Answered step by step

Verified Expert Solution

Question

1 Approved Answer

These questions are all related to each other, so please answer all of them. 1-a. 1-b. 1-c. 1-d. Projects X and Y have the following

These questions are all related to each other, so please answer all of them.

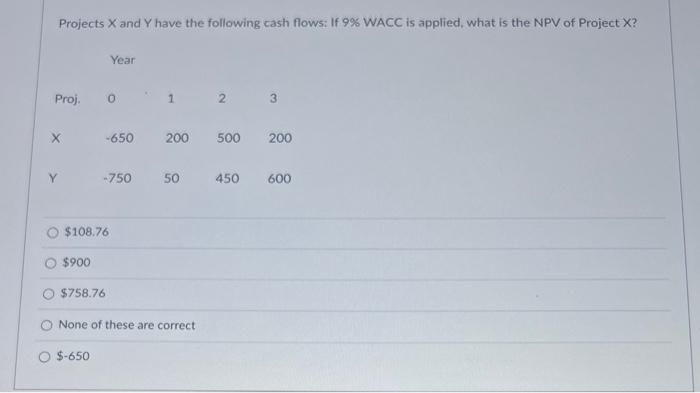

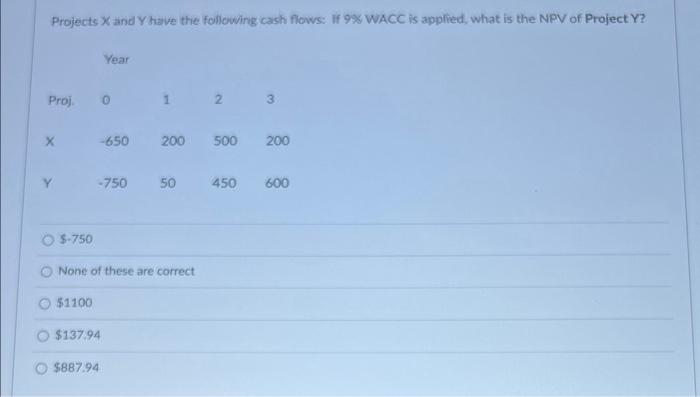

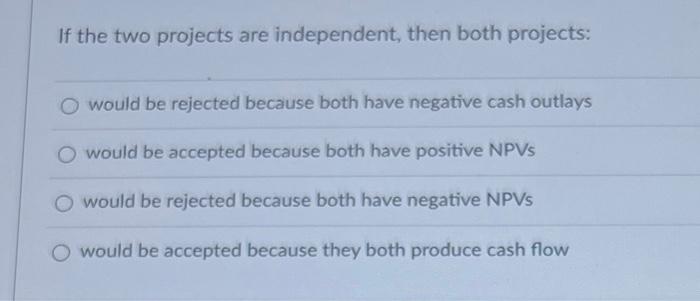

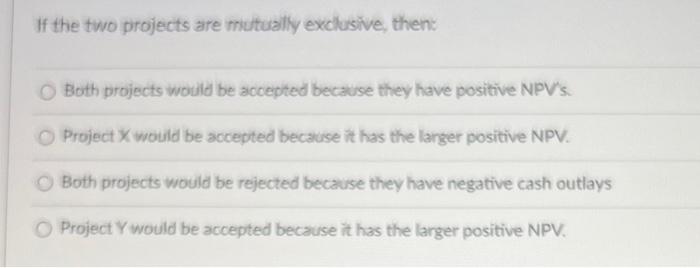

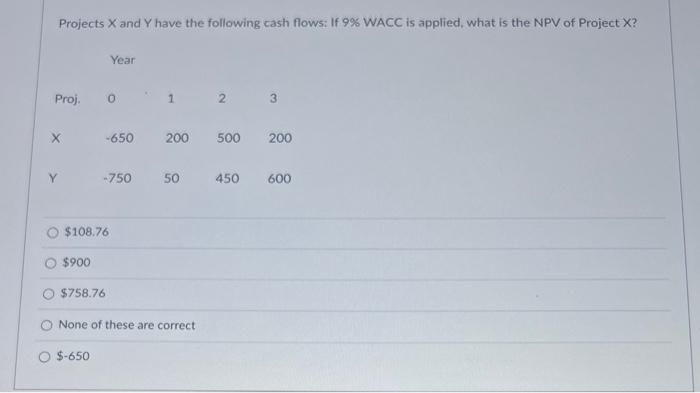

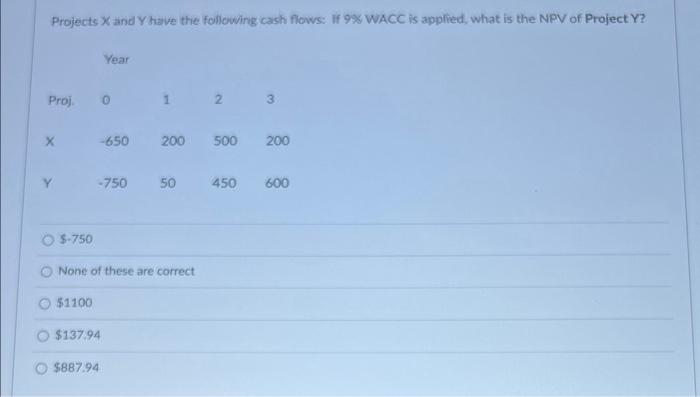

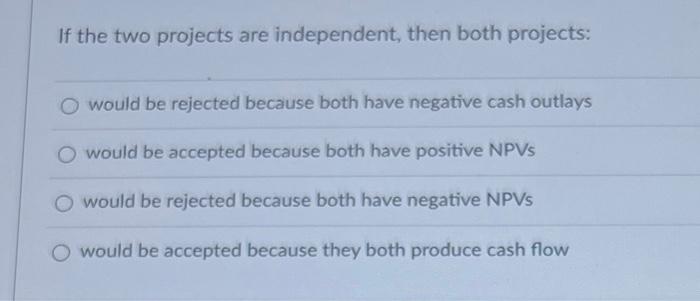

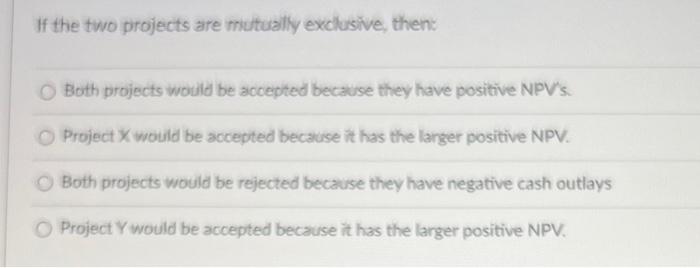

Projects X and Y have the following cash flows: If 9% WACC is applied, what is the NPV of Project X ? $108.76 $900 $758.76 None of these are correct $650 Projects X and Y have the following cash flows: if 9 WACC is applied, what is the NPV of Project Y ? \$. 750 None of these are correct $1100 $137.94 $887.94 If the two projects are independent, then both projects: would be rejected because both have negative cash outlays would be accepted because both have positive NPVs would be rejected because both have negative NPVs would be accepted because they both produce cash flow If the two projects are mutually exclusive, then: Both projects would be accepted because they have positive NPV's. Project X would be accepted because it has the langer positive NPV. Both projects would be rejected because they have negative cash outlays Project Y would be accepted because it has the larger positive NPV 1-a.

1-b.

1-c.

1-d.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started