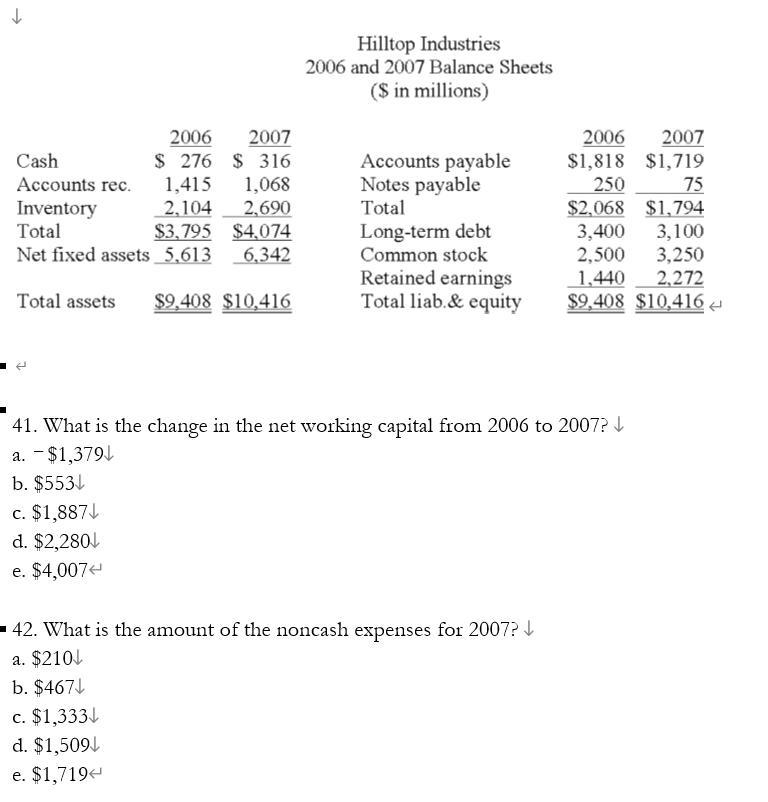

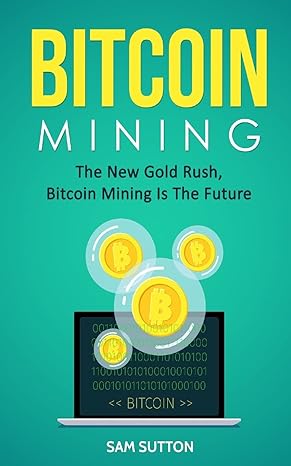

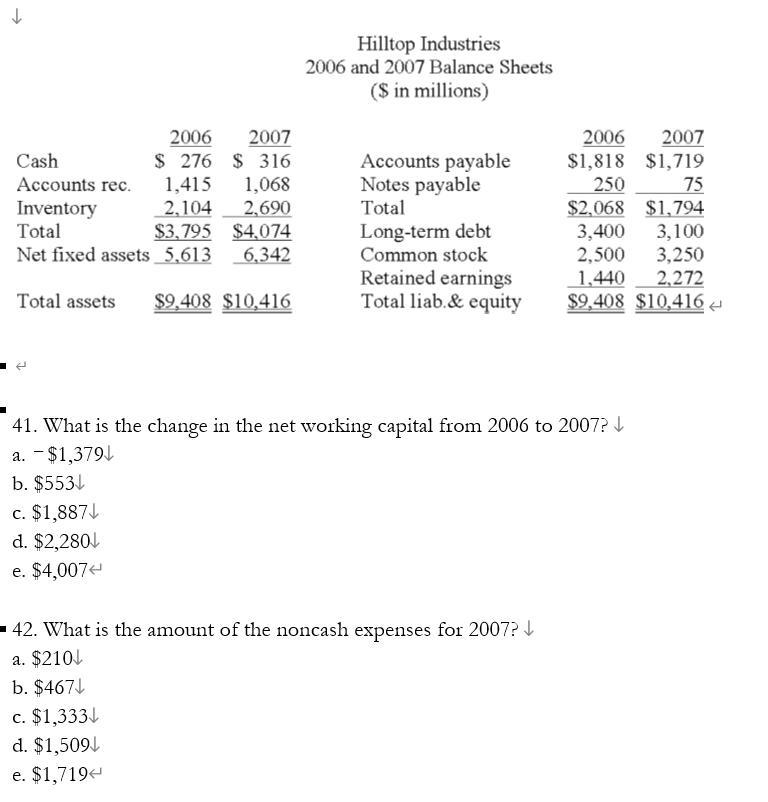

These questions are based on the same table.

