ 43,200 Prepaid (beg) 64,000 19,200 property/bus tax $ 39,000 Purchased 96,000 39,600 supervisor's salary $ 149,400 Used 96,000 39,000 depreciation $ 178,800 Ending Bal 64,000 19,800 insurance $ 96,000 other $ 117,600 $ 624,000 Less: one time pay $ 96,000 insurance $ 8,000 insurance per month $ 39,000 Property tax training & develop per month from Jan to Jun property/bus tax per month from Jul to Dec Less: depreciation $ 178,800 $ 14,900 depreciation per month cash disbursements $ 349,200 or $ 29,100 cash disbursements per month Selling and Admin Lowest level of sales 375,000 total operating expenses 750,000 total operating expenses $ $ 778,710 1,022,460 Highest level of sales Per unit fixed or per month Sales collection pattern current month following month 2 months after uncollectible Nov Total sales $ Nov collected Dec collected Jan receivable Feb receivable total receivable 55.0% 35.0% 9.5% 0.5% Dec 700,000 $ 1,500,000 Monthly tax installments $ 5,000 outstanding from previous year $ Income tax rate 21,500 to be paid in April 25% Fixed asset purchase $ 204,300 Nov payment 40% $ 81,720 Dec payment 60% $ 122,580 Master Budget Case for Data for Budget Assignment PetWorks Ltd For the year ended December 31, 2025 7.30 Absorption Costing 6.0520 Variable Costing estimated sales: 2024 (in units) 475,000 2025 (in units) 500,000 2026 (in units) 500,000 price per unit $10.00 cost per unit previous year cost per unit previous year SAS $ $ Sales pattern Jan 1% Feb 5% Mar 1% Apr 10% May 1% Jun 1% Jul 2% Aug 2% Sep 2% Oct 15% Nov 20% Dec 40% 100% desired ending inventory (finished goods) rental cost--Admn & Selling cost Sep Oct Nov Dec SSSSA $ 20,000 $ 20,000 $ 20,000 $ 20,000 25% of next month's sales Raw material: SSA (Space-age acrylic) required for each unit of product cost per kilogram desired ending inventory (raw materials) Accounts payable payment pattern: Beginning Accounts Payable: November Sales December sales 70,000 150,000 $ 5 kg 0.45 40% next month's production needs 20% in the month of purchase 45% in the month following the purchase 35% in the 2nd month following the purchase These numbers will automatically populate as you fill in the blocks above and assist you in calculating the beginning balances for January and February. Nov Dec Jan Feb Sales in units 70,000 150,000 5,000 25,000 Desired ending inventory 37,500 1,250 6,250 Total required 107,500 151,250 11,250 Less: beginning inventory 17,500 37,500 1,250 Production required 90,000 113,750 10,000 SAA per unit 5 5 5 Total raw material needed 450,000 568,750 50,000 desired ending inventory 227,500 20,000 total required 677,500 588,750 Less: beginning inventory 180,000 227,500 RM to be purchased 497,500 361,250 cost per unit $ 0.45 $ 0.45 Cost of purchases $ 223,875 $ 162,563 Nov paid Dec paid Jan payable SASASA $ 44,775 $ 100,744 $ 32,513 $ 78,356 $ 73,153 Feb payable $ 56,897 $ 208,406 Time in production 18 minutes or 0.30 hour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started