Answered step by step

Verified Expert Solution

Question

1 Approved Answer

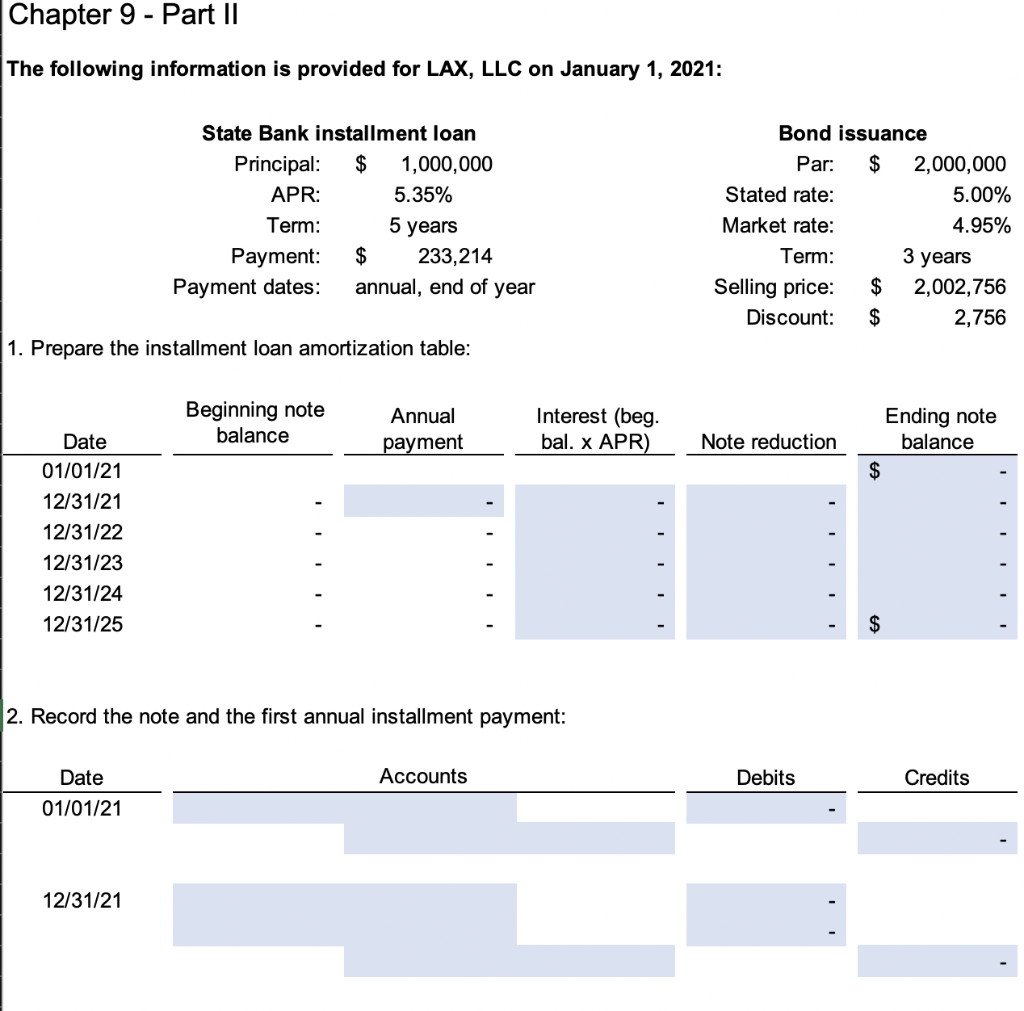

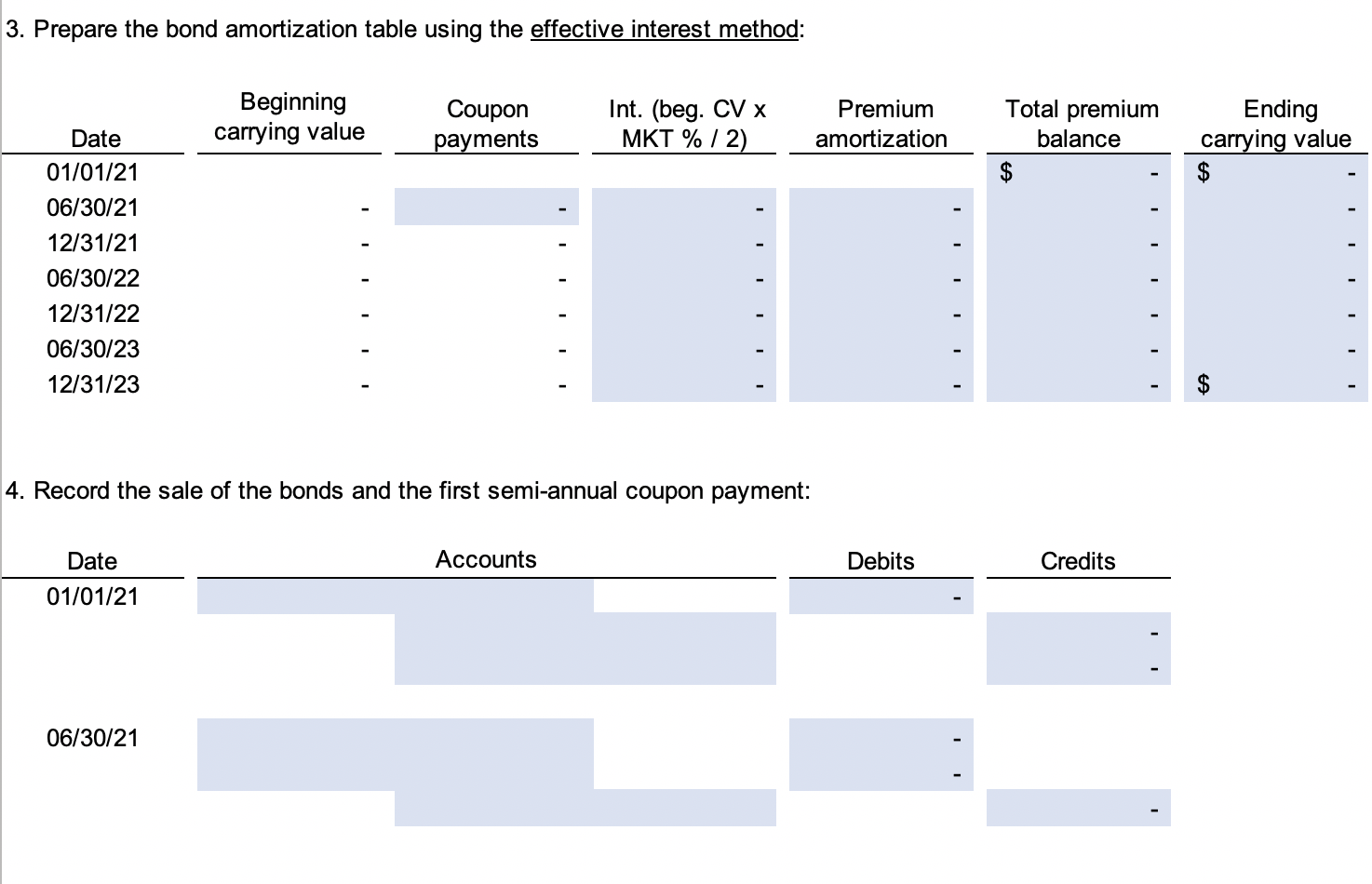

These questions both go together. Chapter 9 - Part II The following information is provided for LAX, LLC on January 1, 2021: State Bank installment

These questions both go together.

Chapter 9 - Part II The following information is provided for LAX, LLC on January 1, 2021: State Bank installment loan Principal: $ 1,000,000 APR: 5.35% Term: 5 years Payment: $ 233,214 Payment dates: annual, end of year Bond issuance Par: $ 2,000,000 Stated rate: 5.00% Market rate: 4.95% Term: 3 years Selling price: $ 2,002,756 Discount: 2,756 $ 1. Prepare the installment loan amortization table: Beginning note balance Annual payment Interest (beg. bal. x APR) Ending note balance Note reduction Date 01/01/21 12/31/21 12/31/22 12/31/23 12/31/24 12/31/25 2. Record the note and the first annual installment payment: Accounts Debits Credits Date 01/01/21 12/31/21 3. Prepare the bond amortization table using the effective interest method: Beginning carrying value Coupon payments Int. (beg. CV X MKT % / 2) Premium amortization Total premium balance Ending carrying value Date 01/01/21 06/30/21 12/31/21 06/30/22 12/31/22 06/30/23 12/31/23 4. Record the sale of the bonds and the first semi-annual coupon payment: Accounts Debits Credits Date 01/01/21 06/30/21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started