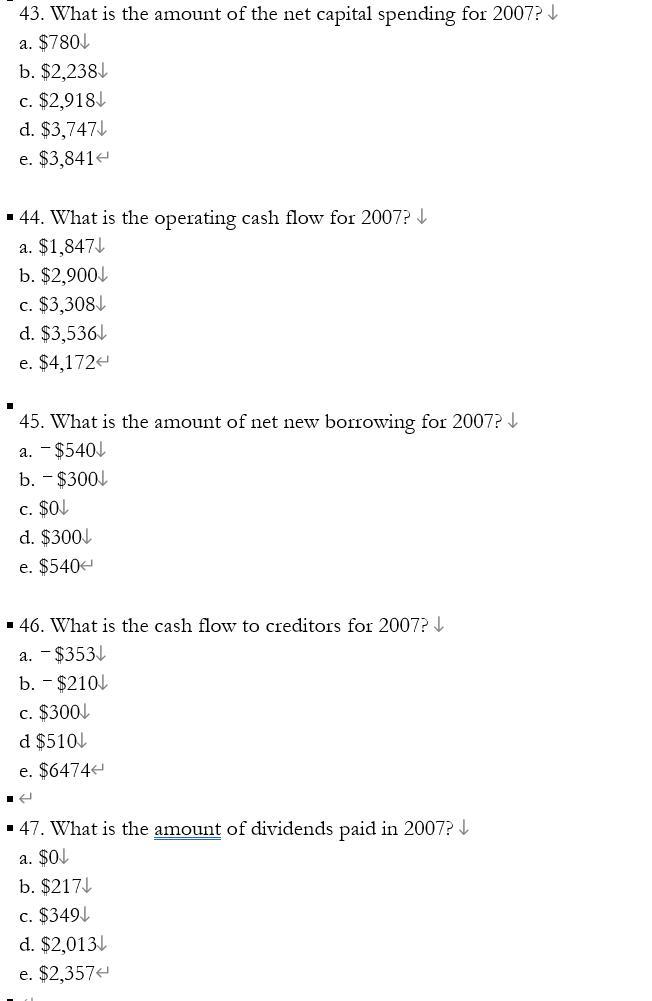

Hilltop Industries 2006 and 2007 Balance Sheets ($ in millions) 2006 2007 Cash $ 276 $ 316 Accounts rec. 1,415 1,068 Inventory 2,104 2,690 Total $3,795 $4,074 Net fixed assets 5,613 6,342 Accounts payable Notes payable Total Long-term debt Common stock Retained earnings Total liab.& equity 2006 2007 $1,818 $1,719 250 75 $2,068 $1,794 3,400 3,100 2,500 3.250 1,440 2,272 $9,408 $10,416 Total assets $9,408 $10,416 41. What is the change in the net working capital from 2006 to 2007? a. - $1,3791 b. $5531 c. $1,8871 d. $2,280 e. $4,007 - 42. What is the amount of the noncash expenses for 2007? a. $210 b. $4671 c. $1,3331 d. $1,5091 e. $1,7194 43. What is the amount of the net capital spending for 2007? a. $7801 b. $2,2381 c. $2,918 d. $3,747 e. $3,841 44. What is the operating cash flow for 2007? a. $1,847 b. $2,9001 c. $3,308) d. $3,536 e. $4,1724 1 45. What is the amount of net new borrowing for 2007? a. - $540J b. -$3001 c. $02 d. $3001 e. $5404 46. What is the cash flow to creditors for 2007? a. - $3531 b. - $2101 c. $3001 d $5101 e. $6474 -47. What is the amount of dividends paid in 2007? a. $0 b. $2171 c. $349/ d. $2,013 e. $2,357 Hilltop Industries 2006 and 2007 Balance Sheets ($ in millions) 2006 2007 Cash $ 276 $ 316 Accounts rec. 1,415 1,068 Inventory 2,104 2,690 Total $3,795 $4,074 Net fixed assets 5,613 6,342 Accounts payable Notes payable Total Long-term debt Common stock Retained earnings Total liab.& equity 2006 2007 $1,818 $1,719 250 75 $2,068 $1,794 3,400 3,100 2,500 3.250 1,440 2,272 $9,408 $10,416 Total assets $9,408 $10,416 41. What is the change in the net working capital from 2006 to 2007? a. - $1,3791 b. $5531 c. $1,8871 d. $2,280 e. $4,007 - 42. What is the amount of the noncash expenses for 2007? a. $210 b. $4671 c. $1,3331 d. $1,5091 e. $1,7194 43. What is the amount of the net capital spending for 2007? a. $7801 b. $2,2381 c. $2,918 d. $3,747 e. $3,841 44. What is the operating cash flow for 2007? a. $1,847 b. $2,9001 c. $3,308) d. $3,536 e. $4,1724 1 45. What is the amount of net new borrowing for 2007? a. - $540J b. -$3001 c. $02 d. $3001 e. $5404 46. What is the cash flow to creditors for 2007? a. - $3531 b. - $2101 c. $3001 d $5101 e. $6474 -47. What is the amount of dividends paid in 2007? a. $0 b. $2171 c. $349/ d. $2,013 e. $2,357