Question

These quotes apply to all problems UNLESS stated otherwise. The time period is 1 year for all problems. NOK - Norwegian krona. The quotes

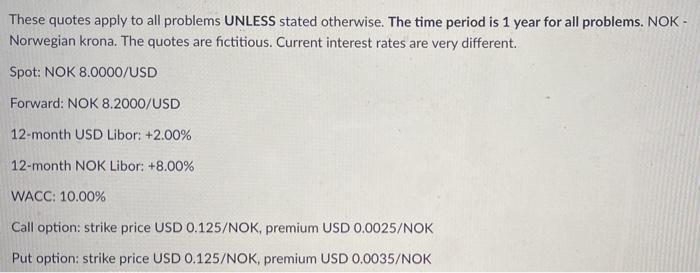

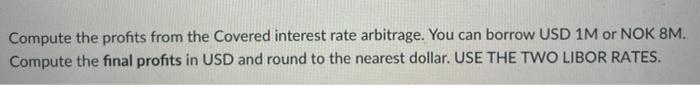

These quotes apply to all problems UNLESS stated otherwise. The time period is 1 year for all problems. NOK - Norwegian krona. The quotes are fictitious. Current interest rates are very different. Spot: NOK 8.0000/USD Forward: NOK 8.2000/USD 12-month USD Libor: +2.00% 12-month NOK Libor: +8.00% WACC: 10.00% Call option: strike price USD 0.125/NOK, premium USD 0.0025/NOK Put option: strike price USD 0.125/NOK, premium USD 0.0035/NOK Compute the profits from the Covered interest rate arbitrage. You can borrow USD 1M or NOK 8M. Compute the final profits in USD and round to the nearest dollar. USE THE TWO LIBOR RATES.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

covered interest rate arbitrage can be used to exploit the interest rate differential between the US...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Marketing And Export Management

Authors: Gerald Albaum , Alexander Josiassen , Edwin Duerr

8th Edition

1292016922, 978-1292016924

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App